Economy of the Philippines

|

| |

| Currency | Philippine peso (Filipino: piso; sign: ₱; code: PHP) |

|---|---|

| Calendar year | |

Trade organisations | APEC, ASEAN, WTO, EAS, AFTA, ADB, and others |

| Statistics | |

| GDP |

(nominal) $311.687 billion (Q2 2016)[1] (PPP) $831.47 billion (Q2 2016)[2] |

| GDP rank |

|

GDP growth |

|

GDP per capita |

(nominal) $3,042 (2016 est.)[2] (126th) |

GDP by sector |

agriculture: 9.49% industry: 33.48% services: 57.03% (2015)[5] |

|

| |

Population below poverty line | 21.6%[7] |

| 43.04 (2012)[8] | |

Labour force | 64.80 million (April 2015)[9] |

Labour force by occupation |

services: 53% agriculture: 32% industry: 15% (2012 est.)[10] |

| Unemployment |

|

Main industries | electronics assembly, business process outsourcing, food manufacturing, shipbuilding, chemicals, textiles, garments, metals, petroleum refining, fishing, rice[12] |

|

| |

| External | |

| Exports | $58.827 billion (2015)[14] |

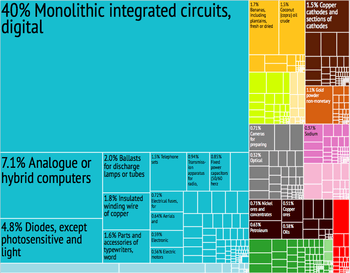

Export goods | semiconductors and electronic products, transport equipment, garments, copper products, petroleum products, coconut oil, fruits[15] |

Main export partners |

|

| Imports | $71.067 billion (2015)[17] |

Import goods | electronic products, mineral fuels, machinery and transport equipment, iron and steel, textile fabrics, grains, chemicals, plastic[15] |

Main import partners |

(2013 est.)[16] |

FDI stock | $8 billion (April 2016)[18] |

Gross external debt |

|

| Public finances | |

| 36.8% of GDP (Q3 2015)[20] | |

| Revenues | $58.97 billion (2016 est.) |

| Expenses | $65.73 billion (2016 est.) |

| Economic aid | $1.67 billion[21] |

Foreign reserves |

|

|

All values, unless otherwise stated, are in US dollars. | |

The Economy of the Philippines is the 36th largest in the world, according to 2016 International Monetary Fund statistics, and is one of the largest economies in the ASEAN. The Philippines is also one of the emerging markets.[27]

The Philippines is considered a newly industrialized country, which has an economy transitioning from one based on agriculture to one based more on services and manufacturing. In 2016, GDP by Purchasing power parity was estimated to be at $811.726 billion.[28]

Primary exports include semiconductors and electronic products, transport equipment, garments, copper products, petroleum products, coconut oil, and fruits. Major trading partners include the Japan, China, United States, Singapore, South Korea, the Netherlands, Hong Kong, Germany, Taiwan, and Thailand. The Philippines has been named as one of the Tiger Cub Economies together with Indonesia, and Thailand. It is currently one of Asia's fastest growing economies. However, major problems remain, mainly having to do with alleviating the wide income and growth disparities between the country's different regions and socioeconomic classes, reducing corruption, and investing in the infrastructure necessary to ensure future growth.

The Philippine economy is projected to be the 16th biggest in the world by 2050.[29]

History

| Date range | Official rate | Calculated rate[lower-alpha 1] |

|---|---|---|

| 18th century | 0.1% | |

| 18th century | 0.6% | |

| 20th century | 2.7% | |

| 1900-1949 | 1.4% | |

| 1950-1999 | 4.6% | 4.0% |

| 1950-1959 | 6.7% | 5.9% |

| 1960-1969 | 5.3% | 4.7% |

| 1970-1979 | 6.5% | 5.6% |

| 1980-1989 | 11.0% | 0.9% |

| 1990-1999 | 3.2% | 3.0% |

Pre Colonial Era (900s–1565)

The economic history of the Philippine Islands had been traced back to the pre-colonial times. The country which was then composed of different kingdoms and thalassocracies oversaw the large number of merchants coming to the islands for trade. Indian, Arab, Chinese and Japanese merchants were welcomed by these kingdoms, which were mostly located by riverbanks, coastal ports and central plains. The merchants traded for goods such as gold, rice, pots and other products. The barter system was implemented at that time and the pre-colonial people enjoyed a life filled with imported goods which reflected their fashion and lifestyle.

From the 12th century, a huge industry centred around the manufacture and trade of burnay clay pots, used for the storage of tea and other perishables, was set up in the northern Philippines with Japanese and Okinawan traders. These pots were known as 'Ruson-tsukuri' (Luzon-made) in Japanese, and were considered among the best storage vessels used for the purpose of keeping tea leaves and rice wine fresh. Hence, Ruson-Tsukuri pots became sought after in Northeast Asia. Each Philippine kiln had its own branding symbol, marked on the bottom of the Ruson-tsukuri by a single baybayin letter.

The people also were great agriculturists and the islands especifically Luzon has great abundance of rice, fowls, wine as well as great numbers of carabaos, deer, wild boar and goats. In addition, there were also great quantities of cotton and colored clothes, wax, honey and date palms produced by the natives. The Huangdom of Pangasinan often exported deer-skins to Japan and Okinawa. The Kingdom of Tondo was also a entrepot for the distribution of Chinese goods across the archipelago.

The Visayas islands which is home to the Kedatuan of Madja-as, the Rajahnate of Cebu and the polity of Bohol, on the other hand were abundant in rice, fish, cotton, swine, fowls, wax and honey. Leyte was said to produce two rice crops a year, and Pedro Chirino commented on the great rice and cotton harvests that were sufficient to feed and cloth the people.

In Mindanao, the Rajahnate of Butuan specialized in the mining of gold and the manufacture of jewellery. The Sultanate of Maguindanao was known for the raising and harvesting of cinnamon. The Sultanate of Sulu had a lively pearl-diving industry.

The kingdoms of ancient Philippines were active in international trade, and they used the ocean as natural highways.[32] Ancient peoples were engaged in long-range trading with their Asian neighbors as far as west as Maldives and as far as north as Japan.

Some historians even proposed that they also had regular contacts with the people of Western Micronesia because it was the only area in the Oceania that had rice crops, tuba (fermented coconut sap), and tradition of betel nut chewing when the first Europeans arrived there. The uncanny resemblance of complex body tattoos among the Visayans and those of Borneo also proved some interesting connection between Borneo and ancient Philippines.[33] Magellan's chronicler, Antonio Pigafetta, mentioned that merchants and ambassadors from all surrounding areas came to pay tribute to the rajah of Sugbu (Cebu) for the purpose of trade. While Magellan's crew were with the rajah, a representative from Siam was paying tribute to the rajah.[33] Miguel López de Legazpi also wrote how merchants from Luzon and Mindoro had come to Cebu for trade, and he also mentioned how the Chinese merchants regularly came to Luzon for the same purpose.[33] The Visayan Islands had earlier encounters with Greek traders in 21 AD.[34] Its people enjoyed extensive trade contacts with other cultures. Indians, Japanese, Arabs, Vietnamese, Cambodians, Thais, Malays and Indonesians as traders or immigrants.[35][36]

Aside from trade relations, the natives were also involved in aquaculture and fishing. The natives make use of the salambao, which is a type of raft that utilizes a large fishing net which is lowered into the water via a type of lever made of two criss-crossed poles. Night fishing was accomplished with the help of candles made from a particular type of resin similar to the copal of Mexico. Use of safe pens for incubation and protection of the small fry from predators was also observed, and this method astonished the Spaniards at that time.[33] During fishing, large mesh nets were also used by the natives to protect the young and ensure future good catches.

Spanish Era: New Spain (1565–1815)

.

The natives already had a great economy and were considered one of the economic centers in Asia when the Spanish colonized and unified the islands. Their economy grew even further when the Spanish government inaugurated the Manila Galleon trade system. Trading ships made voyages once or twice per year across the Pacific Ocean from the port of Acapulco in Mexico to Manila in the Philippines. Both cities were part of the then Province of New Spain.

This trade made the city of Manila one of the major global cities in the world, improving the growth of Philippine economy in the succeeding years.

The Manila Galleon system operated until 1815, when Mexico got its independence. Nevertheless, it didn't affect the economy of the islands.

On March 10, 1785, King Charles III of Spain confirmed the establishment of the Royal Philippine Company with a 25-year charter. The Basque-based company was granted a monopoly on the importation of Chinese and Indian goods into the Philippines, as well as the shipping of the goods directly to Spain via the Cape of Good Hope.

Spanish Era: Spanish East Indies (1815–98)

After Spain lost Mexico as a territory, New Spain was dissolved making the Philippines and other Pacific islands to form the Spanish East Indies. This resulted in the Philippines being governed directly by the King of Spain and the Captaincy General of the Philippines while the Pacific islands of Northern Mariana Islands, Guam, Micronesia and Palau was governed by the Real Audiencia of Manila and was part of the Philippine territorial governance.

It made the economy of the Philippines grow further as people saw the rise of opportunities. The agriculture remained the largest contributor to economy, being the largest producer of coffee in Asia as well as the large produce of tobacco.

In Europe, the Industrial Revolution spread from Great Britain during the period known as the Victorian Age. The industrialization of Europe created great demands for raw materials from the colonies, bringing with it investment and wealth, although this was very unevenly distributed. Governor-General Basco had opened the Philippines to this trade. Previously, the Philippines was seen as a trading post for international trade but in the nineteenth century it was developed both as a source of raw materials and as a market for manufactured goods. The economy of the Philippines rose rapidly and its local industries developed to satisfy the rising demands of an industrializing Europe. A small flow of European immigrants came with the opening of the Suez Canal, which cut the travel time between Europe and the Philippines by half. New ideas about government and society, which the friars and colonial authorities found dangerous, quickly found their way into the Philippines, notably through the Freemasons, who along with others, spread the ideals of the American, French and other revolutions, including Spanish liberalism.

In 1834 the Royal Company of the Philippines was abolished, and free trade was formally recognized. With its excellent harbor, Manila became an open port for Asian, European, and North American traders. European merchants alongside the Chinese immigrants opened stores selling goods from all parts of the world. The El Banco Español Filipino de Isabel II (now the Bank of the Philippine Islands) was the first bank opened in the Philippines in 1851.

In 1873 additional ports were opened to foreign commerce, and by the late nineteenth century three crops—tobacco, abaca, and sugar—dominated Philippine exports.

First Philippine Republic (1899–1901)

The economy of the Philippines during the insurgency of the First Philippine Republic remained the same throughout its early years but was halted due to the break out of the Philippine–American War. Nevertheless, during the era of the First Republic, the estimated GDP per capita for the Philippines in 1900 was of $1,033.00. That made it the second richest place in all of Asia, just a little behind Japan ($1,135.00), and far ahead of China ($652.00) or India ($625.00).[37]

American Era (1901–35)

When the Americans defeated the first Philippine Republic and made the Philippines a showcase territory of the United States, the country saw a redevelopment under the American system. Economy as well was re-developed. The Philippines saw the growth of the economy once again after the war as the Americans built new public schools, transportation, reform system, boutiques, offices and civic buildings.

When the Great Depression happened in the United States, the Philippines on the other hand wasn't affected. Instead, the US relied on the Philippine economy throughout the depression era.

Commonwealth Era (1935–45)

When the United States granted the Philippines commonwealth status, the country enjoyed a rapid growth of prosperity. Tourism, industry, and agriculture were among the largest contributors to the economy. Products included abaca (a species of banana), coconuts and coconut oil, sugar, and timber. Numerous other crops and livestock were grown for local consumption by the Filipino people. Manila became one of the most visited cities in Asia alongside Hong Kong. Manila is considered the most beautiful city in Asia. This draws tourists from around the world, helping to boost the Philippine economy.

The performance of the economy was good despite challenges from various agrarian uprisings. Taxes collected from a robust coconut industry helped boost the economy by funding infrastructure and other development projects. The people enjoyed a first world economy until the time when the Philippines was dragged into World War II. That resulted to a recession in the economy.

World War II (1941–45)

Due to the Japanese invasion establishing the unofficial Second Philippine Republic, the economic growth receded and food shortages occurred. Prioritizing the shortages of food, Jose Laurel, the appointed President, organized an agency to distribute rice, even though most of the rice was confiscated by Japanese soldiers. Manila was one of the many places in the country that suffered from severe shortages, due mainly to a typhoon that struck the country in November 1943. The people were forced to cultivate private plots which produced root crops like kangkong. The Japanese, in order to raise rice production in the country, brought a quick-maturing horai rice, which was first used in Taiwan. Horai rice was expected to make the Philippines self-sufficient in rice by 1943, but rains during 1942 prevented this.

-500_Pesos_(1944).jpg)

Also during World War II in the Philippines, the occupying Japanese government issued fiat currency in several denominations; this is known as the Japanese government-issued Philippine fiat peso.

The first issue in 1942 consisted of denominations of 1, 5, 10 and 50 centavos and 1, 5, and 10 Pesos. The next year brought "replacement notes" of the 1, 5 and 10 Pesos while 1944 ushered in a 100 Peso note and soon after an inflationary 500 Pesos note. In 1945, the Japanese issued a 1,000 Pesos note. This set of new money, which was printed even before the war, became known in the Philippines as Mickey Mouse money due to its very low value caused by severe inflation. Anti-Japanese newspapers portrayed stories of going to the market laden with suitcases or "bayong" (native bags made of woven coconut or buri leaf strips) overflowing with the Japanese-issued bills.[38] In 1944, a box of matches cost more than 100 Mickey Mouse pesos.[39] In 1945, a kilogram of camote cost around 1000 Mickey Mouse pesos.[40] Inflation plagued the country with the devaluation of the Japanese money, evidenced by a 60% inflation experienced in January 1944.[41]

Third Philippine Republic (1946–65)

After the re-establishment of the Commonwealth in 1945, the country was left with a devastated city, food crisis and financial crisis. A year later in 1946, the Philippines got its independence in America, creating the Third Philippine Republic.

In an effort to solve the massive socio-economic problems of the period, newly elected President Manuel Roxas reorganized the government, and proposed a wide-sweeping legislative program. Among the undertakings of the Third Republic's initial year were: The establishment of the Rehabilitation Finance Corporation (which would be reorganized in 1958 as the Development Bank of the Philippines);[42] the creation of the Department of Foreign Affair and the organization of the foreign service through Executive Order No. 18; the GI Bill of Rights for Filipino veterans; and the revision of taxation laws to increase government revenues.[43]

President Roxas moved to strengthen sovereignty by proposing a Central Bank for the Philippines to administer the Philippine banking system[44] which was established by Republic Act No. 265.

In leading a "cash-starved[45] government" that needed to attend a battered nation, President Roxas campaigned for the parity amendment to the 1935 Constitution. This amendment, demanded by the Philippine Trade Relations Act or the Bell Trade Act,[46] would give American citizens and industries the right to utilize the country’s natural resources in return for rehabilitation support from the United States. The President, with the approval of Congress, proposed this move to the nation through a plebiscite.

The Roxas administration also pioneered the foreign policy of the Republic. Vice President Elpidio Quirino was appointed Secretary of Foreign Affairs. General Carlos P. Romulo, as permanent representative[47] of the Philippines to the United Nations, helped shape the country’s international identity in the newly established stage for international diplomacy and relations. During the Roxas administration, the Philippines established diplomatic ties with foreign countries and gained membership to international entities, such as the United Nations General Assembly, the United Nations Educational, Scientific and Cultural Organization (UNESCO), the World Health Organization (WHO), the International Labor Organization (ILO), etc.

When President Carlos P. Garcia won the elections, his administration promoted the "Filipino First" policy, whose focal point was to regain economic independence; a national effort by Filipinos to "obtain major and dominant participation in their economy."[48] The administration campaigned for the citizens' support in patronizing Filipino products and services, and implemented import and currency controls favorable for Filipino industries.[49] In connection with the government's goal of self-sufficiency was the "Austerity Program," which President Garcia described in his first State of the NatIon Address as "more work, more thrift, more productive investment, and more efficiency" that aimed to mobilize national savings.[50] The Anti Graft and Corrupt Practices Act, through Republic Act No. 301, aimed to prevent corruption, and promote honesty and public trust. Another achievement of the Garcia administration was the Bohlen–Serrano Agreement of 1959, which shortened the term of lease of the US military bases in the country from the previous 99 to 25 years.[51]

President Diosdado Macapagal, during his inaugural address on December 30, 1961, emphasized the responsibilities and goals to be attained in the "new era" that was the Macapagal administration. He reiterated his resolve to eradicate corruption, and assured the public that honesty would prevail in his presidency. President Macapagal, too, aimed at self-sufficiency and the promotion of every citizen's welfare, through the partnership of the government and private sector, and to alleviate poverty by providing solutions for unemployment.

Among the laws passed during the Macapagal administration were: Republic Act No. 3844 or the Agricultural Land Reform Code (an act that established the Land Bank of the Philippines);[52] Republic Act No. 3466, which established the Emergency Employment Administration; Republic Act No. 3518, which established the Philippine Veterans Bank; Republic Act No. 3470, which established the National Cottage Industries Development Authority (NACIDA) to organize, revive, and promote the establishment of local cottage industries; and Republic Act No. 4156, which established the Philippine National Railways (PNR) to operate the national railroad and tramways. The administration lifted foreign exchange controls as part of the decontrol program in an attempt to promote national economic stability and growth.

Marcos Era (1965–86)

President Ferdinand E. Marcos declared martial law in the midst of rising student movements and an increasing number communist and socialist groups lobbying for reforms in their respective sectors. Leftists held rallies to express their frustrations to the government, this restiveness culminating in the First Quarter Storm, where activists stormed Malacañang Palace only to be turned back by the Philippine Constabulary. This event in particular left four people dead and many injured after heavy exchanges of gunfire. There was further unrest, and in the middle of the disorder on 21 September 1972, Marcos issued Proclamation No. 1081, effectively installing martial law in the Philippines, a declaration that suspended civil rights and imposed military rule in the country.

The GDP of the Philippines rose during the martial law, rising from P55 million to P193 million in about 8 years. This growth was spurred by massive lending from commercial banks, accounting for about 62% percent of external debt.[53] As a developing country, the Philippines during the martial law was one of the heaviest borrowers. These aggressive moves were seen by critics as a means of legitimizing martial law by purportedly enhancing the chances of the country in the global market. Much of the money was spent on pump-priming to improve infrastructure and promote tourism. However, despite the aggressive borrowing and spending policies, the Philippines lagged behind its Southeast Asia counterparts in GDP growth rate per capita. The country, in 1970–1980, only registered an average 3.4 percent growth, while its counterparts like Thailand, Malaysia, Singapore, and Indonesia garnered a mean growth of 5.4 percent.[53] This lag, which became very apparent at the end of the Marcos Regime, can be attributed to the failures of economic management that was brought upon by State-run monopolies, mismanaged exchange rates, imprudent monetary policy and debt management, all underpinned by rampant corruption and cronyism. As said by Emannuel de Dios “[…]main characteristics distinguishing the Marcos years from other periods of our history has been the trend towards the concentration of power in the hands of the government, and the use of governmental functions to dispense economic privileges to some small factions in the private sector.”[53]

There are few more palpable and glaring examples of the economic mismanagement of the time than the Bataan Nuclear Power Plant (BNPP) located in Morong, Bataan. Started in the 1970s, the BNPP was supposed to boost the country’s competitiveness by providing affordable electricity to fuel industrialization and job creation in the country. Far from this, the US$2.3 billion nuclear plant suffered from cost over-runs and engineering and structural issues which eventually led to its mothballing—without generating a single watt of electricity.

Income inequality grew during the era of martial law, as the poorest 60 percent of the nation were able to contribute only 22.5 percent of the income at 1980, down from 25.0 percent in 1970. The richest 10 percent, meanwhile, took a larger share of the income at 41.7 percent at 1980, up from 37.1 percent at 1970.[53] These trends coincided with accusations of cronyism in the Marcos administration, as the administration faced questions of favoring certain companies that were close to the ruling family.

According to the FIES (Family Income and Expenditure Survey) conducted from 1965 to 1985, poverty incidence in the Philippines rose from 41 percent in 1965 to 58.9 percent in 1985. This can be attributed to lower real agricultural wages and lesser real wages for unskilled and skilled laborers. Real agricultural wages fell about 25 percent from their 1962 level, while real wages for unskilled and skilled laborers decreased by about one-third of their 1962 level. It was observed that higher labor force participation and higher incomes of the rich helped cushion the blow of the mentioned problems.

Aquino Administration (1986–92)

The Aquino administration took over an economy that had gone through socio-political disasters during the People Power revolution, where there was financial and commodity collapse caused by an overall consumer cynicism, a result of the propaganda against cronies, social economic unrest resulting from numerous global shortages, massive protests, lack of government transparency, the opposition's speculations, and various assassination attempts and failed coups. At that point in time, the country's incurred debt from the Marcos Era's debt-driven development began crippling the country, which slowly made the Philippines the "Latin-American in East Asia" as it started to experience the worst recession since the post-war era.

Most of the immediate efforts of the Aquino administration was directed in reforming the image of the country and paying off all debts, including those that some governments were ready to write-off, as possible. This resulted in budget cuts and further aggravated the plight of the lower class because the jobs offered to them by the government was now gone. Infrastructure projects, including repairs, were halted in secluded provinces turning concrete roads into asphalt. Privatization of many government corporations, most catering utilities, was the priority of the Aquino administration which led to massive lay-offs and inflation. The Aquino administration was persistent in its belief that the problems that arose from the removal of the previous administration can be solved by the decentralization of power.

Growth gradually began in the next few years of the administration. Somehow, there was still a short-lived, patchy, and erratic recovery from 1987 to 1991 as the political situation stabilized a bit. With this, the peso became more competitive, confidence of investors was gradually regained, positive movements in terms of trade were realized, and regional growth gradually strengthened.

Ramos Administration (1992–98)

The Ramos administration basically served its role as the carrier of the momentum of reform and as an important vehicle in "hastening the pace of liberalization and openness in the country".[54] The administration was a proponent of capital account liberalization, which made the country more open to foreign trade, investments, and relations. It was during this administration when the Bangko Sentral ng Pilipinas was established, and this administration was also when the Philippines joined the World Trade Organization and other free trade associations such as the APEC. During the administration, debt reduction was also put into consideration and as such, the issuance of certain government bonds called Brady Bonds also came to fruition in 1992. Key negotiations with conflicting forces in Mindanao actually became more successful during the administration, which also highlighted the great role and contributions of Jose Almonte as the key adviser of this liberal administration.

By the time Ramos succeeded Corazon Aquino in 1992, the Philippine economy was already burdened with a heavy budget deficit. This was largely the result of austerity measures imposed by a standard credit arrangement with the International Monetary Fund and the destruction caused by natural disasters such as the eruption of Mt. Pinatubo. Hence, according to Canlas, pump priming through government spending was immediately ruled out due to the deficit. Ramos therefore resorted to institutional changes through structural policy reforms, of which included privatization and deregulation. He sanctioned the formation of the Legislative-Executive Development Advisory Council (LEDAC), which served as a forum for consensus building, on the part of the Executive and the Legislative branches, on important bills on economic policy reform measures (4).

The daily brownouts that plagued the economy were also addressed through the enactment of policies that placed guaranteed rates. The economy during the first year of Ramos administration suffered from severe power shortage, with frequent brownouts, each lasting from 8 to 12 hours. To resolve this problem, the Electric Power Crisis Act was made into law together with the Build-Operate-Transfer Law. Twenty power plants were built because of these, and in effect, the administration was able to eliminate the power shortage problems in December 1993 and sustained economic growth for some time.[55]

The economy seemed to be all set for long-run growth, as shown by sustainable and promising growth rates from 1994 to 1997. However, the Asian Crisis contagion which started from Thailand and Korea started affecting the Philippines. This prompted the Philippine economy to plunge into continuous devaluation and very risky ventures, resulting in property busts and a negative growth rate. The remarkable feat of the administration, however, was that it was able to withstand the contagion effect of the Asian Crisis better than anybody else in the neighboring countries. Most important in the administration was that it made clear the important tenets of reform, which included economic liberalization, stronger institutional foundations for development, redistribution, and political reform.[56]

Perhaps some of the most important policies and breakthroughs of the administration are the Capital Account Liberalization and the subsequent commitments to free trade associations such as APEC, AFTA, GATT, and WTO. The liberalization and opening of the capital opening culminated in full-peso convertibility in 1992.[57] And then another breakthrough is again, the establishment of the Bangko Sentral ng Pilipinas, which also involved the reduction of debts in that the debts of the old central bank were taken off its books.

Estrada Administration (1998–2001)

Although Estrada's administration had to endure the continued shocks of the Asian Crisis contagion, the administration was also characterized by the administration's economic mismanagement and "midnight cabinets." As if the pro-poor rhetoric, promises and drama were not really appalling enough, the administration also had "midnight cabinets composed of 'drinking buddies' influencing the decisions of the "daytime cabinet'"[58]). Cronyism and other big issues caused the country's image of economic stability to change towards the worse. And instead of adjustments happening, people saw further deterioration and hopelessness that better things can happen. Targeted revenues were not reached, implementation of policies became very slow, and fiscal adjustments were not efficiently conceptualized and implemented. All those disasters caused by numerous mistakes were made worse by the sudden entrance of the Jueteng controversy, which gave rise to the succeeding EDSA Revolutions.

Despite all these controversies, the administration still had some meaningful and profound policies to applaud. The administration presents a reprise of the population policy, which involved the assisting of married couples to achieve their fertility goals, reduce unwanted fertility and match their unmet need for contraception. The administration also pushed for budget appropriations for family planning and contraceptives, an effort that was eventually stopped due to the fact that the church condemned it.[59] The administration was also able to implement a piece of its overall Poverty Alleviation Plan, which involved the delivery of social services, basic needs, and assistance to the poor families. The Estrada administration also had limited contributions to Agrarian Reform, perhaps spurred by the acknowledgement that indeed, Agrarian Reform can also address poverty and inequitable control over resources. In that regard, the administration establishes the program "Sustainable Agrarian Reform Communities-Technical Support to Agrarian and Rural Development".[60] As for regional development, however, the administration had no notable contributions or breakthroughs.

Macapagal-Arroyo's Administration (2001–10)

The Arroyo administration, economically speaking, was a period of good growth rates simultaneous with the USA, due perhaps to the emergence of the Overseas Filipino workers (OFW) and the Business Process Outsourcing (BPO). The emergence of the OFW and the BPO improved the contributions of OFW remittances and investments to growth. In 2004, however, fiscal deficits grew and grew as tax collections fell, perhaps due to rampant and wide scale tax avoidance and tax evasion incidences. Fearing that a doomsday prophecy featuring the [Argentina default] in 2002 might come to fruition, perhaps due to the same sort of fiscal crisis, the administration pushed for the enactment of the 12% VAT and the E-VAT to increase tax revenue and address the large fiscal deficits. This boosted fiscal policy confidence and brought the economy back on track once again.

Soon afterwards, political instability afflicted the country and the economy anew with Abu Sayyaf terrors intensifying. The administration's Legitimacy Crisis also became a hot issue and threat to the authority of the Arroyo administration. Moreover, the Arroyo administration went through many raps and charges because of some controversial deals such as the NBN-ZTE Broadband Deal. Due however to the support of local leaders and the majority of the House of Representatives, political stability was restored and threats to the administration were quelled and subdued. Towards the end of the administration, high inflation rates for rice and oil in 2008 started to plague the country anew, and this led to another fiscal crisis, which actually came along with the major recession that the United States and the rest of the world were actually experiencing.

The important policies of the Arroyo administration highlighted the importance of regional development, tourism, and foreign investments into the country. Therefore, apart from the enactment and establishment of the E-VAT policy to address the worsening fiscal deficits, the administration also pushed for regional development studies in order to address certain regional issues such as disparities in regional per capita income and the effects of commercial communities on rural growth.[61] The administration also advocated for investments to improve tourism, especially in other unexplored regions that actually need development touches as well. To further improve tourism, the administration launched the policy touching on Holiday Economics, which involves the changing of days in which we would celebrate certain holidays. Indeed, through the Holiday Economics approach, investments and tourism really improved. As for investment, the Arroyo administration would normally go through lots of trips to other countries in order to encourage foreign investments for the betterment of the Philippine economy and its development.

Benigno Aquino III's Administration (2010–16)

The Philippines consistently coined as one of the Newly Industrialized Countries has had a fair gain during the latter years under the Arroyo Presidency to the current administration. The government managed foreign debts falling from 58% in 2008 to 47% of total government borrowings. According to the 2012 World Wealth Report, the Philippines was the fastest growing economy in the world in 2010 with a GDP growth of 7.3% driven by the growing business process outsourcing and overseas remittances.[62]

The country markedly slipped to 3.6% in 2011 after the government placed less emphasis on exports, as well as spending less on infrastructure. In addition, the disruption of the flow of imports for raw materials as a result from floods in Thailand and the tsunami in Japan have affected the manufacturing sector in the same year. "The Philippines contributed more than $125 million as of end-2011 to the pool of money disbursed by the International Monetary Fund to help address the financial crisis confronting economies in Europe.This was according to the Bangko Sentral ng Pilipinas, which reported Tuesday that the Philippines, which enjoys growing foreign exchange reserves, has made available about $251.5 million to the IMF to finance the assistance program—the Financial Transactions Plan (FTP)—for crisis-stricken countries."[63]

Remarkably the economy grew by 6.59% in 2012 the same year the Supreme Court Chief Justice Renato Corona was impeached for a failed disclosure of statements of assets, liabilities and network or SALN coherent to the anti-corruption campaign of the administration.[64] The Philippine Stock Exchange index ended in the year with 5,812.73 points a 32.95% growth from the 4,371.96-finish in 2011.[65]

BBB- investment grade by Fitch Ratings on the first quarter of 2013 for the country was made because of a resilient economy by remittances, growth despite the global economic crisis in the last five years reforms by the VAT reform law of 2005, BSP inflation management, good governance reforms under the Aquino administration.[66]

Macroeconomic trends

The Philippine economy has been growing steadily over decades and the International Monetary Fund in 2014 reported it as the 39th largest economy in the world. However its growth has been behind that of many of its Asian neighbors, the so-called Asian Tigers, and it is not a part of the Group of 20 nations. Instead it is grouped in a second tier for emerging markets or newly industrialized countries. Depending on the analyst, this second tier can go by the name the Next Eleven or the Tiger Cub Economies.

In the years 2012 and 2013, the Philippines posted high GDP growth rates, reaching 6.8% in 2012 and 7.2% in 2013,[67][68][69] the highest GDP growth rates in Asia for the first two quarters of 2013, followed by China and Indonesia.[70]

A chart of selected statistics showing trends in the gross domestic product of the Philippines using data taken from the International Monetary Fund.[71][72]

| Year | GDP growth in percent (constant prices, base year = 2000) | GDP in PHP Billion (current prices) | GDP in USD Billion (current prices) | GDP per capita in USD (current prices) | GDP in USD Billion (PPP) | GDP per capita in USD (PPP) | Peso vs Dollar Exchange Rate |

|---|---|---|---|---|---|---|---|

| 1980 | 5.15 | 270.1 | 35.9 | 744 | 64.4 | 1334 | 7.51 |

| 1981 | 3.42 | 312.0 | 39.5 | 797 | 72.9 | 1471 | 7.90 |

| 1982 | 3.62 | 351.4 | 41.1 | 810 | 80.1 | 1578 | 8.54 |

| 1983 | 1.88 | 408.9 | 36.8 | 707 | 84.9 | 1630 | 11.11 |

| 1984 | -7.32 | 581.1 | 34.8 | 652 | 81.6 | 1530 | 16.70 |

| 1985 | -7.31 | 633.6 | 34.1 | 623 | 77.9 | 1426 | 18.61 |

| 1986 | 3.42 | 674.6 | 33.1 | 591 | 82.4 | 1471 | 20.39 |

| 1987 | 4.31 | 756.5 | 36.8 | 641 | 88.4 | 1540 | 20.57 |

| 1988 | 6.75 | 885.5 | 42.0 | 715 | 97.6 | 1663 | 21.09 |

| 1989 | 6.21 | 1025.3 | 47.3 | 786 | 107.6 | 1791 | 21.70 |

| 1990 | 3.04 | 1190.5 | 48.9 | 796 | 115.2 | 1873 | 24.33 |

| 1991 | -0.58 | 1379.9 | 50.2 | 797 | 118.6 | 1882 | 27.48 |

| 1992 | 0.34 | 1497.5 | 58.7 | 912 | 121.8 | 1891 | 25.51 |

| 1993 | 2.12 | 1633.6 | 60.2 | 914 | 127.1 | 1929 | 27.12 |

| 1994 | 4.39 | 1875.7 | 71.0 | 1052 | 135.5 | 2007 | 26.42 |

| 1995 | 4.68 | 2111.7 | 83.7 | 1224 | 144.8 | 2118 | 25.24 |

| 1996 | 5.85 | 2406.4 | 93.5 | 1336 | 156.1 | 2232 | 26.22 |

| 1997 | 5.19 | 2688.7 | 92.8 | 1297 | 167.1 | 2336 | 28.98 |

| 1998 | -0.58 | 2952.8 | 73.8 | 1009 | 168.1 | 2297 | 40.02 |

| 1999 | 3.08 | 3244.2 | 83.0 | 1110 | 175.8 | 2352 | 39.09 |

| 2000 | 4.41 | 3580.7 | 81.0 | 1053 | 187.5 | 2437 | 44.19 |

| 2001 | 2.89 | 3888.8 | 76.3 | 971 | 197.3 | 2511 | 50.99 |

| 2002 | 3.65 | 4198.3 | 81.4 | 1014 | 207.8 | 2591 | 51.60 |

| 2003 | 4.97 | 4548.1 | 83.9 | 1025 | 222.7 | 2720 | 54.20 |

| 2004 | 6.70 | 5120.4 | 91.4 | 1093 | 242.7 | 2905 | 56.04 |

| 2005 | 4.78 | 5677.8 | 103.1 | 1209 | 261.0 | 3061 | 55.09 |

| 2006 | 5.24 | 6271.2 | 122.2 | 1405 | 283.5 | 3255 | 51.31 |

| 2007 | 6.62 | 6892.7 | 149.4 | 1684 | 309.9 | 3493 | 46.15 |

| 2008 | 4.15 | 7720.9 | 173.6 | 1919 | 329.0 | 3636 | 44.47 |

| 2009 | 1.15 | 8026.1 | 168.5 | 1851 | 335.4 | 3685 | 47.64 |

| 2010 | 7.63 | 9003.5 | 199.6 | 2155 | 365.3 | 3945 | 45.11 |

| 2011 | 3.64 | 9706.3 | 224.1 | 2379 | 386.1 | 4098 | 43.31 |

| 2012[73] | 6.82 | 10564.9 | 250.2 | 2611 | 419.6 | 4380 | 42.23 |

| 2013[74] | 7.16 | 11546.1 | 272.2 | 2792 | 454.3 | 4660 | 42.45 |

| 2014[75] | 6.10 | 12645.3 | 284.8 | 2844 | 642.8 | 6924 | 44.40 |

| 2015[75] | 5.8 | 13307.3 | 292.4 | 2863 | 741.0 | 6547 | 45.50 |

| 2016[75] |

GDP growth at constant 1985 prices in Philippine pesos:[71][76][77]

| Year | 1970 | 1971 | 1972 | 1973 | 1974 | 1975 | 1976 | 1977 | 1978 | 1979 |

|---|---|---|---|---|---|---|---|---|---|---|

| GDP growth % | 4.6 | 4.9 | 4.8 | 9.2 | 5 | 6.4 | 8 | 5.6 | 5.2 | 5.6 |

| Year | 1980 | 1981 | 1982 | 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|

| GDP growth % | 5.149 | 3.423 | 3.619 | 1.875 | -7.324 | -7.307 | 3.417 | 4.312 | 6.753 | 6.205 |

| Year | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|

| GDP growth % | 3.037 | -0.578 | 0.338 | 2.116 | 4.388 | 4.679 | 5.846 | 5.185 | -0.577 | 3.082 |

| Year | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GDP growth % | 4.411 | 2.894 | 3.646 | 4.970 | 6.698 | 4.778 | 5.243 | 7.117 | 4.153 | 1.148 | 7.632 | 3.6 | 6.8 | 7.2 | 6.1[75] | 5.8 | 7.0 |

Composition by sector

As a newly industrialized country, the Philippines is still an economy with a large agricultural sector; however, services have come to dominate the economy. Much of the industrial sector is based on processing and assembly operations in the manufacturing of electronics and other high-tech components, usually from foreign multinational corporations.

Filipinos who go abroad to work–-known as Overseas Filipino Workers or OFWs—are a significant contributor to the economy but are not reflected in the below sectoral discussion of the domestic economy. OFW remittances is also credited for the Philippines' recent economic growth resulting to investment status upgrades from credit ratings agencies such as the Fitch Group and Standard & Poor's.[78] In 1994, more than $2 billion USD worth of remittance from Overseas Filipinos were sent to the Philippines.[79] In 2012, Filipino Americans sent 43% of all remittances sent to the Philippines, totaling to $10.6 billion USD.[80]

Agriculture

Agriculture employs 30% of the Filipino workforce as of 2014.[81] Agriculture accounts for 11% of Philippines GDP as of 2014.[82] The type of activity ranges from small subsistence farming and fishing to large commercial ventures with significant export focus.

The Philippines is the world's largest producer of coconuts producing 19,500,000 tons in 2009. Coconut production in the Philippines is generally concentrated in medium-sized farms.[83] The Philippines is also the world's largest producer of pineapples, producing 2,458,420 million metric tons in 2013.[84]

Rice production in the Philippines is important to the food supply in the country and economy. The Philippines is the 8th largest rice producer in the world, accounting for 2.8% of global rice production.[85] The Philippines was also the world's largest rice importer in 2010.[86] Rice is the most important food crop, a staple food in most of the country. It is produced extensively in Luzon, the Western Visayas, Southern Mindanao, and Central Mindanao.

The Philippines is one of the largest producers of sugar in the world.[87] At least 17 provinces located in 8 regions of the country have grown sugarcane crops, of which Negros island accounts for half of the country’s total production. As of Crop Year 2012-2013, 29 mills are operational divided as follows: 6 mills in Luzon, 13 mills in Negros, 4 mills in Panay, 3 mills in Eastern Visayas and 3 mills in Mindanao.[88] A range from 360,000 to 390,000 hectares are devoted to sugarcane production. The largest sugarcane areas are found in Negros which accounts for 51% of sugarcane areas planted. This is followed by Mindanao which accounts for 20%; Luzon, 17%; Panay islands, 7% and Eastern Visayas, 4%.[89]

Shipbuilding and repair

The Philippines is a major player in the global shipbuilding industry with shipyards in Subic, Cebu, General Santos City and Batangas.[90][91] It became the fourth largest shipbuilding nation in 2010.[92][93] Subic-made cargo vessels are now exported to countries where shipping operators are based. South Korea's Hanjin started production in Subic in 2007 of the 20 ships ordered by German and Greek shipping operators.[94] The country’s shipyards are now building ships like bulk carriers, container ships and big passenger ferries. General Santos' shipyard is mainly for ship repair and maintenance.[95]

Being surrounded by waters, the country has abundant natural deep-sea ports ideal for development as production, construction and repair sites. On top of the current operating shipyards, two additional shipyards in Misamis Oriental and Cagayan province are being expanded to support future locators. It has a vast manpower pool of 60,000 certified welders that comprise the bulk of workers in shipbuilding.

In the ship repair sector, the Navotas complex in Metro Manila is expected to accommodate 96 vessels for repair.[96]

Automotive

The ABS used in Mercedes-Benz, BMW, and Volvo cars are made in the Philippines. Ford,[97] Toyota,[98] Mitsubishi, Nissan and Honda are the most prominent automakers manufacturing cars in the country. Kia and Suzuki produce small cars in the country. Isuzu also produces SUVs in the country. Honda and Suzuki produce motorcycles in the country. A 2003 Canadian market research report predicted that further investments in this sector were expected to grow in the following years. Toyota sells the most vehicles in the country.[99] By 2011, China's Chery Automobile company is going to build their assembly plant in Laguna, that will serve and export cars to other countries in the region if monthly sales would reach 1,000 units.[100] Automotive sales in the Philippines moved up from 165,056 units in 2011 to over 180,000 in 2012. Japan’s automotive manufacturing giant Mitsubishi Motors has announced that it will be expanding its operations in the Philippines.[101]

Aerospace

Aerospace products in the Philippines are mainly for the export market and include manufacturing parts for aircraft built by both Boeing and Airbus. Moog is the biggest aerospace manufacturer with base in Baguio in the Cordillera region. The company produces aircraft actuators in their manufacturing facility.

In 2011, the total export output of aerospace products in the Philippines reached US $3 billion.[102]

Electronics

A Texas Instruments plant in Baguio has been operating for 20 years and is the largest producer of DSP chips in the world.[103] Texas Instruments' Baguio plant produces all the chips used in Nokia cell phones and 80% of chips used in Ericsson cell phones in the world.[104] Until 2005, Toshiba laptops were produced in Santa Rosa, Laguna. Presently the Philippine plant's focus is in the production of hard disk drives. Printer manufacturer Lexmark has a factory in Mactan in the Cebu region. Electronics and other light industries are concentrated in Laguna, Cavite, Batangas and other CALABARZON provinces with sizable numbers found in Southern Philippines that account for most of the country's export.

Mining and extraction

The country is rich in mineral and geothermal energy resources. In 2003, it produced 1931 MW of electricity from geothermal sources (27% of total electricity production), second only to the United States,[105] and a recent discovery of natural gas reserves in the Malampaya oil fields off the island of Palawan is already being used to generate electricity in three gas-powered plants. Philippine gold, nickel, copper and chromite deposits are among the largest in the world. Other important minerals include silver, coal, gypsum, and sulphur. Significant deposits of clay, limestone, marble, silica, and phosphate exist.

About 60% of total mining production are accounted for by non-metallic minerals, which contributed substantially to the industry's steady output growth between 1993 and 1998, with the value of production growing 58%. In 1999, however, mineral production declined 16% to $793 million. Mineral exports have generally slowed since 1996. Led by copper cathodes, Philippine mineral exports amounted to $650 million in 2000, barely up from 1999 levels. Low metal prices, high production costs, lack of investment in infrastructure, and a challenge to the new mining law have contributed to the mining industry's overall decline.

The industry rebounded starting in late 2004 when the Supreme Court upheld the constitutionality of an important law permitting foreign ownership of Philippines mining companies. However, the DENR has yet to approve the revised Department Administrative Order (DAO) that will provide the Implementing Rules and Regulations of the Financial and Technical Assistance Agreement (FTAA), the specific part of the 1994 Mining Act that allows 100% foreign ownership of Philippines mines.

Offshoring & outsourcing

In 2008, the Philippines has surpassed India as the world leader in business process outsourcing.[106][107] The majority of the top ten BPO firms of the United States operate in the Philippines.[108] The industry generated 100,000 jobs, and total revenues were placed at $960 million for 2005. In 2012, BPO sector employment ballooned to over 700,000 people and is contributing to a growing middle class. BPO facilities are located mainly in Metro Manila and Cebu City although other regional areas such as Baguio, Bacolod, Cagayan de Oro, Clark Freeport Zone, Dagupan, Davao City, Dumaguete, Lipa, Iloilo City, and Naga City, Camarines Sur are now being promoted and developed for BPO operations.

Call centers began in the Philippines as plain providers of email response and managing services and is now a major source of employment. Call center services include customer relations, ranging from travel services, technical support, education, customer care, financial services, online business to customer support, and online business-to-business support. Business process outsourcing (BPO) is regarded as one of the fastest growing industries in the world. The Philippines is also considered as a location of choice due to its many outsourcing benefits such as less expensive operational and labor costs, the high proficiency in spoken English of a significant number of its people, and a highly educated labor pool. In 2011, the business process outsourcing industry in the Philippines generated 700 thousand jobs[109] and some US$11 billion in revenue,[110] 24 percent higher than 2010. By 2016, the industry is projected to reach US$27.4 billion in revenue with employment generation to almost double at 1.3 million workers.[111]

BPOs and the call center industry in general are also credited for the Philippines' recent economic growth resulting in investment status upgrades from credit ratings agencies such as Fitch and S&P.[78]

With the Philippines being the 33rd largest economy in the world, the country continues to be a promising prospect for the BPO Industry. Just in August 2014, the Philippines hit an all-time high for employment in the BPO industry. From 101,000 workers in 2004, the labor force in the industry has grown to over 930,000 in just the first quarter of 2014.[112]

Growth in the BPO industry continues to show significant improvements with an average annual expansion rate of 20%. Figures have shown that from $1.3 Billion in 2004, export revenues from the BPO sector has increased to over $13.1 Billion in 2013. The IT and Business Process Association of the Philippines (IBPAP) also projects that the sector will have an expected total revenue of $25 Billion in 2016.[112]

This growth in the industry is further promoted by the Philippine government. The industry is highlighted by the Philippines Development Plan as among the 10 high potential and priority development areas. To further entice investors, government programs include different incentives such as tax holidays, tax exemptions, and simplified export and import procedures. Additionally, training is also available for BPO applicants.[112]

Tourism

Tourism is an important sector for the Philippine economy, contributing 7.8% to the Philippine gross domestic product (GDP) in 2014.[113]

The tourism industry employed 3.8 million Filipinos, or 10.2 per cent of national employment in 2011, according to data gathered by the National Statistical Coordination Board. In a greater thrust by the Aquino administration to pump billion to employ 7.4 million people by 2016, or about 18.8 per cent of the total workforce, contributing 8 per cent to 9 per cent to the nation's GDP.[114]

In 2014, the tourism sector contributed 1.4 trillion pesos to the country's economy.[115]

Regional Accounts

Gross Regional Domestic Product (GRDP) is GDP measured at regional levels. Figures below are for the year 2015:

| Region | GRDP (in ₱B) | % of GDP | Agriculture (in ₱B) | % of GRDP | Industry (in ₱B) | % of GRDP | Services (in ₱B) | % of GRDP | per capita GRDP |

|---|---|---|---|---|---|---|---|---|---|

| Metro Manila | 5,047.838 | 37.9 | 11.168 | 0.2 | 884.571 | 17.5 | 4,152.099 | 82.3 | 398,985 |

| Cordillera | 233.834 | 1.8 | 22.992 | 9.8 | 113.478 | 48.5 | 97.365 | 41.6 | 131,110 |

| Ilocos | 407.189 | 3.1 | 91.167 | 22.4 | 107.566 | 26.4 | 208.456 | 51.2 | 79,281 |

| Cagayan Valley | 235.728 | 1.8 | 87.988 | 37.3 | 34.250 | 14.5 | 113.491 | 48.1 | 67,391 |

| Central Luzon | 1,183.518 | 8.9 | 189.153 | 16.0 | 500.266 | 42.3 | 494.098 | 41.7 | 106,634 |

| CALABARZON | 2,060.578 | 15.5 | 118.176 | 5.7 | 1,216.491 | 59.0 | 725.911 | 35.2 | 145,859 |

| MIMAROPA | 204.303 | 1.5 | 54.904 | 26.9 | 59.918 | 29.3 | 89.481 | 43.8 | 66,132 |

| Bicol | 281.283 | 2.1 | 64.742 | 23.0 | 65.070 | 23.1 | 151.471 | 53.9 | 46,631 |

| Western Visayas | 546.888 | 4.1 | 123.272 | 22.5 | 122.535 | 22.4 | 301.081 | 55.1 | 70,984 |

| Central Visayas | 866.935 | 6.5 | 58.437 | 6.7 | 295.822 | 34.1 | 512.677 | 59.1 | 116,417 |

| Eastern Visayas | 269.760 | 2.0 | 51.881 | 19.2 | 105.776 | 39.2 | 112.103 | 41.6 | 59,455 |

| Zamboanga Peninsula | 275.835 | 2.1 | 60.744 | 22.0 | 95.155 | 34.5 | 119.936 | 43.5 | 73,269 |

| Northern Mindanao | 516.255 | 3.9 | 126.546 | 24.5 | 165.295 | 32.0 | 224.413 | 43.5 | 109,685 |

| Davao Region | 563.793 | 4.2 | 107.215 | 19.0 | 167.960 | 29.8 | 288.618 | 51.2 | 113,597 |

| SOCCSKSARGEN | 355.963 | 2.7 | 104.409 | 29.3 | 109.475 | 30.8 | 142.079 | 39.9 | 77,397 |

| Caraga | 158.380 | 1.2 | 32.935 | 20.8 | 46.296 | 29.2 | 79.149 | 50.0 | 58,299 |

| Muslim Mindanao | 99.186 | 0.7 | 60.335 | 60.8 | 4.946 | 5.0 | 33.905 | 34.2 | 26,757 |

| Total | 13,307.265 | 100 | 1,366.063 | 10.3 | 4,094.870 | 30.8 | 7,846.332 | 59.0 | 131,026 |

Note: Green-colored cells indicate higher value or best performance in index, while yellow-colored cells indicate the opposite.

Economic indicators and international rankings

Statistics

| Economic growth[139][140][141] | ||

|---|---|---|

| Year | % GDP | % GNI |

| 1999 | 3.1 | 2.7 |

| 2000 | 4.4 | 7.7 |

| 2001 | 2.9 | 3.6 |

| 2002 | 3.6 | 4.1 |

| 2003 | 5.0 | 8.5 |

| 2004 | 6.7 | 7.1 |

| 2005 | 4.8 | 7.0 |

| 2006 | 5.2 | 5.0 |

| 2007 | 7.1 | 6.2 |

| 2008 | 4.2 | 5.0 |

| 2009 | 1.1 | 6.1 |

| 2010 | 7.6 | 8.2 |

| 2011 | 3.7 | 2.6 |

| 2012[75] | 6.8 | 6.5 |

| 2013[75] | 7.2 | 7.5 |

| 2014[75] | 6.1 | 5.8 |

| 2015[75] | 5.8 | 5.4 |

| 2016 | ||

| * Computed at Constant 2000 Prices | ||

| ** Source: NEDA and NSCB | ||

Most of the following statistics are sourced from the International Monetary Fund – Philippines (as of 2012; figures are in US dollars unless otherwise indicated).

- GDP – purchasing power parity: $751.770 billion (2015)

- GDP – real growth rate: 5.6% (Q2 2015)

- GDP per capita purchasing power parity: $6,985.680 (2014)

- GDP nominal: $330.259 billion (2015)

- GDP per capita: $2,913.344 (2014)[142]

- GDP – composition by sector:

- agriculture: 10.3%

- industry: 30.9%

- services: 58.8% (2015 est.)[15]

- Population below poverty line: less than $1.25 / 10.41% (2009)

less than $2 / 25.2% (2012),[143] 26.3% (2009),[143] 32.9% (2006 est.)[15] - Household income or consumption by percentage share:

- lowest 10%: 2.9%

- highest 10%: 30.5% (2012 est.)[15]

- Inflation rate (consumer prices): 1.4% (2015 est.), 4.1% (2014 est.), 5.3% (2011 est.),[15] 3.5% (September 2010)[144]

- Labor force: 41.37 million (2015 est.)[15]

- Labor force by occupation:

- agriculture 29%

- industry 16%

- services 55% (2015 est.)[15]

- Unemployment rate: 6.3% (2015 est.), 6.8% (2014 est.)[15] 7.5% (April 2013),[145] 6.9% (April 2012),[145] 7.2% (April 2011)[146]

- Budget:

- Foreign Reserves: US$85.761 billion (January 2013)[148]

- Industries: electronics assembly, shipbuilding, garments, footwear, pharmaceuticals, chemicals, wood products, food processing, petroleum refining, fishing

- Industrial production growth rate: 6% (2015 est.)[15]

- Electricity – production: 75.27 billion kWh (2013 est.)[15]

- Electricity – consumption: 75.27 billion kWh (2013 est.)[15]

- Electricity – exports: 0 kWh (2013)[15]

- Electricity – imports: 0 kWh (2013)[15]

- Agriculture – products: sugarcane, coconuts, rice, corn, bananas, cassavas, pineapples, mangoes; pork, eggs, beef; fish[15]

- Exports: $58.65 billion (Jan-Sept 2015 est.) $62.1 billion (2014) $53.98 billion (2013)[149]$54.17 billion (2011 est.); $69.46 billion (2010 est.)[15][150]

- Exports – commodities: semiconductors and electronic products, transport equipment, garments, copper products, petroleum products, coconut oil, fruits[15]

- Exports – partners: Japan 21%, United States 15%, China 11%, Hong Kong 10.6%, Singapore 6.2%, Germany 4.5%, South Korea 4.3% (2015)[15]

- Imports: $66.69 billion (2015), $65.4 billion (2014), $61.831 billion (2013),[149] $68.84 billion (2011 est.)[15]

- Imports – commodities: electronic products, mineral fuels, machinery and transport equipment, iron and steel, textile fabrics, grains, chemicals, plastic[15]

- Imports – partners: China 16.2%, United States 10.8%, Japan 9.6%, Singapore 7%, South Korea 6.5%, Thailand 6.4%, Malaysia 4.7, Indonesia 4.4% (2015)[15]

- Debt – external: $75.61 billion (30 September 2015 est.)[15]

- Currency: 1 Philippine peso (₱) = 100 centavos

- Exchange rates: Philippine pesos (PHP) per US dollar – 45.50 (2015) 44.39 (2014 average),[151] 42.43 (2012 average),[151] 43.44 (2011), 45.11 (2010), 47.68 (2009), 44.439 (2008), 46.148 (2007), 51.246 (2006),[15] 55.086 (2005)

Government budget

The national government budget for 2016 has set the following budget allocations:[152]

| Budget Allocation | Billions of Pesos (PHP) | Billions of US Dollars (USD) | % |

|---|---|---|---|

| Department of Education | 435.9 | 9.54 | 14.52 |

| Department of Public Works and Highways | 394.5 | 8.64 | 13.14 |

| Department of National Defense | 172.7 | 3.78 | 5.75 |

| Department of Interior and Local Government | 154.5 | 3.38 | 5.14 |

| Department of Health | 128.4 | 2.81 | 4.28 |

| Department of Social Welfare and Development | 104.2 | 2.28 | 3.47 |

| Department of Agriculture | 93.4 | 2.05 | 3.11 |

| Department of Finance | 55.3 | 1.21 | 1.84 |

| Department of Transportation and Communications | 49.3 | 1.08 | 1.64 |

| Department of Environment and Natural Resources | 25.8 | 0.56 | 0.85 |

| Department of Science and Technology | 18.6 | 0.41 | 0 |

See also

- List of companies of the Philippines

- Next Eleven

- Tiger Cub Economies

- Newly Industrialized countries

- Economy of Asia

- Emerging markets

- Bamboo network

References

- ↑ "Philippines". International Monetary Fund. Retrieved April 12, 2016.

- 1 2 3 "Report for Selected Countries and Subjects".

- ↑ http://psa.gov.ph/content/philippine-economy-posts-71-percent-gdp-growth-third-quarter-2016

- ↑ http://www.philstar.com/business/2016/11/17/1644683/philippine-economy-grows-7.1-q3-2016/

- ↑ "Summary Tables" (PDF). Retrieved 8 March 2009.

- ↑ http://www.philstar.com/business/2016/11/28/1648011/imf-raise-philippine-growth-forecast

- ↑ Torres, Ted (October 28, 2016). Philippine Star http://www.philstar.com/headlines/2016/10/28/1638032/poverty-incidence-drops-21.6. Retrieved October 28, 2016. Missing or empty

|title=(help) - ↑ http://data.worldbank.org/indicator/SI.POV.GINI?end=2012&locations=PH&start=2012&view=bar

- ↑ http://business.inquirer.net/193337/unemployment-eased-to-6-4-in-april. Retrieved 10 June 2015. Missing or empty

|title=(help) - ↑ "The World Factbook". Retrieved 3 March 2015.

- ↑ "VIBRANT LABOR MARKET ACCOMPANIES GDP GROWTH". Philippines. 9 September 2016. Retrieved 9 September 2016.

- ↑ "Manufacturing" (PDF). Retrieved 8 April 2016.

- ↑ "Doing business". World Bank. May 31, 2016. Retrieved May 31, 2016.

- ↑ "Final Foreign Trade Statistics January to December 2015".

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 CIA World Factbook, Philippines, Retrieved May 15, 2009.

- 1 2 https://psa.gov.ph/content/foreign-trade-statistics-philippines-2013

- ↑ "Final Foreign Trade Statistics January to December 2015".

- ↑ http://www.philstar.com/business/2016/08/01/1608614/philippines-emerging-winner-fdi

- ↑ http://www.bsp.gov.ph/publications/media.asp?id=3761

- ↑ . 2016-04-08= http://business.inquirer.net/209294/aquino-to-leave-behind-crisis-proof-economy-says-capital-economics. Retrieved 2016-04-08. Check date values in:

|date=(help); Missing or empty|title=(help) - ↑ "NEDA: Foreign aid releases slightly increased in 2011 | Inquirer Business". Business.inquirer.net. 2012-03-05. Retrieved 2012-10-12.

- ↑ "Sovereigns rating list". Standard & Poor's. Retrieved 8 May 2014.

- ↑ "Philippines secures 2nd investment grade rating from S&P". Philippine Star Business. 2013-10-09.

- ↑ "Rating Action: Moody's upgrades Philippines to Baa2, outlook stable". Moody's Investors Service. 2014-12-11. Retrieved 2014-12-12.

- ↑ "Fitch Revises the Philippines' Outlook to Positive; Affirms at 'BBB-'". Reuters. Reuters. 25 March 2015. Retrieved 27 March 2013.

- ↑ http://www.bsp.gov.ph/publications/media.asp?id=4163

- ↑ "World Economic Outlook Database". Retrieved 13 April 2016.

- ↑

- ↑ http://www.bworldonline.com/content.php?section=Economy&title=phl-economy-projected-as-16th-biggest-by-2050----hsbc&id=119247.

|first1=missing|last1=in Authors list (help); Missing or empty|title=(help) - ↑ Sabillon, Carlos (2005). World Economic Historical Statistics. Algora Publishing. pp. 7, 111, 158. ISBN 978-0-87586-353-5.

- ↑ Sabillon 2005, p. 111

- ↑ From the mountains to the seas. Mallari, Perry Gil S. The Manila Times. January 18, 2009.

- 1 2 3 4 Ancient Philippine Civilization. Accessed January 7, 2013.(archived from the original on 2007-12-01)

- ↑ Felix Regalado and Quentin B. Franco, History of Panay (Iloilo City, Central Philippines University: 1973) ed., Eliza B. Grimo, p. 78.

- ↑ The Cultural Influences of India, China, Arabia, and Japan – Philippine Almanac

- ↑ Cebu, a Port City in Prehistoric and in Present Times. Accessed September 05, 2008.

- ↑ NationMaster (2010). "GDP per capita in 1900 by country. Definition, graph and map.". Retrieved 2010-12-12.

- ↑ Kasaysayan: History of the Filipino People, Volume 7. Reader's Digest. 1990.

- ↑ Agoncillo, Teodoro A. & Guerrero, Milagros C., History of the Filipino People, 1986, R.P. Garcia Publishing Company, Quezon City, Philippines

- ↑ Ocampo, Ambeth (2010). Looking Back 3: Death by Garrote. Anvil Publishing, Inc. pp. 22–25.

- ↑ Hartendorp, A. (1958) History of Industry and Trade of the Philippines, Manila: American Chamber of Commerce on the Philippines, Inc.

- ↑ History of the Development Bank of the Philippines, About DBP accessed on July 2, 2015

- ↑ Blue Book of the First Year of the Republic, Manila: Bureau of Printing, 1947, p. 27

- ↑ "Creating a Central Bank for the Philippines", Bangko Sentral ng Pilipinas website, accessed on July 2, 2015

- ↑ Gleeck, Lewis, The Third Republic, New Day Publishers, Quezon City,1993, p.47

- ↑ Leclerc, Grégoire and Hall, Charles A. S., Making World Development Work: Scientific Alternatives to Neoclassical Economic Theory, (New Mexico: University of New Mexico Press, 2007)

- ↑ Castro, Pacifico A., Diplomatic Agenda of the Philippine Presidents, Foreign Service Institute, Manila, 1985, p. 1.

- ↑ Carlos P. Garcia, "Third State of the Nation Address," January 25, 1960, Official Gazette, January 25, 1960, accessed on July 2, 2015,

- ↑ Abinales, Patricio N., Amoroso, Donna J., State and Society in the Philippines. Maryland: Rowman & Little Publishers, Inc., 2005. p. 182,

- ↑ McFerson, Hazel M. Mixed Blessing: The Impact of the American Colonial Experience on Politics and Society in the Philippines. Connecticut: Greenwood Press, 2002., p. 227,

- ↑ Cooley, Alexander, Base Politics: Dramatic Change and the U.S. Military Overseas, NY: Cornell University Press, 2008, p. 68,

- ↑ "History: Milestones in Corporate Existence", Landbank web site, accessed on July 2, 2015,

- 1 2 3 4 De Dios, Emmanuel (1984). An Analysis of the Philippine Economic Crisis. Diliman, Q.C.: University of the Philippines Press.

- ↑ Balisacan and Hill, The Philippine Economy, p. 106

- ↑ Canlas, p. 4–5

- ↑ Balisacan and Hill, The Philippine Economy, p. 57–59

- ↑ Balisacan and Hill, 'The Philippine Economy, p. 21

- ↑ Balisacan and Hill, The Philippine Economy, p. 19

- ↑ Balisacan and Hill, The Philippine Economy, p. 299

- ↑ Villegas, p. 646–647

- ↑ Balisacan and Hill, The Dynamics, p. 378

- ↑ "Philippines, 6th fastest growing in the world: wealth report". Rappler. Aug 21, 2012. Retrieved Aug 21, 2012.

- ↑ "Philippines contributed $125M to IMF as of end-'11". Philippine Daily Inquirer. Feb 22, 2012. Retrieved Feb 22, 2012.

- ↑ "Senate votes 20–3 to convict Corona". Philippine Daily Inquirer. May 29, 2012. Retrieved May 30, 2012.

- ↑ "PSEi ends 2012 in the green, up 33% from last year". ABS-CBN News. Dec 28, 2012. Retrieved Dec 28, 2012.

- ↑ "A first: Investment grade rating for PH". Rappler. March 27, 2013. Retrieved March 27, 2013.

- ↑ "Philippine Economy Grew by 7.2 percent in 2013". National Statistical Coordination Board. Retrieved March 12, 2014.

- ↑ "Philippine economy grows a stunning 7.8%". Asia News Network. Retrieved June 6, 2013.

- ↑ "2012 PH GDP growth revised to 6.8 pct". ABS-CBN News. Retrieved June 10, 2013.

- ↑ "Philippines is fastest growing Asian country for first quarter of 2013". Inquirer News. Retrieved June 10, 2013.

- 1 2 International Monetary Fund. (April 2012). World Economic Outlook Data, By Country – Philippines: [selected annual data for 1980–2017]. Retrieved 2012-06-23 from the World Economic Outlook Database.

- ↑ International Monetary Fund. (April 2010). "World Economic Outlook (WEO) Database April 2010 – Report for Selected Countries and Subjects – Philippines and United States".

- ↑ "Report for Selected Countries and Subjects". Imf.org. 2013-04-16. Retrieved 2013-04-19.

- ↑ "Report for Selected Countries and Subjects". Retrieved 3 March 2015.

- 1 2 3 4 5 6 7 8 Philippine Statistics Authority – National Statistical Coordination Board, Retrieved April 23, 2014.

- ↑ International Monetary Fund. (October 2010). The Philippine Stock Exchange, It is one of the oldest stock exchanges in Southeast Asia, having been in continuous operation since its inception in 1927. It currently maintains two trading floors, one at the Ayala Tower One in the Makati Central Business District, and one at its headquarters in Pasig City. The PSE is composed of a 15-man Board of Directors, chaired by Jose T. Pardo. World Economic Outlook Data, By Country – Philippines: [selected annual data for 1980–2015]. Retrieved 2011-01-31 from the World Economic Outlook Database.

- ↑ International Monetary Fund. (April 2002). "The World Economic Outlook (WEO) Database April 2002 – Real Gross Domestic Product (annual percent change) – All countries".

- 1 2 King del Rosario. "MBA Buzz: More Funds in the Philippines". Retrieved 2013-06-11.

- ↑ Kevin Starr (22 June 2011). Coast of Dreams. Knopf Doubleday Publishing Group. p. 159. ISBN 978-0-307-79526-7.

- ↑ Drew Desilver (13 November 2013). "More than 3.4M Americans trace their ancestry to the Philippines". Fact Tank. Pew Research Center. Retrieved 19 December 2014.

- ↑ "Employment in agriculture (% of total employment)". Retrieved 3 March 2015.

- ↑ "Agriculture, value added (% of GDP)". Retrieved 3 March 2015.

- ↑ Hayami, Yūjirō; Quisumbing, Maria Agnes R.; Adriano, Lourdes S. (1990). Toward an alternative land reform paradigm: a Philippine perspective. Ateneo de Manila University Press. p. 108. ISBN 978-971-11-3096-1. Retrieved 15 November 2011.

- ↑ FAO. "Food and Agricultural commodities production / Commodities by country". Retrieved 26 May 2016.

- ↑ Faostat

- ↑ "Factbox - Top 10 rice exporting, importing countries". Reuters. 28 January 2011. Retrieved 30 March 2011.

- ↑ "ESS Website ESS : Statistics home". Retrieved 3 March 2015.

- ↑ "Historical Statistics". Retrieved 3 March 2015.

- ↑ Master Plan For the Philippine Sugar Industry. Sugar Master Plan Foundation, Inc. 2010. p. 7.

- ↑ "Philippines Shipbuilding Hub In Asia-Pacific". Yahoo News Philippines. 4 December 2012. Retrieved 3 March 2015.

- ↑ "Business - Cebu shipbuilder to deliver PHs largest vessel - INQUIRER.net". Retrieved 3 March 2015.

- ↑ http://www.crossworldmarine.com/index.php?option=com_content&view=article&id=85:philippines-one-of-the-worlds-leaders-in-shipbuilding&catid=6:press-releases&Itemid=26

- ↑ John Pike. "Philippine Shipbuilding Industry". Retrieved 3 March 2015.

- ↑ "New era as shipbuilding production begins in the Philippines". Retrieved 3 March 2015.

- ↑ William Poole. "Big ambitions for Philippines shipbuilding". Retrieved 3 March 2015.

- ↑ http://www.businessmirror.com.ph/index.php/news/top-news/3760-filipino-firm-invests-p259m-for-shipyard-in-navotas

- ↑ "Ford Philippines - The Ford Philippines Assembly Plant". Retrieved 3 March 2015.

- ↑ Toyota defends assembly of small cars in the Philippines | Manila Bulletin

- ↑ Oslowski, Justin. (March 25, 2003). "Automotive Production in the Philippines". Industry Canada. Archived from the original on 2007-12-08. Retrieved 2007-12-11.

- ↑ http://newsinfo.inquirer.net/10788/laguna-car-plant-seen-to-boost-chery%E2%80%99s-sales Laguna car plant seen to boost Chery’s sales

- ↑ "Mitsubishi expands in the Philippines". Investvine.com. 2013-02-21. Retrieved 2013-02-21.

- ↑ http://ph.news.yahoo.com/relocating-firms-double-exports-aerospace-components-6b-093830140--finance.html Relocating Firms To Double Exports Of Aerospace Components To $6B

- ↑ "The positive outlook to the Philippines". philnews.com. Retrieved 2007-12-11

- ↑ "Texas Instruments in Baguio retrenches 392 employees - Equipment\cn-c114 ĄŞ C114 - China Communication Network". Cn-c114.net. Retrieved 2012-10-12.

- ↑ Tester, JK; Anderson, Bj; Batchelor, As; Blackwell, Dd; DiPippo, R; Drake, Em; Garnish, J; Livesay, B; Moore, Mc; Nichols, K; Petty, S; Toksoz, Mn; Veatch, Rw; Baria, R; Augustine, C; Murphy, E; Negraru, P; Richards, M (Apr 2007). "Geothermal Energy Systems". Philosophical Transactions of the Royal Society A. ResLab, Australia. 365 (1853): 1057–94. doi:10.1098/rsta.2006.1964. PMID 17272236. Archived from the original on 2005-03-09. Retrieved 2007-12-11 (from internet archive)

- ↑ IBM Global Business Services. (October 2008). Global Location Trends – 2008 Annual Report.

- ↑ Balana, Cynthia D. and Lawrence de Guzman. (December 5, 2008). It's official: Philippines bests India as No. 1 in BPO. The Philippine Daily Inquirer.

- ↑ "foreign companies eye local BPO sector". inquirer.net. Retrieved 5 August 2015.

- ↑ http://www.abs-cbnnews.com/business/03/21/12/bpo-industry-generate-100000-jobs-year-wb BPO industry to generate 100,000 jobs

- ↑ "IT-BPO revenue reached $11B in 2011". Retrieved 3 March 2015.

- ↑ IT-BPO Sector Sees $27.4-B Revenues by 2016 | PINOY OFW

- 1 2 3 "The Philippines – Poised for Growth Through BPO". trendline.dcrworkforce.com. Retrieved 2015-11-10.

- ↑ "Tourism Contributes 7.8 gdp". National Statistical Coordination Board. Retrieved 2013-09-27.

- ↑ Calderon, Justin (5 March 2013). "Philippine tourism to create 3.6m jobs". Inside Investor. Retrieved 23 May 2013.

- ↑ "WTTC: Tourism contributed P1.4T to economy".

- ↑ List of countries by GDP (PPP)

- ↑ List of countries by GDP (nominal)

- ↑ List of countries by GDP (PPP) per capita

- ↑ List of countries by GDP (nominal) per capita

- ↑ List of countries by foreign-exchange reserves

- ↑ List of countries by population

- ↑ Area List of countries and outlying territories by total area

- ↑ Population Density List of sovereign states and dependent territories by population density

- ↑ "Global Health Observatory Data Repository". Retrieved 3 March 2015.

- ↑ Literacy Rate List of countries by literacy rate

- ↑ External Debt List of countries by external debt

- ↑ Human Development Index 2014 List of countries by Human Development Index

- ↑ "The Global Competitiveness Report 2014 - 2015". The Global Competitiveness Report 2014 - 2015 - World Economic Forum. Retrieved 3 March 2015.

- ↑ "Phl now 56th in world economic freedom rankings". Thechroniclevarsitarian.wordpress.com. Retrieved 2013-09-22.

- ↑ "The Global Gender Gap Report 2014" (PDF). World Economic Forum. Retrieved 24 May 2015.

- ↑ "The Travel & Tourism Competitiveness Index 2013 and 2011 comparison" (PDF). weforum.org. Retrieved 2013-10-04.

- ↑ "Phl moves up in WEF Enabling Trade Index". philstar.com. Retrieved 3 March 2015.

- ↑ "Ease of Doing Business Report". Doingbusiness.org. Retrieved 2013. Check date values in:

|access-date=(help) - ↑ "Corruption Perceptions Index". ManilaTimes. Retrieved 2013-12-03.

- ↑ http://www.abs-cbnnews.com/business/05/07/14/ph-improves-economic-freedom-ranking

- ↑ Global Peace Index

- ↑ "World Press Freedom Index 2013". Reporters Without Borders. Retrieved 2013-10-04.

- ↑ "The Financial Development Index 2012 rankings: Comparison with 2011" (PDF). World Economic Forum. Retrieved 2014-09-15.

- ↑ National Economic and Development Authority (NEDA), Republic of the Philippines. (January 31, 2011). Annual GDP Sizzled to its Highest Growth Rate in the Post Marcos Era at 7.3 Percent; Q4 2010 GDP grew by 7.1 percent

- ↑ National Economic and Development Authority (NEDA), Republic of the Philippines. "National Income Accounts (NIA) – GNP/GDP Matrices". Retrieved September 2010. Check date values in:

|access-date=(help) - ↑ Agcaoili, Lawrence. (November 26, 2010). GDP growth slows to 6.5% in 3rd quarter. The Philippine Star.

- ↑ , International Monetary Fund.

- 1 2 Philippine Statistics Authority – National Statistical Coordination Board, Retrieved April 23, 2014.

- ↑ National Statistics Office, Republic of the Philippines. (2010-10-05). "Consumer Price Index September 2010". Retrieved 2010-09-30.

- 1 2 Philippine Statistics Authority – National Statistical Coordination Board, Retrieved April 23, 2014.

- ↑ "April 2011 Labor Force Survey (LFS)". Census.gov.ph. Archived from the original on 2011-06-24. Retrieved 2011-09-04.

- 1 2 Philippine Statistics Authority – National Statistical Coordination Board, Retrieved April 23, 2014.

- ↑ "End-September forex reserves climb to $81.9-B". InterAksyon.com. 2012-10-05. Retrieved 2012-10-12.

- 1 2 Philippine Statistics Authority – National Statistical Coordination Board, Retrieved April 23, 2014.

- ↑ Ho, Abigail. (December 28, 2010). DTI says export earnings to hit $100B by '16. The Philippine Daily Inquirer. Retrieved December 28, 2010.

- 1 2 Philippine Statistics Authority – National Statistical Coordination Board, Retrieved April 23, 2014.

- ↑ "P3-T 'continuity' 2016 budget submitted to House". Retrieved 2015-08-04..

Further reading

- Balisacan, Arsenio; Hal Hill (2003). The Philippine Economy: Development, Policies, and Challenges. New York: Oxford University Press. p. 496. ISBN 978-0-19-515898-4

- Balisacan, Arsenio; Hal Hill (2007). "The Dynamics of Regional Development: The Philippines in East Asia" (PDF). Cheltenham, UK: Edward Elgar

- Bhagwati, Jagdish and Anne Krueger. (1974). Foreign Trade Regimes and Economic Development. National Bureau of Economic Research.

- Kang, David C. (2002). Crony Capitalism – Corruption and Development in South Korea and the Philippines. Cambridge University Press. ISBN 978-0-521-00408-4.

- Villegas, Bernardo. (2010). The Philippine Advantage (3rd ed.). Manila: University of Asia and the Pacific.