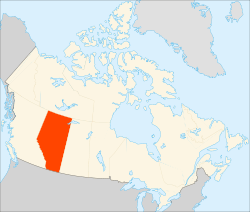

Economy of Alberta

Alberta's economy is the sum of all economic activity in Alberta, Canada's fourth largest province by population. Although Alberta has a presence in many industries such as agriculture, forestry, education, tourism, finance, and manufacturing, the politics and culture of the province have been closely tied to the production of fossil energy since the 1940s. Alberta—with an estimated 1.4 billion cubic metres of unconventional oil resource in the bituminous oil sands—leads Canada as an oil producer.[1] Revenue from oil and natural gas extraction has fueled a series of economic booms in the province's recent history, and economic spin-offs have included petrochemical and pipelines. In 1985 36.1% of Alberta's $66.8 billion GDP was from energy industries. In 2012, "the mining and oil and gas extraction industry made up 23.3% of Alberta's GDP."[2] By 2013 Alberta's GDP was $331.9 billion with 24.6% in energy. The energy industry provided 7.7% of all jobs in Alberta in 2013.[3]

From 1990 to 2003, Alberta's economy grew by 57% compared to 43% for all of Canada—the strongest economic growth of any region in Canada.[1] In 2006 Alberta's per capita GDP was higher than all US states, and one of the highest figures in the world. In 2006, the deviation from the national average was the largest for any province in Canadian history.[4] Alberta's per capita GDP in 2007 was by far the highest of any province in Canada at C$74,825 (approx. US$75,000). Alberta's per capita GDP in 2007 was 61% higher than the Canadian average of C$46,441 and more than twice that of all the Maritime provinces. From 2004 to 2014 Alberta's "exports of commodities rose 91%, reaching $121 billion in 2014" and 500,000 new jobs were created.[3] In 2014, Alberta’s real GDP by expenditure grew by 4.8%, the strongest growth rate among the provinces."[5]

Beginning in June 2014 the record high volume of worldwide oil inventories in storage—referred to as a global oil glut[6]—caused crude oil prices to collapse at near ten-year low prices.[7][8][9] By 2016 West Texas Intermediate (WTI)—the benchmark light, sweet crude oil—reached its lowest price in ten years—US$26.55. In 2012 the price of WTI had reached US$125 and in 2014 the price was $100. By February 2016 the price of Western Canadian Select WCS—the Alberta benchmark heavy crude oil—was US$14.10[10][11]—the cheapest oil in the world.[12] Alberta's economy suffered with over 100,000 oil patch jobs lost.[13] In spite of the surplus with the low price of WCS in 2015—99% of Canada's oil exports went to the United States[14] and in 2015 Canada was still their largest exporter of total petroleum—3,789 thousand bpd in September, 3,401 thousand bpd in October up from 3,026 thousand bpd in September 2014.[15]

Minister of Finance quarterly reports

Each fiscal quarter the office of Alberta Treasury Board and Finance submits a report which includes an updated Alberta economic outlook and predictions for the following year.

2015–16 Third Quarter Fiscal Update and Economic Statement

In the third quarterly fiscal update published in February 2016, forecasts for the Crown debt was $18.9 billion compared to a surplus of $1.12 billion in 2014/2015. The deficit was forecast at $6.3 billion, revenue was forecast to be $43.1 billion and the expense was forecast at $49.4 billion.[16]:4 The 2015/2016 forecast for non-renewable resource revenue has been decreased to $2.47, down from In 2014-15 the non-renewable resource revenue was $8.95 billion. In the 2015 spring budget it was projected to be $2.77 billion.[16]:4 With the lower exchange rate crude oil royalties—budgeted at $610 million are forecast to be $74 million higher but remain much lower than the $2.25 billion in 2014-15.[16]:6 Transfers from the federal government are forecast at a total of 7,256 million up from 5,982 in 2014-15.[16]:6 If global oil production continued to outperform expectations for an even more prolonged period, Alberta's outlook will be further weakened.[16]:14 In January 2016 the price of Western Canadian Select WCS—the Alberta heavy oil benchmark—fell below US$20 per barrel—"the lowest level since trading began in 2004."[16]:12 However, Alberta's economy experienced real GDP growth because of an improved trade balance with declining imports and rising exports—mainly because of the low Canadian dollar.[16]:13 The unemployment rate was expected to average 7.4% in 2016.[16]:13

2015–16 First Quarter Fiscal Update and Economic Statement

On August 30, 2015, Joe Ceci Minister of Finance of Alberta, released the quarterly fiscal update which covers the period from April 1 to June 30, stating that the Alberta budget "could include a deficit of as much as $6.5-billion (Canadian) – $1.1-billion more than his previous estimate – if the oil industry downturn persists at recent levels."[17][18] Rachel Notley’s NDP party came into power on May 24, 2015.[18][19]

Factors such as the lower Canadian-US exchange rate and the lower WTI-WCS price differential bolstered the otherwise downgraded outlook. The dramatic drop in the price of oil, weakened Alberta's economic outlook[19]:12 and continued to contribute to the province's loss of revenue. Alberta's oil and gas investment is "expected to fall over 30% in 2015, with weakness carrying into 2016."[19]:12 From January through July oil rig activity declined almost 50%.[19]:12 By July 2015 the unemployment rate was 6.0%.[19]:13 In spite of the rising unemployment rate, and the outflow of some Albertans due to job loss, 7,723 people from outside Alberta moved there from January to April, leaving a positive net flow with a forecast population growth of 2% in 2015.[19]:13

Economic geography

Alberta has a small internal market, and it is relatively distant from major world markets, despite good transportation links to the rest of Canada and to the United States to the south. Alberta is located in the northwestern quadrant of North America, in a region of low population density called the Interior Plains. Alberta is landlocked, and separated by a series of mountain ranges from the nearest outlets to the Pacific Ocean, and by the Canadian Shield from ports on the Lakehead or Hudson Bay. From these ports to major populations centres and markets in Europe or Asia is several thousands of kilometers. The largest population clusters of North America (the Boston – Washington, San Francisco - San Diego, Chicago – Pittsburgh, and Quebec City – Windsor Corridors) are all thousands of kilometers away from Alberta. Partly for this reason, Alberta has never developed a large presence in the industries that have traditionally started industrialization in other places (notably the original Industrial Revolution in Great Britain) but which require large labour forces, and large internal markets or easy transportation to export markets, namely textiles, metallurgy, or transportation-related manufacturing (automotives, ships, or train cars).

Agriculture has the been a key industry since the 1870s. The climate is dry, temperate, and continental, with extreme variations between seasons. Productive soils are found in most of the southern half of the province (excluding the mountains), and in certain parts of the north. Agriculture on a large scale is practiced further north in Alberta than anywhere else in North America, extending into the Peace River country above the 55th parallel north. Generally, however, northern Alberta (and areas along the Alberta Rockies) is forested land and logging is more important than agriculture there. Agriculture is divided into primarily field crops in the east, livestock in the west, and a mixture in between and in the parkland belt in the near north.

Conventional oil and gas fields are found throughout the province on an axis running from the northwest to the southeast. Oil sands are found in the northeast, especially around Fort McMurray (the Athabasca Oil Sands).

Because of its (relatively) economically isolated location, Alberta relies heavily on transportation links with the rest of the world. Alberta's historical development has been largely influenced by the development of new transportation infrastructure, (see "trends" below). Alberta is now served by two major transcontinental railways (CN and CP), by three major highway connections to the Pacific (the Trans-Canada via Kicking Horse Pass, the Yellowhead via Yellowhead Pass and the Crowsnest via Crowsnest Pass), and one to the United States (Interstate 15), as well as two international airports (Calgary and Edmonton). Also, Alberta is connected to the TransCanada pipeline system (natural gas) to Eastern Canada, the Northern Border Pipeline (gas), Alliance Pipeline (gas) and Enbridge Pipeline System (oil) to the Eastern United States, the Gas Transmission Northwest and Northwest Pipeline (gas) to the Western United States, and the McNeill HVDC Back-to-back station (electric power) to Saskatchewan.

| Part of a series on the |

| Economy of Canada |

|---|

| Economic history of Canada |

| Sectors |

|

| Economy by province |

| Economy by city |

Economic regions and cities

Since the days of early agricultural settlement, the majority of Alberta's population has been concentrated in the parkland belt (mixed forest-grassland), a boomerang-shaped strip of land extending along the North Saskatchewan River from Lloydminster to Edmonton and then along the Rocky Mountain foothills south to Calgary. This area is slightly more humid and treed than the drier prairie (grassland) region called Palliser's Triangle to its south, and large areas of the south (the “Special Areas”) were depopulated during the droughts of the 1920s and 30s. The chernozem (black soil) of the parkland region is more agriculturally productive than the red and grey soils to the south. Urban development has also been most advanced in the parkland belt. Edmonton and Red Deer are parkland cities, while Calgary is on the parkland-prairie fringe. Lethbridge and Medicine Hat are prairie cities. Grande Prairie lies in the Peace River Country a parkland region (with isolated patches of prairie, hence the name) in the northwest isolated from the rest of the parkland by the forested Swan Hills. Fort McMurray is the only urbanized population centre in the boreal forest which covers much of the northern half of the province.

Calgary and Edmonton

The Calgary and Edmonton regions, by far the province's two largest metropolitan regions, account for the majority of the province’s population. They are relatively close to each other by the standards of Western Canada and distant from other metropolitan regions such as Vancouver or Winnipeg. This has produced a history of political and economical rivalry and comparison but also economic integration that has created an urbanized corridor between the two cities.

The economic profile of the two regions is slightly different. Both cities are mature service economies built on a base of resource extraction in their hinterlands. However Calgary is predominant in hosting the regional and national headquarters of oil and gas exploration and drilling companies. Edmonton skews much more towards governments, universities and hospitals as large employers, while Edmonton’s suburban fringes (e.g. Fort Saskatchewan, Nisku, Strathcona County (Refinery Row), Leduc, Beaumont, Acheson) are home to most of the province’s manufacturing (much of it related to oil and gas).[20]

Calgary-Edmonton Corridor

The Calgary-Edmonton Corridor is the most urbanized region in the province and one of the densest in Canada. Measured from north to south, the region covers a distance of roughly 400 kilometres (250 mi). In 2001, the population of the Calgary-Edmonton Corridor was 2.15 million (72% of Alberta's population).[21] It is also one of the fastest growing regions in the country. A 2003 study by TD Bank Financial Group found the corridor was the only Canadian urban centre to amass a U.S. level of wealth while maintaining a Canadian-style quality of life, offering universal health care benefits. The study found GDP per capita in the corridor was 10% above average U.S. metropolitan areas and 40% above other Canadian cities at that time.

Calgary–Edmonton rivalry

Seeing Calgary and Edmonton are part of a single economic region as the TD study did in 2003 was novel. The more traditional view had been to see the two cities as economic rivals. For example, in the 1980 both cities claimed to be the "Oil Capital of Canada".

Trends

Alberta has always been an export-oriented economy. In line with Harold Innis' "Staples Thesis", the economy has changed substantially as different export commodities have risen or fallen in importance. In sequence, the most important products have been: fur, wheat and beef, and oil and gas.

The development of transportation in Alberta has been crucial to its historical economic development. The North American fur trade relied on birch-bark canoes, York boats, and Red River carts on buffalo trails to move furs out of, and European trade goods into, the region. Immigration into the province was eased tremendously by the arrival of the Canadian Pacific Railway's transcontinental line in 1880s. Commercial farming became viable in the area once the grain trade had developed technologies to handle the bulk export of grain, especially hopper cars and grain elevators. Oil and gas exports have been possible because of increasing pipeline technology.

Prior to the 1950s, Alberta was a primarily agricultural economy, based on the export of wheat, beef, and a few other commodities. The health of economy was closely bound up with the price of wheat.

In 1947 a major oil field was discovered near Edmonton. It was not the first petroleum find in Alberta, but it was large enough to significantly alter the economy of the province (and coincided with growing American demand for energy). Since that time, Alberta's economic fortunes have largely tracked the price of oil, and increasingly natural gas prices. When oil prices spiked during the 1967 Oil Embargo, 1973 oil crisis, and 1979 energy crisis, Alberta's economy boomed. However, during the 1980s oil glut Alberta's economy suffered. Alberta boomed once again during the 2003-2008 oil price spike. In July 2008 the price of oil peaked and began to decline and Alberta's economy soon followed suit, with unemployment doubling within a year. By 2009 with natural gas prices at a long-term low, Alberta's economy was in poor health compared to before, although still relatively better than many other comparable jurisdictions. By 2012 natural gas prices were at a ten-year low, the Canadian dollar was high, and oil prices recovered until June 2014.

The spin-offs from petroleum allowed Alberta to develop many other industries. Oilpatch-related manufacturing is an obvious example, but financial services and government services have also benefited from oil money.

A comparison of the development of Alberta's less oil and gas-endowed neighbours, Saskatchewan and Manitoba, reveals the role petroleum has played. Alberta was once the smallest of the three Prairie Provinces by population in the early 20th century, but by 2009, Alberta's population was 3,632,483 or approximately three times as much as either Saskatchewan (1,023,810) or Manitoba (1,213,815).

Employment

Alberta's economy is a highly developed one in which most people work in services such as healthcare, government, or retail. Primary industries are also of great importance, however.

By March 2016 the unemployment rate in Alberta rose to 7.9%—[22] its "highest level since April 1995 and the first time the province’s rate has surpassed the national average since December 1988."[5] There were 21,200 fewer jobs than February 2015.[22] The unemployment rate was expected to average 7.4% in 2016.[16]:13 The Canadian Association of Petroleum Producers (CAPP) claimed that Alberta lost 35,000 jobs in 2015—25,000 from the oil services sector and 10,000 from exploration and production.[23] Full-time employment increased by 10,000 in February 2016 after falling 20,000 in both December 2015 and January 2016. The natural resources industry lost 7,400 jobs in February. "Year-over-year (y/y), the goods sector lost 56,000 jobs, while the services sector gained 34,800."[22] In 2015 Alberta's population increased by 3,900.[22] While Alberta had a reprieve in job loss in February 2016—up 1,400 jobs after losing jobs in October, November, December 2015 and January 2016—Ontario lost 11,200 jobs, Saskatchewan lost 7,800 jobs and New Brunswick lost 5,700 jobs.[22]

Employment in extraction industries

In 2013 171,200 people were employed in the mining and oil and gas extraction industry.[2]

In 2007 there were 146,900 people working in the mining and oil and gas extraction industry.[24]

- Oil and Gas Extraction industry = 69,900

- Support Activities for Mining & Oil & Gas Extraction (primarily oil and gas exploration and drilling) = 71,700

- Mining other than oil and gas (mainly coal and mineral mining & quarrying) = 5,100

Largest employers

According to Alberta Venture magazine's list of the 50 largest employers in the province, the largest employers are:

| Rank (2012)[25] | Rank (2010)[26] | Rank (2007)[27] | Employer | Industry | 2012 Employees (Total) | 2010 Employees (Total) | 2007 Employees (Total) | Head office | Description | Notes |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | * | Alberta Health Services | Healthcare | 99,400 | 92,200 | see note | Edmonton | Provincial public health authority | Created in 2008 by merging nine separate provincial health authorities. |

| 2 | 2 | 4. | Canada Safeway Limited | Wholesale and Retail Trade | 30,000 | 30,000 | 34,318 | Calgary | Food and drug retailer | subsidiary of Sobeys Inc. since 2014, before that subsidiary of American chain |

| 3 | 6 | n/a | Agrium Inc. | Agri-business | 14,800 | 11,153 | n/a | Calgary | Wholesale producer, distributor and retailer of agricultural products and services in North and South America | n/a = not listed in 2007 |

| 4 | 7 | 8 | University of Alberta | Education | 14,500 | 10,800 | 11,000 | Edmonton | Publicly funded accredited university | |

| 5 | 4 | 29 | Canadian Pacific Railway | Transportation | 14,169 | 14,970 | 15,232 | Calgary | Railway and inter-modal transportation services | |

| 6 | 5 | 31 | Suncor Energy | Petroleum Resource Industry | 13,026 | 12,978 | 5,800 | Calgary | Petroleum extraction, refining, and retail | Merged with Petro-Canada in 2009 |

| 7 | 9 | 35 | Shaw Communications | Communications | 12,500 | 10,000 | 8,985 | Calgary | Provider of digital telecommunications services [cable television / internet / telephony] and community television production facilities | |

| 8 | 8 | 15 | Flint Energy Services Ltd. | Energy | 11,211 | 10,280 | 6,169 | Calgary | Energy / Construction | |

| 9 | 11 | n/a | Stantec Inc. | Professional Services | 11,100 | 9,300 | n/a | Edmonton | Architecture/Engineering/Construction | n/a = not listed in 2007 |

| 10 | 12 | 9 | Calgary Board of Education | Public Education | 9,106 | 9,278 | 10,972 | Calgary | Municipal K-12 Public Education School Board |

Sectors

Industry

Alberta is the largest producer of conventional crude oil, synthetic crude, natural gas and gas products in the country. Alberta is the world’s 2nd largest exporter of natural gas and the 4th largest producer.[28] Two of the largest producers of petrochemicals in North America are located in central and north central Alberta. In both Red Deer and Edmonton, world class polyethylene and vinyl manufacturers produce products shipped all over the world, and Edmonton's oil refineries provide the raw materials for a large petrochemical industry to the east of Edmonton.

The Athabasca Oil Sands (sometimes known as the Athabasca Tar sands) have estimated unconventional oil reserves approximately equal to the conventional oil reserves of the rest of the world, estimated to be 1.6 trillion barrels (250×109 m3). With the development of new extraction methods such as steam assisted gravity drainage (SAGD), which was developed in Alberta, bitumen and synthetic crude oil can be produced at costs close to those of conventional crude. Many companies employ both conventional strip mining and non-conventional in situ methods to extract the bitumen from the oil sands. With current technology and at current prices, about 315 billion barrels (50.1×109 m3) of bitumen are recoverable. Fort McMurray, one of Canada's fastest growing cities, has grown enormously in recent years because of the large corporations which have taken on the task of oil production. As of late 2006 there were over $100 billion in oil sands projects under construction or in the planning stages in northeastern Alberta.

Another factor determining the viability of oil extraction from the oil sands was the price of oil. The oil price increases since 2003 made it more than profitable to extract this oil, which in the past would give little profit or even a loss.

Alberta's economy was negatively impacted by the 2015-2016 oil glut with a record high volume of worldwide oil inventories in storage,[6] with global crude oil collapsing at near ten-year low prices.[7][8][9] The United States doubled its 2008 production levels mainly due to substantial improvements in shale "fracking" technology, OPEC members consistently exceeded their production ceiling, and China experienced a marked slowdown in economic growth and crude oil imports.[7][8][9][29][30]

With concerted effort and support from the provincial government, several high-tech industries have found their birth in Alberta, notably patents related to interactive liquid crystal display systems.[31] With a growing economy, Alberta has several financial institutions dealing with civil and private funds.

Energy

Oil and gas

Since the early 1940s, Alberta had supplied oil and gas to the rest of Canada and the United States. The Athabasca River region produces oil for internal and external use. The Athabasca Oil Sands contain the largest proven reserves of oil in the world outside Saudi Arabia. Natural gas has been found at several points, and in 1999, the production of natural gas liquids (ethane, propane, and butanes) totalled 172.8 million barrels (27.47×106 m3), valued at $2.27 billion. Alberta also provides 13% of all the natural gas used in the United States.

Notable gas reserves were discovered in the 1883 near Medicine Hat.[32] The town of Medicine Hat began using gas for lighting the town, and supplying light and fuel for the people, and a number of industries using the gas for manufacturing. In fact a large glassworks was established at Redcliff. When Rudyard Kipling visited Medicine Hat he described it as the city "with all hell for a basement".

Basic statistics

- In 2003, Alberta produced 629 thousand barrels per day (100.0×103 m3/d) of conventional light, medium, and heavy crude, plus an additional 142 thousand barrels per day (22.6×103 m3/d) of pentanes plus used for blending with heavy crude oil and bitumen to facilitate its transportation through pipelines.[33]

- Alberta exports over 1 million barrels per day (160×103 m3/d) of oil to US markets accounting for 10 per cent of US oil imports.

- The conventional oil resource is estimated to have approximately 1.6 billion barrels (250×106 m3) of remaining established reserves.

- Conventional crude oil production (not including oil sands and pentanes plus) represented 38.6% of Alberta ’s total crude oil and equivalent production and 25.5% of Canada’s total crude oil and equivalent production.

- Alberta's oil sands reserve is considered to be one of the largest in the world, containing 1.6 trillion barrels (250×109 m3) of bitumen initially in place. Of this total, 174.5 billion barrels (27.74×109 m3) are considered to be remaining established reserves, recoverable using current technology under present and anticipated economic conditions. To date, about 2% of the initial established resource has been produced.

- In 2003, total crude bitumen production in Alberta averaged 964 thousand barrels per day (153.3×103 m3/d).

- Disposition of Alberta ’s total crude oil and equivalent production in 2003 was approximately:

- 62% to the United States

- 24% within Alberta

- 14% to the rest of Canada

- In 2003, Alberta produced 4.97 trillion cubic feet (141×109 m3) of marketable natural gas.

- The average Albertan household uses 135 gigajoules (38,000 kWh) of natural gas a year.

- Over 80 per cent of Canada’s natural gas production is from Alberta.

- In 2006, Alberta consumed 1.45 trillion cubic feet (41×109 m3) of natural gas. The rest was exported across Canada and to the United States.

- Royalties to Alberta from natural gas and its byproducts are larger than royalties from crude oil and bitumen.

- In 2006, there were 13,473 successful natural gas wells drilled in Alberta: 12,029 conventional gas wells and 1,444 coalbed methane wells

- There may be up to 500 trillion cubic feet (14×1012 m3) of coalbed methane in Alberta, although it is unknown how much of this gas might be recoverable.

- Alberta has one of the most extensive natural gas systems in the world as part of its energy infrastructure, with 39,000 kilometres (24,000 mi) of energy related pipelines.

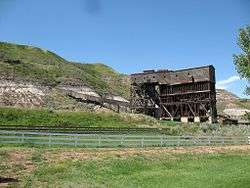

Coal

Coal has been mined in Alberta since the late 19th century. Over 1800 mines have operated in Alberta since then.[32]

The coal industry was vital to the early development of several communities, especially those in the foothills and along deep river valleys where coal was close to the surface.

Alberta is still a major coal producer, every two weeks Alberta produces enough coal to fill the Sky Dome in Toronto.[32]

Much of that coal is burned in Alberta for electricity generation. Alberta uses over 25 million tonnes of coal annually to generate electricity.[32]

Alberta has vast coal resources and 70 per cent of Canada's coal reserves are located in Alberta. This amounts to 33.6 Gigatonnes.[32]

Vast beds of coal are found extending for hundreds of miles, a short distance below the surface of the plains. The coal belongs to the Cretaceous beds, and while not so heavy as that of the Coal Measures in England is of excellent quality. In the valley of the Bow River, alongside the Canadian Pacific Railway, valuable beds of anthracite coal are still worked. The usual coal deposits of the area of bituminous or semi-bituminous coal. These are largely worked at Lethbridge in southern Alberta and Edmonton in the centre of the province. Many other parts of the province have pits for private use.

Electricity

As of June 2016, Alberta's generating capacity was 16,261 MW,[34] and Alberta has about 26,000 kilometres (16,000 mi) of transmission lines.[35]

Alberta has 1491 megawatts of wind power capacity.[34]

Production of Electricity in Alberta in 2015 by source:[34]

| Generation | GWh | Share by Fuel |

|---|---|---|

| Coal | 41,378 | 51% |

| Natural Gas | 32,215 | 39% |

| Hydro | 1,745 | 2% |

| Wind | 3,816 | 5% |

| Biomass | 2,149 | 3% |

| Others | 318 | 0% |

| Total | 81,621 | 100% |

Alberta has added 9,000 MW of new supply since 1998.[34]

Peak for power use in one day was set on July 9, 2015 – 10,520 MW.[36]

Mineral mining

Building stones mined in Alberta include Rundle stone, and Paskapoo sandstone.

Diamonds were first found in Alberta in 1958, and many stones have been found since, although to date no large-scale mines have been developed.[32]

Manufacturing

The Edmonton area, and in particular Nisku is a major centre for manufacturing oil and gas related equipment. As well Edmonton's Refinery Row is home to a petrochemical industry.

According to a Statistics Canada report Alberta's manufacturing sales year-over-year sales fell 13.2 per cent, with a loss of almost four per cent from December to January. Alberta's economy continued to shrink because of the collapse of the oil and gas sector. The petroleum and coal product manufacturing industry is now third— behind food and chemicals.[37]

Biotechnology

Several companies and services in the biotech sector are clustered around the University of Alberta, for example ColdFX.

Food processing

Owing to the strength of agriculture, food processing was once a major part of the economies of Edmonton and Calgary, but this sector has increasingly moved to smaller centres such as Brooks, the home of XL Foods, responsible for one third of Canada's beef processing in 2011.

Transportation

Edmonton is a major distribution centre for northern communities, hence the nickname "Gateway to the North". Edmonton is one CN Rail's most important hubs. Since 1996, Canadian Pacific Railway has its headquarters in downtown Calgary.

WestJet, Canada's second largest air carrier, is headquartered in Calgary, by Calgary International Airport, which serves as the airline's primary hub.[38] Prior to its dissolution, Canadian Airlines was headquartered in Calgary by the airport.[39] Prior to its dissolution, Air Canada subsidiary Zip was headquartered in Calgary.[40]

Agriculture and forestry

Agriculture

In the past, cattle, horses, and sheep were reared in the southern prairie region on ranches or smaller holdings. Currently Alberta produces cattle valued at over $3.3 billion, as well as other livestock in lesser quantities. In this region irrigation is widely used. Wheat, accounting for almost half of the $2 billion agricultural economy, is supplemented by canola, barley, rye, sugar beets, and other mixed farming. In 2011, Alberta producers seeded an estimated total of 17,900,000,000 acres (7.2×109 ha) to spring wheat, durum, barley, oats, mixed grains, triticale, canola and dry peas. Of the total seeded area, 94 per cent was harvested as grains and oilseeds and six per cent as greenfeed and silage.[41]

Agriculture has a significant position in the province's economy. Over three million cattle are residents of the province at one time or another,[42] and Albertan beef has a healthy worldwide market. Nearly one half of all Canadian beef is produced in Alberta. Alberta is one of the prime producers of plains buffalo (bison) for the consumer market. Sheep for wool and lamb are also raised.

Wheat and canola are primary farm crops, with Alberta leading the provinces in spring wheat production, with other grains also prominent. Much of the farming is dryland farming, often with fallow seasons interspersed with cultivation. Continuous cropping (in which there is no fallow season) is gradually becoming a more common mode of production because of increased profits and a reduction of soil erosion. Across the province, the once common grain elevator is slowly being lost as rail lines are decreased and farmers now truck the grain to central points.

Alberta is the leading beekeeping province of Canada, with some beekeepers wintering hives indoors in specially designed barns in southern Alberta, then migrating north during the summer into the Peace River valley where the season is short but the working days are long for honeybees to produce honey from clover and fireweed. Hybrid canola also requires bee pollination, and some beekeepers service this need.

Forestry

The vast northern forest reserves of softwood allow Alberta to produce large quantities of lumber, oriented strand board (OSB) and plywood, and several plants in northern Alberta supply North America and the Pacific Rim nations with bleached wood pulp and newsprint.

In 1999, lumber products from Alberta were valued at $4.1 billion of which 72% were exported around the world. Since forests cover approximately 59% of the province's land area, the government allows about 23.3 million cubic metres (820×106 cu ft) to be harvested annually from the forests on public lands.

Services

Despite the high profile of the extractive industries, Alberta has a mature economy and most people work in services. In 2014 there were 1,635.8 thousand people employed in the services-producing sector. By January 2016 that number had increased to 1,668.5 thousand and by February 2016 to 1,670.6 thousand.[43] This includes wholesale and retail trade; transportation and warehousing; finance, insurance, real estate, rental and leasing; professional, scientific and technical services; business, building and other support services; educational services; health care and social assistance; information, culture and recreation; accommodation and food services; other services (except public administration) and public administration.[43]

Finance

The TSX Venture Exchange is headquartered in Calgary, and Calgary also has a robust service industry relating to the securities market. The city has the second highest number of corporate head offices in Canada after Toronto, and the financial services industry in Calgary has developed to support them.

Edmonton hosts the headquarters of the only major Canadian banks west of Toronto: Canadian Western Bank, and ATB Financial, as well as the only province-wide credit union, Servus.

Government

Despite Alberta's reputation as a "small government" province, many health care and education professionals are lured to Alberta from other provinces by the higher wages the Alberta government is able to offer because of oil revenues. In 2014 the median household income in Alberta was $100,000 with the average weekly wage at $1,163—23 per cent higher than the Canadian national average.[44] Alberta has the "lowest taxes overall of any province or territory" in Canada.[45]

See also

- Economy of Canada

- Economy of Lethbridge

- Canadian Oil Patch, for the petroleum industry

- History of the petroleum industry in Canada

- Canada's Global Markets Action Plan

- Free trade agreements of Canada

References

- 1 2 "Canada, a Big Energy Consumer: A Regional Perspective". Statistics Canada. November 12, 2009. Retrieved March 17, 2016.

- 1 2 "Mining and Oil and Gas Extraction". OCCinfo: Occupations and Educational Programs. 2015. Retrieved 17 March 2016.

- 1 2 "Economic results". Government of Alberta. October 25, 2015. Retrieved March 16, 2016.

- ↑ Statistics Canada (September 2006). "The Alberta economic Juggernaught:The boom on the rose" (PDF). Retrieved 2007-02-02.

- 1 2 "Alberta Economy: Indicators at a Glance" (PDF). Treasury Board and Finance Economics and Revenue Forecasting. March 11, 2016. Retrieved March 16, 2016.

- 1 2 Firzli, M. Nicolas J. (6 April 2014). "A GCC House Divided: Country Risk Implications of the Saudi-Qatari Rift". Al-Hayat. London. Retrieved 29 December 2014.

- 1 2 3 "Deloitte warns of oil bankruptcies", Globe and Mail via PressReader, February 6, 2016

- 1 2 3 Scheyder, Ernest (16 February 2016). "High risk of bankruptcy for one-third of oil firms: Deloitte". Houston: Reuters. Retrieved 17 February 2016.

- 1 2 3 Zillman, Claire (16 February 2016). "One-Third of Oil Companies Could Go Bankrupt this Year". Fortune. Retrieved 17 February 2016.

- ↑ "Commodities". Calgary Herald. 3 February 2016. p. C7.

- ↑ Wilson, Nick (January 20, 2016). "WCS Slides to US$14.50 per Barrel Global stock and commodities market turmoil continue, with WTI hitting US$26.55 per barrel". Alberta Oil Magazine. Retrieved March 17, 2016.

- ↑ Cattaneo, Claudia (16 December 2015), "Canada's challenge is how to make money selling the world's cheapest oil — but it can be done", Financial Post, retrieved 26 January 2016

- ↑ Healing, Dan (March 17, 2016). "Medicine Hat reeling after second fracking company announces pullout". Calgary Herald. Retrieved March 17, 2016.

- ↑ "Canada Week: Canada is the leading supplier of crude oil to the United States". EIA. November 8, 2012. Retrieved March 18, 2016.

- ↑ Petroleum imports. EIA (Report). December 2016.

- 1 2 3 4 5 6 7 8 9 2015–16 Third Quarter Fiscal Update and Economic Statement (PDF) (Report). Edmonton, Alberta: Department of Finance, Government of Alberta. February 2016. p. 15. Retrieved 16 March 2016.

- ↑ Jones, Jeffrey; Lewis, Jeff (31 August 2015). "Alberta could face record deficit amid oil's downturn". The Globe and Mail. Calgary. Retrieved 31 August 2015.

- 1 2 Giovannetti, Justin (31 August 2015). "Alberta economy in recession, Notley government confirms". The Globe and Mail. Edmonton. Retrieved 31 August 2015.

- 1 2 3 4 5 6 Alberta Treasury Board and Finance (August 2015). 2015–16 First Quarter Fiscal Update and Economic Statement (PDF). Government of Alberta (Report). Edmonton. Alberta Treasury Board and Finance. p. 14. Retrieved 1 September 2015.

- ↑ http://www.edmontonjournal.com/business/Lamphier+Edmonton+roll+lucky/7691047/story.html

- ↑ "Calgary-Edmonton corridor". Statistics Canada, 2001 Census of Population. 2003-01-20. Retrieved 2007-03-22.

- 1 2 3 4 5 "Labour Market Notes Alberta: Reprieve in employment losses" (PDF). Treasury Board and Finance Economics and Revenue Forecasting. March 11, 2016. Retrieved March 16, 2016.

- ↑ Butterfield, Michelle (September 2, 2015), "Alberta Oilpatch Layoffs Total 35,000, Says CAPP", The Huffington Post, Alberta, retrieved March 16, 2016

- ↑ "About us", Alberta Energy

- ↑ Alberta Venture 100 Largest Employers 2012

- ↑ Alberta Venture 50 Largest Employers 2010

- ↑ Alberta Venture 50 Largest Employers 2007

- ↑ State of Alaska - Trade Report on Alberta

- ↑ Krassnov, Clifford (November 3, 2014). "U.S. Oil Prices Fall Below $80 a Barrel". The New York Times. Retrieved December 13, 2014.

- ↑ "OPEC Won't Cut Production to Stop Oil's Slump". Bloomberg News. 4 December 2015.

- ↑ Interactive display system - US Patent U.S. Patent No. 5,448,263; U.S. Patent for Touch Sensitive Technology - SMART Technologies

- 1 2 3 4 5 6 Alberta Energy: Energy Facts

- ↑ Government of Alberta. Energy Overview Archived October 4, 2006, at the Wayback Machine.

- 1 2 3 4 http://www.energy.alberta.ca/electricity/682.asp

- ↑ https://www.aeso.ca/grid/about-the-grid/

- ↑ http://www.cbc.ca/news/canada/calgary/power-consumption-record-set-as-temperature-soars-in-alberta-1.3145637

- ↑ Gibson, John (March 16, 2016). "Alberta manufacturing sales plunge 13% in year as most provinces see upswing StatsCan says sales rose in 16 of 21 industries across Canada while Alberta saw 4% drop last month". CBC. Retrieved March 16, 2016.

- ↑ Contact Us. WestJet. Retrieved on May 20, 2009.

- ↑ Investor & Financial Information at the Wayback Machine (archived March 3, 2000). Canadian Airlines. March 3, 2000. Retrieved on May 20, 2009.

- ↑ Pigg, Susan. "Zip, WestJet in fare war that could hurt them both; Move follows competition bureau ruling Battle could intensify when Zip flies eastward." Toronto Star. January 22, 2003. Business C01. Retrieved on September 30, 2009.

- ↑ "Alberta 2011 Greenfeed and Silage Production Survey Results", Department of Agriculture, Government of Alberta, 2011

- ↑ "Alberta Livestock Inspections", Department of Agriculture, Government of Alberta, August 2006

- 1 2 "Employment by major industry group, seasonally adjusted, by province (monthly) (Alberta)". Statistics Canada. March 11, 2016. Retrieved March 16, 2016.

- ↑ Johnson, Tracy (March 5, 2015). "Alberta wages almost 25% higher than Canadian average: Economists, politicians and business leaders seek ways to bring wages down". CBC. Retrieved March 16, 2016.

- ↑ Bennett, Dean (March 14, 2016). "Joe Ceci Reminds Businesses Alberta Has The Lowest Taxes In Canada". Huffington Post. Retrieved March 16, 2016.

External links

| Wikimedia Commons has media related to Economy of Alberta. |