New trade theory

| Economics |

|---|

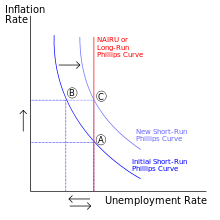

Phillips curve graph, illustrating an economic principle |

|

|

| By application |

|

| Lists |

|

New trade theory (NTT) is a collection of economic models in international trade which focuses on the role of increasing returns to scale and network effects, which were developed in the late 1970s and early 1980s.

New trade theorists relaxed the assumption of constant returns to scale, and some argue that using protectionist measures to build up a huge industrial base in certain industries will then allow those sectors to dominate the world market.

Less quantitative forms of a similar "infant industry" argument against totally free trade have been advanced by trade theorists since at least 1848 (see: History of free trade).

The theory's impact

The value of protecting "infant industries" has been defended at least since the 18th century; for example, Alexander Hamilton proposed in 1791 that this be the basis for US trade policy.[1] What was "new" in new trade theory was the use of mathematical economics to model the increasing returns to scale, and especially the use of the network effect to argue that the formation of important industries was path dependent in a way which industrial planning and judicious tariffs might control.

The models developed predicted the national specialization-by-industry observed in the industrial world (movies in Hollywood, watches in Switzerland, etc.). The model also showed how path-dependent industrial concentrations can sometimes lead to monopolistic competition or even situations of oligopoly.

Some economists, such as Ha-Joon Chang, had argued that protectionist policies had facilitated the development of the Japanese auto industries in the 1950s, when quotas and regulations prevented import competition. Japanese companies were encouraged to import foreign production technology but were required to produce 90% of parts domestically within five years. Japanese consumers suffered in the short term by being unable to buy superior vehicles produced by the world market, but eventually gained by having a local industry that could out-compete their international rivals.[2]

Econometric testing

The econometric evidence for NTT was mixed, and highly technical. Due to the timescales required, and the particular nature of production in each 'monopolizable' sector, statistical judgements were hard to make. In many ways, the available data have been too limited to produce a reliable test of the hypothesis, which doesn't require arbitrary judgements from the researchers.

Japan is cited as evidence of the benefits of "intelligent" protectionism, but critics of NTT have argued that the empirical support post-war Japan offers for beneficial protectionism is unusual, and that the NTT argument is based on a selective sample of historical cases. Although many examples (like Japanese cars) can be cited where a 'protected' industry subsequently grew to world status, regressions on the outcomes of such "industrial policies" (which include failures) have been less conclusive; some findings suggest that sectors targeted by Japanese industrial policy had decreasing returns to scale and did not experience productivity gains.[3]

History of the theory's development

The theory was initially associated with Paul Krugman in the late 1970s; Krugman claims that he heard about monopolistic competition from Robert Solow. Looking back in 1996 Krugman wrote that International economics a generation earlier had completely ignored returns to scale. "The idea that trade might reflect an overlay of increasing-returns specialization on comparative advantage was not there at all: instead, the ruling idea was that increasing returns would simply alter the pattern of comparative advantage." In 1976, however, MIT-trained economist Victor Norman had worked out the central elements of what came to be known as the Helpman–Krugman theory. He wrote it up and showed it to Avinash Dixit. However, they both agreed the results were not very significant. Indeed, Norman never had the paper typed up, much less published. Norman's formal stake in the race comes from the final chapters of the famous Dixit–Norman book.[4]

James Brander, a PhD student at Stanford at the time, was undertaking similarly innovative work using models from industrial organisation theory—cross-hauling—to explain two-way trade in similar products.

"New" new trade theory

Marc Melitz and Pol Antràs started a new trend in the study of international trade. While new trade theory put emphasis on the growing trend of intermediate goods, this new trend emphasizes firm level differences in the same industry of the same country and this new trend is frequently called 'new' new trade theory (NNTT).[5][6] NNTT stresses the importance of firms rather than sectors in understanding the challenges and the opportunities countries face in the age of globalization.[7]

As international trade is increasingly liberalized, industries of comparative advantage are expected to expand, while those of comparative disadvantage are expected to shrink, leading to an uneven spatial distribution of the corresponding economic activities. Within the very same industry, some firms are not able to cope with international competition while others thrive. The resulting intra-industry reallocations of market shares and productive resources are much more pronounced than inter-industry reallocations driven by comparative advantage.

Theoretical foundations

New trade theory and "new" new trade theory (NNTT) need their own trade theory. New trade theories are often based on assumptions such as monopolistic competition and increasing returns to scale. One of the typical explanations, given by Paul Krugman, depends on the assumption that all firms are symmetrical, meaning that they all have the same production coefficients. This is too strict as an assumption and deprived general applicability of Krugman's explanation. Shiozawa, based on much more general model, succeeded in giving a new explanation on why the traded volume increases for intermediates goods when the transport cost decreases.[8]

"New" new trade theory (NNTT) also needs new theoretical foundation. Melitz and his followers concentrate on empirical aspects and pay little interest on theoretical aspects of NNTT. Shiozawa's new construction, or Ricardo-Sraffa trade theory, enables Ricardian trade theory to include choice of techniques. Thus the theory can treat a situation where there are many firms with different production processes. Based on this new theory, Fujimoto and Shiozawa[9] analyze how different production sites, either of competing firms or of the same firms locating in the different countries, compete.

See also

- General equilibrium

- Endogenous growth theory was developed at a similar time to NTT, and is linked through the idea that industrial and trade policy can affect over-all productivity growth.

- Home-market effect

- Dixit–Stiglitz model

References

- ↑ Alexander Hamilton, REPORT ON MANUFACTURES, Communicated to the House of Representatives, December 5, 1791. www.constitution.org/ah/rpt_manufactures.pdf

- ↑ MacEwan, Arthur (1999). Neo-liberalism or democracy?: economic strategy, markets, and alternatives for the 21st century. Zed Books. ISBN 1-85649-725-9. Retrieved 2009-04-04The rapid post-war industrialization in Japan is documented in this book.

- ↑ Beason, Richard; Weinstein, David E. (1996). "Growth, Economies of Scale, and Targeting in Japan (1955–1990)". Review of Economics and Statistics. 78 (2): 286–295. JSTOR 2109930.

- ↑ Theory of International Trade: A Dual, General Equilibrium Approach. Cambridge University Press. 1980. ISBN 0-521-29969-1.

- ↑ Melitz, Marc J. (2003). "The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity". Econometrica. 71: 1695–1725. doi:10.2307/1555536.

- ↑ Antras, Pol; Helpman, Elhanan (2004). "Global Sourcing". Journal of Political Economy. 112: 552–580. doi:10.1086/383099.

- ↑ Ottaviano, Gianmarco I. P. (2011). "'New' new economic geography: firm heterogeneity and agglomeration economies". Journal of Economic Geography. 11 (2): 231–240. doi:10.1093/jeg/lbq041.

- ↑ Y. Shiozawa (2007) A New Construction of Ricardian Trade Theory: A Many-country, Many-commodity with Intermediate Goods and Choice of Techniques, Evolutionary and Institutional Economics Review, 3(2): 141–187.

- ↑ T. Fujimoto and Y. Shiozawa, Inter and Intra Company Competition in the Age of Global Competition: A Micro and Macro Interpretation of Ricardian Trade Theory, Evolutionary and Institutional Economics Review, 8(1): 1–37 (2011) and 8(2): 193–231 (2012).

External links

- On The Smithian Origins Of "New" Trade And Growth Theories, Aykut Kibritcioglu Ankara University shows that Adam Smith's "increasing returns to scale" conception of international trade anticipated NTT by two hundred years.

- Krugman acknowledges NTT's debt to Ohlin. He writes that Ohlin may have lacked the modelling technology necessary to incorporate increasing returns to scale into the Heckscher-Ohlin model, but that his book Interregional and International Trade, discusses the consideration qualitatively.