Chinese head tax in Canada

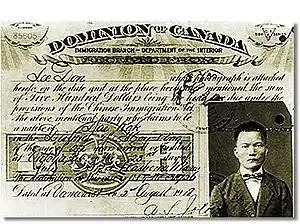

The Chinese head tax was a fixed fee charged to each Chinese person entering Canada. The head tax was first levied after the Canadian parliament passed the Chinese Immigration Act of 1885 and it was meant to discourage Chinese people from entering Canada after the completion of the Canadian Pacific Railway (CPR). The tax was abolished by the Chinese Immigration Act of 1923, which outright prevented all Chinese immigration except for that of business people, clergy, educators, students, and some others.[1]

| Part of a series on |

| Canadian citizenship and immigration |

|---|

.svg.png.webp) |

|

|

The tax

Through the mid- to late nineteenth century, some 17,000 labourers were brought from China to do construction work on the Canadian Pacific Railway (CPR), though they were only paid a third or a half less than their co-workers (about $1/day).[2] The provincial legislature passed a strict law to virtually prevent Chinese immigration in 1878. However, this was immediately struck down by the courts as ultra vires ('beyond the powers of') the provincial legislative assembly, as it impinged upon federal jurisdiction over immigration into Canada.[3]

Responding to anti-immigration sentiment in British Columbia, the federal parliament passed the Chinese Immigration Act in 1885,[4] which stipulated that all Chinese entering Canada must first pay a $50 fee,[5][6] later referred to as a head tax. This was amended in 1887,[7] 1892,[8] and 1901,[9] with the fee increasing to $100 in 1900 and later to its maximum of $500 in 1903, representing a two-year salary of an immigrant worker at that time.[6] However, not all Chinese arrivals had to pay the head tax; those who were presumed to return to China based on the apparent, transitory nature of their occupation or background were exempt from the penalty. These included arrivals identifying themselves as: students, teachers, missionaries, merchants, or members of the diplomatic corps.[4][10]

Not only did the Government of Canada collect about $23 million ($334 million in 2016 dollars[11])[12] in face value from about 81,000 head tax payers,[2] but the tax system also had the effect of constraining Chinese immigration; it discouraged Chinese women and children from joining their men, so the Chinese community in Canada became a "bachelor society."[2] This, however, still did not meet the goal, articulated by contemporary politicians and labour leaders, of exclusion of Chinese immigration altogether.[10] Such was achieved through the same law that ended the head tax: the Chinese Immigration Act of 1923, which stopped Chinese immigration entirely, albeit with certain exemptions for business owners and others.[1] It is sometimes referred to by opponents as the Chinese Exclusion Act, a term also used for its American counterpart.[13]

Redress

After the Chinese Immigration Act was repealed in 1948, various community activists including Wong Foon Sien campaigned the federal government to make its immigration policies more inclusive.

However, the redress movement did not begin until 1984, when Vancouver Member of Parliament (MP) Margaret Mitchell raised in the House of Commons of Canada the issue of repaying the Chinese Head Tax for two of her constituents.[14] Over 4,000 other head tax payers and their family members then approached the Chinese Canadian National Council (CCNC) and its member organizations across Canada to register their Head Tax certificates and ask CCNC to represent them to lobby the government for redress.[15][16] The redress campaign included holding community meetings, gathering support from other groups and prominent people, increasing the media profile, conducting research and published materials, making presentations at schools, etc.

The Chinese Canadian National Council, the longtime advocate [for/against] the head Tax redress, suffered a split after the Tiananmen Square Massacre. The CCNC had strongly condemned the human-rights record of the government of the People's Republic of China (PRC). Don Lee and his friends, who supported the PRC's assault on the protesters in Tiananmen Square, formed the National Congress of Chinese Canadians (NCCC). Don Lee, a former Vancouver NPA city councillor and the son of a deceased head-tax payer, has "acknowledged that some people see head-tax payers as victims, but he disagrees with this interpretation." Lee said his father had the "'foresight' to pay the head tax and suffer the economic consequences, because it provided tremendous benefits to his descendants."[17][18]

Preliminary negotiations

In 1993, then-Conservative prime minister Brian Mulroney made an offer of individual medallions, a museum wing, and other collective measures involving several other redress-seeking communities. These were rejected outright by the Chinese Canadian national groups.

In the same year, after Jean Chrétien replaced Mulroney as prime minister, the Cabinet openly refused to provide an apology or redress.[15]

Then-Liberal Multiculturalism Minister Sheila Finestone announced in a letter that the government "cannot rewrite history" and would not grant financial compensation or redress to groups for past injustices. Instead, the letter confirmed $24 million in financing for a Canadian Race Relations Foundation, an idea raised by the previous Conservative government.[19]

Still, the CCNC and its supporters continued to raise the issue whenever they could, including a submission to the United Nations Human Rights Commission and eventually undertaking court action against the Crown-in-Council, arguing that the federal Crown should not be profiting from racism and that it had a responsibility anadian Charter of Rights and Freedoms and international human rights law. In addition, it argued the 1988 apology and compensation for the internment of Japanese Canadians during the Second World War established a precedent for redressing other racially motivated policies.

Legal challenge

In a $1.2 billion legal challenge, an Ontario court declared in 2001 that the government of Canada had no obligation to redress the head tax levied on Chinese immigrants because the Charter had no retroactive application and the case of internment of Japanese Canadians was not a legal precedent. Two subsequent appeals in 2002 and 2003 were also unsuccessful.[20]

Following the legal setbacks, community activism continued once again across the country. In 2003, Canadian historian Pierre Berton gave a ceremonial iron railway spike to redress activists who toured the historical icon around the country as part of a "Last Spike Campaign", rebuilding support for a public demand for redress.[21]

When Paul Martin won the leadership of the federal Liberal Party and became prime minister in 2003, there was a sense of urgency in the Chinese Canadian community as it became clear that there were perhaps only a few dozen surviving Chinese Head Tax payers left (they were paid $20,000) maybe a few hundred spouses or widows. Several regional and national events had been organised to revitalize the redress campaign:[22][23]

Report of the United Nations Rapporteur

In 2004, Doudou Diène, the United Nations Special Rapporteur on Racism, Racial Discrimination, Xenophobia and Related Intolerance, concluded that Canada should redress the head tax to Chinese Canadians in response to a submission by May Chiu, legal counsel to the Chinese Canadian Redress Alliance.[24] In 2005, Gim Wong, an 82-year-old son of two head tax payers and a World War II veteran, conducted a cross-country Ride for Redress on his Harley Davidson motorcycle, where upon his arrival in Ottawa Prime Minister Paul Martin refused to meet him.[25][26]

Bill C-333

| Chinese Canadian Recognition and Redress Act | |

|---|---|

| Legislative history | |

| Bill | Bill C-333 |

| Status: Not passed | |

On November 17, 2005, a group calling itself the National Congress of Chinese Canadians (NCCC) announced that an agreement had been reached between 11 Chinese-Canadian groups and the federal Cabinet, wherein the Queen-in-Council would pay $12.5 million for the creation of a new non-profit foundation to educate Canadians about anti-Chinese discrimination, with a specific pre-condition that no apology would be expected from any government figure. The NCCC was formed in the early 1990s and negotiated with the mantra "no apology and no individual compensation," so the Liberal government selected them as the representative group to negotiate the deal. The Department of Canadian Heritage's announcement on November 24, 2005 stated that the agreed upon funding would be reduced to $2.5 million. It was later revealed that the Minister for Asia and Pacific affairs, Raymond Chan, who claimed to have negotiated the deal, had purposely misled both the ministers of the Crown and the public and some of the groups named as being party to the agreement stated publicly that their names had been used without permission; several other groups listed did not even exist. Taco Chan stated that "apology is not on" and argued "that to apologize would be tantamount to giving up immunity that has been granted to the government by the court." Don Lee, the co-founder and national director of the NCCC has claimed that his organization had no direct ties to the Liberals; however, Toronto First Radio host Simon Li asked "Why, Mr. Prime Minister, on the eve of a federal election, was so much money given to a single organization that sent out squads of volunteers to campaign for Liberals in Toronto's Chinatown in the last election?"[21][27]

The Liberal deal with the NCCC upset the CCNC and its affiliates, as this purported deal had been reached without their input. Other community groups including the B.C. Coalition of Head Tax Payers and the Ontario Coalition of Chinese Head Tax Payers and Families criticized the agreement as well.[21]

Bill C-333, the Chinese Canadian Recognition and Redress Act, a private member's bill, was tabled in the federal parliament in order to implement the deal in November 2005. While C-333 sought to acknowledge, commemorate and educate about past government wrongdoings, it fell far short of the apology demanded by generations of Chinese Canadians. Furthermore, the clause in C-333 which stated "1.1 The Government of Canada shall undertake negotiations with the NCCC towards an agreement concerning measures that may be taken to recognize the imposition of exclusionary measures on immigrants of Chinese origin from 1885 to 1947" essentially excluded the CCNC, and its representation by proxy of more than 4,000 head tax payers, their spouses and families, from any settlement talks with the government. The Ontario Coalition of Head Tax Payers and Families lobbied the Conservative Party to stop the passage of Bill C-333. The Conservatives exercised a procedural prerogative and switched the order of Bill C-333 with Bill C-331, a bill to recognize past wrongs against Ukrainian Canadians during wartime, causing Bill C-333 to die when Prime Minister Martin's Liberals lost a motion of non-confidence and parliament was dissolved on 28 November 2005.[21]

Political campaigning

As they had done while campaigning for the federal election in 2004, the New Democratic Party and Bloc Québécois stated, during the leadup to the January 2006 election, their support for an apology and redress for the head tax. Similarly, on 8 December 2005, Conservative Party leader Stephen Harper released a press statement expressing his support for an apology for the head tax. As a part of his party platform, Harper promised to work with the Chinese community on redress, should the Conservatives be called to form the next government.[28] Before his party ultimately lost the election, Martin issued a personal apology on a Chinese language radio program. However, he was quickly criticized by the Chinese Canadian community for not issuing the apology in the House of Commons and for then trying to dismiss it completely in the English-speaking media on the very same day. Several Liberal candidates with significant Chinese-Canadian populations in their ridings, including Vancouver-Kingsway MP David Emerson and the Minister of State for Multiculturalism and Richmond MP Raymond Chan, also made futile attempts to change their positions in the midst of the campaign. Others, such as Edmonton Centre MP Anne McLellan lost her riding to Conservative MP Laurie Hawn.

Apology

The 2006 federal election was won by the Conservative Party, though it was a minority government that was formed. Three days after the ballots had been counted on January 23, but before he had been appointed prime minister, Harper reiterated his position on the head tax issue in a news conference: "Chinese Canadians are making an extraordinary impact on the building of our country. They've also made a significant historical contribution despite many obstacles. That's why, as I said during the election campaign, the Chinese Canadian community deserves an apology for the head tax and appropriate acknowledgement and redress."[29]

Formal discussions on the form of apology and redress began on 24 March 2006, with a preliminary meeting between Chinese Canadians representing various groups (including some head tax payers), heritage minister Bev Oda, and Parliamentary Secretary to the Prime Minister Paul Martin resulting in the "distinct possibility" of an apology being issued before 1 July 2006, to commemorate the anniversary of the enacting of the Chinese Exclusion Act of 1923.[30] The meeting was followed by the government's acknowledgement, in the Speech from the Throne delivered by Governor General Michaëlle Jean on 4 April 2006, that an apology would be given along with proper redress.[31]

That year, from April 21 to April 30, the Crown-in-Council hosted public consultations across Canada, in cities most actively involved in the campaign: Halifax, Vancouver, Toronto, Edmonton, Montreal, and Winnipeg.[32] They included the personal testimony of elders and representatives from a number of groups, among them the Halifax Redress Committee; the British Columbia Coalition of Head Tax Payers, Spouses and Descendants; ACCESS; the Ontario Coalition of Head Tax Payers and Families; the CCNC; and the Edmonton Redress Committee of the Chinese Canadian Historical Association of Alberta and Chinese Canadian Redress Alliance.

Some considered that the major issues revolve around the content of any settlement, with the leading groups demanding meaningful redress, not only for the handful of surviving "head tax" payers and widows/spouses, but first-generation sons/daughters who were direct victims, as told in the documentary Lost Years: A People's Struggle for Justice. Some have proposed that the redress be based on the number of "Head Tax" Certificates (or estates) brought forward by surviving sons and daughters who are still able to register their claims, with proposals for individual redress, ranging from $10,000 to $30,000 for an estimated 4,000 registrants.[33][34][35]

On 22 June 2006, in the House of Commons for the first session of the 39th Parliament, Prime Minister Stephen Harper delivered an official apology to Chinese Canadians. During his address Harper spoke a few words in Cantonese, "Ga Na Daai Doe Heep" (Chinese: 加拿大道歉, 'Canada Apologizes'), breaking the Parliamentary tradition of speaking either English and French in the House of Commons. The apology and compensation was for the head tax once paid by Chinese immigrants.[36] Survivors or their spouses were paid approximately CAD$20,000 in compensation.[37] There were only an estimated 20 Chinese Canadians who paid the tax still alive in 2006.[38]

As no mention of redress for the children was made, the Chinese Canadian community continues to fight for a redress from the Canadian government. A national day of protest was held to coincide with Canada Day 2006 in major cities across Canada, and several hundred Chinese Canadians joined in local marches.

Documentaries

- Gee & Radford, Kenda & Tom (2011). "Lost Years: A People's Struggle for Justice". Lost Years Productions, Inc. Archived from the original (Interviews head tax redress leaders) on 11 February 2019. Retrieved 20 August 2011.

- Cho, Karen (2004). "In the Shadow of Gold Mountain" (Interviews head tax survivors). Documentary film. National Film Board of Canada. Retrieved 7 April 2012.

- Dere & Guy, William Ging Wee & Malcolm (1993). "Moving the Mountain: An Untold Chinese Journey". Archived from the original (Interviews head tax redress leaders) on 17 November 2011. Retrieved 26 August 2014.

See also

References

- Morton, James. 1974. In the Sea of Sterile Mountains: The Chinese in British Columbia. Vancouver: J.J. Douglas.

- Canadiana.org (2005), "Asian Immigration", Canada in the Making, retrieved 2007-09-01

- Todd, Alpheus. [1894] 2006. Parliamentary Government in the British Colonies (2nd ed.). Clark, NJ: The Lawbook Exchange. ISBN 1-58477-617-X. p. 194.

- Canada. Dept. of Trade and Commerce (1885), Chinese Immigration Act, 1885, retrieved 2007-09-01

- "Chinese Head Tax and Exclusion Act". CCNC. 1923-07-01. Archived from the original on April 13, 2017. Retrieved 2013-05-13.

- "Chinese-Canadian Genealogy - Chinese Head Tax". Vpl.ca. 1902-01-01. Archived from the original on 2013-06-28. Retrieved 2013-05-13.

- Canada. Dept. of Trade and Commerce (1887), An act to amend the Chinese Immigration Act, 1887, retrieved 2007-09-01

- Canada. Dept. of Trade and Commerce (1892), An act to further amend the Chinese Immigration Act, 1892, retrieved 2007-09-01

- Canada (1901), Act respecting and restricting Chinese immigration, retrieved 2007-09-01

- Vancouver Public Library (2007), Chinese Head Tax, archived from the original on 2007-10-01, retrieved 2007-09-01

- Canadian inflation numbers based on Statistics Canada tables 18-10-0005-01 (formerly CANSIM 326-0021) "Consumer Price Index, annual average, not seasonally adjusted". Statistics Canada. November 15, 2020. Retrieved November 15, 2020. and 18-10-0004-13 "Consumer Price Index by product group, monthly, percentage change, not seasonally adjusted, Canada, provinces, Whitehorse, Yellowknife and Iqaluit". Statistics Canada. Retrieved November 15, 2020.

- Canadian inflation numbers based on: "Consumer Price Index, annual average, not seasonally adjusted." Statistics Canada. 18 January 2019. Retrieved 6 March 2019. table 18-10-0005-01 (formerly CANSIM 326-0021); "Consumer Price Index by product group, monthly, percentage change, not seasonally adjusted, Canada, provinces, Whitehorse, Yellowknife and Iqaluit." Statistics Canada. Retrieved 6 March 2019. table 18-10-0004-13.

- "Chinese Canadian Recognition and Restitution Act". Parliamentary Debates (Hansard). House of Commons, Canada. April 18, 2005. p. 1100.

- Pablo, Carlito (2007-11-28). "Most head-tax families haven't gotten a penny". Straight.com. Retrieved 2013-09-16.

- "Chinese Canadian National Council". Ccnc.ca. Archived from the original on 2014-12-14. Retrieved 2013-09-16.

- "PRM 2005 - Redressing the Past of the Lo Wah Kui". Langara.bc.ca. Archived from the original on 2010-01-21. Retrieved 2013-09-16.

- Head-Tax Issue Causes Division

- Head-Tax Payer Rejects MP's Proposal for Apology

- Platiel, Rudy, Ottawa stuns, angers ethnic groups by refusing to grant financial redress The government cannot rewrite history, multiculturalism minister says, Globe & Mail, Dec 16, 1994, A5

- "2002 CanLII 45062 (ON C.A.)". CanLII. Retrieved 2013-09-16.

- Redress door left open

- "RIGHTING A WRONG BEFORE IT'S TOO LATE". Postmedia, Southam - Edmonton Journal, Vancouver Sun. Retrieved 2015-05-05.

- "Petition & Rally on Parliament Hill". Commons Debates - Hansard. 2003-02-20. Retrieved 2015-05-05.

- Warren, Peter (2005-01-08). "Peter Warren Talk Show: Chinese Canadian Redress Campaign (Guests, Kenda Gee & May Chiu)". Corus Radio. Retrieved 2015-05-05.

- Mickleburgh, Rod (2013-10-01). "The Globe & Mail: Gim Foon Wong's motorcycle ride turned the tide on Chinese head-tax redress". The Globe & Mail Inc. Retrieved 2013-10-15.

- "Gim Wong completes his "Ride for Redress" in Montreal - flying back to Vancouver for Wednesday". GungHaggisFatChoy. Archived from the original on 2016-01-08. Retrieved 2013-09-16.

- Head-tax debate heats up on hustings

- Conservative Party Of Canada Archived September 27, 2007, at the Wayback Machine

- "CCNC Press Release - Chinese Canadians welcome New Year's promise on Head Tax Redress from PM Designate Stephen Harper". Ccnc.ca. 2006-01-26. Archived from the original on 2014-02-02. Retrieved 2013-09-16.

- "Chinese-Cdns. hail promise for head tax apology". CTV.ca. Retrieved 2013-09-16.

- "Throne speech promises crime crackdown, GST cut". CBC News. April 4, 2006.

- Marck, Paul (2006-04-23). "National Post: Head tax tales tinged with anger". National Post-Postmedia Network Inc. Retrieved 2013-10-15.

- Kevin Lee. "Head Tax Families Society". Headtaxfamilies.ca. Retrieved 2013-09-16.

- "Chinese Canadian HTE Redress Committee Protest". Redress.ca. Retrieved 2013-09-16.

- "Charlie Quan was a Canadian Hero". Straight.com. 2012-03-10. Retrieved 2013-09-16.

- Office of the Prime Minister (2006). "Address by the Prime Minister on the Chinese Head Tax Redress". Government of Canada. Archived from the original on 2007-07-15. Retrieved 2006-08-08.

- Kent, Gordon (2006-12-10). "First head-tax compensation paid". CanWest MediaWorks Publications Inc. - Edmonton Journal. Archived from the original on 2013-11-16. Retrieved 2013-10-15.

- Sympatico / MSN : News : CTV.ca: PM apologizes in House of Commons for head tax Archived 2012-02-20 at the Wayback Machine

External links

- Search for names in Canadian government head tax records

- LOST YEARS: A People's Struggle for Justice - International Award-winning epic documentary, 2011

- Transcript of Prime Minister Harper's apology in Parliament

- National Post-Chinese Cdns Speak of Anger, Anguish - April 23, 2006

- Redress.ca

- HeadTaxRedress.org

- ChineseHeadTax.ca