Trial balance

| Accounting |

|---|

|

|

Major types |

|

Selected accounts |

|

People and organizations

|

|

Development |

|

|

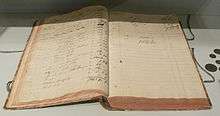

A trial balance is a list of all the general ledger accounts (both revenue and capital) contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance. The debit balance values will be listed in the debit column of the trial balance and the credit value balance will be listed in the credit column. The trading profit and loss statement and balance sheet and other financial reports can then be produced using the ledger accounts listed on the trial balance.

History

The process was first described by Luca Pacioli in the 1494 work Particularis de Computis et Scripturis. Although it did not use the term, he essentially prescribed a technique similar to a post-closing trial balance.[1]

Usage

The purpose of a trial balance is to prove that the value of all the debit value balances equal the total of all the credit value balances. If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts. This error must be found before a profit and loss statement and balance sheet can be produced.

The trial balance is usually prepared by a bookkeeper or accountant who has used daybooks to record financial transactions and then post them to the nominal ledgers and personal ledger accounts. The trial balance is a part of the double-entry bookkeeping system and uses the classic 'T' account format for presenting values.

Limitations

A trial balance only checks the sum of debits against the sum of credits. That is why it does not guarantee that there are no errors. The following are the main classes of errors that are not detected by the trial balance.

- An error of original entry is when both sides of a transaction include the wrong amount.[2] For example, if a purchase invoice for £21 is entered as £12, this will result in an incorrect debit entry (to purchases), and an incorrect credit entry (to the relevant creditor account), both for £9 less, so the total of both columns will be £9 less, and will thus balance.

- An error of omission is when a transaction is completely omitted from the accounting records.[3] As the debits and credits for the transaction would balance, omitting it would still leave the totals balanced. A variation of this error is omitting one of the ledger account totals from the trial balance (but in this case the trial balance will not balance).

- An error of reversal is when entries are made to the correct amount, but with debits instead of credits, and vice versa.[4] For example, if a cash sale for £100 is debited to the Sales account, and credited to the Cash account. Such an error will not affect the totals.

- An error of commission is when the entries are made at the correct amount, and the appropriate side (debit or credit), but one or more entries are made to the wrong account of the correct type.[5] For example, if fuel costs are incorrectly debited to the postage account (both expense accounts). This will not affect the totals.

- An error of principle is when the entries are made to the correct amount, and the appropriate side (debit or credit), as with an error of commission, but the wrong type of account is used. For example, if fuel costs (an expense account), are debited to stock (an asset account).[3] This will not affect the totals.

- Compensating errors are multiple unrelated errors that would individually lead to an imbalance, but together cancel each other out.[3]

References

| Library resources about Trial balance |

- ↑ Michael Chatfield; Richard Vangermeersch (5 February 2014). The History of Accounting (RLE Accounting): An International Encylopedia. Routledge. pp. 587–. ISBN 978-1-134-67545-6.

- ↑ AAT Foundation - Course Companion - Units 1 - 4 (Fourth ed.). BPP Professional Education. April 2004. p. 411. ISBN 0-7517-1583-2.

- 1 2 3 Mohammed Hanif (1 May 2001). Modern Acc. Vol I, 2E. Tata McGraw-Hill Education. p. 4.15. ISBN 978-0-07-463017-4.

- ↑ Riad Izhar; Janet Hontoir (2001). Accounting, Costing and Management. Oxford University Press. pp. 61–62. ISBN 978-0-19-832823-0.

- ↑ Arun Kumar; Rachana Sharma (1 January 2001). Auditing: Theory and Practice. Atlantic Publishers & Dist. pp. 20–. ISBN 978-81-7156-720-1.