Transformation problem

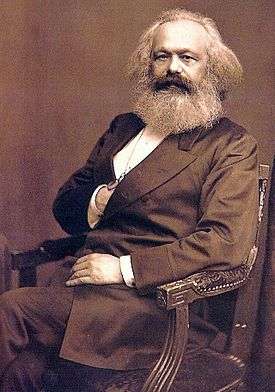

In 20th-century discussions of Karl Marx's economics, the transformation problem is the problem of finding a general rule by which to transform the "values" of commodities (based on their socially necessary labour content, according to his labour theory of value) into the "competitive prices" of the marketplace. This problem was first introduced by Marx in chapter 9 of the draft of volume 3 of Capital, where he also sketched a solution. The essential difficulty was this: given that Marx derived profit, in the form of surplus value, from direct labour inputs, and that the ratio of direct labour input to capital input varied widely between commodities, how could he reconcile this with the tendency toward an average rate of profit on all capital invested?

Marx's theory

Marx defines value as the number of hours of labor contained in a commodity. This includes two elements: First, it includes the hours that a worker of normal skill and dedication would take to produce a commodity under average conditions and with the usual equipment (Marx terms this "living labor"). Second, it includes the labor embodied in raw materials, tools, and machinery used up or worn away during its production (which Marx terms "dead labor"). In capitalism, workers spend a portion of their working day reproducing the value of their means of subsistence, represented as wages, (necessary labor), and a portion of their day producing value above and beyond that, referred to as surplus value, which goes to the capitalist (surplus labor).

Since, according to Marx, the source of capitalist profit is this surplus labor of the workers, and since in this theory only new, living labor produces profit, it would appear logical that enterprises with a low organic composition (a higher proportion of capital spent on living labor) would have a higher rate of profit than would enterprises with a high organic composition (a higher proportion of capital spent on raw materials and means of production). However, in models of classical perfect competition, higher rates of profit are not generally found in enterprises with a low organic composition, and low profit rates are not generally found in enterprises with a high organic composition. Instead, there is a tendency toward equalization of the rate of profit in industries of different organic compositions. That is, in such models with no barriers to entry, capitalists are free to disinvest or invest in any industry, a tendency exists towards the formation of a general rate of profits, constant across all industries.

Marx outlined the transformation problem as a theoretical solution to this discrepancy. The tendency of the rate of profit toward equalization means that, in this theory, there is no simple translation from value to money—e.g., 1 hour of value equals 20 dollars—that is the same across every sector of the economy. While such a simple translation may hold approximately true in general, Marx postulated that there is an economy-wide, systematic deviation according to the organic compositions of the different industries, such that 1 hour of value equals 20 dollars times T, where T represents a transformation factor that varies according to the organic composition of the industry in consideration.

In this theory, T is approximately 1 in industries where the organic composition is close to average, less than 1 in industries where the organic composition is below average, and greater than 1 in industries where the organic composition is higher than average.

Because Marx was considering only socially necessary, simple labor, this variation among industries has nothing to do with higher-paid, skilled labor versus lower-paid, unskilled labor. This transformation factor varies only with respect to the organic compositions of different industries.

British classical labour theory of value

Marx's value theory was developed from the labour theory of value discussed by Adam Smith and used by many British classical economists. It became central to his economics.

Simplest case: labor costs only

Consider the simple example used by Adam Smith to introduce the subject. Assume a hunters’ economy with free land, no slavery, and no significant current production of tools, in which beavers and deer are hunted. In the language of modern linear production models, call the unit labour-input requirement for the production of each good , where may be or (i.e., is the number of hours of uniform labour normally required to catch either a beaver or a deer; notice that we need to assume labour as uniform in order to be able, later on, to use a uniform wage rate).

In this case, Smith noticed, each hunter will be willing to exchange one deer (which costs him hours) for beavers. The ratio —i.e., the relative quantity of labour embodied in (unit) deer production with respect to beaver production—gives thus the exchange ratio between deer and beavers, the "relative price" of deer in units of beavers. Moreover, since the only costs are here labor costs, this ratio is also the "relative unit cost" of deer for any given competitive uniform wage rate . Hence the relative quantity of labor embodied in deer production coincides with the competitive relative price of deer in units of beavers, which can be written as (where the stands for absolute competitive prices in some arbitrary unit of account, and are defined as ).

Capital costs

Things become more complicated if production uses some scarce capital good as well. Suppose that hunting requires also some arrows , with input coefficients equal to , meaning that to catch, for instance, one beaver you need to use arrows, besides hours of labour. Now the unit total cost (or absolute competitive price) of beavers and deer becomes

where denotes the capital cost incurred in using each arrow.

This capital cost is made up of two parts. First, there is the replacement cost of substituting the arrow when it is lost in production. This is , or the competitive price of the arrows, multiplied by the proportion of arrows lost after each shot. Second, there is the net rental or return required by the arrows' owner (who may or may not be the same person as the hunter using it). This can be expressed as the product , where is the (uniform) net rate of return of the system.

Summing up, and assuming a uniform replacement rate , the absolute competitive prices of beavers and deer may be written as

Yet we still have to determine the arrows' competitive price . Assuming arrows are produced by labor only, with man-hours per arrow, we have:

Assuming further, for simplicity, that (i.e., all arrows are lost after just one shot, so that they are circulating capital), the absolute competitive prices of beavers and deer become:

Here, is the quantity of labor directly embodied in beaver and deer unit production, while is the labor indirectly thus embodied, through previous arrow production. The sum of the two,

- ,

gives the total quantity of labor embodied.

It is now obvious that the relative competitive price of deer can no longer be generally expressed as the ratio between total amounts of labour embodied. With the ratio will correspond to only in two very special cases: if either ; or, if . In general the two ratios will not only differ: may change for any given , if the net rate of return or the wages vary.

As it will now be seen, this general lack of any functional relationship between and , of which Ricardo had been particularly well aware, is at the heart of Marx's transformation problem. For Marx, r is the quotient of surplus value to the value of capital advanced to non-labor inputs, and is typically positive in a competitive capitalist economy.

Marx’s labour theory of value

Surplus value and exploitation

Marx distinguishes between labour power as the potential to work, and labour, which is its actual use. He describes labour power as a commodity, and like all commodities, Marx assumes that on average it is exchanged at its value. Its value is determined by the value of the quantity of goods required for its reproduction.

Yet there is a difference between the value of labour power and the value produced by that labour power in its use. Unlike other commodities, in its use, labour power produces new value beyond that used up by its use. This difference is called surplus value and is for Marx the source of profit for the capitalists. The appropriation of surplus labor is what Marx denoted the exploitation of labour.

Labour as the "value-creating substance"

Marx defined the "value" of a commodity as the total amount of socially necessary labour embodied in its production. He developed this special brand of the labour theory of value in the first chapter of volume 1 of Capital'. Due to the influence of Marx's particular definition of value on the transformation problem, he is quoted at length where he argues as follows:

"Let us take two commodities, e.g., corn and iron. The proportions in which they are exchangeable, whatever those proportions may be, can always be represented by an equation in which a given quantity of corn is equated to some quantity of iron: e.g., 1 quarter corn = x cwt. iron. What does this equation tell us? It tells us that in two different things—in 1 quarter of corn and x cwt. of iron, there exists in equal quantities something common to both. The two things must therefore be equal to a third, which in itself is neither the one nor the other. Each of them, so far as it is exchange value, must therefore be reducible to this third." […]

"This common 'something' cannot be either a geometrical, a chemical, or any other natural property of commodities. Such properties claim our attention only in so far as they affect the utility of those commodities, make them use values. But the exchange of commodities is evidently an act characterised by a total abstraction from use value." […]

"If then we leave out of consideration the use value of commodities, they have only one common property left, that of being products of labour. […] Along with the useful qualities of the products themselves, we put out of sight both the useful character of the various kinds of labour embodied in them, and the concrete forms of that labour; there is nothing left but what is common to them all; all are reduced to one and the same sort of labour, human labour in the abstract." […]

"A use value, or useful article, therefore, has value only because human labour in the abstract has been embodied or materialised in it. How, then, is the magnitude of this value to be measured? Plainly, by the quantity of the value-creating substance, the labour, contained in the article."

- Karl Marx, Capital Volume I, Chapter 1

Variable and constant capital

As labour produces in this sense more than its own value, the direct-labour input is called variable capital and denoted as . The quantity of value that living labour transmits to the deer, in our previous example, varies according to the intensity of the exploitation. In the previous example, .

By contrast, the value of other inputs—in our example, the indirect (or "dead") past labour embodied in the used-up arrows—is transmitted to the product as it stands, without additions. It is hence called constant capital and denoted as c. The value transmitted by the arrow to the deer can never be greater than the value of the arrow itself. In our previous example, .

Value formulas

The total value of each produced good is the sum of the above three elements: constant capital, variable capital, and surplus value. In our previous example:

Where stands for the (unit) Marxian value of beavers and deer.

However, from Marx's definition of value as total labour embodied, it must also be true that:

Solving for the above two relationships one has:

for all .

This necessarily uniform ratio is called by Marx the rate of surplus value, and it allows to re-write Marx's value equations as:

Classical Tableux

Like Ricardo, Marx knew that relative labour values— in the above example—do not generally correspond to relative competitive prices— in the same example. However, in volume 3 of Capital he argued that competitive prices are obtained from values through a 'transformation process, whereby capitalists redistribute among themselves the given aggregate surplus value of the system in such a way as to bring about a tendency toward an equal rate of profit, , among sectors of the economy. This happens because of the capitalists' tendency to shift their capital toward sectors where it earns higher returns. As competition becomes fierce in a given sector, the rate of return falls, while the opposite will happen in a sector with a low rate of return. Marx describes this process in detail. [1]

Marx's reasoning

The following two tables adapt the deer-beaver-arrow example seen above (which, of course, is not found in Marx, and is only a useful simplification) to illustrate Marx's approach. In both cases it is assumed that the total quantities of beavers and deer captured are and respectively. It is also supposed that the subsistence real wage is one beaver per unit of labour, so that the amount of labour embodied in it is . Table 1 shows how the total amount of surplus value of the system, shown in the last row, is determined.

| Sector | Total Constant Capital |

Total Variable Capital |

Total Surplus Value |

Unit Value |

|---|---|---|---|---|

| Beavers | ||||

| Deer | ||||

| Total |

Table 2 illustrates how Marx thought this total would be redistributed between the two industries, as "profit" at a uniform return rate, r, over constant capital. First, the condition that total "profit" must equal total surplus value—in the final row of table 2—is used to determine r. The result is then multiplied by the value of the constant capital of each industry to get its "profit". Finally, each (absolute) competitive price in labour units is obtained, as the sum of constant capital, variable capital, and "profit" per unit of output, in the last column of table 2.

| Sector | Total Constant Capital |

Total Variable Capital |

Redistributed Total Surplus Value |

Resulting Competitive Price |

|---|---|---|---|---|

| Beavers | ||||

| Deer | ||||

| Total |

Tables 1 and 2 parallel the tables in which Marx elaborated his numerical example. [2]

Marx's error and its correction

Later scholars argued that Marx's formulas for competitive prices were mistaken.

First, competitive equilibrium requires a uniform rate of return over constant capital valued at its price, not its Marxian value, contrary to what is done in table 2 above. Second, competitive prices result from the sum of costs valued at the prices of things, not as amounts of embodied labour. Thus, both Marx's calculation of and the sums of his price formulas do not add up in all the normal cases, where, as in the above example, relative competitive prices differ from relative Marxian values. Marx noted this but thought that it was not significant, stating in chapter 9 of volume 3 of Capital that "Our present analysis does not necessitate a closer examination of this point."

The simultaneous linear equations method of computing competitive (relative) prices in an equilibrium economy is today very well known. In the greatly simplified model of tables 1 and 2, where the wage rate is assumed as given and equal to the price of beavers, the most convenient way is to express such prices is in units of beavers, which means normalising . This yields the (relative) price of arrows as

- beavers.

Substituting this into the relative-price condition for beavers,

- ,

gives the solution for the rate of return as

Finally, the price condition for deer can hence be written as

- .

This latter result, which gives the correct competitive price of deer in units of beavers for the simple model used here, is generally inconsistent with Marx's price formulae of table 2.

Ernest Mandel, defending Marx, explains this discrepancy in term of the time frame of production rather than as a logical error; i.e., in this simplified model, capital goods are purchased at a labour value price, but final products are sold under prices that reflect redistributed surplus value. [3]

After Marx

Engels

Friedrich Engels, the editor of volume 3 of Capital, hinted since 1894 at an alternative way to look at the matter. His view was that the pure Marxian "law of value" of volume 1 and the "transformed" prices of volume 3 applied to different periods of economic history. In particular, the "law of value" would have prevailed in pre-capitalist exchange economies, from Babylon to the 15th century, while the "transformed" prices would have materialized under capitalism: see Engels's quotation by Morishima and Catephores (1975), p. 310.

Engels's reasoning was later taken up by Meek (1956) and Nell (1973). These authors argued that, whatever one might say of his interpretation of capitalism, Marx's "value" theory retains its usefulness as a tool to interpret pre-capitalist societies, because, they maintained, in pre-capitalist exchange economies there were no "prices of production" with a uniform rate of return (or "profit") on capital. It hence follows that Marx's transformation must have had a historical dimension, given by the actual transition to capitalist production (and no more Marxian "values") at the beginning of the modern era. In this case, this true "historical transformation" could and should take the place of the mathematical transformation postulated by Marx in chapter 9 of volume 3.

As Althusser and Balibar (1970) and others have pointed out, this proposal runs counter to Marx's own ideas, as expressed in Marx (1859):

- "The point at issue is not the role that various economic relations have played in the succession of various social formations appearing in the course of history […], but their position within modern society." (En. trans. p. 210, italics in the original.)

Moreover, the available quantitative research by economic historians has not generally endorsed Engels's view of antiquity and the Middle Ages as a "value epoch" in the Marxian sense: see, for instance, Hicks (1969) and Godelier (1973).

Other Marxist views

There are several schools of thought among those who see themselves as upholding or furthering Marx on the question of transformation from values to prices, or modifying his theory in ways to make it more consistent.

According to the temporal single-system interpretation of Capital advanced by Alan Freeman, Andrew Kliman, and others, Marx's writings on the subject can be interpreted in such a way as to remove any supposed inconsistencies (Choonara 2007). Modern traditional Marxists argue that not only does the labour theory of value hold up today, but also that Marx's understanding of the transformation problem was in the main correct.[4]

Political-economic readings of Capital, such as Harry Cleaver's Reading Capital Politically redefine exploitation as a direct control of worked time, unrelated as such to distribution. These readings are usually associated with the autonomist strand of Marxism, which focuses on production as the key economic site within society. These readings of Capital are typically hostile to economics as such, and consider the transformation problem unimportant because they see all social arrangements in capitalism (in particular, profit and distribution) as politically determined contests between classes.

In the probabilistic interpretation of Marx advanced by Emmanuel Farjoun and Moshe Machover in Laws of Chaos (see references), they "dissolve" the transformation problem by reconceptualising the relevant quantities as random variables. In particular, they consider profit rates to reach an equilibrium distribution. A heuristic analogy with the statistical mechanics of an ideal gas leads them to the hypothesis that this equilibrium distribution should be a gamma distribution.

Finally, there are Marxist scholars (e.g., Anwar Shaikh, Fred Moseley, Alan Freeman, Makoto Itoh, Gerard Dumenil and Dominique Levy, and Duncan Foley) who hold that there exists no incontestable logical procedure by which to derive price magnitudes from value magnitudes, but still think that it has no lethal consequences on his system as a whole. In a few very special cases, Marx's idea of labour as the "substance" of (exchangeable) value would not be openly at odds with the facts of market competitive equilibrium. These authors have argued that such cases—though not generally observed—throw light on the "hidden" or "pure" nature of capitalist society. Thus Marx's related notions of surplus value and unpaid labour can still be treated as basically true, although they hold that the practical details of their workings are more complicated than Marx thought.

In particular, some (e.g., Anwar Shaikh) have suggested that since aggregate surplus value will generally differ from aggregate "profit", the former should be in fact treated as a mere pre-condition for the latter, rather than a full explanation of it. Using input-output data and empirical proxies for labour-values, Shaikh and Ochoa have provided some statistical evidence to show that, although no incontestable logical deduction may be possible of specific price magnitudes from specific value magnitudes, even within a complex model (in contrast to a probabilistic prediction), even a "93% Ricardian theory" of labour-value appears to be a better empirical predictor of price than its rivals.

Critics of the theory

Many mathematical economists assert that a set of functions in which Marx's equalities hold does not generally exist at the individual enterprise or aggregate level, so that chapter 9's transformation problem has no general solution, outside two very special cases. This was first pointed out by, among others, Böhm-Bawerk (1896) and Bortkiewicz (1906). In the second half of the 20th century, Leontief’s and Sraffa’s work on linear production models provided a framework within which to prove this result in a simple and general way.

Although he never actually mentioned the transformation problem, Sraffa’s (1960) chapter 6 on the "reduction" of prices to "dated" amounts of current and past embodied labour gave implicitly the first general proof, showing that the competitive price of the produced good can be expressed as

- ,

where is the time lag, is the lagged-labour input coefficient, is the wage, and is the "profit" (or net return) rate. Since total embodied labour is defined as

- ,

it follows from Sraffa’s result that there is generally no function from to , as was made explicit and elaborated upon by later writers, notably Ian Steedman in Marx after Sraffa.

A standard reference, with an extensive survey of the entire literature prior to 1971 and a comprehensive bibliography, is Samuelson's (1971) "Understanding the Marxian Notion of Exploitation: A Summary of the So-Called Transformation Problem Between Marxian Values and Competitive Prices" Journal of Economic Literature 9 2 399–431.

Since the 1970s, several major schools of Marxian economics have arisen in response to the transformation problem–related challenges of the neoclassical and Sraffian schools. Analytical Marxists held that the transformation problem disproved the labour theory of value and based their Marxian social theory on a combination of the Fundamental Marxian theorem, game theory, and other neoclassical and mathematical tools. Empirical Marxists, including Anwar Shaikh, Moshe Machover, and Paul Cockshott, maintain that since empirical data bears out the correspondence of prices and labour values, the transformation problem is irrelevant. Followers of the temporal single system interpretation and the new interpretation argue that critics have misunderstood Marx's definition of value and that, correctly defined, there is no difference between value and price.

The lack of any function to transform Marx's "values" to competitive prices has important implications for Marx's theory of labour exploitation and economic dynamics—namely that, some people argue with Okishio's theorem, that there is no tendency of the rate of profit to fall. This means that it is not preordained that capitalists must exploit labour to compensate for a declining rate of profit. This implies that Marx's prophecy that worsening labour exploitation would result in an eventual revolution against the capitalist system and the establishment of communism is logically and mathematically false.

Proponents of the temporal single system interpretation such as Moseley (1999), who argue that the determination of prices by simultaneous linear equations (which assumes that prices are the same at the start and end of the production period) is logically inconsistent with the determination of value by labour time, question whether the mathematical proof that Marx's transformation problem has no general solution. Other Marxian economists accept the proof, but reject its relevance for some key elements of Marxian political economy. Still others reject Marxian economics outright, and emphasise the politics of the assumed relations of production instead. To this extent, the transformation problem—or rather its implications—is still a controversial issue today.

Non-Marxian critiques

Mainstream scholars such as Paul Samuelson question the assumption that the basic nature of capitalist production and distribution can be gleaned from unrealistic special cases. For example, in special cases where it applies, Marx's reasoning can be easily turned upside down, through an inverse transformation process; Samuelson argues that Marx's inference that

"Profit is therefore the [bourgeois] disguise of surplus value which must be removed before the real nature of surplus value can be discovered." (Capital, volume 3, chapter 2)

could with equal cogency be "transformed" into:

"Surplus value is therefore the [Marxist] disguise of profit which must be removed before the real nature of profit can be discovered", [5]

To clarify this point, it may be noticed that the special cases in question are also precisely those where J. B. Clark's old model of aggregate marginal productivity holds strictly true, leading to equality between the equilibrium levels of the real wage rate and labour's aggregate marginal product, a hypothesis regarded as disproved by all sides during the Cambridge capital controversy. One would thus have a "pure" state of capitalist society where Marx's exploitation theory and its main supposed confutation were both true.

This remarkable result, it is maintained, leads straight to the heart of the matter. Like Clark's contention about the "fairness" of marginal-productivity wages, so Marx's basic argument—from the "substance" of value to the concept of exploitation—is claimed to be a set of non-analytical and non-empirical propositions. That is why, being non-falsifiable, both theories may be found to apply to the same formal and/or empirical object, though they are supposed to negate each other, as Karl Popper and many others had argued.

Samuelson not only dismissed the labour theory of value because of the transformation problem, but provided himself, in cooperation with economists like Carl Christian von Weizsäcker, solutions. Von Weizsäcker (1962),[6] along with Samuelson (1971),[7] analysed the problem under the assumption that the economy grows at a constant rate following the Golden Rule of Accumulation. Weizsäcker concludes:

"The price of the commodity today is equal to the sum of the 'present' values of the different labour inputs". [8]

Marxian reply to non-Marxian critiques

The Marxian reply to this mainstream view is as follows. The attempt to discard the theoretical relevance of the necessary preconditions of Marx's value analysis in volume 1 of Capital through a reductio ad absurdum is superficial. By first identifying that the preconditions necessary for J. B. Clark's old model of aggregate marginal productivity to hold true are the same as those necessary for Marxian values to conform to relative prices, we are then supposed to conclude that the foundation of Marx's analysis as based in these preconditions is faulty because Clark's model had been proven wrong in the Cambridge capital controversy. The superficiality stems from the fact that those who support this reduction forget that the Cambridge capital controversy called the entire concept of marginal productivity into question by attacking not Clark's special case assumptions but the notion that physical capital can be aggregated. Marx simply does not run into this problem because his analysis does not rely on an aggregation of physical quantities that receive a return based on their contribution as "factors" of production. The fact that marginal productivity in its aggregate form is "a hypothesis regarded as disproved by all sides during the Cambridge capital controversy" has nothing to do with the validity of the special cases of Marx, and thus we would not "have a "pure" state of capitalist society where Marx's exploitation theory and its main supposed confutation (Clark) were both true", as is concluded from this view, because the "correctness" or "incorrectness" of Clark's aggregate marginal productivity scheme in this case flows not from special case assumptions but from the fact that he is aggregating physical units of capital; i.e., Clark's argument would still not hold true even with the assumed special cases.

To further clarify this point, consider the following. First, it is never possible to provide any absolute scientific proof for the truth of any particular concept of economic value in economics, because the attribution of economic value itself always involves human and moral interpretations that go beyond facts and logic. By nature, the concept of economic value is not a scientifically provable concept but an assumption. Marx himself explicitly ridiculed the idea that he should be required to "prove his concept of value".

Second, however, the validity of any proposed theory of value depends on its explanatory, heuristic, and predictive power—i.e., whether it makes possible a coherent interpretation of the known facts that can at least to some extent predict observable trends. In this sense, Marx evidently felt that he had "proved" the validity of his concept of value by the integrated theory of capitalist development that it made possible (see also law of value). What mattered was the application of the concept.

Third, once a certain concept of economic value is assumed, certain predictions or explanations can be made on the basis of it, and those explanations or predictions can at least in principle be falsified by reference to logic and observable evidence. And that concept of value can be compared with rival concepts and the rival theories they make possible in order to establish which has greater explanatory or predictive capacity.

Fourth, modern philosophy of science rejects Popper's falsification theory as an adequate portrayal of science. Scientific statements are not necessarily falsifiable statements but fallible statements (i.e., they could be wrong) that, in principle, can be tested against observables, even if we do not yet know technically how to do this. Scientists do not aim mainly to falsify theories, but to confirm them in order to provide usable knowledge.

Finally, as Piero Sraffa showed clearly, the theory of the production and distribution of a surplus, however it might be devised, is logically independent of any particular theory of the exploitation of labour. Labour exploitation may occur and be conceptualised in various ways, regardless of which theory of value is held to be true. Consequently, if Marx's theory of labour exploitation is false, this is a separate issue.

See also

- Labour theory of value

- Law of value

- Surplus value

- Socially necessary labour time

- Prices of production

- Capital accumulation

- Return of capital

- Temporal single-system interpretation

Notes

- ↑ Capital III, Ch. 9

- ↑ Capital, III Chapter 9

- ↑ Ernest Mandel Marx's Theory of Value

- ↑ Joseph Green (2010): On the non-naturalness of value: A defense of Marx and Engels on the transformation problem (part one)

- ↑ Samuelson (1971), p. 417

- ↑ Weizsäcker, Carl Christian von (2010): A New Technical Progress Function (1962). German Economic Review 11/3 (first publication of an article written in 1962)

- ↑ Weizsäcker Carl Christian von, and Paul A. Samuelson (1971): A new labor theory of value for rational planning through use of the bourgeois profit rate. Proceedings of the National Acadademy of Sciences U S A. download of facsimile

- ↑ Weizsäcker (2010 [1962]), p. 262

References

- Marx, K. (1859) Zur Kritik der politischen Oeconomie, Berlin (trans. A Contribution to the Critique of Political Economy London 1971).

- Marx, K. (1867) Das Kapital Volume I.

- Marx, K. (1894) Das Kapital Volume III (ed. by F. Engels).

- Böhm-Bawerk, E., von (1896) "Zum Abschluss des Marxschen Systems" Festgabe für Karl Knies Berlin [trans. P. Sweezy ed. (1949) Karl Marx and the close of his system by Eugen Böhm-Bawerk and Böhm-Bawerk’s criticism of Marx by Rudolf Hilferding with an appendix by L. von Bortkiewicz].

- Bortkiewicz, L. von (1906) "Wertrechnung und Preisrechnung im Marxschen System" Archiv für Sozialwissenschaft und Sozialpolitik 3, XXIII and XXV [trans. "Value and Price in the Marxian System" International Economic Papers 1952 2 5–60].

- Choonara, J. (2007) "Marx's "transformation" made easy"

- Alan Freeman: Price, value and profit - a continuous, general treatment. In: Alan Freeman, Guglielmo Carchedi (editors): Marx and non-equilibrium economics. Edward Elgar. Cheltenham, UK, Brookfield, US 1996.

- Meek, R. (1956) 'Some Notes on the Transformation Problem' Economic Journal 66 (March) 94-107.

- Sraffa, P. (1960) Production of commodities by means of commodities.

- Hicks, J. (1969) A Theory of Economic History Oxford.

- Althusser, L. and E. Balibar (1970) Reading 'Capital' London.

- Samuelson, P.A. (1971) "Understanding the Marxian Notion of Exploitation: A Summary of the So-Called Transformation Problem Between Marxian Values and Competitive Prices" Journal of Economic Literature 9 2 399–431.

- Godelier, M. (1973) Horizon, trajets marxistes en anthropologie Paris.

- Nell, E.J. (1973) 'Marx's Economics. A Dual Theory of Value and Growth: by Micho Morishima' (book review) Journal of Economic Literature XI 1369-71.

- Morishima, M. and G. Catephores (1975) 'Is there an "historical transformation problem"?' Economic Journal 85 (June) 309-28.

- Anwar Shaikh papers:

- Alan Freeman papers:

- Fred Moseley papers:

- Makoto Itoh, The Basic Theory of Capitalism.

- Gerard Dumenil & Dominique Levy papers

- Duncan Foley papers

- Hagendorf, Klaus: Labour Values and the Theory of the Firm. Part I: The Competitive Firm. Paris: EURODOS; 2009.

- Moseley, Fred (1999). "A 'New Solution' for the Transformation Problem: A Sympathetic Critique".