Lou Pearlman

| Lou Pearlman | |

|---|---|

|

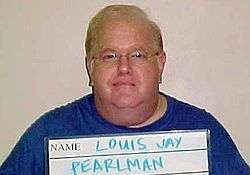

2007 arrest mugshot | |

| Born |

Louis Jay Pearlman June 19, 1954 Flushing, New York, U.S. |

| Died |

August 19, 2016 (aged 62) Miami, Florida, U.S. |

| Cause of death | Cardiac arrest |

| Other names | |

| Criminal charge | |

| Criminal penalty | 25 years in prison |

| Criminal status | Deceased |

|

Musical career | |

| Genres | Dance-pop |

| Occupation(s) | Record producer, manager |

| Years active | 1993–2006 |

| Labels | Trans Continental Records |

| Associated acts | |

Louis Jay "Lou" Pearlman (June 19, 1954 – August 19, 2016) was an American record producer and fraudster. He was the manager of successful 1990s boy bands such as Backstreet Boys and NSYNC. In 2006, he was accused of running one of the largest and longest-running Ponzi schemes in history, leaving more than $300 million in debts. After being apprehended, he pled guilty to conspiracy, money laundering, and making false statements during a bankruptcy proceeding. In 2008, Pearlman was convicted and sentenced to up to 25 years in prison.[3][4][5][6] He died in federal custody in 2016.

Early life

Pearlman was born and raised in Flushing, New York, the only child of Jewish parents, Hy Pearlman, who ran a dry cleaning business, and Reenie Pearlman, a school lunchroom aide. He was a first cousin of Art Garfunkel. His home at Mitchell Gardens Apartments was located across from Flushing Airport, where he and childhood friend Alan Gross would watch blimps take off and land. According to his autobiography, Bands, Brands, & Billions, it was during this period that he used his position on his school newspaper to earn credentials and get his first ride in a blimp. This is disputed by Gross, who claims he was the school reporter, and allowed Pearlman to tag along.[7][8]

His cousin Garfunkel's fame and wealth helped fire Pearlman's own interest in the music business. As a teenager he managed a band, but when success in music proved elusive, he turned his attention to aviation. During his first year as a student at Queens College, Pearlman wrote a business plan for a class project based on the idea of a helicopter taxi service in New York City. By the late 1970s, he had launched the business based on his business plan, starting with one helicopter.[9] He persuaded German businessman Theodor Wüllenkemper to train him on blimps and subsequently spent some time at Wüllenkemper's facilities in Germany learning about the airships.

Suspicions of insurance fraud and pump & dump

Returning to the United States, Pearlman formed Airship Enterprises Ltd, which leased a blimp to Jordache before actually owning one. He used the funds from Jordache to construct a blimp, which promptly crashed. The two parties sued each other, and seven years later Pearlman was awarded $2.5 million in damages. On the advice of a friend, Pearlman started a new company, Airship International, taking it public to raise the $3 million he needed to purchase a blimp, claiming (falsely) that he had a partnership with Wüllenkemper. He leased the blimp to McDonald's for advertising.[7][8]

He then relocated Airship International to Orlando, Florida in July 1991, where he signed MetLife and SeaWorld as clients for his blimps. Airship International suffered when one of its clients left and three of the aircraft crashed. The company's stock, which had once been pumped up to $6 a share, dropped to a price of 3 cents a share, and the company was shut down:[10][11]

After he took his air charter company, Airship International, public in 1985, Pearlman became personally and professionally close to Jerome Rosen, a partner at small-cap trading outfit Norbay Securities. Based in Bayside, Queens, and frequently in trouble with regulators, Norbay actively traded Airship stock. This sent Airship's stock price consistently higher, enabling Pearlman to sell hundreds of thousands of shares and warrants at ever-higher prices. However, Airship was reporting little revenue, cash flow or net income. In return for keeping his penny stock liquid, Pearlman allegedly paid Rosen handsome commissions, according to a mutual friend, that reached into 'the tens of thousands of dollars' per trade.

Entertainment industry career

Pearlman became fascinated with the success of the New Kids on the Block, who had made hundreds of millions of dollars in record, tour and merchandise sales. He started Trans Continental Records with the intent of mimicking their boy-band business model. The label's first band, the Backstreet Boys, consisted of five unknown performers selected by Pearlman in a $3 million talent search.[12] Management duties were assigned to a former New Kids on the Block manager, Johnny Wright, and his wife Donna.[13] The Backstreet Boys became the best-selling boy band of all time, with record sales of 130 million,[14] hitting gold, platinum, and diamond in 45 different countries. Pearlman and the Wrights then repeated this formula almost exactly with the band NSYNC, which sold over 55 million records globally.

With these two major successes under his belt, Pearlman had become a music mogul. Other boy bands managed by Pearlman were O-Town (created during the ABC–MTV reality TV series Making the Band), LFO, Take 5, Natural and US5, as well as the girl group Innosense (with Britney Spears in the very beginning as a short-term member), co-managed with Lynn Harless (the mother of *NSYNC band member Justin Timberlake). Other artists on the Trans Continental label included Aaron Carter, Jordan Knight, Smilez & Southstar and C-Note. Pearlman also owned a large entertainment complex in Orlando, including a recording studio he called Trans Continental Studios, and a dance studio by Disney World named "O-Town".[10] In 2002, Pearlman and Wes Smith co-wrote Bands, Brands and Billions: My Top 10 Rules for Making Any Business Go Platinum.[15]

Lou Pearlman also was an officer at TAG Entertainment. The independent film company produced some low-budget yet profitable movies and DVDs.

Band lawsuits

With the exception of US5, all of the musical acts who worked with Pearlman sued him in Federal Court for misrepresentation and fraud. All cases against Pearlman have either been won by those who have brought lawsuits against him, or have been settled out of court. All cases also ended with a confidentiality agreement, meaning none of the parties are allowed to discuss Pearlman's practices in detail.[8]

The members of Backstreet Boys were the first to file a lawsuit against Pearlman, feeling that their contract — under which Pearlman collected as both manager and producer — was unfair, since Pearlman was also paid as a sixth member of the Backstreet Boys (i.e., one-sixth of the band's own income). The band's dissatisfaction began when member Brian Littrell hired a lawyer to determine why the group had received only $300,000 for all of their work, while Pearlman and his record company had made millions. Fellow boy band *NSYNC was having similar issues with Pearlman, and its members soon followed suit.[8]

At the age of 14, pop star Aaron Carter filed a lawsuit in 2002 that accused Pearlman and Trans Continental Records of cheating him out of hundreds of thousands of dollars and of racketeering in a deliberate pattern of criminal activity. This suit was later settled out of court.[16]

Talent scouting scandal

In September 2002, Pearlman purchased Mark Tolner's internet-based talent company, Options Talent Group f/k/a Sector Communications (previously named Emodel and Studio 58), which would then go through several names including Trans Continental Talent, TCT, Wilhelmina Scouting Network (WSN), Web Style Network, Fashion Rock and Talent Rock. Regardless of the name, all incarnations were based on the business model used by Emodel founder Ayman el Difrawi (aka Alec Defrawy), himself a convicted conman,[17] who played a principal role in running Options / TCT / WSN[18] and setting up Fashion Rock. The companies received unfavorable press attention, ranging from questions about their business practices to outright declarations that they were scams.[19][20][21][22][23][24][25][26][27]

After Hotjobs and Monster.com pulled over a thousand of the company's job ads from their boards,[28] they were further advertised on the Difrawi-founded[29] "Industry Magazine" website. The Better Business Bureau's opinion about Options / TCT / WSN was negative (a "pattern of complaints concerning misrepresentation in selling practices").[30] The New York State Consumer Protection Board issued an alert, naming it the largest example they had found of a photo mill scam[31] (in which agencies force models to shoot portfolios with photographers on their own payrolls), and a state senator called it trying "to make a quick, dishonest dollar".[32]

The San Francisco labor commissioner declared it in violation of California law, and several state agencies were reported to be investigating.[33] In Florida, around 2,000 complaints were filed with the then-Attorney General Charlie Crist and the Better Business Bureau, and an investigation was started by Assistant AG Dowd. However, no charges were filed, as the newly appointed Assistant AG MacGregor was unable to find "any substantial violations" and the company had declared bankruptcy, "leaving no deep pockets to collect damages from."[34][35]

By June 2004, Fashion Rock, LLC had filed a civil suit for defamation against some who had criticized Pearlman's talent businesses. The case was dismissed and closed in 2006.[36][37] One of the accused, Canadian consumer-fraud expert Les Henderson, successfully pursued a libel lawsuit against Pearlman, Tolner, El-Difrawi and several others.[38][39][40]

Fashion Rock, LLC lived on until February 2, 2007,[41][42] when its assets were sold in Pearlman's bankruptcy proceeding.[43][44] Difrawi continued filing lawsuits that all got dismissed and currently runs Expand, Inc. dba Softrock.org aka Employer Network, from the same address as former TCT.

Ponzi scheme

In 2006, investigators discovered Pearlman had perpetrated a long-running Ponzi scheme that defrauded investors out of more than $300 million. For more than 20 years, Pearlman had enticed individuals and banks to invest in Trans Continental Airlines Travel Services Inc. and Trans Continental Airlines Inc., both of which existed only on paper.[45] Pearlman used falsified Federal Deposit Insurance Corporation, AIG and Lloyd's of London documents to win investors' confidence in his "Employee Investment Savings Account" program, and he used fake financial statements created by the fictitious accounting firm Cohen and Siegel to secure bank loans.[8]

Investigation

In February 2007, Florida regulators announced that Pearlman's Trans Continental Savings Program was indeed a massive fraud and the state took possession of the company.[46] Most of the at least $95 million which was collected from investors was gone. Orange County Circuit Judge Renee Roche ordered Pearlman and two of his associates, Robert Fischetti and Michael Crudelle, to bring back to the United States "any assets taken abroad which were derived from illegal transactions."[47]

Following a flight from officials, Pearlman was arrested in Indonesia on June 14, 2007 after being spotted by a German tourist couple.[48] He was living in a tourist hotel in Nusa Dua in Bali. Pearlman had been seen in Orlando in late January 2007, in early February in Germany, including an appearance on German television on February 1. Reportedly he was also seen in Russia, Belarus, Germany, Israel, Spain, Panama, Brazil and Indonesia. In early February, an attorney in Florida received a letter from Pearlman sent from Bali.[49] Pearlman was then indicted by a federal grand jury on June 27, 2007.[50] Specifically, Pearlman was charged with three counts of bank fraud, one count of mail fraud and one count of wire fraud.

Conviction and sentencing

Five days before his sentencing, Pearlman requested a telephone and an Internet connection two days a week to continue to promote bands. U. S. District Judge G. Kendall Sharp rejected the request.[51] On May 21, 2008, Sharp sentenced Pearlman to 25 years in prison on charges of conspiracy, money laundering, and making false statements during a bankruptcy proceeding. Pearlman could reduce his prison time by one month for every million dollars he helped a bankruptcy trustee recover. He also ordered individual investors to be paid before institutions in distributing any eventual assets.[52][53]

Bankruptcy

Pearlman and his companies were forced into involuntary bankruptcy in March 2007.[54] Trustees and lenders auctioned off Pearlman's assets and personal belongings through eBay and a traditional bankruptcy auction.[55][56] Church Street Station, a historic train station in downtown Orlando which Pearlman had purchased in 2002, was sold at a bankruptcy auction in April 2007 for $34 million.[54] Several of Pearlman's belongings, including his college degrees, were purchased by AV Club journalist and film critic Nathan Rabin during the eBay auction.[57]

Death

In 2008, Pearlman began his prison sentence with a projected release date of March 24, 2029. He suffered a stroke in 2010 while incarcerated.[51] Pearlman died while still in custody at the Federal Correctional Institution in Miami, Florida, on August 19, 2016 from cardiac arrest; he was 62 years old.[58][59]

References

- ↑ Roche, Timothy; Handy, Bruce (February 1, 1999). "Big Poppa's Bubble Gum Machine". Time Magazine. Retrieved April 9, 2009.

- ↑ Handy, Bruce (June 18, 2007). "Lou Pearlman appears at hearing in Guam". USA Today. Retrieved 2009-04-09.

- 1 2 "Boy band founder to plead guilty in $300M suit". Associated Press. March 4, 2008. Retrieved April 9, 2009.

- ↑ Liston, Barbara (May 21, 2008). "Boy band mogul Pearlman sentenced to 25 years". Reuters. Retrieved April 9, 2009.

- ↑ Huntley, Helen. "Special report: Unraveling a transcontinental fraud". tampabay.com. Retrieved April 9, 2009.

- ↑ "More coverage of the Lou Pearlman saga". Orlando Sentinel. Retrieved April 9, 2009.

- 1 2 St. Petersburg Times By Helen Huntley, October 21, 2007 In humble Queens, Lou Pearlman was king

- 1 2 3 4 5 Magazine, Vanity Fair. "Mad About the Boys".

- ↑ Henderson 2006, p. 174.

- 1 2 Orlando Sentinel April 1, 2007 A world out of sync

- ↑ New York Post February 22, 2007 BOY BAND KINGPIN'S PENNY ROOTS SHOWING

- ↑ Gray, Tyler (October 7, 2007). "The Fat Man Sings". Radar. p. 91.

- ↑ St. Petersburg Times The starmaker

- ↑ Garcia, Cathy Rose A. (February 22, 2010). "Backstreet Boys Share Secrets to Success". The Korea Times. Retrieved January 24, 2011.

- ↑

- ↑ St. Petersburg Times June 25, 2002. Lawsuit: Pop star's manager a racketeer Archived February 19, 2007, at the Wayback Machine.

- ↑ SEC Info Trans Continental Entertainment Group Inc – 8-K For 10/7/02 The SEC about the nature of the business relations between Trans Continental and Ayman El-Difrawi, Ralph Edward Bell, Cortes Wesley Randell and Jason Hoffman, the felony records of El-Difrawi and Randell, and the FTC sanctions against Bell and Hoffman.

- ↑ Barker, Tim (October 5, 2003). "Scouting Network's History Troubles Pearlman". Orlando Sentinel. Retrieved October 20, 2010.

- ↑ Olson, Wyatt (September 6, 2001). "Hustling for Models". New Times Broward-Palm Beach. Retrieved April 8, 2009.

- ↑ Barack, Lauren (January 26, 2002). "MANNEQUIN MESS TOP AGENCIES DENY CONNECTION TO EMODEL". New York Post. Archived from the original on July 14, 2011. Retrieved April 8, 2009.

- ↑ Kimberlin, Joanne (January 28, 2002). "Cashing in on dreams of glamour". pilotonline.com. Archived from the original on February 4, 2002.

- ↑ "Is eModel Golden Opportunity Or Big Business?". Ksat.com. February 12, 2002. Archived from the original on July 20, 2011.

- ↑ Reed, Travis (May 13, 2002). "Options Talent Group: An I-Team Investigation". Fox Atlanta. Archived from the original on November 7, 2005. Retrieved April 8, 2009.

- ↑ Thompson, Connie (August 13, 2002). "Buyer Beware: Ever Thought About Being A Model?". Komo News. Archived from the original on December 13, 2006. Retrieved April 8, 2009.

- ↑ Reed, Travis (November 14, 2002). "Trans Continental Talent". Fox Atlanta. Archived from the original on October 29, 2005. Retrieved April 8, 2009.

- ↑ "Hidden Cameras Expose Talent Agency Scam". ClickOnDetroit.com. November 15, 2002. Archived from the original on May 12, 2006.

- ↑ I Am Not A Model, Jane Magazine, March 2003

- ↑ Braiker, Brian (July 18, 2003). "Model Misbehavior". Newsweek. Retrieved April 8, 2009.

- ↑ National Arbitration Forum Decision – Industry Publications LLC v. Industry magazine

- ↑ BBB Orlando report on Web Style Network a/k/a Options Talent, TC Talent, Trans Continental Talent, Wilhelmina Scouting Network, Wilhelmina Scouts, WSN. Quote: "Based on BBB files, this company has an unsatisfactory record with the BBB due to a pattern of complaints concerning misrepresentation in selling practices"

- ↑ "Model Agency Labeled A Scam" PageSix, New York Post, October 20, 2003

- ↑ Office of Consumer Affairs Wilhelmina Scouting Network, Modeling Agency

- ↑ "Modeling Agency- Big Fees, Small Return," KRON-4 San Francisco, February 18, 2003.

- ↑ "Archived copy". Archived from the original on September 27, 2007. Retrieved September 27, 2007.

- ↑ "Archived copy" (PDF). Archived from the original on February 25, 2007. Retrieved February 25, 2007., PDF document: John MacGregor providing status of the Options Talent investigation

- ↑ Billman, Jeffrey C. "Pearlman's jihad".

- ↑ Clerk Circuit Court Orange County Florida, search case number 2004-CA-004844-O

- ↑ CanLII Court File No. C-8937-05, Henderson v. Pearlman, Tolner, Difrawi a.o., 2006 Ontario Superior Court of Justice

- ↑ New York Post September 24, 2006 LOUIE WASN'T 'N SYNC / LAWSUIT BACKFIRES "LOU Pearlman picked the wrong guy to sue" Archived December 23, 2008, at the Wayback Machine.

- ↑ CanLII – 2009/08/18 Court File No. C-8937-05 – Henderson v. Pearlman a.o., a case in the Ontario Superior Court of Justice

- ↑ Orlando Sentinel February 2, 2007 Pearlman hit with another huge suit

- ↑ St. Petersburg Times Blog: Money Talk February 9, 2007 State shuts down Fashion Rock Archived February 7, 2007, at the Wayback Machine.

- ↑ Orlando Sentinel March 24, 2007 Pearlman's talent-scout company sold

- ↑ "BBB of Central Florida, Inc.".

- ↑ USDOJ press release March 4, 2008 LOU PEARLMAN SIGNS PLEA AGREEMENT THAT INCLUDES ADDITIONAL CHARGES THAT HE DEFRAUDED INVESTORS

- ↑ "State Takes Over Lou Pearlman's Embattled Orlando Company". wftv.com. February 2, 2007.

- ↑ "State: Trans Continental Savings Program a Fraud". February 2, 2007. Archived from the original on March 2, 2008. Retrieved June 29, 2012.

- ↑ Lou Pearlman Taken Into Custody In Indonesia Archived January 1, 2010, at the Wayback Machine.

- ↑ Sentinel, Pedro Ruz Gutierrez, Scott Powers and Sara K. Clarke/The Orlando. "Boy-band mogul expelled from Indonesia, in FBI custody".

- ↑ Tampa Bay's WTSP 10 News Pearlman indicted on fraud charges

- 1 2 Abramovitch, Seth. "Boy Band Mogul Lou Pearlman's Prison Interview: My Ponzi Scheme Was Smarter Than Madoff's". The Hollywood Reporter. Retrieved August 20, 2016.

- ↑ "Boy band founder to plead guilty in $300M suit". March 5, 2008.

- ↑ Reuters Boy band mogul Pearlman sentenced to 25 years

- 1 2 Huntley, Helen. "Lou Pearlman gets 25 years in scam, time off for loot". Tampa Bay Times. Retrieved August 21, 2016.

- ↑ Johnston, Maura (February 29, 2008). "If You Want A Piece Of Lou Pearlman, You Can Find One On EBay | Idolator". Idolator. Retrieved August 21, 2016.

- ↑ Reed, Travis (June 12, 2007). "Boy-Band Loot Sold at Bankruptcy Auction". The Washington Post. Retrieved August 21, 2016.

- ↑ Rabin, Nathan (July 31, 2009). "Why Do I Own This?: Lou Pearlman 20th Century Republican Leader Certificate". The A.V. Club. Retrieved August 21, 2016.

- ↑ "Inmate Locator". Federal Bureau of Prisons. Retrieved August 20, 2016.

- ↑ Stackaug, Liam (August 22, 2016). "Lou Pearlman, Svengali Behind Backstreet Boys and 'NSync, Dies at 62". The New York Times. Retrieved August 23, 2016.

Further reading

- Gray, Tyler (2008). The Hit Charade: Lou Pearlman, Boy Bands, and the Biggest Ponzi Scheme in U.S. History. Harper Collins. p. 320. ISBN 978-0-06-157966-0.

- Henderson, Wes (2006). Under Investigation: The Inside Story of the Florida Attorney General's Investigation of Wilhelmina Scouting Network, the Largest Model and Talent Scam in America. Coyote Ridge Publishing. p. 511. ISBN 978-0-9687133-3-4. Cited as Henderson 2006.

- Pearlman, Lou; Smith, Wes (2002). Bands, Brands and Billions: My Top 10 Rules for Making Any Business Go Platinum. McGraw-Hill. ISBN 978-0-07-138565-7. Cited as Pearlman 2002.

External links

- Lou Pearlman case

- Page Six Story on Pearlman

- Interview, HitQuarters Jul 2005

- The CNBC program American Greed, narrated by Stacy Keach Jr., describes, in Episode #18, "Lou Pearlman: Boy Band Bandit," the massive fraud and Ponzi scheme, victim outrage at the federal offer to reduce Pearlman's sentence, and his proposed "Jailhouse Rock" (gag) reality series, and it also discusses the issue of sex with underage boys. Bryan Burrough, interviewed for the episode, noted of this last that he had not expected to hear about sexual improprieties, and ascribed the lack of willingness to come forward about them to Pearlman's repeated usage of the tactic of veiled threats to intimidate those who would have otherwise done so.

- Lou Pearlman at the Internet Movie Database