Swiss Market Index

|

SMI performance between 1988 and 2012 | |

| Foundation | 30 June 1988 |

|---|---|

| Operator | SIX Swiss Exchange |

| Exchanges | SIX Swiss Exchange |

| Constituents | 20 |

| Type | Large cap |

| Market cap | CHF 783.1 billion (end 2009)[1] |

| Weighting method | Market value-weighted |

| Related indices | SMI Mid, SMI Expanded |

| Website | six-swiss-exchange.com |

The Swiss Market Index (SMI) is Switzerland's blue-chip stock market index, which makes it the most important in the country. It is made up of 20 of the largest and most liquid Swiss Performance Index (SPI) large- and mid-cap stocks. As a price index, the SMI is not adjusted for dividends, but a performance index that takes account of such distributions is available (the SMIC - SMI Cum Dividend).

The SMI was introduced on 30 June 1988 at a baseline value of 1500 points. Its composition is examined once a year. Calculation takes place in real-time: as soon as a new transaction occurs in a security contained in the SMI, an updated index level is calculated and displayed.

The securities contained in the SMI currently represent more than 90% of the entire market capitalisation, as well as of 90% trading volume, of all Swiss and Liechtenstein equities listed on the SIX Swiss Exchange. Because the SMI is considered to be a mirror of the overall Swiss stock market, it is used as the underlying index for numerous derivative financial instruments such as options, futures and index funds (e.g. ETFs).

Rules

Acceptance criteria

To be accepted into the SMI, a given issue must meet stringent requirements with regard to liquidity and market capitalisation. On one hand, it must represent at least 50% of the average liquidity of the SPI constituent issues and, on the other, have a minimum free-float capitalisation equal to 0.45% or more of the entire SPI capitalisation. Moreover, trading volume and capitalisation are the determining factors in the quarterly rankings. The composition of the index is reviewed annually on the third Friday in September.

2007 restructuring

The SMI comprises a fixed number of 20 securities as of the ordinary review date in September 2007. Prior to this date, the index contained 25 listings. The ranking as of 30 June 2007 (according to average capitalisation and the turnover achieved during one year, i.e. from 1 July 2006 through 30 June 2007) determined which companies would remain within the SMI. On 5 July 2007, SWX announced that Ciba Specialty Chemicals, Lonza Group, Givaudan, SGS and one of the two classes of shares of Swatch Group would leave the SMI as of 24 September 2007 leaving 20 securities in the index.[2]

Constituents

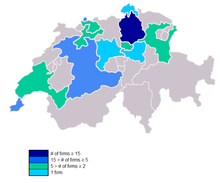

The following 20 stocks make up the SMI index.[3]

| Company | ICB Sector | Canton | Ticker symbol |

|---|---|---|---|

| ABB | electronic equipment | Zurich | ABBN |

| Actelion | biotechnology | Basel | ATLN |

| Adecco | business training and employment agencies | Zurich | ADEN |

| Credit Suisse | banks | Zurich | CSGN |

| Geberit | building materials and fixtures | St. Gallen | GEBN |

| Givaudan | specialty chemicals | Geneva | GIVN |

| Julius Baer Group | banks | Zurich | BAER |

| LafargeHolcim | building materials and fixtures | LHN | |

| Nestlé | food products | Vaud | NESN |

| Novartis | pharmaceuticals | Basel | NOVN |

| Richemont | clothing and accessories | Geneva | CFR |

| Roche | pharmaceuticals | Basel | ROG |

| SGS | business support services | Geneva | SGSN |

| Swatch Group | clothing and accessories | Bern | UHR |

| Swiss Life | Life insurance | Zurich | SLHN |

| Swiss Re | reinsurance | Zurich | SREN |

| Swisscom | fixed line telecommunications | Bern | SCMN |

| Syngenta | specialty chemicals | Basel | SYNN |

| UBS | banks | Zurich | UBSG |

| Zurich Insurance Group | full line insurance | Zurich | ZURN |

Notes and references

- ↑ "SMI Family – Factsheet" (PDF). SIX Swiss Exchange. February 2010. Retrieved 20 June 2010.

- ↑ "SWX Indices: Adjustments to SMI, SMIM and SLI composition and SPI Small/Mid/Large breakdown" (PDF) (Press release). SWX Swiss Exchange. 2007-07-05. Retrieved 2007-07-18.

- ↑ "SMI® PR". SIX Swiss Exchange. Retrieved 2016-12-03.

External links

- Reuters page for .SSMI

- SMI rules

- SWX release on index restructuring

- New equity index selection list

- SMI basket

- Share Indices at SWX Swiss Exchange

- SWX-Homepage

- Bloomberg page for SMI:IND