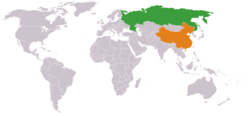

Sino-Russian relations since 1991

|

|

Russia |

China |

|---|---|

Diplomatic relations between the People's Republic of China and the Russian Federation dramatically improved after the dissolution of the Soviet Union and the establishment of the Russian Federation in 1991. American scholar Joseph Nye argues:

- With the collapse of the Soviet Union, that de facto US-China alliance ended, and a China-Russia rapprochement began. In 1992, the two countries declared that they were pursuing a “constructive partnership”; in 1996, they progressed toward a “strategic partnership”; and in 2001, they signed a treaty of “friendship and cooperation.”[1]

The two countries share a long land border which was demarcated in 1991, and they signed a Treaty of Good-Neighborliness and Friendly Cooperation in 2001. On the eve of a 2013 state visit to Moscow by Chinese President Xi Jinping, Russian President Vladimir Putin remarked that the two nations were forging a special relationship.[2]

Country comparison

| People's Republic of China (China) |

Russian Federation (Russia) | |

|---|---|---|

| Coat of Arms |  |

|

| Flag |  |

|

| Area | 9,640,011 km² (3,717,813 sq mi) | 17,125,242 km² (6,612,093 sq mi) |

| Population | 1,365,700,000 | 146,068,400 (2014) |

| Population Density | 140/km² (363/sq mi) | 8.3/km² (21.5/sq mi) |

| Capital | Beijing | Moscow |

| Largest City | Shanghai (23,019,148) | Moscow (14,837,510) |

| Government | Unitary socialist one-party state | Federal semi-presidential republic |

| Ruling political party | Communist Party of China | United Russia |

| Legislature | National People's Congress | State Duma |

| Official languages | Mandarin | Russian |

| GDP (nominal) | $9.181 trillion | $2.118 trillion (2013) |

| GDP (PPP) | $17,632 trillion[3] | $3,558 trillion[3] |

| GDP (nominal) per capita | $7,589 (IMF 2014 calculations) | $12,926 (IMF 2014 calculations) |

| GDP (PPP) per capita | $11,907 | $24,114 |

| Human Development Index | 0.719 (high)[4] | 0.788 (high) |

| Foreign exchange reserves | 3,990,000 (millions of USD) | 467,200 (millions of USD) |

| Military expenditures | $131.57 billion [5] | $90.7 billion (2013)[6] |

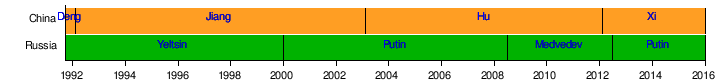

Leaders of the People's Republic of China and the Russian Federation since 1991.

History

China and the USSR were at sword's point after the Sino-Soviet split in 1961. They were competing for control of the worldwide Communist movement. There was a serious possibility of a major war in the early 1960s; a brief border war took place in 1969. This enmity began to lessen after the death of Mao Zedong in 1976, but relations were poor until the fall of the Soviet Union in 1991.

On December 23, 1992, Russian President Boris Yeltsin made his first official visit to China.[7]

In December 1998, at the end of Prime Minister Li Peng’s visit to Moscow, Russia and China issued a joint communique pledging to build an ‘equal and reliable partnership’. This reinforced the Sino-Russian views that the United States was their main competitor in the global political scene.

In 2001, the close relations between the two countries were formalized with the Treaty of Good-Neighborliness and Friendly Cooperation, a twenty-year strategic, economic, and – controversially and arguably – an implicit military treaty. A month before the treaty was signed, the two countries joined with junior partners Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan in the Shanghai Cooperation Organisation (SCO). The organization is expected to counter the growing influence of the United States military outreach program in Central Asia. The PRC is currently a key purchaser and licensee of Russian military equipment, some of which has been instrumental in the modernization of the People's Liberation Army. The PRC is also main beneficiary of the Russian Eastern Siberia – Pacific Ocean oil pipeline.

Border

On May 29, 1994, during the visit of Russian Prime Minister Viktor Chernomyrdin to Beijing, Russian and Chinese officials signed an agreement on the Sino-Russian Border Management System intended to facilitate border trade and hinder criminal activity.[7] On September 3 that year, a demarcation agreement was signed fixing the boundary along a disputed 55-km stretch of the western Sino-Russian border.

The 2004 Complementary Agreement between the People's Republic of China and the Russian Federation on the Eastern Section of the China–Russia Boundary[8] stated that Russia agrees to transfer a part of Abagaitu Islet, whole Yinlong (Tarabarov) Island, about a half of Bolshoy Ussuriysky Island and some adjacent islets to China. A border dispute between Russia and China, standing since Japanese invasion of Manchuria of 1931, was resolved. These Amur River islands were until then administered by Russia and claimed by China. The event was meant to foster feelings of reconciliation and cooperation between the two countries by their leaders. The transfer has been ratified by both the Chinese National People's Congress and the Russian State Duma. The official transfer ceremony was held on-site October 14, 2008.

The Republic of China, based on Taiwan, refused to relinquish its claims to parts of disputed islands remaining in Russian possession.

Economic relations

Most of Russia's exports to China are from the mining and petrochemicals sector.[9]

Energy relations

Since the dissolution of the USSR in 1991, energy relations between China and Russia have been generally marked by cooperation and a regard for mutual geopolitical and strategic interests. China's fast-growing economy places increasing pressure on itself to secure energy imports, while Russia's economy is largely driven by the demand for the export of natural resources. China became a petroleum importer for the first time in 1993, had become the world's second-largest oil consuming country as of 2011, and the world's largest overall energy consumer as of 2010.[10][11] In a report released January 2012, the China Petroleum and Chemical Industry Federation estimated that the country's crude oil consumption would increase to 480 million tonnes in 2012, or 9.6 million barrels per day. The group also forecast that natural gas consumption would rise 15.3 percent to 148.2 billion cubic meters (bcd).[12] Given its geographical proximity to China and position as one of the world's largest oil producers and natural gas exporters, Russia has been a clear candidate in meeting this increased demand.[13] While energy relations have been primarily around hydrocarbons of oil, gas, and coal, there have been partnerships with regard to nuclear and renewable (wind and water) energy technology.[14]

From the mid-1990s, when the tightening of global energy markets coincided with his rise to power, Russian President Vladimir Putin has signaled the importance of oil and particularly natural gas for Russia's emergence as a global power.[15] Long-term prospects for Russian gas exports to China will be affected by several global pricing trends.[16] Surges in liquefied natural gas (LNG) capacity, the increasingly competitive nature of Central Asian gas supplies, advances in shale gas technology, and potential greenhouse gas policies may all impact Chinese consumption.[17]

Despite frequent declarations of goodwill and bilateral energy cooperation, Chinese-Russian energy relations since 1991 have been limited by mutual suspicions, pricing concerns, inadequate transportation infrastructure, and competition for influence in Eurasia.[18] Russian leaders have expressed growing concerns regarding Chinese, Japanese and Korean settlement in the energy-rich but sparsely-populated Russian Far East as well as increased Chinese investment in and control of Russian energy ventures. China's growing oil and gas partnerships with former Soviet Central Asian republics like Kazakhstan, Turkmenistan, and Tajikistan have also been a source of conflict, as Chinese policy makers act warily in this region given Moscow’s traditional dominant regional influence. (See references below).

History

The official relationship between the People's Republic of China and the Russian Federation has been upgraded three times since the establishment of diplomatic relations in 1991. Beginning as “good-neighborly and mutually beneficial” in December 1992, it evolved into a “constructive partnership” in September 1994, and finally a “strategic partnership of coordination” in April 1996.[19] In September 1999, the two countries began joint construction of a nuclear power station at Lianyungang, Jiangsu Province with an installed capacity of 2 million kW, one of the first situations of mutual energy cooperation.[20] The late 1990s also marked the beginning of feasibility studies for natural gas and oil pipeline projects in Western and Eastern Siberia. In 2001, Russian company Yukos proposed the unprecedented Eastern Siberia-Pacific Ocean (ESPO) Oil Pipeline Project, which would link Yukos's oil refinery in Angarsk to Daqing, in northern China.[21] At the time, rail routes were the only means of transporting oil into the growing Chinese market.

The project stalled in October 2003, when Yukos chief executive Mikhail Khodorkovsky was arrested on charges including tax evasion and fraud, and the Russian government launched an immediate investigation into the company.[22][23] Many speculated that the series of events were politically motivated, given that Mr. Khodorkovsky had been a vocal opponent of President Putin.[24] A week after Mr. Khodorkovsky's arrest, China Foreign Ministry spokeswoman Zhang Qiyue publicly announced that the Kremlin investigation would not impact the proposed China-Russia oil pipeline project.[25]

In September 2004, Chinese premier Wen Jiabao met with Russian Prime Minister Mikhail Fradkov in Moscow, where the two heads of government signed agreements affirming Russia's promise to set the route of a proposed pipeline from Eastern Siberia to the Pacific, with priority given to laying a pipeline spur to China, as well as to increase rail oil exports to China to 10 million tons (200,000 b/d) in 2005 and 15 million tons (300,000 b/d) in 2006.[26] Four days before Wen's visit, Yukos, then the largest supplier of Russian oil to China and Russia's biggest oil producer, publicly announced that rail shipments of crude oil to the China National Petroleum Corporation (CNPC) would end beginning on September 28, 2004. The Kremlin had begun auctioning off the troubled company's operating assets a month prior in August.[27]

Gazprom, Soyuzneftegaz, and the Chinese Embassy in Moscow all expressed interest in Yuganskneftegaz, a main arm of Yukos.[28] The subsidiary was ultimately acquired by Russia's state-owned oil company Rosneft for roughly $9.3 billion. In February 2005, Russian Finance Minister Alexei Kudrin revealed that Chinese banks provided $6 billion in financing the Rosneft acquisition. This financing was reportedly secured by long-term oil delivery contracts between Rosneft and the CNPC.[29] In the same month, the Chinese Foreign Ministry denied that China provided "funds" for the deal. The Foreign Ministry could not confirm whether there were any "loans" involved, ministry spokesman Kong Quan said.[30]

State-owned Lukoil became China's largest Russian oil supplier when CNPC reached a strategic cooperation agreement with the company in September 2006.[31] As promised during Premier Wen's visit to Moscow in 2004, construction on a direct pipeline spur to China began in March 2006, when CNPC signed an agreement providing state oil producer Transneft $400 million for constructing a pipeline from Skovorodino, about 70 km (43 mi) from the Chinese border. In the same month, CNPC agreed to a set of principles establishing future joint ventures with Rosneft.[32][33]

In 2006, Gazprom was made responsible for all exports of gas from Russia's eastern Siberian fields, outside of sales made through production sharing agreements (PSAs).[34][35] This was another move widely seen to be politically motivated, since successful commercial development of these fields and export to Asian markets would be impossible without Gazprom – and therefore Kremlin – involvement. [Ibid]. Two years prior, Gazprom acknowledged in an annual shareholder report a plan for supplying natural gas to China. Two routes, roughly equal in capacity, would be constructed, with a total volume of 68 billion cubic meters of gas per annum. An Altai pipeline would link West Siberian fields with the Xinjiang-Uyghur Autonomous Region in western China, while the eastern pipeline would run from Yakutia into northeastern China.[36][37]

Chinese domestic natural gas consumption roughly matched domestic production in 2004. Since then, however, its rate of growth and more sustainable energy profile compared to oil inevitably led to a surge in Chinese natural gas imports.[37] In March 2006, CNPC signed a memorandum of understanding (MOU) with Gazprom for the delivery of natural gas to China, which officially began pricing negotiations between Gazprom chief executive Alexei Miller and Chen Geng, then head of the CNPC. In September 2007, the Russian Federation Industry and Energy Ministry approved a development plan for an integrated gas production, transportation, and supply system in Eastern Siberia and the Far East, taking into account potential gas exports to China and other Asia-Pacific countries. Gazprom was appointed by the Russian Government as the Eastern Gas Program execution coordinator.[38]

Russia's desire to diversify its export markets has been matched by China's willingness to invest in Russian energy production and infrastructure. Russian policymakers, however, have expressed reserve about increased Chinese influence in the energy sector. In 2002, CNPC attempted to bid for Russian oil firm Slavneft, but withdrew just weeks later.[39][40] International news sources suggested the bid failed partly due to anti-foreign sentiment in the Duma, Russia's lower parliamentary house.[41][42][43][44] Slavneft was privatized by parity owners TNK (later OAO TNK-BP) and Sibneft (later OAO Gazprom Neft) soon afterwards. In 2004, Slavneft was then acquired by TNK-BP, the product of a merger between the Alfa Access Renova Consortium (AAR, Alfa Group) and British Petroleum (BP).[45]

In 2006, Russia denied CNPC a significant stake in OAO Rosneft. When the Russian company went public, CNPC was allowed to purchase $500 million worth of shares, one-sixth of the $3 billion it had sought.[46][47] The financial crisis triggered in 2008 gave China its opportunity to invest in Russia on a grander scale through a loans for oil program.[48] In 2009 and 2010, China's long-term energy-backed loans (EBL) extended large sums of capital to companies and entities not only in Russia, but also in Brazil, Ecuador, Turkmenistan and Venezuela. [Ibid].

Growing Chinese investment is speculated to be about more than energy security for China. Chinese news agency Xinhua reported in 2010 that many Chinese enterprises believe the Russian market will allow them to become truly global.[49] Gao Jixiang, Associate Research Fellow of the Russian Economy Research Office of the Russia, East Europe, and Central Asia Research Institute of the Chinese Academy of Social Sciences, reported that China's investments in Russia totaled $1.374 billion as of 2007, and were projected to reach $12 billion by 2020.[50] In 2008–09 alone, total investments rose 25.4% to $2.24 billion and direct investment went from $240 million to $410 million.[51]

2009 marked the 60th anniversary of established diplomatic relations between Moscow and Beijing, and also coincided with the signing of over 40 contracts worth roughly $3 billion.[52] President Hu Jintao of China and President Dmitry Medvedev of Russia conferred three times in four days during mid-June—at the Shanghai Cooperation Organisation summit in Yekaterinburg, at the first-ever heads-of-state meeting of the BRIC countries (Brazil, Russia, India, and China), and again when Hu made a state visit to Moscow from June 16–18, representing what many saw to be a high-water mark in Chinese-Russian relations.[53]

Growing economic closeness also seemed to suggest a growing political alliance. In an interview with China Central TV on the day of Hu's arrival in Russia, Medvedev cited the high-level exchanges and other bilateral achievements in what both governments refer to as their "strategic partnership" as evidence of what he called "the highest level of ties in the history of Russian-Chinese relations."[54] A joint statement released by the two heads of state expanded upon how the two governments usually pledge mutual support for their sovereignty and territorial integrity. The Russian government explicitly affirmed that Tibet along with Taiwan are "inalienable parts of the Chinese territory", while the Chinese supported "Russia's efforts in maintaining peace and stability in the region of Caucasus."[55] During Hu's visit, however, Gazprom announced it could not begin delivering natural gas to China in 2011 as planned, because of pricing disagreements. Construction of the Western Siberian Altai pipeline, which could deliver over 30 billion cubic meters of natural gas annually to China, was supposed to begin in 2008. A senior Gazprom official observed, "As soon as there is a price, we will start the construction, but this is a complicated issue."[56]

September 27, 2010 marked the completion of the 1,000-kilometre (620 mi) Russia-China Crude Pipeline. Stretching from Russia's Skovorodino station to China's Mohe station, it was the first pipeline ever built between China and Russia.[57] In April 2009, Rosneft and Transneft had signed deals with CNPC guaranteeing the pipeline's production of 300,000 barrels of crude oil per day for twenty years as part of a $25 billion loan-for-oil agreement.[58] Upon the pipeline's completion in 2010, CNPC also signed a general agreement with Transneft over the operation of the pipeline, a framework agreement with Gazprom to import natural gas to China from 2015 onwards, an agreement with Rosneft on extending oil supply to the Russia-China Crude Pipeline, and an agreement with Lukoil on expanding strategic cooperation.[59] Both sides hailed the series of agreements as a "new era" in co-operation, and Russia's Deputy Prime Minister Igor Sechin told reporters in Beijing that Russia was "ready to meet China's full demand in gas" going forward. [Ibid]

Andrei Slepnev, a Russian deputy economic development minister, announced in 2009 that Russia and China not only had good prospects for cooperation in oil and gas, but also nuclear power engineering as well as space exploration.[52] In September 2010, President Putin reaffirmed the potential nuclear future of Russia and China's energy relations, saying "Of course, our cooperation with China is not limited to just hydrocarbons … Russia is China's main partner in the field of peaceful use of nuclear energy, and equipment supplies here amount to billions of dollars".[60] However, as of 2011, Russian officials have remained reluctant to transfer nuclear energy technologies and other knowledge products to Chinese partners. Industry experts have pointed out that while proprietary technology would protect Russian exports from being displaced by lower-cost Chinese products in third-party markets, such an approach may reinforce Chinese doubts about Russia’s reliability as a long-term energy partner.[18]

The Russian oil industry has not only been burdened by corporate struggles such as with Yukos and political disagreements between the countries, but also by the reoccurring breaches in safety. From the Kazakh riots[61] to endless environmental concerns,[62][63][64] but most recently the capsizing of an oil platform that was allowed to operate in the north late in the season and was being towed under adverse maritime conditions.[65] Incidents such as these cannot help but give potential foreign investment, which the region needs, pause as to the reliability of Russian energy supplies.

Russian Far East (RFE)

In 1996, the Russian Federation completed two production sharing agreements (PSA) for oil and gas exploration off the northeast coast of the Sakhalin Islands. The Sakhalin-I project, operated by Exxon Neftegas Limited (ENL), has estimated potential recoverable reserves are estimated at 307 million tons of oil (2.3 billion bbn) and 485 billion cubic meters of gas as of 2002.[66][67] ENL, a subsidiary of US-based ExxonMobil, holds a 30 percent interest in the project while Rosneft holds 20 percent via its affiliates RN-Astra (8.5 percent) and Sakhalinmorneftegas-Shelf (11.5 percent). Japanese consortium SODECO and Indian state-owned oil company ONGC Videsh Ltd. holds the remaining 50 percent (30 and 20 percent, respectively).

The Sakhalin-II project is managed by the Sakhalin Energy Investment Company Ltd. (Sakhalin Energy). As of 2011, Russian state monopoly Gazprom holds 50% plus 1 share, RoyalDutch Shell 27.5%, Mitsui 12.5% and Mitsubishi 10%.[68] Gazprom purchased its majority stake from Sakhalin-2 operator Royal Dutch Shell in 2006. The project had been placed permanently on hold by environmental regulators, but moved forward after the sale.[69] The series of events led to widespread speculation that environmental violations may have been used to as a bargaining chip in the deal.[70] Sakhalin-II consists of two 800-km pipelines running from the northeast of the island to Prigorodnoye (Prigorodnoe) in Aniva Bay at the southern end. The consortium built Russia's first liquefied natural gas (LNG) plant at Prigorodnoye. Industry sources speculated that "some in Russia hope to sell China gas from Sakhalin-2's or other facilities' future LNG holdings now that it has mastered the technology".[71] Sakhalin-II LNG first started flowing in 2009, heading to markets in Japan, South Korea and the United States.

In December 2003, CNPC and Sakhalin Energy signed a frame agreement on exploration and development in Russia’s Sakhalin oilfield [72] ExxonMobil also looked towards the Chinese market, making preliminary agreements on supplying Sakhalin-I gas to China as early as 2002. On November 2, 2004, CNPC began negotiations with ExxonMobil on possible long-term gas deliveries from Sakhalin-1.[73] Negotiations were concluded in October 2006, when Exxon and CNPC officially announced an agreement. Under the deal, Sakhalin-1 could sell up to 10 billion cubic meters of gas to China over 20 years by pipeline. The plan met strong opposition from Gazprom, which has a rival pipeline project and controls all Russian gas exports apart from sales through PSAs such as Sakhalin-1.[74] In August 2006, Sakhalin-I's De-Kastri oil terminal began exporting processed petroleum to markets including China, Japan, and South Korea.[75]

The influence of Russia's regional energy trade has led to a sense of local uneasiness as to the foreign countries' influence. In 2000, President Putin warned a Siberian audience that unless Russia intensified the region's development, the Russian Far East would end up speaking Chinese, Japanese and Korean.[76][77] In 2002, the Deputy Secretary of the Russian Security Council, Vladimir Potapov, expressed serious concerns about the region's combined remoteness, weak infrastructure, declining population, and wealth "in very diverse resources".[78][79] Political figures like Viktor Ozerov, Chairman of the Federation Council's Defense and Security Committee, warned of military threats in the Far East and decried the predatory use of the region's resources, and large-scale illegal immigration, though scholars pointed out that no imminent threat was visible.[80] Dmitri Trenin stated that, 'the principal domestic reason is the situation of eastern Russia, especially East Siberia and the Russian Far East. Since the collapse of the Soviet Union, the territories have been going through a deep crisis. The former model of their development is inapplicable; a new model is yet to be devised and implemented. Meanwhile, the vast region has been going through depopulation, deindustrialization, and general degradation. ... The quality of Moscow's statesmanship will be tested by whether it can rise up to the challenge in the East."[81] The RFE has been one of the most difficult areas to transition between the structure of the Soviet Union and the still developing Russian state due to the lack of economic self-sufficiency in the region or any prospects of stable growth.

In September 2005, the Minister of Economic Development and Trade German Gref promised a doubling of state support for the RFE to $612 million in 2006, and consideration of allocating a new $2.5 billion infrastructure fund for projects there.[82] A year later, at the end of 2006, Putin reiterated that the socio-economic isolation of the RFE represented a threat to national security, and advocated yet another new socioeconomic commission and regional development strategy to be formed. He specifically pointed to the perceived threat of foreign immigration in the Far East.[83] Scholars and regional experts have suggested that China's rapid economic growth (especially relative to Russia's GDP growth rate) lies at the bottom of anxieties concerning the RFE. While the Russian and Chinese economies were roughly the same size in 1993, China's grew to over 3.5 times larger than Russia's by 2008. Even since 1998, when Russia began a rapid economic recovery, China has grown at a faster rate; the gap has only widened since the global economic crisis and falling energy prices of the late 2000s. China's growth has led to the creation of new productive capacity, whereas Russia's recovery has been based largely on reutilizing Soviet-era capacity that had idled in the early 1990s.[84][85] China's growing appetite for raw materials therefore coincides with Russia's increasing dependency on foreign investment.

Russian officials have repeatedly reiterated their opposition to being merely China's natural resources storehouse.[86] As early as 2001, Deputy Prime Minister and Finance Minister Aleksei Kudrin warned that if Russia failed to become "a worthy economic partner" for Asia and the Pacific Rim, "China and the Southeast Asian countries will steamroll Siberia and the Far East."[87][88] At the start of his presidency in September 2008, Dmitri Medvedev echoed similar concerns, warning a Kamchatka audience that if Russia fails to develop the RFE it could turn into a raw material base for more developed Asian countries and "unless we speed up our efforts, we can lose everything."[89][90]

Regional experts have pointed out that despite these increasingly vocal concerns, the local economy of the RFE has become increasingly reliant on Chinese goods, services, and labor over the past decade; furthermore, local out-migration shows little sign of reversing. For all the early promise under Putin, Moscow's policy towards the RFE has not seemed effective as of 2008.[91]

Dmitri Trenin of the Moscow branch of the Carnegie Endowment has argued that Siberia's development could become Russia's most urgent challenge.[92] Failure to develop the region into more than a raw material outpost could lead to what he calls a "Chinese takeover of the region, not by migration but rather by economic means of trade and investment." [Ibid]

Russia's plans for this region have revolved around building energy infrastructure to leverage exports and attracting investment so that the capital will be available for modernizing regional infrastructure.[93][94] These plans largely depend on foreign investments, which Russian companies have grudgingly acknowledged. In 2008, a consortium of Chinese engineering firms led by Harbin Turbine signed an agreement with Russian power producer OGK to produce coal-fired turbines in the RFE, adding 41,000 megawatts of new generating capacity by 2011. Stanislav Nevynitsyn, Executive Director of OGK, admitted, "It is simply a necessity for us to work with the Chinese – we will not get the capacity built otherwise."[95] Through loans to Russia's Bank for Development and Foreign Economic Affairs, Vnesheconombank (VEB), China became a major stockholder in Lukoil in 2009.[96] In the same year, after having excluded foreign firms from bidding on the huge Udokan copper mine in Southeast Siberia, Moscow welcomed Chinese, South Korean, and Kazakh miners and refiners back into the bidding process.[97][98]

As part of the 'Russia's Energy Strategy till 2020' the Russian government launched a program of creating a unified gas production, transportation and supply system in Eastern Siberia and the RFE in 2006. The program would ultimately provide affirmation of an all-Russia gas system from the Baltic Sea up to the Pacific Ocean."[99] Russian policymakers have also suggested building an international center for spent fuel and nuclear energy in the RFE, hoping to raise the profile in the export of nuclear energy to the global market.[100]

In 2009, Gazprom was awarded subsurface licenses for the Kirinsky, Vostochno-Odoptinsky and Ayashsky blocks to begin the Sakhalin-III project.[101] Geological exploration has been underway at the Kirinskoye field and, as of 2009, natural gas production is scheduled for 2014. The field will become one of the natural gas sources for the Sakhalin–Khabarovsk–Vladivostok gas transmission system (GTS). The first GTS start-up complex will be 1,350 km, with a capacity of 6 billion cubic meters (bcm) per year.[102]

Central Asia

in 1996, China, Kazakhstan, Kyrgyzstan, Russia and Tajikistan formed the Shanghai Five, a collaborative body that was renamed the Shanghai Cooperation Organisation (SCO) with the addition of Uzbekistan in 2001.[103] As members of the SCO, China and Russia have cooperated in military exercises like counterterrorism drills in Kyrgyzstan in 2002 and in Kazakhstan and China in 2003.[104]

Russian and Chinese leaders regularly call for greater cooperation and coordination in the Shanghai Cooperation Organisation between their two countries in the context of their broader goal of promoting of multilateral diplomacy.[105][106][107] In a joint statement issued on May 23, 2008, Russia and China asserted that “International security is comprehensive and inalienable, and some countries’ security cannot be guaranteed at the cost of some others’, including expanding military and political allies.”[108] Zhao Huasheng, Director of Russian and Central Asian Studies at Fudan University’s Shanghai Cooperation Center, has argued that economic cooperation will ensure the long-term relevance of the SCO, as current security threats recede.[109] While China and Russia do enjoy some bilateral energy cooperation, which experts predict will continue to grow in the future, the two countries have emerged as rivals for Central Asian oil and gas supplies.[110] With the rise in the price of oil in the mid-2000s, Russia has sought to renew its influence in Central Asia, in particular the region's southern flank, to guarantee access to gas supplies for reexport to Europe and for its own domestic needs. As China’s energy needs have grown and its policymakers have sought to develop its western provinces, China, too, has sought to expand its influence in Central Asia.[104]

In 2007, at a meeting of SCO prime ministers in Tashkent, Russian Premier Viktor Zubkov reiterated Moscow's desire to forge a Central Asian energy "club" within the SCO, which comprises Russia, China, Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan. The SCO energy club could be set up as soon as 2008, Russian Deputy Industry and Energy Minister Ivan Materov announced in Tashkent. However, he insisted that the club would not amount to a sort of mini-OPEC. Political and economic analysts in Moscow believe the Kremlin is keen to establish an energy club as a means to prevent a possible clash with China over Central Asia's energy resources.[111]

At a May 2007 SCO summit in Turkmenbashi, Russian, Kazakh and Turkmen leaders announced the expansion of the Prikaspiisky gas pipeline from Turkmenistan into Russia.[112] The plan has stalled due to several obstacles, including price disagreements and the economic recession of the late 2000s. (Ibid).[113][114]

Uncertainty over the Prikaspiisky route has given China an opening, especially in Turkmenistan. During a brief visit to Ashgabat, Prime Minister Wen Jiabao called for efforts "to step up bilateral trade cooperation to a new level." Berdymukhamedov, in turn, expressed interest in "working closely" with China on a natural gas pipeline project, Xinhua reported. In December 2005, Kazakhstani President Nursultan Nazarbayev inaugurated Atasu-Alashankou pipeline to ship oil to China. The $800 million Atasu-Alashankou route still needs Russian crude oil from Western Siberia, transported via the Omsk-Pavlodar-Shymkent pipeline, to reach its full annual capacity of 20 million tons by 2010.[115] Although China and its Central Asian partners view their expanding cooperation as a means of diversifying their energy partnerships, Russia has enjoyed success in other major energy projects. In November 2007, two Russian companies (TNK-BP and GazpromNeft) signed an agreement with KazTransOil to ship up to 5 million tons of oil annually to China via the Omsk-Pavlodar-Atasu-Alanshakou pipeline. In the first quarter of 2008, 300,000 tons of Russian crude oil were exported to China along this route.[116] Moreover, a Russian engineering company, Stroytransgaz, won a tender to build Turkmenistan’s section of the gas pipeline to China.[117]

Latest developments in May 2014 announced that China and Russia reached a 30-year gas deal where "Russia would supply 38 billion cubic meters of natural gas each year to China".[118] These developments continue to show Russia and China's attempts to work together outside of USA confinements.

Trade in national currencies

On November 23, 2010, at a meeting of the Russian Prime Minister Vladimir Putin and the Chinese Premier Wen Jiabao, it was announced that Russia and China have decided to use their own national currencies for bilateral trade, instead of the U.S. dollar. The move is aimed to further improve the relations between Beijing and Moscow and to protect their domestic economies in the conditions of the world financial crisis. The trading of the Chinese yuan against the Russian ruble has started in the Chinese interbank market, while the yuan's trading against the ruble started on the Russian foreign exchange market in December 2010.[119][120]

In coordination with other emerging economies the second BRIC summit was held in Brasília in April 2010.

In 2014 Beijing and Moscow signed a 150 billion yuan central bank liquidity swap line agreement to get around American sanctions on their behaviors.[121]

In December 2014, Chinese Foreign Minister Wang Yi pledged to offer financial support to Russia and support the Ruble if needed, in light of the currency's depreciation.[122]

Military relations

After the EU arms embargo on China imposed as a consequence of the Tiananmen Square protests of 1989, China became a reliable client for Russian military exports, making up 25–50% of all foreign military sales.[123] On November 9, 1993, Russian Defence Minister Pavel Grachev and Chinese Defence Minister Chi Haotian signed a five-year defence cooperation agreement paving the way for an increase in the number of military attachés stationed in their respective capitals. On July 12, 1994 the Russian and Chinese defence ministers signed a border security agreement designed to prevent potentially dangerous military incidents, such as unintentional radar jamming and airspace violations.

On October 19, 1999, Defence Minister of China, General Chi Haotian, after meeting with Syrian Defence Minister Mustafa Tlass in Damascus, Syria to discuss expanding military ties between Syria and China, flew directly to Israel and met with Ehud Barak, the then Prime Minister and Defence Minister of Israel where they discussed military relations. Among the military arrangements was a 1 billion dollar Israeli-Russian sale of military aircraft to China, which were to be jointly produced by Russia and Israel.[124]

In 2004, the Russian Foreign Ministry blocked both the sale of the Su-35 and Tupolev Tu-22M bombers to China over concerns about the arrangements for Chinese production of the Sukhoi Su-27SK (known as the Shenyang J-11).[125] Originally, the licensing agreement required that engines and avionics be sourced by Russian suppliers, however by 2004 these components were being produced domestically.[126]

Currently, China focuses on domestic weapon designs and manufacturing, while still importing certain military products from Russia such as jet engines. China decided to become independent in its defense sector and become competitive in global arms markets; its defense sector is rapidly developing and maturing. Gaps in certain capability remain – most notably in the development of some sophisticated electronic systems and sufficiently reliable and powerful propulsion systems – but China's defense industry is now producing warships and submarines, land systems and aircraft that provide the Chinese armed forces with a capability edge over most military operating in the Asia-Pacific. Where indigenous capability still falls short, China procures from Russia and, until local industry eventually bridges the gap, it hopes that quantity will overcome quality.[127] China's 2015 Defense White Paper called for "independent innovation" and the "sustainable development" of advanced weaponry and equipment.[127]

According to national interest, Chinese industry can still learn much from Russia, but in many areas it has caught up with its model. The vibrancy of China’s tech sector suggests that Chinese military technology will leap ahead of Russian tech in the next decade.[128]

International mail

According to a 2011 report, international mail between China and Russia normally travels through Beijing and Moscow. However, the postal authorities of the two countries considered setting up mail exchange operation in Blagoveshchensk (opposite Heihe), in order to speed up mail transport between the Russian Far East and Northeastern China.[129]

See also

- Foreign relations of Russia

- Russia–United States relations

- Sino-Soviet relations

- History of Sino-Russian relations

References

- ↑ Nye 2015

- ↑

- 1 2 ""Gross domestic product 2014, PPP", International Monetary Fund, accessed on 5 February 2015".

- ↑ "- Human Development Reports". Retrieved 3 April 2016.

- ↑ Michael Martina and Greg Torode (5 March 2014). "China's Xi ramps up military spending in face of worried region". Reuters. Retrieved 3 April 2016.

- ↑ "Комитет Государственной Думы по обороне — Комитет по обороне рассмотрел законопроект "О федеральном бюджете на 2013 г. и на плановый период 2014 и 2015 гг."". Retrieved 3 April 2016.

- 1 2 Chronology of principal defence and security-related agreements and initiatives involving the Russian Federation and Asian countries, 1992–99

- ↑

- ↑ Ratner, Ely; Rosenberg, Elizabeth (20 May 2014). "China Has Russia Over a Barrel". www.foreignpolicy.com. FOREIGN POLICY. Archived from the original on May 20, 2014. Retrieved 20 May 2014.

- ↑ "Countries Compared by Energy > Oil > Consumption. International Statistics at". Nationmaster.com. 2014-05-03. Retrieved 2016-10-22.

- ↑ China overtakes the United States to become world's largest energy consumer. International Energy Agency. Jul 20, 2010. "Archived copy". Archived from the original on January 13, 2012. Retrieved January 17, 2012.

- ↑ "UPDATE 2-China crude oil demand growth to accelerate in 2012-CPCIF". Reuters. 2012-01-11. Retrieved 2016-10-22.

- ↑ "Statistical Review of World Energy | Energy economics | BP Global". Bp.com. 2016-06-20. Retrieved 2016-10-22.

- ↑ Russia: Rosneft and Transneft signed deals with China guaranteeing crude oil supplies in exchange for $25 billion in loans. Energy Compass. April 3, 2009.

- ↑ Goldman, Marshall. Petrostate: Putin, Power and the New Russia, 2008, pg.143.

- ↑ Hartley, P. and K. Medlock. Potential Futures for Russian Natural Gas Exports, Energy Journal, Special Issue on World Natural Gas Markets and Trade, 2009, pp. 73–95.

- ↑ MIT Center for Energy and Environmental Policy Research. July 2011. Paltsev, Sergey . Can Russian Natural Gas go to Non-European Markets? Russia's Natural Gas Export Potential up to 2050, PDF

- 1 2 "Sputnik International". En.rian.ru. 2011-10-20. Retrieved 2016-10-22.

- ↑ Xia, Yishan (May 2000). ""China-Russia Energy Cooperation: Impetus, Prospects and Impacts."" (PDF). James A. Baker III Institute for Public Policy, Rice University. pp. 5–6. Retrieved 2016-10-22.

- ↑ Xia, pg.4.

- ↑ "Asia Times Online :: Central Asian News and current affairs, Russia, Afghanistan, Uzbekistan". Atimes.com. 2005-04-29. Retrieved 2016-10-22.

- ↑ Yukos: The Final Curtain. FSU Oil & Gas Monitor, Jul 26, 2006, p. 5.

- ↑ Aris, Ben. Death of Yukos. FSU Oil & Gas Monitor, Aug 2, 2006, p. 4.

- ↑ Woodruff, David M. Khodorkovsky's Gamble: From Business to Politics in the YUKOS Conflict. PONARS Policy Memo 308. MIT. November 2003. .

- ↑ "Yukos case not to affect China-Russia oil pipeline: FM". English.peopledaily.com.cn. 2003-11-05. Retrieved 2016-10-22.

- ↑ China, Russia in Energy Pact. Oil Daily. Washington: Sep 27, 2004. pg. 1.

- ↑

- ↑

- ↑ "Asia Times Online :: China News, China Business News, Taiwan and Hong Kong News and Business". Atimes.com. 2005-06-04. Retrieved 2016-10-22.

- ↑ "People's Daily Online - China did not fund Rosneft's purchase of Yuganskneftegaz". English.peopledaily.com.cn. 2005-02-04. Retrieved 2016-10-22.

- ↑

- ↑ China, Russia Forge Three Energy Deals. Oil Daily. Washington: Mar 21, 2006. pg. 1.

- ↑

- ↑ Stern, Jonathan. The Future of Russian Gas and Gazprom, pp. 152–9.

- ↑ Henderson, James. Non-Gazprom Gas Producers in Russia, Oxford: Oxford Institute for Energy Studies, 2010, pg. 151.

- ↑

- 1 2 Jun 11, 2008 (2008-06-11). "Asia Times Online :: Central Asian News and current affairs, Russia, Afghanistan, Uzbekistan". Atimes.com. Retrieved 2016-10-22.

- ↑ "Sakhalin–Khabarovsk–Vladivostok Transmissions System". Gazprom Projects. "Archived copy". Archived from the original on September 27, 2011. Retrieved September 10, 2011.

- ↑

- ↑ Alex Frew McMillan CNN Hong Kong. "CNN.com - Chinese pull out of Russian oil bid - Dec. 17, 2002". Edition.cnn.com. Retrieved 2016-10-22.

- ↑ Lelyveld, Michael. Russia: Moscow's Oil Pipeline Plan to China Stalls, Radio Free Europe Radio Liberty (Henceforth RFERL). Newsline. Dec 10, 2002

- ↑ Lim, Le-Min. China Sees Russian Barrier to Slavneft. International Herald Tribune. Dec 17, 2002

- ↑ Anti-China Sentiment Plays Into Duma vote," Stratfor, Dec 16, 2002

- ↑ "Chinese Drop Plans to Bid for Slavneft. Rosbusiness Consulting. Dec 17, 2002.

- ↑ Investments:Slavneft. "Archived copy". Archived from the original on January 21, 2012. Retrieved January 17, 2012.

- ↑ O'Rourke, Breffni. China/Russia: CNPC Denied Intended Stake in Rosneft. RFE/RL. Jul 19, 2006

- ↑ "CNPC invests $500M in Rosneft's IPO". Chinadaily.com.cn. 2006-07-19. Retrieved 2016-10-22.

- ↑

- ↑ Xinhua, FBIS SOV, Mar 22, 2010.

- ↑ Yuejin, Wang and Na, Zhang. Russia: Is It a New Investment Opportunity for China? Zhongguo Jingli Shibao Online. Sep 23, 2008, FBIS SOV, trans. Oct 7, 2008.

- ↑ Interfax, FBIS SOV, Mar 22, 2010.

- 1 2 "Sputnik International". En.rian.ru. 2011-10-20. Retrieved 2016-10-22.

- ↑ "Global Insights: Chinese-Russian Relations the Best Ever?". Worldpoliticsreview.com. 2009-06-23. Retrieved 2016-10-22.

- ↑ "Sputnik International". En.rian.ru. 2011-10-20. Retrieved 2016-10-22.

- ↑ "China, Russia sign five-point joint statement_English_Xinhua". News.xinhuanet.com. 2009-06-18. Retrieved 2016-10-22.

- ↑ "Sputnik International". En.rian.ru. 2011-10-20. Retrieved 2016-10-22.

- ↑ "China,Russia mark completion of crude oil pipeline". Chinadaily.com.cn. 2010-09-27. Retrieved 2016-10-22.

- ↑ Russia: Rosneft and Transneft signed deals with China guaranteeing crude oil supplies in exchange for $25 billion in loans. Energy Compass. Apr 3, 2009.

- ↑ "Russia and China sign series of energy agreements". BBC News. 2010-09-27. Retrieved 2016-10-22.

- ↑ Russia begins filling ESPO spur to China with oil. Anon. Interfax : Russia & CIS Oil & Gas Weekly. (Sep 1, 2010).

- ↑ "Назарбаев сменил руководство "Казмунайгаза" и Мангистауской области". Retrieved 3 April 2016.

- ↑

- ↑ "Neva is Being Poisoned with Oil Products and Naphthalene | Greenpeace Russia". Greenpeace.org. 2007-08-21. Retrieved 2016-10-22.

- ↑ Zhao, H., & Lu, X. Yu, X., Wang, G., Zou, Y., Wang, Q. Effects of pipeline construction on wetland ecosystems: Russia-china oil pipeline project (mohe-daqing section), Ambio, 2010. 39(5), pp. 447–50.

- ↑ "Russia oil rig capsizes off Sakhalin, dozens missing". BBC News. December 18, 2011.

- ↑ "Sakhalin-1 Project homepage, Exxon Neftegas Limited". Sakhalin-1.com. 2016-08-18. Retrieved 2016-10-22.

- ↑ "ExxonMobil, CNPC Negotiate on Sakhalin-1". Yuzno.com. 2008-02-19. Retrieved 2016-10-22.

- ↑ "Archived copy". Archived from the original on January 16, 2012. Retrieved January 17, 2012.

- ↑ "A Tale Of Three Thefts: China, Russia, And The U.S". Forbes.com. Retrieved 2016-10-22.

- ↑ Elder, Miriam (December 27, 2008). "Russia look to control world's gas prices". The Daily Telegraph. London.

- ↑ Pipeline & Gas Journal's 2008 International Pipeline Construction Report. Pipeline & Gas Journal. Aug 2008, p. 20.

- ↑ "Archived copy". Archived from the original on December 30, 2011. Retrieved January 17, 2012.

- ↑ "China Joins the Battle for Sakhalin - Kommersant Moscow". Kommersant.com. Retrieved 2016-10-22.

- ↑

- ↑

- ↑ Nezavisimaya Gazeta, Jul 22, 2000

- ↑ BBC Monitoring, Jul 22, 2000

- ↑ ""New Security Challenges and Russia. " / Russia in Global Affairs. Foreign policy research foundation". Retrieved 3 April 2016.

- ↑ Alexseev, Mikhail A. Program on New Alternatives in the Study of Russian Society (PONARS), Policy Memo 317 (2003), p. 4.

- ↑ Rzhesevskiy, Alexander. Far East Military threats: Old and New. Parlametnskaya Gazeta. In Russian, May 14, 2005, FBIS SOV, trans, May 24, 2005.

- ↑ Trenin, Dmitri. Russia's Asia Policy Under Vladimir Putin, 2000–2005. Rozman, Gilbert, Togo, Kazuhiko and Ferguson, Joseph P. (eds.), 2006. Russian Strategic Thought Toward Asia, New York, Palgrave Macmillan, p. 131.

- ↑ Wishnick, Elizabeth. Russia and the CIS in 2005. Asian Survey, vol 46, no. 1 (2006), p. 72.

- ↑ Kim,Woo-Jun. Cooperation and Conflict Among Provinces: The Three Northeastern Provinces of China, the Russian Far East, and Sinujiu, North Korea. Issues & Studies, vol. 44, no. 3. September 2008, p. 219.

- ↑ Blank, 2010

- ↑ Graham, Thomas. The Sources of Russia's Insecurity. Survival, vol. 52, no. 1. 2010, p. 63.

- ↑ Blagov, Sergei. Russia Wants to Be More than China's Source for Raw materials. Jamestown Foundation, Eurasia Daily Monitor, vol. 2, no. 181. September 30, 2005.

- ↑ Interfax, Presidential Bulletin, FBIS SOV, Aug 21, 2001

- ↑ Asia and the Russian Far East: The Dream of Economic Integration, AsiaInt Special Reports. Nov 2002, pp. 3–6. [www.Asiaint.com].

- ↑ Medvedev: Far East Ignored Too Long Without Action, Russia Will Lose It, He Says. Analytical Department of RIA RosbusinessConsulting. Sep 26, 2008

- ↑ Johnson's Russia list, Sep 27, 2008.

- ↑ Lo, Bobo. Axis of Convenience: Moscow, Beijing, and the New Geopolitics. Washington D.C., Brookings Institution Press. 2008, p. 66.

- ↑ Trenin, Dmitri. The End of Eurasia: Russia on the Border Between Geopolitics and Globalization. Washington, D.C., Carnegie Endowment for International Peace. 2002.

- ↑ Gulkov, Alexander N. Basic Concepts of Cooperation in North-East Asia in the Oil and Gas Sector for the Period 2010–2030. Northeast Asia Energy Focus, vol. 7, no. 1. Spring 2010, pp.10–15.

- ↑ Kulagin, Vyacheslav. The East as the New Priority of the Russian Energy Policy. Northeast Asia Energy Focus, vol. 7, no. 1. Spring 2010, pp. 36–43.

- ↑ Kaysen, Ronda. "The New York Times - Breaking News, World News & Multimedia". International Herald Tribune. Retrieved 2016-10-22.

- ↑ Blank, Stephen. "Russia's Failure in Asia'. UNISCI Discussion Papers 24. Oct 2010, pp 61–82.

- ↑ Helmer, John. Kremlin Extends Welcome to Foreign Miners. Asia Times Online. Jul 1, 2009

- ↑ Interfax Russia & CIS Oil and Gas Weekly, FBIS SOV Jun 17, 2009

- ↑ Potapov, Maxim. China’s Experience as a Member of APEC: Lessons for Russia. Far Eastern Affairs, no. 1 (2001): 47.

- ↑ ITAR-TASS, FBIS SOV, April 6, 2006. [www.president.ru].

- ↑ "Gazprom in Eastern Russia, Entry into Asia-Pacific Markets" (PDF). Gazprom.com. June 17, 2009. Retrieved 2016-10-22.

- ↑ Eastern Gas Program. Gazprom Website Archived July 14, 2010, at the Wayback Machine.

- ↑

- 1 2 Wishnick, 2009.

- ↑ Medvedev Pledges to Build Strategic Partnership with China. RIA Novosti. May 24, 2008. [www.en.rian.ru], accessed May 28, 2008

- ↑ Reaping the Benefits of Two Glorious Years. Xinhua. Nov 7, 2007. [Chinadaily.com.cn], accessed May 19, 2008.

- ↑ “Joint Statement between The People’s Republic of China and the Russian Federation”. Apr 4, 2007. [www.fmprc.cn], accessed May 28, 2008.

- ↑ China-Russia Joint Statement Says International Security ‘Inalienable’. Xinhua. May 23, 2008. [www.lexisnexis.com], accessed May 28, 2008.

- ↑ Huasheng, Zhao. The Shanghai Cooperation Organisation at 5: Achievements and Challenges Ahead. China and Eurasia Forum Quarterly, Vol. 4, No. 3. 2006, p. 117-118.

- ↑ Guang, Pan. Bishkek: SCO’s Success in the Hinterland of Eurasia. China and Eurasia Forum Quarterly, Vol. 5, No. 4. 2007, p. 5.

- ↑ "Russia Urges Formation of Central Asian Energy Club". EurasiaNet.org. 2007-11-06. Retrieved 2016-10-22.

- ↑ Luft, Gal and Anne Korin. Energy Security Challenges for the 21st Century. Greenwood Publishing Press, 2009. pg. 96.

- ↑ "Prikaspiisky Pipeline: Temporary Delay or Fundamental Problem?". EurasiaNet.org. 2007-06-25. Retrieved 2016-10-22.

- ↑ "Russia Talks TAPI with Turkmenistan; Postpones Prikaspiisky". EurasiaNet.org. 2010-10-25. Retrieved 2016-10-22.

- ↑ Clark, Martin. Beijing Triumphs with Inauguration of Kazakhstani Crude Pipe. FSU Oil & Gas Monitor. Dec 21, 2005.

- ↑ KazTransOil Announces Beginning of Russian Crude Transit to China. Interfax. Jan 21, 2008. [www.uoalberta.ca], accessed Jul 24, 2008.

- ↑ Gurt, Marat. Russian Company Wins Turkmen Pipeline Tender. Reuters. Feb 19, 2008. [www.lexisnexis.com], accessed Jul 23, 2008.

- ↑ "China and Russia Reach 30-Year Gas Deal". The New York Times. 22 May 2014. Retrieved 3 April 2016.

- ↑ China, Russia quit dollar China Daily

- ↑ "Chinese minister says China-Russia economic, trade co-op at new starting point". News.xinhuanet.com. Retrieved 3 April 2016.

- ↑ Smolchenko, Anna (13 October 2014). "China, Russia seek 'international justice', agree currency swap line". news.yahoo.com. AFP News. Retrieved 13 October 2014.

- ↑ "China-Russia Partnership to Grow". InvestAsian. Retrieved 3 April 2016.

- ↑ Richard Weitz, The Diplomat. "Why China Snubs Russia Arms". The Diplomat. Retrieved 3 April 2016.

- ↑ "China defense minister visits Israel". World Tribune. Thursday, October 21, 1999

- ↑ Zhao 2004, p. 216.

- ↑ Sputnik (21 February 2008). "China copies Su-27 fighter, may compete with Russia - paper". Retrieved 3 April 2016.

- 1 2 Jon Grevatt, Special to CNN (4 September 2015). "China's defence industry: good but could do better". CNN. Retrieved 3 April 2016.

- ↑ "Russia vs. China: The Race to Dominate the Defense Market". The National Interest. Retrieved 3 April 2016.

- ↑ "Russia and China forge closer mail links in Far East « Post & Parcel". Postandparcel.info. 2011-08-26. Retrieved 2016-10-22.

Further reading

- Efremenko D. "New Russian Government’s Foreign Policy towards East Asia and the Pacific" Journal of East Asian Affairs (2012) 26#2 (Seoul: Institute for National Security ) metaCode=en_m_pub&boardId=a57b3ef8b2bff73bb9e00084&pkey=1 online

- Flikke, Geir. "Sino–Russian Relations: Status Exchange or Imbalanced Relationship?." Problems of Post-Communism (2016): 1-12.

- Hsu, Jing-Yun, and Jenn-Jaw Soong. "Development of China-Russia Relations (1949-2011) Limits, Opportunities, and Economic Ties." Chinese economy 47.3 (2014): 70-87. online

- Kim, Younkyoo, and Stephen Blank. "Rethinking Russo-Chinese Relations in Asia: Beyond Russia's Chinese Dilemma." China: An International Journal(2013) 11#3 pp: 136-148. online

- Kim, Younkyoo, and Fabio Indeo. "The new great game in Central Asia post 2014: The US “New Silk Road” strategy and Sino-Russian rivalry." Communist and Post-Communist Studies (2013) 46#2 pp: 275-286. online

- Korolev, Alexander. "The Strategic Alignment between Russia and China: Myths and Reality." Singapore: Lee Kuan Yew School of Public Policy Research Paper #15-19 (2015). online

- Moshes, Arkady and Matti Nojonen, eds. Russia-China relations: Current state, alternative futures, and implications for the West FIIA Report 30, The Finnish Institute of International Affairs (September 2011)

- Nye, Joseph. "A New Sino-Russian Alliance?" Project Syndicate 12 January 2015

- Quested, Rosemary K.I. Sino-Russian relations: a short history (Routledge, 2014)

- Rozman, Gilbert. The Sino-Russian Challenge to the World Order: National Identities, Bilateral Relations, and East versus West in the 2010s (2014) online review

- Tian, Hao. "Sino-Russian Relations: Conflict and Cooperation." (Lehigh University, 2016), bibliography pp 55-60; online

- Trenin, Dmitri. Challenges and Opportunities: Russia and the Rise of China and India in Strategic Asia 2011–12: Asia Responds to Its Rising Powers – China and India (September 2011)

- Weitz, Richard. China-Russia security relations: strategic parallelism without partnership or passion? (Maroon Ebooks, 2015)