Redlining

In the United States, redlining is the practice of denying services, either directly or through selectively raising prices, to residents of certain areas based on the racial or ethnic composition of those areas. While the best known examples of redlining have involved denial of financial services such as banking or insurance,[2] other services such as health care[3] or even supermarkets[4] have been denied to residents (or in the case of retail businesses like supermarkets, simply located impractically far away from said residents) to result in a redlining effect.[5] The term "redlining" was coined in the late 1960s by John McKnight, a sociologist and community activist.[6] It refers to the practice of marking a red line on a map to delineate an area where banks would not make loans; later the term was applied to discrimination against a particular group of people (usually on the basis of race or sex) irrespective of geography.

During the heyday of redlining, the areas most frequently discriminated against were black inner city neighborhoods. For example, in Atlanta in the 1980s, a Pulitzer Prize-winning series of articles by investigative-reporter Bill Dedman showed that banks would often lend to lower-income whites but not to middle- or upper-income blacks.[7] The use of blacklists is a related mechanism also used by redliners to keep track of groups, areas, and people that the discriminating party feels should be denied business or aid or other transactions. In the academic literature, redlining falls under the broader category of credit rationing.

Reverse redlining occurs when a lender or insurer targets nonwhite consumers, not to deny them loans or insurance, but rather to charge them more than could be charged to a comparable white consumer.[8][9]

History

| Part of a series of articles on Racial segregation | |

|---|---|

| |

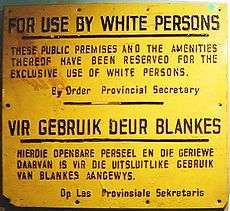

| South Africa | |

| United States | |

Although informal discrimination and segregation had existed in the United States, the specific practice called "redlining" began with the National Housing Act of 1934, which established the Federal Housing Administration (FHA).[10] Racial segregation and discrimination against minorities and minority communities pre-existed this policy. The implementation of this federal policy aggravated the decay of minority inner city neighborhoods caused by the withholding of mortgage capital, and made it even more difficult for neighborhoods to attract and retain families able to purchase homes.[11] In 1935, the Federal Home Loan Bank Board (FHLBB) asked Home Owners' Loan Corporation (HOLC) to look at 239 cities and create "residential security maps" to indicate the level of security for real-estate investments in each surveyed city. The assumptions in redlining resulted in a large increase in residential racial segregation and urban decay in the United States. Urban planning historians theorize that the maps were used by private and public entities for years afterwards to deny loans to people in black communities.[10] But, recent research has indicated that the HOLC did not redline in its own lending activities, and that the racist language reflected the bias of the private sector and experts hired to conduct the appraisals.[12]

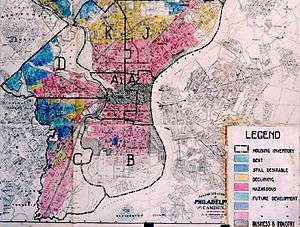

On the maps, the newest areas—those considered desirable for lending purposes—were outlined in green and known as "Type A". These were typically affluent suburbs on the outskirts of cities. "Type B" neighborhoods, outlined in blue, were considered "Still Desirable", whereas older "Type C" were labeled "Declining" and outlined in yellow. "Type D" neighborhoods were outlined in red and were considered the most risky for mortgage support. These neighborhoods tended to be the older districts in the center of cities; often they were also black neighborhoods.[10]

Some redlined maps were also created by private organizations, such as J.M. Brewer's 1934 map of Philadelphia. Private organizations created maps designed to meet the requirements of the Federal Housing Administration's underwriting manual. The lenders had to consider FHA standards if they wanted to receive FHA insurance for their loans. FHA appraisal manuals instructed banks to steer clear of areas with "inharmonious racial groups", and recommended that municipalities enact racially restrictive zoning ordinances.[13][14]

Following a National Housing Conference in 1973, a group of Chicago community organizations led by The Northwest Community Organization (NCO) formed National People's Action (NPA), to broaden the fight against disinvestment and mortgage redlining in neighborhoods all over the country. This organization, led by Chicago housewife Gale Cincotta and Shel Trapp, a professional community organizer, targeted The Federal Home Loan Bank Board, the governing authority over federally chartered Savings & Loan institutions (S&L) that held at that time the bulk of the country's home mortgages. NPA embarked on an effort to build a national coalition of urban community organizations to pass a national disclosure regulation or law to require banks to reveal their lending patterns.[15]

For many years, urban community organizations had battled neighborhood decay by attacking blockbusting, forcing landlords to maintain properties, and requiring cities to board up and tear down abandoned properties. These actions addressed the short-term issues of neighborhood decline. Neighborhood leaders began to learn that these issues and conditions were symptoms of a disinvestment that was the true, though hidden underlying cause of these problems. They changed their strategy as more data was gathered.[16]

With the help of NPA, a coalition of loosely affiliated community organizations began to form. At the Third Annual Housing Conference held in Chicago in 1974, eight hundred delegates representing 25 states and 35 cities attended. The strategy focused on the Federal Home Loan Bank Board (FHLBB), which oversaw S&L's in cities all over the country.

In 1974, Chicago's Metropolitan Area Housing Association (MAHA), made up of representatives of local organizations, succeeded in having the Illinois State Legislature pass laws mandating disclosure and outlawing redlining. In Massachusetts, organizers allied with NPA confronted a unique situation. Over 90% of home mortgages were held by state-chartered savings banks. A Jamaica Plain neighborhood organization pushed the disinvestment issue into the statewide gubernatorial race. The Jamaica Plain Banking & Mortgage Committee and its citywide affiliate, The Boston Anti-redlining Coalition (BARC), won a commitment from Democratic candidate Michael S. Dukakis to order statewide disclosure through the Massachusetts State Banking Commission. After Dukakis was elected, his new Banking Commissioner ordered banks to disclose mortgage-lending patterns by zip code. The suspected redlining was revealed.[17]

NPA and its affiliates achieved disclosure of lending practices with the passage of The Home Mortgage Disclosure Act of 1975. The required transparency and review of loan practices began to change lending practices. NPA began to work on reinvestment in areas that had been neglected. Their support helped gain passage in 1977 of the Community Reinvestment Act.

Effect

"As a consequence of redlining, neighborhoods that local banks deemed unfit for investment were left underdeveloped or in disrepair. Attempts to improve these neighborhoods with even relatively small-scale business ventures were commonly obstructed by financial institutions that continued to label the underwriting as too risky or simply rejected them outright. When existing businesses collapsed, new ones were not allowed to replace them, often leaving entire blocks empty and crumbling. Consequently African Americans in those neighborhoods were frequently limited in their access to banking, healthcare, retail merchandise, and even groceries." according to blackpast.org contributor Brent Gaspaire.[18] Redlining paralyzed the housing market, lowered property values in certain areas and encouraged landlord abandonment. As abandonment increased, the population density became lower. Abandoned buildings served as havens for drug dealing and other illegal activity, increasing social problems and reluctance of people to invest in these areas.[11]

The film Revolution '67 examines the practice of redlining that occurred in Newark, New Jersey in the 1960s.

Challenges

| African American topics | |||

|---|---|---|---|

|

|||

|

Civic / economic groups |

|||

|

Sports

|

|||

|

Ethnic subdivisions |

|||

|

Diaspora |

|||

| |||

In the United States, the Fair Housing Act of 1968 was passed to fight the practice. According to the Department of Housing and Urban Development "The Fair Housing Act makes it unlawful to discriminate in the terms, conditions, or privileges of sale of a dwelling because of race or national origin. The Act also makes it unlawful for any person or other entity whose business includes residential real estate-related transactions to discriminate against any person in making available such a transaction, or in the terms or conditions of such a transaction, because of race or national origin."[19] The Office of Fair Housing and Equal Opportunity was tasked with administering and enforcing this law. Anyone who suspects that their neighborhood has been redlined is able to file a housing discrimination complaint. The Community Reinvestment Act of 1977 further required banks to apply the same lending criteria in all communities.[20] Although open redlining was made illegal in the 70s through community reinvestment legislation, the practice may have continued in less overt ways.[11] AIDS activists allege redlining of health insurance against the LGBT community in response to the AIDS crisis.[21]

ShoreBank, a community-development bank in Chicago's South Shore neighborhood, was a part of the private-sector fight against redlining.[22] Founded in 1973, ShoreBank sought to combat racist lending practices in Chicago's African-American communities by providing financial services, especially mortgage loans, to local residents.[23] In a 1992 speech, then-Presidential candidate Bill Clinton called ShoreBank "the most important bank in America."[22] On August 20, 2010, the bank was declared insolvent, closed by regulators and most of its assets were acquired by Urban Partnership Bank.

Current issues

Dan Immergluck writes that in 2002 small businesses in black neighborhoods received fewer loans, even after accounting for business density, business size, industrial mix, neighborhood income, and the credit quality of local businesses.[24] Gregory D. Squires wrote in 2003 that data showed that race continues to affect the policies and practices of the insurance industry.[25] Workers living in American inner cities have more difficulty finding jobs than do suburban workers.[26] Redlining has helped preserve segregated living patterns for blacks and whites in the United States, as discrimination is often contingent on the racial composition of neighborhoods and the race of the applicant. Lending institutions such as Wells Fargo have been shown to treat black mortgage applicants differently when they are buying homes in white neighborhoods than when buying homes in black neighborhoods.[8][9][27]

Mortgages

Reverse redlining occurs when a lender or insurer particularly targets minority consumers, not to deny them loans or insurance, but to charge them more than would be charged to a similarly situated white consumer, specifically marketing the most expensive and onerous loan products. These communities had largely been ignored by most lenders just a couple of decades earlier. In the 2000s some financial institutions considered black communities as suitable for subprime mortgages. Wells Fargo partnered with churches in black communities, where the pastor would deliver "wealth building" seminars in their sermons, and the bank would make a donation to the church in return for every new mortgage application. Working-class blacks wanted a part of the nation’s home-owning trend.[8][9]

A survey of two districts of similar incomes, one being largely white and the other largely black, found that bank branches in the black community offered largely subprime loans and almost no prime loans. Studies found out that high-income blacks were almost twice as likely to end up with subprime home-purchase mortgages as did low-income whites. Some loan officers referred to blacks as “mud people” and to subprime lending as “ghetto loans.”[8][9][28] A lower savings rate and a distrust of banks, stemming from a legacy of redlining, may help explain why there are fewer branches in minority neighborhoods. In the early 21st century, brokers and telemarketers actively pushed subprime mortgages. A majority of the loans were refinance transactions, allowing homeowners to take cash out of their appreciating property or pay off credit card and other debt.[29]

Several state attorneys general have begun investigating these practices, which may violate fair lending laws. The NAACP filed a class-action lawsuit charging systematic racial discrimination by more than a dozen banks.

Redlining Property Type. Other forms of redlining include the nullification of mortgage loans based on internal bank policies and procedures that fail to recognize complex property types. Co-Op and condo conversions in New York City are one such example. These building types are often made up of legacy rent-controlled and rent-stabilized units or may contain another protected class of tenant. Lenders who practice redlining often cite "sponsor concentration" or "high rental concentration" as an excuse to redline the property type. Such internal policies run counter to state and municipal laws and statutes.

Retail

Retail redlining is a spatially discriminatory practice among retailers. Taxicab services and delivery food may not serve certain areas, based on their ethnic-minority composition and assumptions about business (and perceived crime), rather than data and economic criteria, such as the potential profitability of operating in those areas. Consequently, consumers in these areas are vulnerable to prices set by fewer retailers. They may be exploited by retailers who charge higher prices and/or offer them inferior goods.[30]

Credit cards

Credit card redlining is a spatially discriminatory practice among credit card issuers, of providing different amounts of credit to different areas, based on their ethnic-minority composition, rather than on economic criteria, such as the potential profitability of operating in those areas.[31] Scholars assess certain policies, such as credit card issuers reducing credit lines of individuals with a record of purchases at retailers frequented by so-called "high-risk" customers, to be akin to redlining.

Insurance

Racial profiling or redlining has a long history in the property-insurance industry in the United States. From a review of industry underwriting and marketing materials, court documents, and research by government agencies, industry and community groups, and academics, it is clear that race has long affected and continues to affect the policies and practices of the insurance industry.[32] Home-insurance agents may try to assess the ethnicity of a potential customer just by telephone, affecting what services they offer to inquiries about purchasing a home-insurance policy. This type of discrimination is called linguistic profiling.[33] There have also been concerns raised about redlining in the automotive insurance industry.[34] Review of insurance scores based on credit are shown to have unequal results by ethnic group. The Ohio Department of Insurance in the early 21st century allows insurance providers to use maps and collection of demographic data by zip code in determining insurance rates. This practice has been criticized as a kind of redlining. Insurance rates should be related to data about claims.

Student loans

In December 2007, a class action lawsuit was brought against student loan lending giant Sallie Mae in the United States District Court for the District of Connecticut. The class alleged that Sallie Mae discriminated against African American and Hispanic private student loan applicants.[35]

The case alleged that the factors Sallie Mae used to underwrite private student loans caused a disparate impact on students attending schools with higher minority populations. The suit also alleged that Sallie Mae failed to properly disclose loan terms to private student loan borrowers.

The lawsuit was settled in 2011. The terms of the settlement included Sallie Mae agreeing to make a $500,000 donation to the United Negro College Fund and the attorneys for the plaintiffs receiving $1.8 million in attorneys' fees.[36](subscription required)

Environmental racism

Policies related to redlining and urban decay can also act as a form of environmental racism, which in turn affect public health. Urban minority communities may face environmental racism in the form of parks that are smaller, less accessible and of poorer quality than those in more affluent or white areas in some cities.[37] This may have an indirect effect on health, since young people have fewer places to play, and adults have fewer opportunities for exercise.[37]

Robert Wallace writes that the pattern of the AIDS outbreak during the '80s was affected by the outcomes of a program of "planned shrinkage" directed at African-American and Hispanic communities. It was implemented through systematic denial of municipal services, particularly fire protection resources, essential to maintain urban levels of population density and ensure community stability.[38] Institutionalized racism affects general health care as well as the quality of AIDS health intervention and services in minority communities. The over-representation of minorities in various disease categories, including AIDS, is partially related to environmental racism. The national response to the AIDS epidemic in minority communities was slow during the '80s and '90s, showing an insensitivity to ethnic diversity in prevention efforts and AIDS health services.[39]

Liquorlining

Some service providers target low-income neighborhoods for nuisance sales. When those services are believed to have adverse effects on a community, they may considered to be a form of "reverse redlining." The term "liquorlining" is sometimes used to describe high densities of liquor stores in low income and/or minority communities relative to surrounding areas. High densities of liquor stores are associated with crime and public health issues, which may in turn drive away supermarkets, grocery stores, and other retail outlets, contributing to low levels of economic development.[40] Controlled for income, nonwhites face higher concentrations of liquor stores than do whites.[41]

See also

- Black flight

- Computer-assisted reporting

- Cream skimming

- Housing segregation

- Inclusionary zoning

- Racial steering

- Sundown town

- Urban renewal

- Timeline of racial tension in Omaha, Nebraska

- White flight

References

Footnotes

- ↑ The HOLC maps are part of the records of the FHLBB (RG195) at the National Archives II.

- ↑ Racial Discrimination and Redlining in Cities

- ↑ See: Race and health

- ↑ In poor health: Supermarket redlining and urban nutrition, Elizabeth Eisenhauer, GeoJournal Volume 53, Number 2 / February, 2001

- ↑ How East New York Became a Ghetto by Walter Thabit. ISBN 0-8147-8267-1. Page 42.

- ↑ Sagawa, Shirley; Segal, Eli (1999). Common Interest, Common Good: Creating Value Through Business and Social Sector Partnerships. Harvard Business Press. p. 30. ISBN 0-87584-848-6. Retrieved 2010-01-04.

- ↑ Dedman, Bill (1988-05-01). "The Color of Money". The Atlanta Journal-Constitution. Retrieved 2009-01-05.

- 1 2 3 4 Ehrenreich, Barbara; Muhammad, Dedrick (September 13, 2009). "The Recession's Racial Divide". The New York Times.

- 1 2 3 4 Powell, Michael (June 7, 2009). "Bank Accused of Pushing Mortgage Deals on Blacks". The New York Times.

- 1 2 3 Jackson, Kenneth T. (1985), Crabgrass Frontier: The Suburbanization of the United States, New York: Oxford University Press, ISBN 0-19-504983-7

- 1 2 3 When Work Disappears: The World of the New Urban Poor By William Julius Wilson. 1996. ISBN 0-679-72417-6

- ↑ Crossney and Bartelt 2005 Urban GeographyCrossney and Bartelt 2006 Housing Policy Debate

- ↑ Principles to Guide Housing Policy at the Beginning of the Millennium, Michael Schill & Susan Wachter, Cityscape

- ↑ "Racial" Provisions of FHA Underwriting Manual, 1938

Recommended restrictions should include provision for the following: Prohibition of the occupancy of properties except by the race for which they are intended ...Schools should be appropriate to the needs of the new community and they should not be attended in large numbers by inharmonious racial groups. Federal Housing Administration, Underwriting Manual: Underwriting and Valuation Procedure Under Title II of the National Housing Act With Revisions to February, 1938 (Washington, D.C.), Part II, Section 9, Rating of Location.

- ↑ Hallahan, Kirk. "THE MORTGAGE REDLINING CONTROVERSY, 1972–1975" (PDF). Qualitative Studies Division, Association in Journalism and Mass Communication, Montreal August 1992. Retrieved 12 November 2012.

- ↑ Michael, Westgate and Ann, Vick-Westgate (2011). Gale Force, The Battles for Disclosure and Community Reinvestment. Cambridge, Ma.: Harvard Bookstore. pp. 40–41. ISBN 978-0615449012.

- ↑ Jordan, Patricia (June 12, 1975). "Mass Thrifts Plan Suit Over Redlining, Commissioner Stands Firm". American Banker.

- ↑ "Redlining (1937- ) | The Black Past: Remembered and Reclaimed". www.blackpast.org. Retrieved 2015-11-04.

- ↑ "HUDNo_15-064". portal.hud.gov. Retrieved 2015-11-04.

- ↑ Comeback Cities: A Blueprint for Urban Neighborhood Revival By Paul S. Grogan, Tony Proscio. ISBN 0-8133-3952-9. Published 2002. Page 114.

The goal was not to relax lending restrictions but rather to get banks to apply the same criteria to residents in the inner-city as in the suburbs.

- ↑ Redlining Gay Neighborhoods, 2002

- 1 2 Douthwaite, Richard. "HOW A BANK CAN TRANSFORM A NEIGHBOURHOOD", "Short Circuit". Retrieved on January 8, 2007

- ↑ Thomsen, Mark. "ShoreBank Surpasses $1 Billion in Community Development Investment", "Social Funds", 2001-11-1. Retrieved on January 8, 2007.

- ↑ "Redlining Redux", Urban Affairs Review, Vol. 38, No. 1, 22–41 (2002)

- ↑ "Racial Profiling, Insurance Style: Insurance Redlining and the Uneven Development of Metropolitan Areas", Journal of Urban Affairs 25 (4), 391–410.

- ↑ Racial Discrimination and Redlining in Cities, Yves Zenou and Nicolas Boccard 1999

- ↑ Stephen R Holloway (1998), "Exploring the Neighborhood Contingency of Race Discrimination in Mortgage Lending in Columbus, Ohio", Annals of the Association of American Geographers, 88 (2), 252–276.

- ↑ Mantell, Ruth (July 6, 2007). "Minority families face wave of foreclosures: Consumer groups urge more 'teeth' in laws combating predators". Retrieved December 22, 2009.

- ↑ Bajaj, Vikas; Fessenden, Ford (November 4, 2007). "What's Behind the Race Gap?". The New York Times.

- ↑ Denver D’Rozario, "Retail Redlining: Definition, Theory, Typology, and Measurement", Journal of Macromarketing, Vol. 25, No. 2, 175–186 (2005)

- ↑ Cohen-Cole, Ethan, "Credit Card Redlining" (2008). FRB of Boston Quantitative Analysis Unit Working Paper No. QAU08-1 Available at SSRN: http://ssrn.com/abstract=1098403 http://www.bos.frb.org/bankinfo/qau/wp/2008/qau0801.htm

- ↑ Gregory D. Squires (2003) "Racial Profiling, Insurance Style: Insurance Redlining and the Uneven Development of Metropolitan Areas", Journal of Urban Affairs Volume 25 Issue 4 Page 391-410, November 2003

- ↑ Gregory D. Squires, "Linguistic Profiling: A Continuing Tradition of Discrimination in the Home Insurance Industry?", Urban Affairs Review, Vol. 41, No. 3, 400–415 (2006)

- ↑ Karen Bouffard, "Michigan to crack down on uninsured drivers", The Detroit News

- ↑

- ↑ "SDSD District Version 1.3". United States District Court for the District of Connecticut. Retrieved July 25, 2014.

- 1 2 Minority Communities Need More Parks, Report Says by Angela Rowen The Berkeley Daily Planet

- ↑ Wallace, R. "Urban desertification, public health and public order: 'planned shrinkage', violent death, substance abuse and AIDS in the Bronx." Soc Sci Med, 1990 – ncbi.nlm.nih.gov

- ↑ "AIDS and racism in America." Hutchinson J., Journal of the National Medical Association, 1992 Feb;

- ↑ Maxwell, Ann; Daniel, Immergluck (January 1997). "Liquorlining: Liquor Store Concentration and Community Development in Lower-income Cook County Neighborhoods" (PDF). Woodstock Institute. Retrieved 14 March 2015.

- ↑ Romley, John A.; Cohen, Deborah; et al. (January 2007). Schuckit, Mark A., ed. "Alcohol and Environmental Justice:The Density of Liquor Stores and Bars in Urban Neighborhoods in the United States" (PDF). Journal of Studies on Alcohol and Drugs. Alcohol Research Documentation. 68 (1): 48–55. Retrieved 14 March 2015 – via RAND Corporation.

Notations

- Frederick Babcock "Neighborhood Life Cycle" theory

Further reading

Greenwald, Carol S., Banks are Dangerous to your Wealth, Prentice-Hall 1980.

Hallahan, Kirk. "The Mortgage Redlining Controversy 1972–1975" http://lamar.colostate.edu/~pr/redlining.pdf

Westgate, Michael and Ann Vick., Gale Force, The Battles For Disclosure and Community Reinvestment, Harvard Book Store, 2nd edition, 2011. ISBN 978-0-615-44901-2

External links

- Mapping Inequality: Redlining in New Deal America

- File a housing discrimination complaint

- Learn more about housing discrimination

- HOLC Maps for several U.S. cities

- Redlining in Philadelphia. Amy Hillier, PhD

- Redlining, and Neighborhood Appraisals in Philadelphia

- "The Color of Money": Bill Dedman received the Pulitzer Prize for Investigative Reporting in 1989 for this series of articles, which described racial discrimination in mortgage lending in the Atlanta area.

- Crossney and Bartelt 2005. Residential Security, Risk, and Race: The Home Owners' Loan Corporation and Mortgage Access in Two Cities. Urban Geography

- Roundtable on Redlining in Minneapolis

.svg.png)