Petrodollar recycling

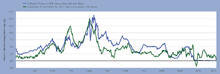

Petrodollar recycling is the international deployment of a country's revenue from petroleum exports. It generally refers to the phenomenon of major petroleum-exporting nations, mainly the OPEC members and Russia, earning more money from the export of crude oil than they could feasibly invest in their own economies. The resulting global interdependencies and financial flows, from oil producers back to oil consumers, can reach a scale of hundreds of billions of US dollars per year across a variety of currencies, heavily influenced by government-level decisions regarding international investment and aid. The phenomenon is most pronounced during periods when the price of oil is historically high.[3] The first major petrodollar wave (1974–1981) resulted in more financial complications than the second (2005–2014).

Capital flows

Background

Especially during the years 1974–1981 and 2005–2014, oil exporters amassed large surpluses of "petrodollars" from historically expensive oil.[1][2][4] (The word has been credited alternately to Egyptian-American economist Ibrahim Oweiss and to former US Secretary of Commerce Peter G. Peterson, both in 1973.)[5][6] These petrodollar surpluses could be defined as net US dollar-equivalents earned from the export of petroleum, in excess of the internal development needs of the exporting nations.[7] The surpluses could not be efficiently invested in their own economies, due to small populations or being at early stages of industrialization; but the surpluses could be usefully invested in other nations, or spent on imports such as construction supplies, defense systems, and consumer products. Alternatively, global economic growth would have suffered if that money was withdrawn from the world economy, while the oil-exporting nations needed to be able to invest profitably to raise their long-term standard of living.[8]

1974–1981 period

While petrodollar recycling reduced the short-term recessionary impact of the 1973 oil crisis, it caused problems especially for oil-importing countries that were paying much higher prices for oil, and incurring long-term debts. The International Monetary Fund (IMF) estimated that the foreign debts of 100 developing countries increased by 150% between 1973 and 1977, complicated further by a worldwide shift to floating exchange rates. Johan Witteveen, the Managing Director of the IMF, said in 1974: "The international monetary system is facing its most difficult period since the 1930s."[9] The IMF administered a new lending program during 1974–1976 called the Oil Facility. Funded by oil-exporting nations and other lenders, it was available to nations suffering from acute problems with their balance of trade due to the rise in oil prices.[10]

From 1974 through 1981, the total current account surplus for all members of OPEC amounted to US$450 billion, without scaling-up for the subsequent decades of inflation. Ninety percent of this surplus was accumulated by the Arab countries of the Persian Gulf and Libya, with Iran also accumulating significant oil surpluses prior to the Iranian Revolution in 1979.[7]

Large volumes of Arab petrodollars were invested directly in US Treasury securities and in other financial markets of the major industrial economies, often directed discreetly by government entities now known as sovereign wealth funds.[11][12] Many billions of petrodollars were also invested through the major commercial banks of the US and Europe. In fact, the process contributed to the growth of the Eurodollar market as a less-regulated rival to US monetary markets. As the recessionary condition of the world economy made investment in corporations less attractive, bankers lent the money directly to the governments of developing countries, especially in Latin America such as Brazil and Argentina[7] as well as other major developing nations like Turkey. The 1973 oil crisis had created a vast dollar shortage in these countries; however, they still needed to finance their imports of oil and machinery. In early 1977, when Turkey stopped heating its prime minister's office, opposition leader Suleyman Demirel famously described the shortage as: "Turkey is in need of 70 cents."[13] As political journalist William Greider summarized the situation: "Banks collected the deposits of revenue-rich OPEC governments and lent the money to developing nations so they could avoid bankruptcy."[14] In subsequent decades, many of these developing nations found their accumulated debts to be unpayably large, concluding that it was a form of neocolonialism from which debt relief was the only escape.[15]

2005–2014 period

In the 2005–2014 petrodollar wave, financial decision-makers were able to benefit somewhat from the lessons and experiences of the previous cycle. Developing economies generally stayed better balanced than they did in the 1970s, and global inflation and interest rates were much better contained. Oil exporters opted to make most of their investments directly into diverse global markets, and the recycling process was less dependent on Western intermediaries such as international banks and the IMF.[17][18] Thanks to the historic oil price increases of 2003–2008, OPEC revenues approached an unprecedented US$1 trillion per year in 2008 and 2011–2013.[2] Norway and Russia also experienced substantial surpluses,[4] and sovereign wealth funds worldwide amassed US$7 trillion by 2014–2015.[19] Most of the large exporters had accumulated enough financial reserves to cushion the shock when oil prices fell sharply again from a supply glut in 2014–2016.[20]

Foreign aid

As an example of "checkbook diplomacy", oil-exporting countries have used part of their petrodollar surpluses to fund foreign aid programs, with certain Arab nations becoming some of the largest donors in the years after 1973,[7][21] including through the IMF and the OPEC Fund for International Development. Oil exporters have also aided poorer nations indirectly through the personal remittances sent home by tens of millions of foreign workers in the Middle East.[22] Likewise, high-priced oil allowed the USSR to subsidize the struggling economies of the Soviet bloc for a time, and the loss of petrodollar income during the 1980s oil glut contributed to the bloc's collapse in 1989.[23] During the 2005–2014 petrodollar wave, OPEC member Venezuela played a similar role for Cuba and other regional allies.[24]

Gallery of notable examples

These images illustrate the diversity of major petrodollar recycling activities, in roughly chronological order:

London's Chelsea Football Club, Russian-owned since 2003 through the Sibneft oil fortune[28][29][30]

London's Chelsea Football Club, Russian-owned since 2003 through the Sibneft oil fortune[28][29][30] "Oil for doctors" program, with thousands of Cuban physicians anchoring the Venezuelan health system from 2004[31]

"Oil for doctors" program, with thousands of Cuban physicians anchoring the Venezuelan health system from 2004[31]

UAE construction boom during 2003–2014, primarily built by imported foreign workers and contractors[34]

UAE construction boom during 2003–2014, primarily built by imported foreign workers and contractors[34]

See also

References

- 1 2 "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. January 10, 2006. Archived from the original on January 7, 2008.

- 1 2 3 "OPEC Revenues Fact Sheet". U.S. Energy Information Administration. June 14, 2016. Retrieved August 25, 2016.

- ↑ Nsouli, Saleh M. (March 23, 2006). "Petrodollar Recycling and Global Imbalances". International Monetary Fund. Retrieved December 22, 2008.

- 1 2 "Petrodollar Profusion". The Economist. April 28, 2012. Retrieved February 7, 2016.

- ↑ "Personality: Ibrahim M. Oweiss". Washington Report on Middle East Affairs. December 26, 1983. p. 8. Retrieved February 5, 2016.

In March 1973 [actually March 1974] ... Two weeks after Dr. Oweiss had used the word – at an international monetary seminar held at Columbia University's Arden House in Harriman, New York – it was picked up by a prestigious economics commentator in The New York Times.

- ↑ Rowen, Hobart (July 9, 1973). "Peterson Urges Cooperation". Washington Post. p. A1. Retrieved February 5, 2016.

He thinks the U.S. should give more study to ways in which the excess funds – he calls them petro dollars – can be soaked up.

- 1 2 3 4 Oweiss, Ibrahim M. (1990). "Economics of Petrodollars". In Esfandiari, Haleh; Udovitch, A.L. The Economic Dimensions of Middle Eastern History. Darwin Press. pp. 179–199. Retrieved January 31, 2016.

- ↑ "Petrodollar Problem". International Monetary Fund. Retrieved January 31, 2016.

- ↑ "Recycling Petrodollars". International Monetary Fund. Retrieved January 31, 2016.

- ↑ Neu, Carl Richard (August 1977). "International Balance of Payments Financing and the Budget Process". U.S. Congressional Budget Office. pp. 27–29. Retrieved February 5, 2016.

- ↑ Spiro, David E. (1999). The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets. Ithaca: Cornell University Press. pp. 74–75. ISBN 0-8014-2884-X. Retrieved February 8, 2016.

- ↑ Wong, Andrea (May 30, 2016). "The Untold Story Behind Saudi Arabia's 41-Year U.S. Debt Secret". Bloomberg News. Retrieved May 31, 2016.

- ↑ Özel, Işık (2014). State–Business Alliances and Economic Development: Turkey, Mexico and North Africa. Routledge. p. 34. ISBN 978-1-317-81782-6. Retrieved January 31, 2016.

- ↑ Greider, William (1987). Secrets of the Temple. Simon & Schuster. p. 340. ISBN 978-0-671-47989-3. Retrieved January 31, 2016.

- ↑ Carrasco, Enrique; McClellan, Charles; Ro, Jane (April 2007). "Foreign Debt: Forgiveness and Repudiation". The E-Book on International Finance & Development. University of Iowa. Retrieved June 6, 2011.

- ↑ "Federal Reserve Economic Data graph". Federal Reserve Bank of St. Louis. Retrieved August 25, 2016.

- ↑ Lubin, David (March 19, 2007). "Petrodollars, emerging markets and vulnerability" (PDF). Citigroup. Retrieved January 31, 2016.

- ↑ "Recycling the Petrodollars". The Economist. November 10, 2005. Retrieved February 14, 2016.

- ↑ Bianchi, Stefania (February 22, 2016). "Sovereign Wealth Funds May Sell $404 Billion of Equities". Bloomberg News. Retrieved February 22, 2016.

- ↑ Blas, Javier (April 13, 2015). "Oil-Rich Nations Are Selling Off Their Petrodollar Assets at Record Pace". Bloomberg News. Retrieved February 14, 2016.

- ↑ Hubbard, Ben (June 21, 2015). "Cables Released by WikiLeaks Reveal Saudis' Checkbook Diplomacy". The New York Times. Retrieved February 16, 2016.

- ↑ Mukherjee, Andy (February 4, 2016). "Oil's Plunge Spills Over". Bloomberg News. Retrieved February 4, 2016.

- ↑ McMaken, Ryan (November 7, 2014). "The Economics Behind the Fall of the Berlin Wall". Mises Institute. Retrieved January 12, 2016.

High oil prices in the 1970s propped up the regime so well, that had it not been for Soviet oil sales, it's quite possible the regime would have collapsed a decade earlier.

- ↑ Gibbs, Stephen (August 24, 2005). "Venezuela ends upbeat Cuba visit". BBC. Retrieved November 28, 2016.

- ↑ Deffner, Hans H. (c. 1991). An F-15 Eagle aircraft of the Royal Saudi Air Force takes off during Operation Desert Shield. U.S. Department of Defense. Retrieved October 25, 2009.

- ↑ Mohr, Charles (August 22, 1981). "Saudi AWACS Deal Passes $8 Billion". The New York Times. Retrieved November 5, 2016.

- ↑ "Mohammed Fayed sells Harrods store to Qatar Holdings". BBC. May 8, 2010. Retrieved February 7, 2016.

- ↑ "Russian businessman buys Chelsea". BBC. July 2, 2003. Retrieved March 23, 2016.

- ↑ Critchley, Mark (April 12, 2015). "Roman Abramovich reaches 700 games as Chelsea owner – but how does his reign stack up against the rest?". The Independent. Retrieved August 1, 2016.

Since the Russian oligarch began pouring petro-dollars into Stamford Bridge, he has turned one of English football's underachieving clubs into an established powerhouse.

- ↑ Delaney, Miguel (February 2, 2014). "The colossal wealth of Manchester City and Chelsea is changing the landscape of British football". The Sunday Mirror. Retrieved August 1, 2016.

It should not escape notice that this is the first true title showdown, and first genuine title race, between the petrodollar clubs.

- ↑ Corrales, Javier (December 2005). "The Logic of Extremism: How Chávez Gains by Giving Cuba So Much" (PDF). Inter-American Dialogue. Retrieved November 29, 2016.

- ↑ Bagli, Charles V. (July 10, 2008). "Abu Dhabi Buys 90% Stake in Chrysler Building". The New York Times. Retrieved July 3, 2016.

- ↑ Peers, Alexandra (February 2012). "Qatar Purchases Cézanne's The Card Players for More Than $250 Million, Highest Price Ever for a Work of Art". Vanity Fair. Retrieved February 19, 2016.

- ↑ Davis, Mike (September–October 2006). "Fear and Money in Dubai". New Left Review (41). Retrieved February 12, 2016.

Further reading

- Clark, William R. (2005). Petrodollar Warfare. New Society Publishers. ISBN 978-0-86571-514-1.

- Smolyar, Leonid (2006). Petrodollars: Tracking the Flow and Investment of Oil Windfalls (PDF) (B.Sc. thesis). New York University. Archived from the original on April 25, 2012.

- Staats, Elmer B. (1979). "The U.S.–Saudi Arabian Joint Commission on Economic Cooperation". U.S. Government Accountability Office. Retrieved January 31, 2016.