Monetarism

| Economics |

|---|

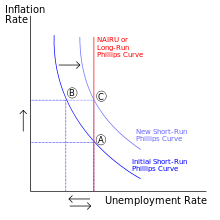

Phillips curve graph, illustrating an economic principle |

|

|

| By application |

|

| Lists |

|

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy.[1]

Monetarism today is mainly associated with the work of Milton Friedman, who was among the generation of economists to accept Keynesian economics and then criticise Keynes's theory of gluts using fiscal policy (government spending). Friedman and Anna Schwartz wrote an influential book, A Monetary History of the United States, 1867–1960, and argued "inflation is always and everywhere a monetary phenomenon." Though he opposed the existence of the Federal Reserve,[2] Friedman advocated, given its existence, a central bank policy aimed at keeping the supply and demand for money at equilibrium, as measured by growth in productivity and demand.

Description

Monetarism is an economic theory that focuses on the macroeconomic effects of the supply of money and central banking. Formulated by Milton Friedman, it argues that excessive expansion of the money supply is inherently inflationary, and that monetary authorities should focus solely on maintaining price stability.

This theory draws its roots from two historically antagonistic schools of thought: the hard money policies that dominated monetary thinking in the late 19th century, and the monetary theories of John Maynard Keynes, who, working in the inter-war period during the failure of the restored gold standard, proposed a demand-driven model for money. While Keynes had focused on the value stability of currency, with the resulting panics based on an insufficient money supply leading to alternate currency and collapse, then Friedman focused on price stability, which is the equilibrium between supply and demand for money.

The result was summarised in a historical analysis of monetary policy, Monetary History of the United States 1867–1960, which Friedman coauthored with Anna Schwartz. The book attributed inflation to excess money supply generated by a central bank. It attributed deflationary spirals to the reverse effect of a failure of a central bank to support the money supply during a liquidity crunch.

Friedman originally proposed a fixed monetary rule, called Friedman's k-percent rule, where the money supply would be automatically increased by a fixed percentage per year. Under this rule, there would be no leeway for the central reserve bank, as money supply increases could be determined "by a computer", and business could anticipate all money supply changes.[3][4] With other monetarists he believed that the active manipulation of the money supply or its growth rate is more likely to destabilise than stabilise the economy.

Opposition to the gold standard

Most monetarists oppose the gold standard. Friedman, for example, viewed a pure gold standard as impractical.[5] For example, whereas one of the benefits of the gold standard is that the intrinsic limitations to the growth of the money supply by the use of gold would prevent inflation, if the growth of population or increase in trade outpaces the money supply, there would be no way to counteract deflation and reduced liquidity (and any attendant recession) except for the mining of more gold.

Rise

Clark Warburton is credited with making the first solid empirical case for the monetarist interpretation of business fluctuations in a series of papers from 1945.[1]p. 493 Within mainstream economics, the rise of monetarism accelerated from Milton Friedman's 1956 restatement of the quantity theory of money. Friedman argued that the demand for money could be described as depending on a small number of economic variables.[6]

Thus, where the money supply expanded, people would not simply wish to hold the extra money in idle money balances; i.e., if they were in equilibrium before the increase, they were already holding money balances to suit their requirements, and thus after the increase they would have money balances surplus to their requirements. These excess money balances would therefore be spent and hence aggregate demand would rise. Similarly, if the money supply were reduced people would want to replenish their holdings of money by reducing their spending. In this, Friedman challenged a simplification attributed to Keynes suggesting that "money does not matter."[6] Thus the word 'monetarist' was coined.

The rise of the popularity of monetarism also picked up in political circles when Keynesian economics seemed unable to explain or cure the seemingly contradictory problems of rising unemployment and inflation in response to the collapse of the Bretton Woods system in 1972 and the oil shocks of 1973. On the one hand, higher unemployment seemed to call for Keynesian reflation, but on the other hand rising inflation seemed to call for Keynesian disinflation.

In 1979, President Jimmy Carter appointed a Federal Reserve chief Paul Volcker, who made inflation fighting his primary objective, and restricted the money supply (in accordance with the Friedman rule) to tame inflation in the economy. The result was a rise in the interest rates, not only in the United States but worldwide. In the summer of 1982, the Mexican debt crisis entailed the end of the 'Volcker shock' that began in August 1979. Because of the failure of the Volcker shock in 1982, monetarist economists never recognized that the policy implemented by the Federal Reserve from 1979 was a monetarist policy. Nevertheless, the influence of monetarism on the Federal Reserve was twofold: a direct influence, by the adhesion of some members of the Federal Open Market Committee to monetarist ideas; and an indirect influence, because monetarist views were permanently taken into account in the determination of US monetary policy: even the members of the FOMC who were not monetarists took monetarist influence into strong consideration.[7]

Monetarists not only sought to explain present problems; they also interpreted historical ones. Milton Friedman and Anna Schwartz in their book A Monetary History of the United States, 1867–1960 argued that the Great Depression of 1930 was caused by a massive contraction of the money supply and not by the lack of investment Keynes had argued. They also maintained that post-war inflation was caused by an over-expansion of the money supply.

They made famous the assertion of monetarism that 'inflation is always and everywhere a monetary phenomenon'. Many Keynesian economists initially believed that the Keynesian vs. monetarist debate was solely about whether fiscal or monetary policy was the more effective tool of demand management. By the mid-1970s, however, the debate had moved on to other issues as monetarists began presenting a fundamental challenge to Keynesianism.

Many monetarists sought to resurrect the pre-Keynesian view that market economies are inherently stable in the absence of major unexpected fluctuations in the money supply. Because of this belief in the stability of free-market economies they asserted that active demand management (e.g. by the means of increasing government spending) is unnecessary and indeed likely to be harmful. The basis of this argument is an equilibrium between "stimulus" fiscal spending and future interest rates. In effect, Friedman's model argues that current fiscal spending creates as much of a drag on the economy by increased interest rates as it creates present consumption: that it has no real effect on total demand, merely that of shifting demand from the investment sector (I) to the consumer sector (C).

When Margaret Thatcher, leader of the Conservative Party in the United Kingdom, won the 1979 general election defeating the incumbent Labour Party led by James Callaghan, Britain had endured several years of severe inflation, which was rarely below 10% and by the time of the election in May 1979 stood at 5.4%.[8] Thatcher implemented monetarism as the weapon in her battle against inflation, and succeeded at reducing it to 4.6% by 1983.

James Callaghan himself had adopted policies echoing monetarism while serving as prime minister from 1976 to 1979, adopting deflationary policies and reducing public spending in response to high inflation and national debt. He initially had some success, as inflation was below 10% by the summer of 1978, although unemployment now stood at 1,500,000. However, by the time of his election defeat barely a year later, inflation had fallen to 5.4%.[9]

Current state

Since 1990, the classical form of monetarism has been questioned. This is because of events that many economists interpreted as being inexplicable in monetarist terms: the disconnection of the money supply growth from inflation in the 1990s and the failure of pure monetary policy to stimulate the economy in the 2001–2003 period. Greenspan argued that the 1990s decoupling was explained by a virtuous cycle of productivity and investment on one hand, and a certain degree of "irrational exuberance" in the investment sector on the other.

There are also arguments linking monetarism and macroeconomics, treating monetarism as a special case of Keynesian theory. The central test case over the validity of these theories would be the possibility of a liquidity trap, like that experienced by Japan. Ben Bernanke, Princeton professor and another former chairman of the U.S. Federal Reserve, argued that monetary policy could respond to zero interest rate conditions by direct expansion of the money supply. In his words, "We have the keys to the printing press, and we are not afraid to use them." Progressive economist Paul Krugman has advanced the counterargument that this would have a corresponding devaluationary effect, like the sustained low interest rates of 2001–2004 produced against world currencies.

These disagreements—along with the role of monetary policies in trade liberalisation, international investment and central bank policy—remain lively topics of investigation and argument.

Notable proponents

See also

- Austrian School of economics

- Chicago school of economics

- Demurrage (currency)

- Fiscalism (usually contrasted to monetarism)

- Inflation targeting

- Monetarists

- Market monetarism

- Modern Monetary Theory

General:

References

- 1 2 Phillip Cagan, 1987. "Monetarism", The New Palgrave: A Dictionary of Economics, v. 3, Reprinted in John Eatwell et al. (1989), Money: The New Palgrave, pp. 195–205 & 492–497

- ↑ Doherty, Brian (June 1995). "Best of Both Worlds". Reason. Retrieved July 28, 2010.

- ↑ Thomas Palley (November 27, 2006). "Milton Friedman: The Great Conservative Partisan". Retrieved June 20, 2013.

- ↑ Ip, Greg; Whitehouse, Mark (2006-11-17). "How Milton Friedman Changed Economics, Policy and Markets". The Wall Street Journal.

- ↑ Monetary Central Planning and the State, Part 27: Milton Friedman's Second Thoughts on the Costs of Paper Money Archived June 20, 2015, at the Wayback Machine.

- 1 2 Friedman, Milton (1970). "A Theoretical Framework for Monetary Analysis". Journal of Political Economy. 78 (2): 193–238 [p. 210]. doi:10.1086/259623. JSTOR 1830684.

- ↑ Reichart Alexandre & Abdelkader Slifi (2016). 'The Influence of Monetarism on Federal Reserve Policy during the 1980s.' Cahiers d'économie Politique/Papers in Political Economy, (1), pp. 107-150. https://www.cairn.info/revue-cahiers-d-economie-politique-2016-1-page-107.htm

- ↑ "Economy tables: GDP, interest rates and inflation history, unemployment". This Is Money. Retrieved June 20, 2013.

- ↑ "History – James Callaghan (1912–2005)". BBC. Retrieved June 20, 2013.

Further references

- Andersen, Leonall C., and Jerry L. Jordan, 1968. "Monetary and Fiscal Actions: A Test of Their Relative Importance in Economic Stabilisation", Federal Reserve Bank of St. Louis Review (November), pp. 11–24. PDF (30 sec. load: press +) and HTML.

- _____, 1969. "Monetary and Fiscal Actions: A Test of Their Relative Importance in Economic Stabilisation — Reply", Federal Reserve Bank of St. Louis Review (April), pp. 12–16. PDF (15 sec. load; press +) and HTML.

- Brunner, Karl, and Allan H. Meltzer, 1993. Money and the Economy: Issues in Monetary Analysis, Cambridge. Description and chapter previews, pp. ix–x.

- Cagan, Phillip, 1965. Determinants and Effects of Changes in the Stock of Money, 1875–1960. NBER. Foreword by Milton Friedman, pp. xiii–xxviii. Table of Contents.

- Friedman, Milton, ed. 1956. Studies in the Quantity Theory of Money, Chicago. Chapter 1 is previewed at Friedman, 2005, ch. 2 link.

- _____, 1960. A Program for Monetary Stability. Fordham University Press.

- _____, 1968. "The Role of Monetary Policy", American Economic Review, 58(1), pp. 1–17 (press +).

- _____, [1969] 2005. The Optimum Quantity of Money. Description and table of contents, with previews of 3 chapters.

- Friedman, Milton, and David Meiselman, 1963. "The Relative Stability of Monetary Velocity and the Investment Multiplier in the United States, 1897–1958", in Stabilization Policies, pp. 165–268. Prentice-Hall/Commission on Money and Credit, 1963.

- Friedman, Milton, and Anna Jacobson Schwartz, 1963a. "Money and Business Cycles", Review of Economics and Statistics, 45(1), Part 2, Supplement, p. p. 32–64. Reprinted in Schwartz, 1987, Money in Historical Perspective, ch. 2.

- _____. 1963b. A Monetary History of the United States, 1867–1960. Princeton. Page-searchable links to chapters on 1929-41 and 1948–60

- Johnson, Harry G., 1971. "The Keynesian Revolutions and the Monetarist Counter-Revolution", American Economic Review, 61(2), p. p. 1–14. Reprinted in John Cunningham Wood and Ronald N. Woods, ed., 1990, Milton Friedman: Critical Assessments, v. 2, p. p. 72 – 88. Routledge,

- Laidler, David E.W., 1993. The Demand for Money: Theories, Evidence, and Problems, 4th ed. Description.

- Schwartz, Anna J., 1987. Money in Historical Perspective, University of Chicago Press. Description and Chapter-preview links, pp. vii-viii.

- Warburton, Clark, 1966. Depression, Inflation, and Monetary Policy; Selected Papers, 1945–1953 Johns Hopkins Press. Amazon Summary in Anna J. Schwartz, Money in Historical Perspective, 1987.

External links

- "Monetarism" at The New School's Economics Department's History of Economic Thought website.

- McCallum, Bennett T. (2008). "Monetarism". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Monetarism from the Economics A–Z of The Economist