Market structure

| Economics |

|---|

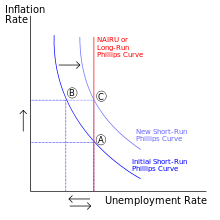

Phillips curve graph, illustrating an economic principle |

|

|

| By application |

|

| Lists |

|

In economics, market structure is best defined as the organisational and other characteristics of a market.

Types of market structures

1. Monopolistic competition, a type of imperfect competition such that many producers sell products or services that are differentiated from one another (e.g. by branding or quality) and hence are not perfect substitutes. In monopolistic competition, a firm takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other. This market structure exists when there are multiple sellers who are attempting to seem different than each other.

2. Oligopoly, in which a market is run by a small number of firms that together control the majority of the market share.

- Duopoly, a special case of an oligopoly with two firms.

- Monopsony, when there is only a single buyer in a market.

- Oligopsony, a market where many sellers can be present but meet only a few buyers.

3. Monopoly, where there is only one provider of a product or service.

- Natural monopoly, a monopoly in which economies of scale cause efficiency to increase continuously with the size of the firm. A firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialized firms.

4. Perfect competition, a theoretical market structure that features low barriers to entry, identical products with no differentiation, an unlimited number of producers and consumers, and a perfectly elastic demand curve. [1]

Elements and concerns

The imperfectly competitive structure is quite identical to the realistic market conditions where some monopolistic competitors, monopolists, oligopolists, and duopolists exist and dominate the market conditions. The elements of Market Structure include the number and size distribution of firms, entry conditions, and the extent of differentiation.

These somewhat abstract concerns tend to determine some but not all details of a specific concrete market system where buyers and sellers actually meet and commit to trade. Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the seller’s financial need to cover its costs. In other words, competition can align the seller’s interests with the buyer’s interests and can cause the seller to reveal his true costs and other private information. In the absence of perfect competition, three basic approaches can be adopted to deal with problems related to the control of market power and an asymmetry between the government and the operator with respect to objectives and information: (a) subjecting the operator to competitive pressures, (b) gathering information on the operator and the market, and (c) applying incentive regulation.[2]

| Market Structure | Seller Entry Barriers | Seller Number | Buyer Entry Barriers | Buyer Number |

|---|---|---|---|---|

| Perfect Competition | No | Many | No | Many |

| Monopolistic competition | No | Many | No | Many |

| Oligopoly | Yes | Few | No | Many |

| Oligopsony | No | Many | Yes | Few |

| Monopoly | Yes | One | No | Many |

The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly, and pure monopoly.

The main criteria by which one can distinguish between different market structures are: the number and size of producers and consumers in the market, the type of goods and services being traded, and the degree to which information can flow freely.

See also

- Economics

- Microeconomics

- Macroeconomics

- Industrial organization

- Herfindahl index

- Structure-conduct-performance paradigm

References

- ↑ "AP Economics Review: 4 Market Structures". ReviewEcon.com. 2016-09-10.

- ↑ Body of Knowledge on Infrastructure Regulation “Market Structure: Introduction.”

External links

| Library resources about Market structure |

- Microeconomics by Elmer G. Wiens: Online Interactive Models of Oligopoly, Differentiated Oligopoly, and Monopolistic Competition