Great Recession in the United States

| Great Recession |

|---|

Following the bursting of the housing bubble in mid-2007, and the housing market correction and subprime mortgage crisis the following year, the United States entered a severe recession.

The National Bureau of Economic Research (NBER) dates the beginning of the recession as December 2007. According to the Department of Labor, roughly 8.7 million jobs were shed from February 2008 to February 2010, and GDP contracted by 5.1%, making the Great Recession the worst since the Great Depression. Unemployment rose from 4.7% in November 2007 to peak at 10% in October 2009.[1]

The bottom, or trough, was reached in the second quarter of 2009 (marking the technical end of the recession, defined as at least two consecutive quarters of declining GDP).[2] The NBER, dating by month, points to June 2009 as the final month of the recession.

The recovery after the 2009 trough was weak and both GDP and job growth erratic and uneven. A solid, strong pace of job growth was not seen until 2011.[3] By August 2015, the unemployment rate was 5.1%,[4] below the historical average of 5.6% but still barely above the 5% when the recession started in December 2007, with roughly 12,639,000 jobs added since the Great Recession's payroll trough in February 2010.[5] American household net worth fell from a pre-recession peak of $68 trillion in Q3 2007 to $55 trillion by Q1 2009,[6] while real median household income fell from $56,436 in 2007 to $51,758 by 2012.[7] The poverty rate increased from 2006 to 2010, reaching a peak of 15%, and held there through 2012 before dropping to 14.5% in 2013.[8]

Background

After the Great Depression of the 1930s, the American economy experienced robust growth, with periodic lesser recessions, for the rest of the 20th century. The federal government enforced the Securities Exchange Act (1934)[9] and The Chandler Act (1938),[10] which tightly regulated the financial markets. The Securities Exchange Act of 1934 regulated the trading of the secondary securities market and The Chandler Act regulated the transactions in the banking sector.

There were a few investment banks, small by current standards, that expanded during the late 1970s, such as JP Morgan. The Reagan Administration in the early 1980s began a thirty-year period of financial deregulation.[11] The financial sector sharply expanded, in part because investment banks were going public, bringing them vast sums of stockholder capital. From 1978 to 2008, the average salary for workers outside of investment banking in the U.S. increased from $40k to $50k[11] – a 25 percent salary increase - while the average salary in investment banking increased from $40k to $100k – a 150 percent salary increase. Deregulation also precipitated financial fraud - often tied to real estate investments - sometimes on a grand scale, such as the savings and loan crisis. By the end of the 1980s, many workers in the financial sector were being jailed for fraud, but many Americans were losing their life savings. Large investment banks began merging and developing Financial conglomerates; this led to the formation of the giant investment banks like Goldman Sachs.

Early suggestions of recession

In the early months of 2008, many observers believed that a U.S. recession had begun.[12][13][14] The collapse of Bear Stearns and the resulting financial market turbulence signaled that the crisis would not be mild and brief.

Alan Greenspan, ex-Chairman of the Federal Reserve, stated in March 2008 that the 2008 financial crisis in the United States "is likely to be judged in retrospect as the most wrenching since the end of World War II".[15] A chief economist at Standard & Poor's said in March 2008 he had projected a worst-case-scenario in which the country would endure a double-dip recession, in which the economy would briefly recover in the summer 2008, before plunging again. Under this scenario, the economy's total output, as measured by the gross domestic product (GDP), would drop by 2.2 percentage points, making it among the worst recessions in the post World War II period.

The former head of the National Bureau of Economic Research said in March 2008 that he believed the country was then in a recession, and it could be a severe one. A number of private economists generally predicted a mild recession ending in the summer of 2008 when the economic stimulus checks going to 130 million households started being spent. A chief economist at Moody's predicted in March 2008 that policymakers would act in a concerted and aggressive way to stabilize the financial markets, and that the economy would suffer, but not enter a prolonged and severe recession. It takes many months before the National Bureau of Economic Research, the unofficial arbiter of when recessions begin and end, would make its own ruling.[16]

According to numbers published by the Bureau of Economic Analysis in May 2008, the GDP growth of the previous two quarters was positive. As one common definition of a recession is negative economic growth for at least two consecutive fiscal quarters, some analysts suggested this indicates that the U.S. economy was not in a recession at the time.[17] However, this estimate has been disputed by analysts who argue that if inflation is taken into account, the GDP growth was negative for those two quarters, making it a technical recession.[18] In a May 9, 2008 report, the chief North American economist for investment bank Merrill Lynch wrote that despite the GDP growth reported for the first quarter of 2008, "it is still reasonable to believe that the recession started some time between September and January", on the grounds that the National Bureau of Economic Research's four recession indicators all peaked during that period.[19]

New York's budget director concluded the state of New York was officially in a recession by the summer of 2008. Governor David Paterson called an emergency economic session of the state legislature for August 19 to push a budget cut of $600 million on top of a hiring freeze and a 7 percent reduction in spending at state agencies that had already been implemented by the Governor.[20] An August 1 report, issued by economists with Wachovia Bank, said Florida was officially in a recession.[21]

White House budget director Jim Nussle maintained at that time that the U.S. had avoided a recession, following revised GDP numbers from the Commerce Department showing a 0.2 percent contraction in the fourth quarter of 2007 down from a 0.6 percent increase, and a downward revision to 0.9 percent from 1 percent in the first quarter of 2008. The GDP for the second quarter was placed at a 1.9 percent expansion, below an expected 2 percent.[22] On the other hand, Martin Feldstein, who headed the National Bureau of Economic Research and served on the group's recession-dating panel, said he believed the U.S. was in a very long recession and that there was nothing the Federal Reserve could do to change it.[23]

In a CNBC interview at the end of July 2008, Alan Greenspan said he believed the U.S. was not yet in a recession, but that it could enter one due to a global economic slowdown.[24]

A study released by Moody's found two-thirds of the 381 largest metropolitan areas in the United States were in a recession. The study also said 28 states were in recession, with 16 at risk. The findings were based on unemployment figures and industrial production data.[25]

In March 2008, financier Warren Buffett stated in a CNBC interview that by a "common sense definition", the U.S. economy was already in a recession. Buffett has also stated that the definition of recession is flawed and that it should be three consecutive quarters of GDP growth that is less than population growth. However, the U.S. only experienced two consecutive quarters of GDP growth less than population growth.[26][27]

Causes

With the advent of internet trading of stocks and the development of new concepts in derivatives trading, the investment banking sector flourished, but often at the price of the loss both of transparency and of basic regulatory controls.

Financial conglomerates, investment banks, and insurance firms were linked together in the trade of mortgage derivatives and other instruments, in a system sometimes called the "securitization food chain".[28]

The securitization food chain created a method of mortgage transfer within the economy. It consists of five positions, in sequential order in the chain –

- home buyers

- lenders

- investment banks

- investors

- insurance companies

In this sequence, the home buyer grants to the lender a mortgage, that the lender then passes to the investment banks for earning interest. The investment banks bundle mortgages and similar debt instruments together into complex derivatives called collateralized debt obligations (CDOs).[29] The CDOs are a mix of such things as home loans, car loans, student loans, and credit card loans. The credit rating agencies, such as Moody's and Standard & Poors, then indirectly rated these CDOs - while being paid by the investment banks for their rating service. The CDOs were sold to still other investors by the banks, again based on the premise that they would earn interest. The insurance agencies, such as AIG, were selling a type of CDO known as credit default swaps to the investors, and earning premiums. The credit default swaps were presented as a kind of insurance for the investors. If the rating of the CDO went down, then the insurer was to pay the investors for their losses. Additionally, with the introduction of derivatives, the speculators were also betting against the CDOs they didn’t own. The insurance companies were earning both through premium from investors, as well as from the derivatives sold to the speculators. Thus the risk was transferred to the insurance agencies.

As the investments were risk free for the investors (as the risk were borne by the insurance agencies in exchange for the premium), the demand for the CDOs grew. Investment banks sought more mortgages to form more CDOs to continue the food chain. In this climate, lenders started signing riskier loans at their end of the food chain.

In the traditional mortgage system, the borrower typically had to pay down 20 percent of their desired investment; the remaining 80 percent could be borrowed from a lender. Moreover, the consumer could take loans worth no more than about four times his or her annual salary. The rise of the securitization food chain paved the way for more loosely termed loans as banks engaged in riskier lending.

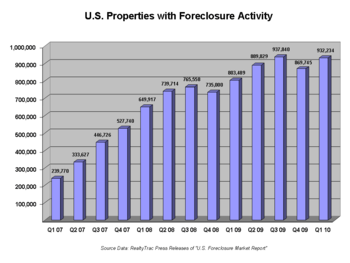

The housing bubble nearly tripled the prices of homes and other real-estate from 1999 to 2007. This huge increase was due in part to the uncontrolled credit given by the American banks that engaged in such practices, and which further increased demand in the housing sector. On December 30, 2008 the Case-Shiller home price index[30] reported the largest price drop in its history. Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the sub prime, collateralized debt obligation, mortgage, credit, hedge fund, and foreign bank markets. As early as October 2007, the U.S. Secretary of the Treasury had called the bursting housing bubble "the most significant risk to our only economy".

Government policies

A federal inquiry found that some federal government policies were responsible to a large extent for the recession in the United States and the resultant vast unemployment.[31] Factors include:

- The Community Reinvestment Act is not a static piece of legislation. It evolved over the years from a relatively hands-off law focused on process into one that focused on outcomes. Banks responded by increasing the CRA loans they made, a move that entailed relaxing their lending standards. Forty-five percent of subprime loan originations went to lower-income borrowers or borrowers in lower-income neighborhoods in 2005 and 2006, where the foreclosures are almost twice as likely. This was made possible by the constant reforms to the Community Reinvestment Act.[32]

- Government-sponsored enterprise under the lax rules made to the Community Reinvestment Act, GSEs started to offer too many loans that were never repaid.[33]

- The repeal of the Glass-Steagall Act allowed banks to use insured depositories to underwrite private securities loans and sell them on the open market in the form of securities. Better known as mortgage-backed security.[34][35]

- Giving Fannie Mae & Freddie Mac GSE status allowed Fannie Mae and Freddie Mac to borrow money in the bond market at lower rates (yields) than other financial institutions. With their funding advantage, they purchased and invested in huge numbers of mortgages and mortgage-backed securities, and they did so with lower capital requirements than other regulated financial institutions and banks. Fannie Mae and Freddie Mac began to experience large losses on their retained portfolios, especially on their Alt-A and subprime investments. In 2008, the sheer size of their retained portfolios and mortgage guarantees led the Federal Housing Finance Agency to conclude that they would soon be insolvent. Under, GSE status Fannie Mae and Freddie Mac's debt and credit guarantees grew so large, that 90 percent of all residential mortgages are financed through Fannie and Freddie or the Federal Housing Administration.[36][37][38]

- By 1966, the United States had suspended its postal savings system which encouraged savings by allowing people to buy certificates of deposit at post offices for as little as a dollar.[39] This started the transformation from a saving to consumption economy. American's started reducing their savings and increased their debt. This temporarily kept private consumption and thus aggregate demand and employment high, but also contributed to the creation of the credit bubble which eventually burst.[40]

- Offshoring of American jobs: The U.S. government has from time to time encouraged the outsourcing of American jobs by various subsidies and through loopholes in tax policy which led to wage stagnation and the loss of American jobs.[41][42] When unemployed Americans did find jobs, many of the jobs were low-wage or entry level jobs.[43]

- Encouraging mergers: The U.S. government in its deregulatory periods has encouraged large corporate mergers, which often have the effect of reducing tax revenues and often choked market competition. Many such mergers act to cut employment, as well. The U.S. Treasury Department has allowed banks and other financial institutions in many cases to use the 2008 and 2009 bailout money to buy out their competitors.[44][45]

- Allowing unemployment to grow to control inflation: U.S. government policy sometimes favors growing unemployment ostensibly in order to achieve long run growth by reducing inflation. According to Merrill Lynch chief economist David Rosenberg,

"The number of people not on temporary layoff surged 220,000 in August and the level continues to reach new highs, now at 8.1 million. This accounts for 53.9% of the unemployed — again a record high — and this is a proxy for permanent job loss, in other words, these jobs are not coming back. Against that backdrop, the number of people who have been looking for a job for at least six months with no success rose a further half-percent in August, to stand at 5 million — the long-term unemployed now represent a record 33% of the total pool of joblessness."[46]

Role of Alan Greenspan

Alan Greenspan was the Chairman of the Federal Reserve of the United States from 1987 to 2006. He was appointed by President Ronald Reagan in August 1987 and was reappointed by President Bill Clinton in 1996. He was, perhaps, the person most singly responsible for the housing bubble in the U.S., although he said that "I really didn't get it until very late in 2005 and 2006."[47] Greenspan stated that the housing bubble was "fundamentally engendered by the decline in real long-term interest rates",[48] though he also claims that long-term interest rates are beyond the control of central banks because "the market value of global long-term securities is approaching $100 trillion" and thus these and other asset markets are large enough that they "now swamp the resources of central banks".[49]

Role of business leaders

A 2012 book by Hedrick Smith, Who Stole the American Dream?, suggests that the Powell Memo was instrumental in setting a new political direction for US business leaders that led to "America’s contemporary economic malaise".[50][51]

Formation of bubble

There was a sharp increase in sub-prime loans in 2006. Now the borrowers could borrow even 99 percent of their investments. The investment banks preferred sub-prime loans, as they earned high revenue due to high risk; poorer ratings yield higher interest rates. This massive credit flow drove demand in the housing sector, helping expand the bubble. Mortgage regulations were relaxed and there were huge profits in the financial sector; some stock prices tied to real estate and financial firms skyrocketed. The leverage ratio during the bubble also was very high, as banks borrowed heavily to give loans. The leverage ratio is the ratio between the funds borrowed by banks and the banks' own assets. The ratio was nearly 33:1 during late 2006. There were also faulty ratings by the trusted rating agencies. Due to the nature of the CDO and the passing of responsibility and risk up the securitization food chain, however, rating agencies had few if any liabilities if their ratings were wrong.

Recession declared by economists

On December 1, 2008, the National Bureau of Economic Research (NBER) declared that the United States entered a recession in December 2007, citing employment and production figures as well as the third quarter decline in GDP.[52][53] The Dow Jones Industrial Average lost 679 points that same day.[54] On January 4, 2009, Nobel Prize–winning economist Paul Krugman wrote, "This looks an awful lot like the beginning of a second Great Depression."[55]

Rise in unemployment

On September 5, 2008, the United States Department of Labor issued a report that its unemployment rate rose to 6.1%, the highest in five years[56][57] and the Congressional Budget Office forecast that the unemployment rate could reach as high as 9% during 2010.[58] The news report cited Department of Labor reports and interviewed Jared Bernstein, an economist:

The unemployment rate jumped to 6.1 percent in August, its highest level in five years, as the erosion of the job market accelerated over the summer. Employers cut 84,000 jobs last month, more than economists had expected, and the Labor Department said that more jobs were lost in June and July than previously thought. So far, 605,000 jobs have disappeared since January. The unemployment rate, which rose from 5.7 percent in July, is now at its highest level since September 2003. Jared Bernstein, economist at the Economics Policy Institute in Washington, said eight months of consecutive job losses had historically signaled that the economy was in a recession. "If anyone is still scratching their head over that one, they can stop," Mr. Bernstein said. Stocks fell after the release of the report, with the Dow Jones industrials down about 100 points after about 40 minutes of trading.|New York Times[59]

CNN also reported the news,[60] quoted another economist, and placed the news in context:

| “ | Job losses are still mild by recession standards, but the losses are relentless and they are accumulating. If job growth had paced with population growth during this year, it would have meant 1.3 million new jobs would have been created. Instead 605,000 were lost. That means about 2 million fewer people are working than if the economy were on a steady path. And that's a big number. But while economists generally study the payroll numbers most closely, it's the unemployment rate that registers with most Americans when they think about the labor market.[60] -- Bob Brusca of FAO Economics |

” |

As of December 2008, the U1 unemployment figure was 2.8% while U6 unemployment was 13.5%.[61] On January 26, 2009 a day dubbed "Bloody Monday" by the media, 71,400 jobs were lost in the U.S.[62]

The unemployment rate among workers with college degrees rose to 3.8% during the first quarter of 2009.[63] This "pinch" was also spreading worldwide.[64]

For all of 2008, the United States incurred a net loss of 3.617 million jobs, and for 2009, a net loss of 5.052 million jobs. Unemployment rose from 5% in December 2007 to peak at 10% in October 2009.

Liquidity crisis

From late 2007 through September 2008, before the official October 3 bailout, there was a series of smaller bank rescues that occurred which totalled almost $800 billion.

In the summer of 2007, Countrywide Financial drew down a $11 billion line of credit and then secured an additional $12 billion bailout in September. This may be considered the start of the crisis.

In mid-December 2007, Washington Mutual bank cut more than 3,000 jobs and closed its sub-prime mortgage business.

In mid-March 2008, Bear Stearns was bailed out by a gift of $29 billion non-recourse treasury bill debt assets.

In early July 2008, depositors at the Los Angeles offices of IndyMac Bank frantically lined up in the street to withdraw their money. On July 11, IndyMac, a spinoff of Countrywide, was seized by federal regulators - and called for a $32 billion bailout - as the mortgage lender succumbed to the pressures of tighter credit, tumbling home prices and rising foreclosures. That day the financial markets plunged as investors tried to gauge whether the government would attempt to save mortgage lenders Fannie Mae and Freddie Mac. The two were placed into conservatorship on September 7, 2008.

During the weekend of September 13–14, 2008, Lehman Brothers declared bankruptcy after failing to find a buyer; Bank of America agreed to purchase investment bank Merrill Lynch; the insurance giant AIG sought a bridge loan from the Federal Reserve; and a consortium of 10 banks created an emergency fund of at least $70 billion to deal with the effects of Lehman's closure,[65] similar to the consortium put forth by financial titan J.P. Morgan during the stock market panic of 1907 and the crash of 1929. Stocks on Wall Street tumbled on Monday, September 15.[66]

On September 16, 2008, news emerged that the Federal Reserve might give AIG an $85 billion rescue package; on September 17, 2008, this was confirmed. The terms of the package were that the Federal Reserve would receive an 80% public stake in the firm. The biggest bank failure in history occurred on September 25 when JP Morgan Chase agreed to purchase the banking assets of Washington Mutual.[67]

The year 2008, as of September 17, had seen 81 public corporations file for bankruptcy in the United States, already higher than the 78 for all of 2007. The largest corporate bankruptcy in U.S. history also made 2008 a record year in terms of assets, with Lehman's size - $691 billion in assets - alone surpassing all past annual totals.[68] The year also saw the ninth biggest bankruptcy, with the failure of IndyMac Bank.[69]

The Wall Street Journal stated that venture capital funding slowed down, which in the past had led to unemployment and slowed new job creation.[70] The Federal Reserve took steps to feed economic expansion by lowering the prime rate repeatedly during 2008.

| Federal reserve rates changes[71] | |||||

| Date | Discount rate | Discount rate | Discount rate | Fed funds | Fed funds rate |

|---|---|---|---|---|---|

| Primary | Secondary | ||||

| rate change | new interest rate | new interest rate | rate change | new interest rate | |

| Apr 30, 2008 | -.25% | 2.25% | 2.75% | -.25% | 2.00% |

| Mar 18, 2008 | -.75% | 2.50% | 3.00% | -.75% | 2.25% |

| Mar 16, 2008 | -.25% | 3.25% | 3.75% | ||

| Jan 30, 2008 | -.50% | 3.50% | 4.00% | -.50% | 3.00% |

| Jan 22, 2008 | -.75% | 4.00% | 4.50% | -.75% | 3.50% |

Bailout of U.S. financial system

On September 17, 2008, Federal Reserve chairman Ben Bernanke advised Secretary of the Treasury Henry Paulson that a large amount of public money would be needed to stabilize the financial system.[72] Short selling on 799 financial stocks was banned on September 19. Companies were also forced to disclose large short positions.[73] The Treasury Secretary also indicated that money funds would create an insurance pool to cover themselves against losses and that the government would buy mortgage-backed securities from banks and investment houses.[73] Initial estimates of the cost of the Treasury bailout proposed by the Bush Administration's draft legislation (as of September 19, 2008) were in the range of $700 billion[74] to $1 trillion U.S. dollars.[75] President George W. Bush asked Congress on September 20, 2008 for the authority to spend as much as $700 billion to purchase troubled mortgage assets and contain the financial crisis.[76][77] The crisis continued when the United States House of Representatives rejected the bill and the Dow Jones took a 777-point plunge.[78] A revised version of the bill was later passed by Congress, but the stock market continued to fall nevertheless.[79] [80] The first half of the bailout money was primarily used to buy preferred stock in banks, instead of troubled mortgage assets. This flew in the face of some economists' argument that buying preferred stock would be far less effective than buying common stock.[81]

As of mid-November 2008, it was estimated that the new loans, purchases, and liabilities of the Federal Reserve, the Treasury, and FDIC, brought on by the financial crisis, totalled over $5 trillion: $1 trillion in loans by the Fed to broker-dealers through the emergency discount window, $1.8 trillion in loans by the Fed through the Term Auction Facility, $700 billion to be raised by the Treasury for the Troubled Assets Relief Program, $200 billion insurance for the GSEs by the Treasury, and $1.5 trillion insurance for unsecured bank debt by FDIC.[82] (Some portion of the Fed's emergency loans would already have been repaid.)

United States policy responses

The Federal Reserve, Treasury, and Securities and Exchange Commission took several steps on September 19 to intervene in the crisis. To stop the potential run on money market mutual funds, the Treasury also announced on September 19 a new $50 billion program to insure the investments, similar to the Federal Deposit Insurance Corporation (FDIC) program.[83] Part of the announcements included temporary exceptions to section 23A and 23B (Regulation W), allowing financial groups to more easily share funds within their group. The exceptions would expire on January 30, 2009, unless extended by the Federal Reserve Board.[84] The Securities and Exchange Commission announced termination of short-selling of 799 financial stocks, as well as action against naked short selling, as part of its reaction to the mortgage crisis.[85]

Recovery

The recession officially ended in the second quarter of 2009,[2] but the nation's economy continued to be described as in an "economic malaise" during the second quarter of 2011,[59] and has been described as the weakest recovery since the Great Depression and World War II.[86][87] The weak economic recovery has led many to call it a "Zombie Economy", so-called because it is neither dead nor alive. Household incomes, as of August 2012, had fallen more since the end of the recession, than during the 18-month recession, falling an additional 4.8% since the end of the recession, totally to 7.2% since the December 2007 level.[88] Additionally as of September 2012, the long-term unemployment is the highest it has been since World War II,[89] and the unemployment rate peaked several months after the end of the recession (10.1% in October 2009) and was above 8% until September 2012 (7.8%) .[90][91] The Federal Reserve has kept interest rates at a historically low 0.25% since December 2008, and both heads Ben Bernanke and Janet Yellen have stated that rates should remain low through at least mid-2015 as long as the recovery is still slow and inflation remains below 2.5%.

In 2010, the US gained 1.058 million jobs, 2.083 million in 2011, 2.236 million in 2012, and 2.331 million in 2013, and 3.116 in 2014. GDP grew roughly 2.5% in 2010, 1.6% in 2011, 2.3% in 2012, 2.2% in 2013, and 2.4% in 2014. May 2014 also marked the recovery of all jobs lost during the recession. Over 12.1 million jobs have been created since job losses stopped in February 2010 as of June 2015. However, these new jobs are not equal in pay to those medium-paying jobs lost: roughly 40% are high-paying jobs and 60% are low-paying jobs, further widening the income gap between poor and affluent Americans. Government attempts to reduce deficits via the sequester budget cuts will remain a drag on the economy for as long as the Budget Control Act of 2011 remains in place.

Economic indicators began an upward turn in 2013, with home values surging 12%, income jumping from $51,000 (2012) to $52,800, and more high- and mid-paying jobs created than low-wage jobs. Forecasts for 2014 are generally optimistic, with GDP growth predicted to be around 3%, foreclosures falling to pre-2007 levels, 2-2.5 million jobs created, and unemployment falling to 6% or below, which would make 2014 the best showing for the American economy since 2006. In September 2014, the Census Bureau reported that poverty had fallen from 15% in 2012 to 14.5% in 2013, mainly due to the recovering job market.

Healthcare costs in the United States slowed in the period after the Great Recession (2008-2012). A decrease in inflation and in the number of hospital stays per population drove a reduction in the rate of growth in aggregate hospital costs at this time. Growth slowed most for surgical stays and least for maternal and neonatal stays.[92]

See also

- Timeline of the Great Recession

- Causes of the Great Recession

- Financial crisis of 2007–08

- 2008–2011 bank failures in the United States

- 2008–09 Keynesian resurgence

- 2010 United States foreclosure crisis

- United States debt-ceiling crisis of 2011

- List of economic crises

References

- ↑ "Civilian Unemployment Rate".

- 1 2 "Business Cycle Dating Committee, National Bureau of Economic Research".

- ↑ "All Employees: Total Nonfarm Payrolls".

- ↑ "Employment Situation Summary".

- ↑ "Graph: All Employees: Total Nonfarm Payrolls".

- ↑ "Households and Nonprofit Organizations; Net Worth, Level".

- ↑ "Real Median Household Income in the United States".

- ↑ "About Poverty - Highlights - U.S Census Bureau".

- ↑ "Securities Exchange Act of 1934" (PDF). Retrieved 12 September 2011.

- ↑ "The Chandler Act". Retrieved 12 September 2011.

- 1 2 "Summary - Inside Job - Condensed Version". Retrieved 8 September 2011.

- ↑ "Recession in the US 'has arrived'". BBC News. 2008-01-08. Retrieved 2010-01-05.

- ↑ Quinn, James (2008-01-07). "US recession is already here, warns Merrill". The Daily Telegraph. London. Retrieved 2010-05-07.

- ↑ Aversa, Jeannine (2008-02-15). "Poll: Majority of people believe recession underway". USA Today. Retrieved 2010-05-07.

- ↑ Greenspan, Alan. "We will never have a perfect model of risk". Financial Times. Archived from the original on April 23, 2008. Retrieved 2008-09-22.

- ↑ CNN, March 21, 2008 Worries grow of deeper U.S. recession. Accessed March 22, 2008.

- ↑ Zumbrun, Joshua (2008-04-30). "Technically, No Recession (Feel Better?)". Forbes. Archived from the original on 3 May 2008. Retrieved 2008-05-08.

- ↑ "US in Recession Despite Manipulated Employment and Inflation Statistics". The Market Oracle. 2008-05-03. Archived from the original on 6 May 2008. Retrieved 2008-05-08.

- ↑ "Rosenberg: Debunking Five Myths". Mish's Global Economic Trend Analysis. 2008-05-18. Retrieved 2008-05-19.

- ↑ Sichko, Adam (2008-07-30). "New York economy officially in recession, state budget director says". The Business Review. Retrieved 2008-08-10.

- ↑ "Wachovia economists say Florida is in recession". Business Week. 2008-08-01. Retrieved 2008-08-10.

- ↑ "White House says U.S. avoided recession". Market Watch. 2008-07-31. Retrieved 2008-08-10.

- ↑ "U.S. May Be in `Very Long' Recession, Harvard's Feldstein Says". Bloomberg. 2008-07-31. Retrieved 2008-08-10.

- ↑ Somerville, Glenn (2008-07-31). "Global slowdown may put U.S. in recession: Greenspan". Reuters. Retrieved 2008-08-10.

- ↑ Petrello, Randi (2008-10-06). "Report finds Honolulu in recession, Hawaii at risk". Pacific Business News. Archived from the original on 14 October 2008. Retrieved 2008-10-07.

- ↑ "United States Quarterly GDP". Indiana Business Bulletin. Archived from the original on 2 November 2008. Retrieved 2008-10-18.

- ↑ "Population Projections - 2008 National Population Projections: Summary Tables". U.S. Census Bureau. Retrieved 2008-10-18.

- ↑ "Overview of the Current International Financial Crisis" (PowerPoint presentation). Retrieved 12 September 2011.

- ↑ "Collateralized Debt Obligations: Structures and Analysis, 2nd Edition". Retrieved 8 September 2011.

- ↑ "S&P/Case-Shiller Home Price Indices". Retrieved 8 September 2011.

- ↑ Chan, Sewell (January 25, 2011). "Financial Crisis Was Avoidable, Inquiry Finds". New York Times. Retrieved October 23, 2016.

- ↑ Carney, John (March 1, 2009). "Here's How The Community Reinvestment Act Led To The Housing Bubble's Lax Lending". Business Insider. Retrieved October 23, 2016.

- ↑ Salsman, Richard (June 27, 2009). "Altruism: The Moral Root of the Financial Crisis". The Objective Standard. Retrieved October 23, 2016.

- ↑ Rickards, James (August 27, 2012). "Repeal of Glass-Steagall Caused the Financial Crisis". U.S. News & World Report. Retrieved October 23, 2016.

- ↑ Gibson, Warren (September 22, 2010). "The Rise and Fall of Glass-Steagall". Foundation for Economic Education. Retrieved October 23, 2016.

- ↑ Nielsen, Barry. "Fannie Mae, Freddie Mac And The Credit Crisis Of 2008". Investopedia. Retrieved October 23, 2016.

- ↑ Dalton, John (February 24, 2014). "Let's End the Fannie & Freddie Monopoly". Real Clear Politics. Retrieved October 23, 2016.

- ↑ Morgenson, Gretchen (May 20, 2016). "Fannie, Freddie and the Secrets of a Bailout With No Exit". The New York Times. Retrieved October 23, 2016.

- ↑ Shiller, Robert (January 14, 2012). "Spend, Spend, Spend. It's the American Way.". The New York Times. Retrieved October 23, 2016.

- ↑ Treeck, Till. "How income inequality contributed to the Great Recession". The Guardian. Retrieved October 23, 2016.

- ↑ Garson, Barbara. "America's forgotten recession". Salon. Retrieved October 23, 2016.

- ↑ Linda Levine (July 21, 2011). "Offshoring (or Offshore Outsourcing) and Job Loss Among U.S. Workers" (PDF). Congressional Research service.

- ↑ Lowrey, Annie. "Recovery Has Created Far More Low-Wage Jobs Than Better-Paid Ones". New York Times. Retrieved October 23, 2016.

- ↑ Davis, Mark (September 13, 2014). "Top 6 U.S. Government Financial Bailouts". Investopedia. Retrieved October 23, 2016.

- ↑ Attkisson, Sharyl (January 12, 2009). "Where Did The Bailout Billions Really Go?". CBS News. Retrieved October 23, 2016.

- ↑ "Has America Suffered a PERMANENT Loss of Jobs?". WashingtonsBlog. December 3, 2009. Retrieved October 23, 2016.

- ↑ Guha, Krishna (September 17, 2007). "Greenspan alert on US house prices". Financial Times. Archived from the original on August 29, 2008. Retrieved October 17, 2008.

- ↑ Guha, Krishna (September 16, 2007). "A global outlook". Financial Times. Retrieved October 17, 2008.

- ↑ Greenspan, Alan (December 12, 2007). "The Roots of the Mortgage Crisis". Wall Street Journal. Retrieved June 22, 2009.

- ↑ "WHO STOLE THE AMERICAN DREAM? by Hedrick Smith". Kirkus Reviews. 2012-08-01. Retrieved 2014-05-30.

- ↑ Michael Lipkin (Director). ""Who Stole the American Dream?"". October 1, 2012: WTTW. Retrieved 2014-05-30. Missing or empty

|series=(help) - ↑ US recession 'began last year'. Accessed December 1, 2008.

- ↑ BBC News (2008-12-01). "US recession 'began last year'". BBC News. Archived from the original on 2 December 2008. Retrieved 2008-12-01.

- ↑ Dow Analysis December 1, 2008 by escaMoney

- ↑ Krugman, Paul (2009-01-05). "Fighting Off Depression". The New York Times. Archived from the original on April 30, 2011. Retrieved 2010-05-07.

- ↑ Michael Grynbaum (2008-09-05). "Unemployment Rate Rises to 6.1%". New York Times. Retrieved 2008-09-05.

- ↑ Graphs and Chart on Unemployment Rate from the Bureau of Labor Statistics government website. Accessed September 5, 2008.

- ↑ The Budget and Economic Outlook: Fiscal Years 2009 to 2019, Congressional Budget Office, January 2009, p. 44, archived from the original on 7 October 2010, retrieved 2 October 2010

- 1 2 Appelbaum, Binyamin (April 24, 2011). "Stimulus by Fed Is Disappointing, Economists Say". The New York Times. Archived from the original on May 2, 2011. Retrieved April 24, 2011.

the disappointing results [of the actions of the Federal Reserve] show the limits of the central bank’s ability to lift the nation from its economic malaise.

- 1 2 Chris Isidore (2008-09-05). "Jobless rate soars to 6.1%: Unemployment surges to 5-year high as employers cut workers for eighth straight month. Total job losses for 2008: 605,000.". CNN at www.cnn.money.com. Archived from the original on 7 September 2008. Retrieved 2008-09-05.

- ↑ "Table A-12. Unemployed persons by duration of unemployment".

- ↑ Pepitone, Julianne (2009-01-26). "Bloody Monday: Over 65,400 jobs lost". CNN. Archived from the original on 8 April 2010. Retrieved 2010-05-07.

- ↑ http://www.bloomberg.com/apps/news?pid=20601087&sid=as64xRuHuEKQ&refer=home Job Losses in US Spreading to Workers With College Degrees

- ↑ http://www.nytimes.com/2009/01/25/world/asia/25china.html?em College Educated Chinese Feel Job Pinch

- ↑ "After Frantic Day, Wall St. Banks Falter". The New York Times. 2008-09-15. Retrieved 2010-05-07.

- ↑ Tim Paradis, "Stocks tumble amid new Wall Street landscape," AP, found at Yahoo News. Retrieved September 15, 2008.

- ↑ Ellis, David; Sahadi, Jeanne (2008-09-25). "JPMorgan to buy WaMu - Sep. 25, 2008". Money.cnn.com. Archived from the original on 30 September 2008. Retrieved 2008-10-01.

- ↑ "2007 Public Company Bankruptcies Surpassed, According to BankruptcyData.com". Market Watch. 2008-09-17. Retrieved 2008-09-19.

- ↑ "Top 10 Bankruptcies". Time. 2008-09-15. Archived from the original on 19 September 2008. Retrieved 2008-09-19.

- ↑ Tam, Pui-Wing; White, Bobby (2008-10-27). "Venture Capital Financing Slows Amid Economic Downturn". The Wall Street Journal. Retrieved 2 October 2010.

- ↑ "Historical Changes of the Target Federal Funds and Discount Rates". Federal Reserve Bank of New York. 2008-12-22. Archived from the original on 21 December 2008. Retrieved 2009-01-04.

- ↑ "America's bail-out plan: The doctors' bill". The Economist. 2008-09-25. Archived from the original on 21 October 2008. Retrieved 2008-10-17.

time had come to call for a big injection of public money

- 1 2 A Hail Mary Pass, but No Receiver in the End Zone, by Joe Nocera, 9/19/2008, nytimes.com

- ↑ "U.S. Treasury proposes $700 billion Wall Street bailout plan", Reuters, Sat Sep 20, 2008

- ↑ "Paulson plan could cost $1 trillion - Mike Allen - Politico.com". Politico.com. Archived from the original on 1 October 2008. Retrieved 2008-10-01.

- ↑ Sahadi, Jeanne, "Bush wants OK to spend $700B Bailout proposal sent to Congress seeks authorization to spend as much as $700 billion to buy troubled mortgage-related assets", CNN Money, September 21, 2008

- ↑ The doctors' bill. The Economist. September 25th 2008. Retrieved on 2008-09-25.

- ↑ "Dow dives 777 points as House rejects bailout plan". Associated Press. Retrieved 2 October 2010.

- ↑ "House Passes Rescue Plan Second Time Around". FOX News. 2008-10-03. Retrieved 2 October 2010.

- ↑ "Panic on Wall Street: Dow Falls Below 9K". FOXBusiness.com. Archived from the original on 6 November 2010. Retrieved 2 October 2010.

- ↑ "Common (Stock) Sense about Risk-Shifting and Bank Bailouts". SSRN.com. December 29, 2009. Archived from the original on 14 February 2009. Retrieved January 21, 2009.

- ↑ Elizabeth Moyer (12 November 2008). "Washington's $5 Trillion Tab". Forbes.

- ↑ Gullapalli, Diya and Anand, Shefali. "Bailout of Money Funds Seems to Stanch Outflow", The Wall Street Journal, September 20, 2008.

- ↑ (Press Release) FRB: Board Approves Two Interim Final Rules, Federal Reserve Bank, September 19, 2008.

- ↑ Boak, Joshua (Chicago Tribune). "SEC temporarily suspends short selling", San Jose Mercury News, September 19, 2008.

- ↑ Paul Wiseman (26 August 2012). "Economy Recovery Ranks as Weakest since World War II". San Diego Union Tribune. Associated Press. Retrieved 27 August 2012.

- ↑ Christopher S. Rugaber (24 August 2012). "Weak recovery leaves laid-off US workers struggling to find new jobs; most take pay cuts". Washington Post. Associated Press. Retrieved 27 August 2012.

- ↑ Jeff Kearns (23 August 2012). "U.S. Incomes Fell More In Recovery, Sentier Says". Bloomberg. Retrieved 4 September 2012.

- ↑ Jon Talton (4 September 2012). "State of the labor force under pressure this holiday". The Seattle Times. Retrieved 4 September 2012.

- ↑ James Sherk (30 August 2012). "Not Looking for Work: Why Labor Force Participation Has Fallen During the Recession". Reports. The Heritage Foundation. Retrieved 4 September 2012.

- ↑ "THE RACE: After convention speeches end and balloons drop, nation faces cold realism on jobs". Washington Post. Associated Press. 4 September 2012. Retrieved 4 September 2012.

- ↑ Moore B, Levit K and Elixhauser A (October 2014). "Costs for Hospital Stays in the United States, 2012". HCUP Statistical Brief #181. Rockville, MD: Agency for Healthcare Research and Quality.

.svg.png)