Economy of Uzbekistan

Commercial buildings in Tashkent | |

| 1 som (UZS) = 100 tiyin | |

| Calendar year | |

Trade organisations | CIS and ECO; observer status in WTO |

| Statistics | |

| GDP | $170.3 billion (2014) |

| GDP rank | 70th (PPP, 2012) |

GDP growth | 7% (Real, 2014 est.) |

GDP per capita | $5,600 (2014 est.) |

GDP by sector | agriculture 18.5%, industry 32%, services 49.5% (2014 est.) |

| 12.1% (CPI, 2014 est.) | |

Population below poverty line | 17% (2011) |

| 36.8 (2003) | |

Labour force | 17.24 million (2014) |

Labour force by occupation | agriculture 25.9%, industry 13.2%, services 60.9% (2012 est.) |

| Unemployment | 4.9% officially, plus another 20% underemployed (2014 est.) |

Main industries | textiles, food processing, machine building, metallurgy, mining, [[]], Chemicals |

| 82nd[1] | |

| External | |

| Exports | $13.32 billion (2014 est.) |

Export goods | energy products, cotton, gold, mineral ferilizers, ferrous and nonferrous metals, food products, machinery, automobiles |

Main export partners |

|

| Imports | $12.5 billion (2014 est.) |

Import goods | machinery and equipment, foodstuffs, chemicals, ferrous and nonferrous metals |

Main import partners |

|

FDI stock | n/av |

Gross external debt | $8.751 billion (31 December 2014) |

| Public finances | |

| 7.5% of GDP (2014 est.) | |

| Revenues | $18.67 billion (2014 est.) |

| Expenses | $19.27 billion (2014 est.) |

| Economic aid | $172.3 million from the U.S. (2005) |

Foreign reserves | $18 billion (31 December 2014 est.) |

Since gaining independence, the Government of Uzbekistan has stated that it is committed to a gradual transition to a market-based economy. The progress with economic policy reforms has been a cautious one, but cumulatively Uzbekistan has shown respectable achievements. The government is yet to eliminate the gap between the black market and official exchange rates by successfully introducing convertibility of the national currency. Its restrictive trade regime and generally interventionist policies continue to have a negative effect on the economy. Substantial structural reform is needed, particularly in these areas: improving the investment climate for foreign investors, strengthening the banking system, and freeing the agricultural sector from state control. Remaining restrictions on currency conversion capacity and other government measures to control economic activity, including the implementation of severe import restrictions and sporadic closures of Uzbekistan's borders with neighboring Kazakhstan, Kyrgyzstan, and Tajikistan have led international lending organizations to suspend or scale back credits.

Working closely with the IMF, the government has made considerable progress in reducing inflation and the budget deficit. The national currency was made convertible in 2003 as part of the IMF-engineered stabilization program, although some administrative restrictions remain. The agriculture and manufacturing industries contribute equally to the economy, each accounting for about one-quarter of the GDP.[2] Uzbekistan is a major producer and exporter of cotton, although the importance of this commodity has declined significantly since the country achieved independence.[3] Uzbekistan is also a big producer of gold, with the largest open-pit gold mine in the world. The country has substantial deposits of copper, strategic minerals, gas, and oil.

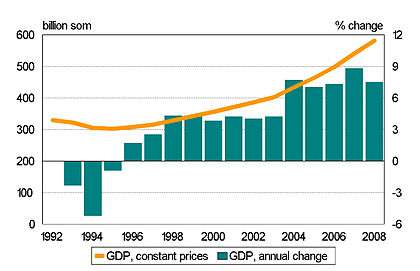

GDP and employment

This is a chart depicting the trend of the gross domestic product in Uzbekistan in constant prices of 1995, estimated by the International Monetary Fund with figures in millions of som.[4] The chart also shows the consumer price index(CPI) as a measure of inflation from the same source and the end-of-year U.S. dollar exchange rate from the Central Bank of the Uzbekistan database.[5] For purchasing power parity comparisons in 2006, the U.S. dollar is exchanged at 340 som.[6]

| Year | GDP (constant prices) | US Dollar Exchange | CPI (2000=100) |

|---|---|---|---|

| 1992 | 330,042 | 1 som | 0.07 |

| 1995 | 302,790 | 36 som | 20 |

| 2000 | 356,325 | 325 som | 100 |

| 2003 | 402,361 | 980 som | 166 |

| 2006 | 497,525 | 1,240 som | 226 |

Uzbekistan's GDP, like that of all CIS countries, declined during the first years of transition and then recovered after 1995, as the cumulative effect of policy reforms began to be felt. It has shown robust growth, rising by 4% per year between 1998 and 2003, and accelerating thereafter to 7%-8% per year. In 2011 the growth rate came up to 9%.

Given the growing economy, the total number of people employed rose from 8.5 million in 1995 to 13.5 million in 2011.[2] This healthy increase of nearly 25% in the labor force lagged behind the increase in GDP during the same period (64%, see chart), which implies a significant increase in labor productivity. Official unemployment is very low: less than 30,000 job seekers were registered in government labor exchanges in 2005-2006 (0.3% of the labor force).[2] Underemployment, on the other hand, is believed to be quite high, especially in agriculture, which accounts for fully 28% of all employed, many of them working part-time on tiny household plots. However, no reliable figures are available due to the absence of credible labor surveys.

The minimum wage, public-sector wages, and old-age pensions are routinely raised twice a year to ensure that base income is not eroded by inflation. Although no statistics are published on average wages in Uzbekistan, pensions as a proxy for the average wage increased significantly between 1995 and 2006, both in real terms and in U.S. dollars. The monthly old-age pension increased in real (CPI-adjusted) sums by almost a factor of 5 between 1995 and 2006.[2] The monthly pension in U.S. dollars was around $20–$25 until 2000, then dropped to $15–$20 between 2001 and 2004, and now is $64. The minimum wage was raised to $34.31 in November 2011.[7] Assuming that the average wages in the country are at a level of 3-4 times the monthly pension, we estimate the wages in 2006 at $100–$250 per month, or $3–$8 per day.

According to the forecast by the Asian Development Bank, the GDP in Uzbekistan in 2009 is expected to grow by 7%.[8] Meanwhile, in 2010 the Uzbekistan GDP growth is predicted at 6,5%.[8]

Labor

Literacy in Uzbekistan is almost universal, and workers are generally well-educated and trained accordingly in their respective fields. Most local technical and managerial training does not meet international business standards, but foreign companies engaged in production report that locally hired workers learn quickly and work effectively. The government emphasizes foreign education. Each year about 50 students are sent to the United States, Europe, and Japan for university degrees, after which they have a commitment to work for the government for 5 years. Reportedly, about 60% of students who study abroad find employment with foreign companies upon completing their degrees, despite their 5-year commitment to work in the government. Some American companies offer their local employees special training programs in the United States.

In addition, Uzbekistan subsidizes studies for students at Westminster International University in Tashkent—one of the few Western-style institutions in Uzbekistan. In 2002, the government "Istedod" Foundation (formerly as "Umid" Foundation) is paying for 98 out of 155 students studying at Westminster. For the next academic year, Westminster is expecting to admit 360 students, from which Istedod is expecting to pay for 160 students. The education at Westminster costs $5,200 per academic year. In 2008 Management Development Institute of Singapore at Tashkent started its work. This university provides high quality education with international degree. Tuition fee was $5000 in 2012. In 2009 Turin Polytechnik University was opened. It is the only university in Central Asia that prepares high quality employees for industries. With the closing or downsizing of many foreign firms, it is relatively easy to find qualified employees, though salaries are very low by Western standards. Salary caps, which the government implements in an apparent attempt to prevent firms from circumventing restrictions on withdrawal of cash from banks, prevent many foreign firms from paying their workers as much as they would like. Labor market regulations in Uzbekistan are similar to those of the Soviet Union, with all rights guaranteed but some rights unobserved. Unemployment is a growing problem, and the number of people looking for jobs in Russia, Kazakhstan, and Southeast Asia is increasing each year. Uzbekistan's Ministry of Labor does not publish information on Uzbek citizens working abroad, but Russia's Federal Migration Service reports 2.5 million Uzbek migrant workers in Russia. There are also indications of up to 1 million Uzbek migrants working illegally in Kazakhstan.[9] Uzbekistan's migrant workers may thus be around 3.5-4 million people, or a staggering 25% of its labor force of 14.8 million.[2] The U.S. Department of State also estimates that between three and five million Uzbek citizens of working age live outside Uzbekistan.[10]

Prices and monetary policy

Uzbekistan experienced galloping inflation of around 1000% per year immediately after independence (1992–1994). Stabilization efforts implemented with active guidance from the International Monetary Fund rapidly paid off, as inflation rates were brought down to 50% in 1997 and then to 22% in 2002. Since 2003 annual inflation rates averaged less than 10%.[6]

The severe inflationary pressures that characterized the early years of independence inevitably led to a dramatic depreciation of the national currency. The exchange rate of Uzbekistan’s first currency, the “notional” ruble inherited from the Soviet period and its successor, the transient "coupon som" introduced in November 1993 in a ratio of 1:1 to the ruble, went up from 100 rubles/US$ in the early 1992 to 3627 rubles (or coupon soms) in mid-April 1994. On July 1, 1994 the "coupon som" was replaced with the permanent new Uzbekistani som (UZS) in a ratio of 1000:1, and the starting exchange rate for the new national currency was set at 7 som/US$, implying an almost two-fold depreciation since mid-April. Within the first six months, between July and December 1994, the national currency depreciated further to 25 som/US$ and continued depreciating at a fast clip until December 2002, when the exchange rate had reached 969 som/US$, i.e., 138 times the starting exchange rate eight and a half years earlier or nearly 10,000 times the exchange rate in early 1992, soon after the declaration of independence.[5] Then the depreciation of the som virtually stopped in response to the government's stabilization program, which at the same time dramatically reduced the inflation rates. During the four years that followed (2003–2007) the exchange rate of the som to the US dollar increased only by a factor of 1.33, from 969 som to around 1865 som in May 2012.

From 1996 until the spring of 2003, the official and so-called "commercial" exchange rate – both set administratively by the Central Bank – were highly overvalued. Many businesses and individuals were unable to buy dollars legally at these "low" rates, so a widespread black market developed to meet hard currency demand. The spread between the official exchange rate and the curb rate widened especially after the Russian financial crisis of August 1998: at the end of 1999 the curb rate stood at 550 som/US$ compared with the official rate of 140 som/US$, a gap by nearly a factor of 4 (up from a factor of "only" 2 in 1997 and the first half of 1998).[11] By mid-2003, the government's stabilization and liberalization efforts had reduced the gap between the black market, official, and commercial rates to approximately 8% and it quickly disappeared as the som was made convertible after October 2003. Today, four foreign currencies—the U.S. dollar, the euro, the pound sterling, and the yen—are freely exchanged in commercial booths all around the cities, while other currencies, including the Russian ruble and the Kazakh tenge, are bought and sold by individual ("black market") money changers, who are allowed to operate openly without harassment. The foreign exchange regime since October 2003 is characterized as "controlled floating rate".[12] Liberalization of the trade regime remains a prerequisite for Uzbekistan to proceed to an IMF-financed program. In 2012, "black market" rate is again significantly higher than official rate, 2850 som/US$ vs. 1865 som/US$ (as of mid-June 2011). This curb rate is often referred to as 'bazar rate', because money changers operate at or near 'bazars' - large farmer markets.

Tax collection rates remained high, due to the use of the banking system by the government as a collection agency. Technical assistance from the World Bank, Office of Technical Assistance at the U.S. Treasury Department, and UNDP is being provided in reforming the Central Bank and Ministry of Finance into institutions capable of conducting market-oriented fiscal and monetary policy.

Agriculture

At the end of 2013, the government announced through the Central Bank of the Republic of Uzbekistan that it predicted agriculture as playing a major component of the country's economic development in the future.[13] Agriculture in Uzbekistan employs 28% of labor force and contributes 24% of GDP (2006 data).[2] Another 8% of GDP is from processing of domestic agricultural output.[14] Cotton, once Uzbekistan's star cash earner, has lost much its luster since independence as wheat began to gain prominence from considerations of food security for the rapidly growing population. Areas cropped to cotton were reduced by more than 25% from 2 million hectares in 1990 to less than 1.5 million hectares in 2006, while wheat cultivation jumped 60% from around 1 million hectares in 1990 to 1.6 million hectares in 2006. Cotton production dropped from 5 million tons annually in the pre-independence decade to around 3.5 million tons since 1995, but even at these reduced levels Uzbekistan produces 3 times as much cotton as all the other Central Asian countries and Azerbaijan combined. Cotton exports tumbled from highs of around 45% of Uzbekistan's total exports in the early 1990s to 17% in 2006. Uzbekistan is the largest producer of jute in West Asia and it also produces significant quantities of silk (Uzbek ikat), fruit, and vegetables, with food products contributing nearly 8% of total exports in 2006. Virtually all agriculture requires irrigation, but because of budgetary constraints there has been practically no expansion of irrigated area since independence: it remains static at 4.2 million hectares, the level reached by 1990 after rapid growth during the Soviet period.

Government intervention in agriculture is reflected in the persistence of state orders for the two main cash crops, cotton and wheat. Farmers receive binding directives on the area to be cropped to these commodities and are obliged to surrender their harvest to designated marketers at state-fixed prices. The incomes of farmers and agricultural workers are substantially lower than the national average because the government pays them less than the world prices for their cotton and wheat, using the difference to subsidize capital intensive industrial concerns, such as factories producing automobiles, airplanes, and tractors. Consequently, many farmers focus on production of fruits and vegetables on their small household plots, because the prices of these commodities are determined by supply and demand, not by government decrees. Farmers also resort to smuggling cotton and especially wheat across the border with Kazakhstan and Kyrgyzstan in order to obtain higher prices.

The government's discriminatory pricing for the main cash crops, cotton and wheat, is apparently responsible for the exceptionally rapid growth of the cattle herd in recent years, as the prices of milk and meat, like those of fruits and vegetables, are also determined by market forces. The number of cattle increased from 4 million head in 1990 to 7 million head in 2006, and virtually all these animals are maintained by rural families with just 2-3 head per household.[2] Sales of own-produced milk, meat, and vegetables in town markets are an important source for augmenting rural family incomes.

The Soviet practice of using "volunteer labor" to help gathering the cotton harvest continues in Uzbekistan where schoolchildren, university students, medical professionals, and state employees are driven en masse out to the fields every year.[9] A recent article posted by a domestic news agency (admittedly with strong anti-government leanings) describes Uzbekistan's cotton as "riches gathered by the hands of hungry children".[15]

Natural resources and energy

Minerals and mining also are important to Uzbekistan's economy. Gold, alongside cotton, is a major foreign exchange earner, unofficially estimated at around 20% of total exports.[10] Uzbekistan is the world's seventh-largest gold producer, mining about 80 tons per year, and holds the fourth-largest reserves in the world. Uzbekistan has an abundance of natural gas, used both for domestic consumption and export; oil used for domestic consumption; and significant reserves of copper, lead, zinc, tungsten, and uranium. Inefficiency in energy use is generally high, because the low controlled prices do not stimulate consumers to conserve energy. Uzbekistan is a partner country of the EU INOGATE energy programme, which has four key topics: enhancing energy security, convergence of member state energy markets on the basis of EU internal energy market principles, supporting sustainable energy development, and attracting investment for energy projects of common and regional interest.[16]

External trade and investment

Uzbekistan's foreign trade policy is based on import substitution.[10] The system of multiple exchange rates combined with the highly regulated trade regime caused both imports and exports to drop each from about US$4.5 billion in 1996 to less than US$3 billion in 2002.[2] The success of stabilization and currency liberalization in 2003 has led to significant increases in exports and imports in recent years, although imports have increased much less rapidly: while exports had more than doubled to US$15.5 by 2011, imports had risen to US$6.5 billion only, reflecting the impact of the government's import substitution policies designed to maintain hard currency reserves. Draconian tariffs, sporadic border closures, and border crossing "fees" have a negative effect on legal imports of both consumer products and capital equipment. Uzbek farmers are deprived of seasonal opportunities to sell legally their popular tomatoes and vegetables for good prices in Kazakhstan. Instead, they are forced to dump their produce at reduced prices on local markets or alternatively continue "exporting" by paying stiff bribes to border guards and customs officers.[17] Uzbek consumers are deprived of access to low-cost Chinese goods that cross the border from Kyrgyzstan in normal times. Uzbekistan's traditional trade partners are the Commonwealth of independent States (CIS) countries, notably Russia, Ukraine, and Kazakhstan, which in aggregate account for over 40% of its exports and imports.[2] Non-CIS partners have been increasing in importance in recent years, with Turkey, China, Iran, South Korea, and the EU being the most active. As of 2011, Russia remains the main foreign trade partner for Uzbekistan.

Uzbekistan is a member of the International Monetary Fund, World Bank, Asian Development Bank, and European Bank for Reconstruction and Development. It has observer status at the World Trade Organization, is a member of the World Intellectual Property Organization, and is a signatory to the Convention on Settlement of Investment Disputes Between States and Nationals of Other States, the Paris Convention for the Protection of Industrial Property, the Madrid Agreement on Trademarks Protection, and the Patent Cooperation Treaty. In 2002, Uzbekistan was again placed on the special "301" Watch List for lack of intellectual copyright protection.

According to EBRD transition indicators,[18] Uzbekistan's investment climate remains among the least favorable in the CIS, with only Belarus and Turkmenistan ranking lower. The unfavorable investment climate has caused foreign investment inflows to dwindle to a trickle. It is believed that Uzbekistan has the lowest level of foreign direct investment per capita in the CIS. Since Uzbekistan's independence, U.S. firms have invested roughly $500 million in the country, but due to declining investor confidence, harassment, and currency convertibility problems, numerous international investors have left the country or are considering leaving.[10] In 2005, the Central Bank has revoked the license of the nascent Biznes Bank citing unspecified violations of local currency exchange rules. The revocation prompted immediate bankruptcy procedures, under which clients' deposits stay arrested for two month. No interest was accrued during that two-month period. In 2006, the Government of Uzbekistan forced out Newmont Mining Corporation (at the time the largest U.S. investor) from its gold mining joint venture in the Muruntau gold mine. Newmont and the government resolved their dispute, but the action adversely affected Uzbekistan's image among foreign investors. The government attempted the same with British-owned Oxus Mining. Coscom, a U.S.-owned telecommunications company, involuntarily sold its stake in a joint venture to another foreign company. GM-DAT, a Korean subsidiary of GM, is the only known U.S. business to have entered Uzbekistan in over two years. It recently signed a joint-venture agreement with UzDaewooAuto to assemble Korean-manufactured cars for export and domestic sale. Other large U.S. investors in Uzbekistan include Case IH, manufacturing and servicing cotton harvesters and tractors; Coca Cola, with bottling plants in Tashkent, Namangan, and Samarkand; Texaco, producing lubricants for sale in the Uzbek market; and Baker Hughes, in oil and gas development.

Banking

Uzbekistan’s banks have demonstrated reasonably stable performance in a largely state-dominated local economy. Sector stability is currently supported by rapid economic growth, low exposure to external financial markets and the strong external and fiscal position of the sovereign. However, the sector remains vulnerable to possible economic shocks due to weak corporate governance and risk management, fast recent asset growth, significant directed lending and acquisitions of problem assets. Banks’ foreign currency obligations, specifically those arising from trade finance, are particularly vulnerable due to existing foreign exchange constraints.[19]

According to Fitch Ratings, there are notable risks of asset quality deterioration in case of a reversal in economic trends. The funding base is mainly short-term, largely sourced from corporate current accounts, while retail funds account for only a small 25% of total deposits. Longer-term funding is provided by the Ministry of Finance and other state agencies, which comprise a notable proportion of sector liabilities. Foreign funding is small, estimated at about 10% of the total liabilities, and plans for further borrowings are moderate. Liquidity management is constrained be the lack of deep capital markets, and banks generally tend to hold substantial cash reserves on their balance sheets. The quality of capital is sometimes compromised by less conservative regulatory requirements for recognition of credit impairment and by investments in non-core assets.

Miscellaneous data

Household income or consumption by percentage share:

- lowest 10%: 2.8%

- highest 10%: 29.6% (2003)

Distribution of family income - Gini index: 36.8 (2003)

Agriculture - products: cotton, vegetables, fruits, grain; livestock

Industrial production growth rate: 6.2% (2003 est.)

Electricity:

- production: 47.7 TWh (2002)

- consumption: 46.66 TWh (2002)

- exports: 4.5 TWh (2002)

- imports: 6.8 TWh (2002)

Electricity - production by source:

- fossil fuel: 88.2%

- hydro: 11.8%

- other: 0% (2001)

- nuclear: 0%

Oil:

- production: 143,300 barrels per day (22,780 m3/d) (2004 est.)

- consumption: 142,000 barrels per day (22,600 m3/d) (2001 est.)

- exports: NA

- imports: NA

- proved reserves: 297,000,000 barrels (47,200,000 m3) (1 January 2002)

Natural gas:

- production: 63.1 billion m³ (2001 est.)

- consumption: 45.2 billion m³ (2001 est.)

- exports: 17.9 billion m³ (2001 est.)

- imports: 0 m³ (2001 est.)

- proved reserves: 937.3 billion m³ (1 January 2002)

Current account balance: $3.045 billion (2007 est.)

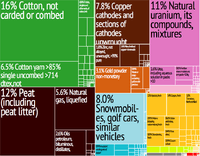

Exports - commodities:[2] cotton 17.2%, energy products 13.1%, metals 12.9%, machinery and equipment 10.1%, food products 7.9%, chemical products 5.6%, services 12.1%( 2006)

Imports - commodities:[2] machinery and equipment 40.3%, chemical products 15.0%, metals 10.4%, food products 8.1%, energy products 4.3%, services 9.1% (2006)

Reserves of foreign exchange & gold: $5.6 billion (Dec. 2007 est.)

Exchange rates: UZS per USD - 1,865 (early 2012)

UZS per EUR - 2,900

Current economy growth (6 months of 2009)[20]

- GDP growth +8,2%

- Volume of industrial production +9.1%

- Volume of agricultural production +4,6%

See also

References

- ↑ "Doing Business in Uzbekistan 2017". World Bank. Retrieved 2015-10-28.

- 1 2 3 4 5 6 7 8 9 10 11 State Committee of the Republic of Uzbekistan on statistics 2006 (Russian)

- ↑ Statistics on Cotton Production in 2010-2012, U.S. Department of Agriculture, 2012.

- ↑ http://www.imf.org/external/pubs/ft/weo/2006/01/data/dbcselm.cfm?G=2001

- 1 2 Central Bank of Uzbekistan database, February 2008

- 1 2 3 IMF World Economic Outlook Database, October 2007

- ↑ Ferghana.Ru Information Agency, October 24, 2007

- 1 2 Uzbekistan GDP forecast for 2009-2010

- 1 2 International Crisis Group, Uzbekistan: Stagnation and Uncertainty, Asia Briefing N°67, 22 August 2007

- 1 2 3 4 U.S. Department of State, Background Notes on Uzbekistan, March 2007

- ↑ IMF, Republic of Uzbekistan: Recent Economic Developments, IMF Staff Country Report 00/36, March 2000

- ↑ EBRD Transition Report 2007

- ↑ Waits, Douglas (December 23, 2013). "Uzbekistan eyes improvements for farmer banking services". CISTRAN Finance. Chicago, Ill. Retrieved January 3, 2014.

- ↑ IMF, Republic of Uzbekistan: Poverty Strategy Reduction Paper, IMF Country Report 08/34, January 2008

- ↑ Uzbekistan's Cotton: Riches Gathered by the Hands of Hungry Children, October 11, 2007 (in Russian)

- ↑ INOGATE website

- ↑ What Is Happening to Tomatoes?, June 26, 2007

- ↑ EBRD Uzbekistan Country Factsheet, 2007

- ↑ "Fitch: Uzbek Banks Benefit from Stable Macro Environment". The Gazette of Central Asia. Satrapia. 17 August 2012. Retrieved 17 August 2012.

- ↑ On results of socio-economic development of the Republic of Uzbekistan in the first half of 2009

Uzbekistan: Accession of Uzbekistan to the Free Trade Area (FTA) CIS