Endogenous money

| Economics |

|---|

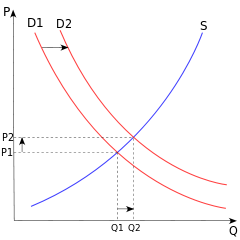

Supply and Demand graph, illustrating one of the most important economic principles |

|

|

| By application |

|

| Lists |

|

In post-Keynesian economics, endogenous money is the term used to convey the view that the quantity of money in an economy (conventionally, and by this account misleadingly, termed the money supply) is determined endogenously—that is, as a result of the interactions of other economic variables, rather than exogenously (autonomously) by an external authority such as a central bank.

The theoretical basis of this position is that money comes into existence driven by the requirements of the real economy and that banking system reserves expand or contract as needed to accommodate loan demand at prevailing interest rates. This theory is based on three main claims:

'Loans create deposits': for the banking system as a whole, drawing down a bank loan by a non-bank borrower creates new deposits (and the repayment of a bank loan destroys deposits). So while the quantity of bank loans may not equal deposits in an economy, a deposit is the logical concomitant of a loan – banks do not need to increase deposits prior to extending a loan. While banks can be capital-constrained, in most countries a solvent bank is never reserve-constrained or funding-constrained: it can always obtain reserves or funding either from the interbank market or from the central bank. Banks rationally pursue any profitable lending opportunities that they can identify up to the level consistent with their level of capital, treating reserve requirements and funding issues as matters to be addressed later – or rather, at an aggregate level. Therefore, the quantity of broad money in an economy is determined endogenously: in other words, the quantity of deposits held by the non-bank sector 'flexes' up or down according to the aggregate preferences of non-banks. Significantly, the theory states that if the non-bank sector's deposits are augmented by a policy-driven exogenous shock (such as quantitative easing), the sector can be expected to find ways to 'shed' most or all of the excess deposit balances by making payments to banks (comprising repayments of bank loans, or purchases of securities).

Central banks implement policy primarily through controlling short-term interest rates. The money supply then adapts to the changes in demand for reserves and credit caused by the interest rate change. The supply curve shifts to the right when financial intermediaries issue new substitutes for money, reacting to profit opportunities during the cycle. Even if the monetary authority refuses to accommodate such changes, banks can still increase reserves for loan demand through their own initiatives.

Given available credit, investment precedes and 'forces' the saving necessary to finance it. Investment determines saving rather than the converse since, in the modern world, no saving can appear without income being distributed, and no income can be distributed without entrepreneurs getting into debt. Therefore, investment plans do not need to consider savings. At times of a positive balance of payments, banks do not retain excess reserves, either lending the excess to other banks that are running a deficit on their balance of payments, by purchasing government debt for profit. It is precisely the credit-creation process dictated by profit seeking motives that is the source of instability.

Governments and central banks, both as lender of last resort and as regulator of financial practices, help monitor the level and quality of debt, and can stop a downward profit trend, which is the key variable for debt validation and for asset prices.

Proponents deny any practical impact of the money multiplier on lending and reserves.

History

Theories of endogenous money date to the 19th century, by Knut Wicksell,[1] and later Joseph Schumpeter.[2]

Knut Wicksell's (1898, 1906) theory of the "cumulative process" of inflation remains the first decisive swing at the idea of money as a "veil". Wicksell's process has its roots in that of Henry Thornton . Recall that the start of the quantity theory of money's mechanism is a "helicopter drop" of cash: an exogenous increase in the supply of money. Wicksell's theory claims, indeed, that increases in the supply of money lead to rises in the price level, but the original increase is endogenous, created by the relative conditions of the financial and real sectors.

With the existence of credit money, Wicksell argued, two interest rates prevail: the "natural" rate and the "money" rate. The natural rate is the return on capital—or the real profit rate. It can be roughly considered to be equivalent to the marginal product of new capital. The money rate, in turn, is the loan rate, an entirely financial construction. Credit, then, is perceived quite appropriately as "money". Banks provide credit, after all, by creating deposits upon which borrowers can draw. Since deposits constitute part of real money balances, therefore the bank can, in essence, "create" money.

Wicksell's main thesis, the disequilibrium engendered by real changes leads endogenously to an increase in the demand for money - and, simultaneously, its supply as banks try to accommodate it perfectly. Given full employment, (a constant income Y) and payments structure (constant monetary velocity V), then in terms of the equation of exchange, MV = PY, a rise in the money supply M leads only to a rise in the price level P. Thus, the story of the quantity theory of money, the long-run relationship between money supply growth and inflation, is kept in Wicksell.

Primarily, Say's law is violated and abandoned by the wayside. However, real aggregate supply does constrain. Inflation results because capital goods industries cannot meet new, real demands for capital goods by entrepreneurs by increasing capacity. They may try but this would involve making higher bids in the factor market which itself is supply-constrained—thus raising factor prices and hence the price of goods in general. In short, inflation is a real phenomenon brought about by a rise in real aggregate demand over and above real aggregate supply.

Finally, for Wicksell the endogenous creation of money, and how it leads to changes in the real market (i.e. increased real aggregate demand) is fundamentally a breakdown of the neoclassical tradition of a dichotomy between the monetary and real sectors. Money is not a "veil" - agents do react to it and this is not due to some irrational money illusion. However, for Wicksell, in the long run, the quantity theory still holds: money is still neutral in the long run, although to do so, we have broken the cherished neoclassical principles of dichotomy, money supply exogeneity and Say's law.[3]

In March 2014 the Bank of England wrote a widely distributed primer endorsing endogenous money and control of the money supply by private banks.[4]

Branches

Endogenous money is a heterodox economic theory with several strands, mostly associated with the post-Keynesian school. Multiple theory branches developed separately and are to some extent compatible (emphasizing different aspects of money), while remaining united in opposition to the New Keynesian theory of money creation.

- Chartalism emphasizes fiat money creation by governments, which they argue is by deficit spending.

- The (quantum) theory of money emissions emphasizes money's creation by commercial banks and its integration with production on the labour market. The theory was developed by the French economist Bernard Schmitt.

- Monetary circuit theory was developed in France and Italy, and emphasizes credit money creation by banks. A detailed explanation of monetary circuit theory was provided by Augusto Graziani in the book The Monetary Theory of Production.[5]

- Horizontalism was developed in America by economist Basil Moore, who was also its main proponent in the 1970s and 1980s. It emphasizes credit money creation by banks.

- Gunnar Heinsohn and Otto Steiger in their book "Eigentum, Zins und Geld" developed a theory called "Property Theory of Money", which also explains money by endogenous processes.

Exogenous theories of money

Mainstream (New Keynesian) economic theory states that the quantity of broad money is a function of the quantity of "high-powered money" or "government money" (notes, coins and bank reserves), and the money multiplier. New Keynesian economists believe that when a bank has no excess reserves, new credits can only be granted if banks' deposits increase. Monetary authorities can use either interest rates or the quantity of money, generally having favored the former during the Great Moderation.

Notes

- ↑ (Wicksell 1898)

- ↑ A handbook of alternative monetary economics, by Philip Arestis, Malcolm C. Sawyer, p. 53

- ↑ http://newschool.edu/~het/home.htm. Retrieved September 18, 2012. Missing or empty

|title=(help) - ↑ http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

- ↑ (Graziani 2003)

References

- Wicksell, Knut (1898), Interest and Prices

- Leijonhufvud, Axel The Wicksell Connection: Variation on a Theme. UCLA. November 1979.

- Lavoie, Marc (2003), "A Primer on Endogenous Credit-money" (PDF), in Rochon, Louis-Philippe; Rossi, Sergio, Modern Theories of Money: The Nature and Role of Money in Capitalist Economies, Edward Elgar Publishing, pp. 506–543, ISBN 1-84064-789-2

- Graziani, Augusto The Monetary Theory of Production. Cambridge, 2003

- Wicksell and origins of modern monetary theory-Lars Pålsson Syll