Disinflation

Disinflation is a decrease in the rate of inflation – a slowdown in the rate of increase of the general price level of goods and services in a nation's gross domestic product over time. It is the opposite of reflation. Disinflation occurs when the increase in the “consumer price level” slows down from the previous period when the prices were rising.

If the inflation rate is not very high to start with, disinflation can lead to deflation – decreases in the general price level of goods and services. For example, if the annual inflation rate for the month of January is 5% and it is 4% in the month of February, the prices disinflated by 1% but are still increasing at a 4% annual rate. Again if the current rate is 1% and it is –2% for the following month, prices disinflated by 3% i.e. [1%–(-2)%] and are decreasing at a 2% annual rate.

Causes

There is widespread consensus among economists that inflation is caused by increases in the supply of money available for use in a nation's economy. Inflation can also occur when the economy 'overheats' because of excess aggregate demand (this is called demand-pull inflation). The causes of disinflation are the opposite, either a decrease in the growth rate of the money supply, or a business cycle contraction (recession). If the central bank of a country enacts tighter monetary policy, that is to say, the government starts selling its securities, the supply of money in an economy is reduced. This contraction of the money supply is known as quantitative tightening. During a recession, competition among businesses for customers becomes more intense, and so retailers are no longer able to pass on higher prices along to their customers. The main reason is that when the central bank adopts tight monetary policy, it becomes expensive to access money, which reduces demand for goods and services in the economy. Even though demand for commodities falls, supply of commodities remains unaltered. Thus, prices fall over time, which leads to disinflation.[1] In contrast, deflation occurs when prices are actually dropping.[2]

A growth rate of unemployment below the natural rate of growth leads to an increase in the rate of inflation. But a growth rate of unemployment above the natural rate of growth leads to a decrease in the rate of inflation, also known as disinflation. This happens because when people are jobless they have less money to spend, which indirectly implies a money supply reduction in an economy.

Japan an example of disinflated economy

The best example for a disinflated economy is Japan. In 1990 Japan's output growth rate was 5.2%, unemployment rate was 2.1% and inflation rate was 2.4%. But in 1992 the output growth rate fell to 1.0%, unemployment rate rose to 2.2% and inflation rate decreased to 1.7%. In the year 2000 the output growth rate was 2.8%, unemployment rate was 4.7% and inflation rate was –1.6%.[3]

| Year | Output Growth Rate % | Unemployment Rate % | Inflation Rate % |

|---|---|---|---|

| 1990 | 5.2 | 2.1 | 2.4 |

| 1991 | 3.4 | 2.1 | 3.0 |

| 1992 | 1.0 | 2.2 | 1.7 |

| 1993 | 0.2 | 2.5 | 0.6 |

| 1994 | 1.1 | 2.9 | 0.1 |

| 1995 | 1.9 | 3.1 | –0.4 |

| 1996 | 3.4 | 3.4 | –0.8 |

| 1997 | 1.9 | 3.4 | 0.4 |

| 1998 | -1.1 | 3.4 | –0.1 |

| 1999 | 0.1 | 4.1 | –1.4 |

| 2000 | 2.8 | 4.7 | –1.6 |

| 2001 | 0.4 | 5.0 | –1.6 |

| 2002 | -0.3 | 5.4 | –1.2 |

| 2003 | 2.7 | 5.3 | –2.5 |

| 2004 | 3.0 | 5.0 | –1.8 |

Disinflation distinguished from deflation

If disinflation continues until the inflation rate is zero, the economy enters a deflationary period, with decreasing general prices on all goods and services produced. An example of this happened during the month of October 2008, when U.S. consumer prices fell (deflation) by 1.01% but the overall annual inflation rate simply decreased (disinflation) from an annual rate of 4.94% to 3.66%.[4] So the distinction between deflation and disinflation at that point was simply one of which time period was referred to—the monthly basis or the annual basis. Over the year, prices were up 3.66% while over the month prices were down 1.01%.

Disinflation is reduction in the inflation rate. Prices are still rising during disinflation, but at a lower rate. The general price level still rises, but at a slower rate resulting in a lower rate of real value destruction in money and other monetary items.

Deflation is a sustained decrease in the general price level (negative inflation rate) resulting in a sustained increase in the real value of money and other monetary items. Money and other monetary items are worth more all the time during deflation as opposed to being worth less all the time during inflation. Deflation causes an increase in the real value of money and other monetary items.

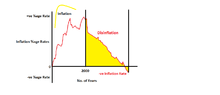

Disinflation, the Phillips curve and sacrifice ratio

The Phillips Curve shows that there is a negative relationship between inflation and unemployment.

The relationship between the Phillips curve and disinflation can be written as Өt-Өt-1=-ἀ(ut-un).

Here Өt is the present year's rate of inflation, Өt-1 is the previous year's rate of inflation, ut is the actual rate of unemployment and un is the natural rate of unemployment. ἀ is the parameter that captures the effect of unemployment on the wage. The L.H.S (left hand side) of the equation is the change in the inflation rate. The above equation explains that the change in the rate of inflation depends upon the difference between the actual rate of unemployment and the natural rate of unemployment i.e., (ut-un). The rate of inflation would decrease when the actual rate of unemployment is higher than the natural rate of unemployment leading to Disinflation. The inflation rate would increase when natural unemployment rate is higher than the actual unemployment rate.

To decrease the rate of inflation, the left side of the equation must be negative and the term (ut-un) must be positive. Mathematically:

ut > un = Disinflation ut < un = High Inflation

Though a decrease in the rate of inflation and the unemployment growth rate are related to each other, the relationship does not depend on the speed of disinflation. Simply speaking, the rate of inflation can be slowed by increasing the rate of unemployment at a smaller rate spread over many years—or disinflation can be achieved quickly by increasing the rate of unemployment at a higher rate spread over a few years. When we sum the rate of unemployment over the years, it is same.

This phenomenon can be explained with the help of point-year of excess unemployment.[5] It is the difference between the actual and the natural rate of unemployment of one percentage point for one year. For example, suppose the natural rate of unemployment is 9%; an unemployment rate of 15% for 5 years in a row corresponds to five times (15-9 = 6; 5*6 = 30) point years of excess unemployment. Suppose the central bank wants to reduce inflation from 15% to 10% so that inflation rate equals to 5% and that too within a period of 1 year. The equation Өt-Өt-1=-ἀ(ut-un). states that to reduce the inflation rate to 5% requires one year of unemployment at 10% above the natural rate. The R.H.S equals to –5% and the inflation rate decreases by 10% within a year. Following this phenomenon to reduce inflation over 5 years requires 5 years of unemployment at 1%i.e.(10/5) above the natural rate, and so on. We can note that in the above phenomenon the number of point-years of excess unemployment required to decrease inflation is the same i.e. 5%.

A cost is always involved in reducing inflation. This is explained with the help of a sacrifice ratio. The sacrifice ratio is the amount of cost required to reduce the rate of inflation over time. It is the ratio of the aggregate percentage loss of GDP to the decrease in inflation. For example, suppose the central bank wants to reduce the inflation rate from 20% to 12% over a period of 4 years. To achieve this rate, suppose the economy must bear the cost of an output level 12% below plausible in the first year, 9% below the plausible in the second year, 6% below plausible in the third year, and 5% below plausible in the fourth year. Thus the total loss of GDP is 32% (12%+9%+6%+5%) and the decrease in inflation rate is 8%. Thus the sacrifice ratio is 4 (32/8).

Disinflation strategies

To reduce inflation, policymakers must choose between cold-turkey and gradualist policies. Cold-Turkey policies try to reduce the inflation rate as quickly as possible towards a target. Gradualist policies reduce the rate of inflation is reduced at a slow pace, that is to say these policies move the economy slowly towards a target. Cold-turkey policies create a shock-effect, which might not be good for the economy if the shock is great but can be good for the economy if it builds policymaker trustworthiness. New information can be incorporated if the gradualist policies are played out by the policymakers.[6]

Credibility and cost of inflation

The Lucas critique states that it is improbable to assume that wage setters would not consider changes in policy when forming their expectation. If wage setters believe that policymakers are committed to decreasing the inflation rate, they lower their expectations of inflation, and this leads to a decline in the rate of actual inflation without the need for prolonged recession. This can be explained with the help of the above-mentioned equation, in which expected inflation is taken on the right: Өt=Өte-ἀ(ut-un). If the wage-setters look at the previous year's inflation rate and form their expectations accordingly, then inflation rate can be reduced only by accepting a higher rate of unemployment for some period. If Өte=Өt-1, from Өt-Өt-1=-ἀ(ut-un. Thus, to achieve: Өt < Өt-1, it must be that ut > un) If, however, wage-setters expect the rate of inflation to fall from 9% to 5%—i.e., it will indeed be lower than the past—then inflation would fall to 5% even if unemployment remains at the natural rate of unemployment.

One of the most important constituents of successful disinflation is the credibility of monetary policy according to Thomas J. Sargent. It states that the beliefs of wage setters are affected if they feel that the central bank are religiously committed in reducing the rate of inflation. The way the wage-setters formed their expectations can only be changed with the help of credibility. The credibility view is that fast disinflation is likely to be more credible than slow disinflation. Credibility decreases the unemployment cost of disinflation. Therefore, the central bank should go for fast disinflation.

See also

References

- ↑ Stephan Smith FX, Disinflation, 15.11.2010

- ↑ investopedia.com - Disinflation

- ↑ Blanchard, Olivier (2000). Macroeconomics (Second ed.). Prentice Hall. ISBN 0-13-013306-X.

- ↑ Inflation Rates for Jan 2000 - Present

- ↑ Blanchard, Olivier (2000). Macroeconomics (Second ed.). Prentice Hall. ISBN 0-13-013306-X. pg. 194

- ↑ <https://books.google.com/books?id=J-XtAAAAMAAJ&q=macroeconomics dornbusch fischer startz 11th edition&dq=macroeconomics dornbusch fischer startz 11th edition&hl=en&ei=n_y_Ts3jB8HWrQezgeG_AQ&sa=X&oi=book_result&ct=book-thumbnail&resnum=2&ved=0CDwQ6wEwAQ>.

Further reading

- Meltzer, A.H. (2006), "From Inflation to More Inflation, Disinflation, and Low Inflation" (PDF), American Economic Review, 96 (2): 185–188, doi:10.1257/000282806777211900

- Goodfriend, M.; King, R.G. (2005), "The incredible Volcker disinflation" (PDF), Journal of Monetary Economics, 52 (5): 981–1015, doi:10.1016/j.jmoneco.2005.07.001

- Calvo, G.A.; Celasun, O.Y.A.; Kumhof, M. (2003), "Inflation Inertia and Credible Disinflation-The Open Economy Case", NBER Working Paper

- Siklos, P.L.; Waterloo, O.N.; Zhang, Y.; Ottawa, O.N. (2006), "Inflation, Disinflation, and Deflation in China: Identifying the Shocks Driving Inflation" (PDF), Western Economic Association meetings in San Diego, California, and the Summer workshop of the Hong Kong Institute for Monetary Research

- Guillermo Calvo; Carlos A. Vegh (1999), "Inflation Stabilization and BOP Crisis in Developing Countries", NBER Working Paper No. 6925

External links

- Globalization and Global Disinflation by Kenneth Rogoff, at IMF.com

- What is Disinflation by Timothy McMahon, at InflationData.com

- http://www.voxeu.org/index.php?q=node/3025

- http://economia.unipv.it/pagp/pagine_personali/gascari/disiflation_msvsirr_may_2011.pdf