Crony capitalism

Crony capitalism is a term describing an economy in which success in business depends on close relationships between business people and government officials. It may be exhibited by favoritism in the distribution of legal permits, government grants, special tax breaks, or other forms of state interventionism.[1][2] Crony capitalism is believed to arise when business cronyism and related self-serving behavior by businesses or businesspeople spills over into politics and government,[3] or when self-serving friendships and family ties between businessmen and the government influence the economy and society to the extent that it corrupts public-serving economic and political ideals.

The term "crony capitalism" made a significant impact in the public arena as an explanation of the Asian financial crisis.[4] It is also used to describe governmental decisions favoring "cronies" of governmental officials. In this context, the term is often used interchangeably with corporate welfare; to the extent that there is a difference, it may be the extent to which a government action can be said to benefit individuals rather than entire industries.

In practice

Crony capitalism exists along a continuum. In its lightest form, crony capitalism consists of collusion among market players which is officially tolerated or encouraged by the government. While perhaps lightly competing against each other, they will present a unified front (sometimes called a trade association or industry trade group) to the government in requesting subsidies or aid or regulation.[5] Newcomers to a market may find it difficult to find loans, acquire shelf space, or receive official sanction. Some such systems are very formalized, such as sports leagues and the Medallion System of the taxicabs of New York City, but often the process is more subtle, such as expanding training and certification exams to make it more expensive for new entrants to enter a market and thereby limit competition. In technological fields, there may evolve a system whereby new entrants may be accused of infringing on patents that the established competitors never assert against each other. In spite of this, some competitors may succeed when the legal barriers are light.

The term crony capitalism is generally used when these practices come to dominate the economy as a whole or to dominate the most valuable industries in an economy.[2] Intentionally ambiguous laws and regulations are common in such systems. Taken strictly, such laws would greatly impede practically all business; in practice, they are only erratically enforced. The specter of having such laws suddenly brought down upon a business provides incentive to stay in the good graces of political officials. Troublesome rivals who have overstepped their bounds can have the laws suddenly enforced against them, leading to fines or even jail time. Even in high-income democracies with well-established legal systems and freedom of the press a larger state is associated with more political corruption.[6]

The term crony capitalism was initially applied to states involved in the 1997 Asian Financial Crisis such as Thailand and Indonesia. In these cases, the term was used to point out how family members of the ruling leaders become extremely wealthy with no non-political justification. Southeast Asian nations still score very poorly in rankings measuring this. Hong Kong,[7] and Malaysia[8] are perhaps most noted for this, and the term has also been applied to the system of oligarchs in Russia.[9][10] Other states to which the term has been applied include India,[11] in particular, the system after the 1990s liberalization whereby land and other resources were given at throwaway prices in the name of public private partnerships, Argentina[12] and Greece.[13] Wu Jinglian, one of China's leading economists[14] and a longtime advocate of its transition to free markets, says that it faces two starkly contrasting futures: a market economy under the rule of law or crony capitalism.[15]

Many prosperous nations have also had varying amounts of cronyism throughout their history including the United Kingdom - especially in the 1600s and 1700s, United States,[2][16] and Japan.

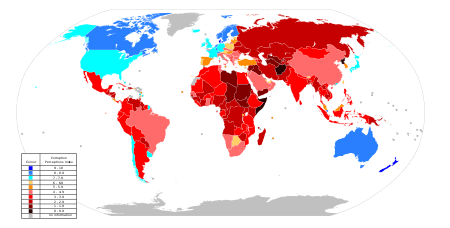

Crony capitalism index

The Economist benchmarks countries based on a "crony-capitalism index" calculated via how much economic activity occurs in industries prone to cronyism. Its 2014 Crony Capitalism Index ranking listed Hong Kong, Russia and Malaysia in the top 3 spots.[10]

Crony Capitalism in Finance

Crony capitalism in finance was found in the Second Bank of the United States. It was a private company, but its largest stockholder was the federal government which owned 20%. It was an early bank regulator and grew to be one being the most powerful organizations in the country due largely to being the depository of the government’s revenue.[17]

The Gramm-Leach-Bliley Act in 1999 completely removed Glass-Steagall’s separation between commercial banks and investment banks. After this repeal, commercial banks, investment banks, and insurance companies combined their lobbying efforts. Critics claim this was instrumental in the passage of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005.[18]

In sections of an economy

More direct government involvement in a specific sector can also lead to specific areas of crony capitalism, even if the economy as a whole may be competitive. This is most common in natural resource sectors through the granting of mining or drilling concessions, but it is also possible through a process known as regulatory capture where the government agencies in charge of regulating an industry come to be controlled by that industry. Governments will often, in good faith, establish government agencies to regulate an industry. However, the members of an industry have a very strong interest in the actions of that regulatory body, while the rest of the citizenry are only lightly affected. As a result, it is not uncommon for current industry players to gain control of the "watchdog" and to use it against competitors. This typically takes the form of making it very expensive for a new entrant to enter the market. An 1824 landmark U.S. Supreme Court ruling overturned a New York State-granted monopoly ("a veritable model of state munificence" facilitated by one of the Founding Fathers, Robert R. Livingston) for the then-revolutionary technology of steamboats.[19] Leveraging the Supreme Court's establishment of Congressional supremacy over commerce, the Interstate Commerce Commission was established in 1887 with the intent of regulating railroad "robber barons". President Grover Cleveland appointed Thomas M. Cooley, a railroad ally, as its first chairman and a permit system was used to deny access to new entrants and legalize price fixing.[20]

The defense industry in the United States is often described as an example of crony capitalism in an industry. Connections with the Pentagon and lobbyists in Washington are described by critics as more important than actual competition, due to the political and secretive nature of defense contracts. In the Airbus-Boeing WTO dispute, Airbus (which receives outright subsidies from European governments) has stated Boeing receives similar subsidies, which are hidden as inefficient defense contracts.[21] Other American defense companies were put under scrutiny for no-bid contracts for Iraq war and Hurricane Katrina related contracts purportedly due to having cronies in the Bush administration.[22]

Gerald P. O'Driscoll, former vice president at the Federal Reserve Bank of Dallas, stated that Fannie Mae and Freddie Mac became examples of crony capitalism. Government backing let Fannie and Freddie dominate mortgage underwriting. "The politicians created the mortgage giants, which then returned some of the profits to the pols - sometimes directly, as campaign funds; sometimes as "contributions" to favored constituents."[23]

Creation in developing economies

In its worst form, crony capitalism can devolve into simple corruption, where any pretense of a free market is dispensed with. Bribes to government officials are considered de rigueur and tax evasion is common; this is seen in many parts of Africa, for instance. This is sometimes called plutocracy (rule by wealth) or kleptocracy (rule by theft).

Corrupt governments may favor one set of business owners who have close ties to the government over others. This may also be done with racial, religious, or ethnic favoritism; for instance, Alawites in Syria have a disproportionate share of power in the government and business there. (President Assad is an Alawite.)[24] This can be explained by considering personal relationships as a social network. As government and business leaders try to accomplish various things, they naturally turn to other powerful people for support in their endeavors. These people form hubs in the network. In a developing country those hubs may be very few, thus concentrating economic and political power in a small interlocking group.

Normally, this will be untenable to maintain in business; new entrants will affect the market. However, if business and government are entwined, then the government can maintain the small-hub network.

Raymond Vernon, specialist in economics and international affairs,[25] wrote that the Industrial Revolution began in Great Britain, because they were the first to successfully limit the power of veto groups (typically cronies of those with power in government) to block innovations.[26] "Unlike most other national environments, the British environment of the early 19th century contained relatively few threats to those who improved and applied existing inventions, whether from business competitors, labor, or the government itself. In other European countries, by contrast, the merchant guilds ... were a pervasive source of veto for many centuries. This power was typically bestowed upon them by government". For example, a Russian inventor produced a steam engine in 1766 and disappeared without a trace. "[A] steam powered horseless carriage produced in France in 1769 was officially suppressed." James Watt began experimenting with steam in 1763, got a patent in 1769, and began commercial production in 1775.[27]

Raghuram Rajan, governor of the Reserve Bank of India, has said "One of the greatest dangers to the growth of developing countries is the middle income trap, where crony capitalism creates oligarchies that slow down growth. If the debate during the elections is any pointer, this is a very real concern of the public in India today."[28] Tavleen Singh, columnist for The Indian Express has disagreed. According to her, India's corporate success is not a product of crony capitalism, but because India is no longer under the influence of crony socialism.[29]

Political viewpoints

While the problem is generally accepted across the political spectrum, ideology shades the view of the problem's causes and therefore its solutions. Political views mostly fall into two camps which might be called the socialist and capitalist critique. The socialist position is that broadly democratic government must regulate economic, or wealthy, interests in order to restrict monopoly. The capitalist position is that "natural monopolies" are rare, therefore governmental regulations generally abet established wealthy interests by restricting competition.[30]

Socialist critique

Critics of crony capitalism including socialists and anti-capitalists often assert that crony capitalism is the inevitable result of any strictly capitalist system. Jane Jacobs described it as a natural consequence of collusion between those managing power and trade, while Noam Chomsky has argued that the word "crony" is superfluous when describing capitalism.[31] Since businesses make money and money leads to political power, business will inevitably use their power to influence governments. Much of the impetus behind campaign finance reform in the United States and in other countries is an attempt to prevent economic power being used to take political power.

Ravi Batra argues that "all official economic measures adopted since 1981...have devastated the middle class" and that the Occupy Wall Street movement should push for their repeal and thus end the influence of the super wealthy in the political process, which he considers a manifestation of crony capitalism.[32]

Socialist economists, such as Robin Hahnel, have criticized the term as an ideologically motivated attempt to cast what is in their view the fundamental problems of capitalism as avoidable irregularities.[33] Socialist economists dismiss the term as an apologetic for failures of neoliberal policy and, more fundamentally, their perception of the weaknesses of market allocation.

Capitalist critique

Supporters of capitalism generally oppose crony capitalism as well, and consider it an aberration brought on by governmental favors incompatible with free market.[34][35] In this view, crony capitalism is the result of an excess of socialist-style interference in the market, which inherently will result in a toxic combination of corporations and government officials running the sector of the economy. Some advocates prefer to equate this problem with terms such as "corporatism, a modern form of mercantilism"[36] to emphasize that the only way to run a profitable business in such a system is to have help from corrupt government officials.

Even if the initial regulation was well-intentioned (to curb actual abuses), and even if the initial lobbying by corporations was well-intentioned (to reduce illogical regulations), the mixture of business and government stifle competition,[37] a collusive result called regulatory capture. Burton W. Folsom, Jr. distinguishes those that engage in crony capitalism—designated by him "political entrepreneurs"—from those who compete in the marketplace without special aid from government, whom he calls "market entrepreneurs". The market entrepreneurs, such as Hill, Vanderbilt, and Rockefeller, succeeded by producing a quality product at a competitive price. The political entrepreneurs, for example, Edward Collins in steamships and the leaders of the Union Pacific Railroad in railroads, were men who used the power of government to succeed. They tried to gain subsidies or in some way use government to stop competitors.[38]

See also

References

Vernon, Raymond (1989), "Technological Development", EDI Seminar Paper, 39, ISBN 978-0821311622

Notes

- ↑ Helen Hughes (Spring 1999). "Crony Capitalism and the East Asian Currency and Financial 'Crises'". Policy . Retrieved 2012-07-22.

Japan’s dismal performance in the 1990s and the East Asian collapses of 1997 indicate that dirigisme can only boost economies in the short run and at high cost. It breaks down in the long run (Lindsey and Lukas 1998).

External link in|magazine=(help) - 1 2 3 Kristof, Nicholas (March 27, 2014). "A Nation of Takers?". New York Times. Retrieved March 27, 2014.

- ↑ The Discovery that Business Corrupts Politics: A Reappraisal of the Origins of Progressivism, by McCormick, Richard. 1981. The American Historical Review, Vol. 86, No. 2 (Apr., 1981), pp. 247-274.

- ↑ Kang, David C. (2002). Crony Capitalism: Corruption and Development in South Korea and the Philippines (PDF). Cambridge: Cambridge University Press. ISBN 978-0-521-00408-4.

Focused only on explaining successful outcomes, the conventional model provided no analytic way to explain the 1997 crisis. Countries previously regarded as miracles now were nothing more than havens for crony capitalists (p.3)

- ↑ "Uber vs. Washington, D.C.: This Is Insane". July 10, 2012. Retrieved July 11, 2012.

a fight over a new competitor to the District's (often horrible) taxi service offers something I haven't seen in a while. Not routine retail-level corruption, nor skillful top-level favor trading, but instead what appears to be a blatant attempt to legislate favors for one set of interests by hamstringing another.

- ↑ Hamilton, Alexander (2013), Small is beautiful, at least in high-income democracies: the distribution of policy-making responsibility, electoral accountability, and incentives for rent extraction , World Bank.

- ↑ Vines, Stephen (1 April 2014). "Why Hong Kong's latest No 1 ranking was greeted with silence". South China Morning Post. Retrieved 4 April 2014.

- ↑ http://scholarlycommons.law.northwestern.edu/cgi/viewcontent.cgi?article=1213&context=facultyworkingpapers

- ↑ "Having it both ways". The Economist. May 20, 2004.

- 1 2 "The countries where politically connected businessmen are most likely to prosper". The Economist. 15 March 2014. Retrieved 4 April 2014.

- ↑ "Govt Patronises Crony Capitalism Again". June 19, 2011. Retrieved 11 August 2013.

- ↑ "Peronism and its perils". The Economist. June 3, 2004.

- ↑ "The Scourge of Crony Capitalism". June 20, 2012. Retrieved 9 October 2013.

- ↑ "Keeping an eye on business". The Economist. May 27, 2004.

- ↑ Jinglian, Wu (June 2006). "The road ahead for capitalism in China". The McKinsey Quarterly.

- ↑ "Planet Plutocrat: The countries where politically connected businessmen are most likely to prosper". The Economist. March 15, 2014.

- ↑ Zingales, Luigi (2012). A Capitalism for the People: Recapturing the Lost Genius of American Prosperity. New York: Basic Books. p. 50.

- ↑ Zingales, Luigi (2012). A Capitalism for the People: Recapturing the Lost Genius of American Prosperity. New York: Basic Books. pp. 50–52.

- ↑ Styles, T.J. The First Tycoon: The Epic Life of Cornelius Vanderbilt. ISBN 978-0-375-41542-5.

Property requirements for suffrage under New York's constitution of 1777 hardened the culture of rank into law. Two distinct levels of wealth were required to vote, one for state assembly, and a second and higher level for the state senators and governor... [this suffrage scheme fostered] mercantilism, which in the state empowered private parties to carry out activities thought to serve the public interest. The standard reward for such an undertaking was a monopoly—just what Chancellor Livingston sought when he offered to meet a most pressing public need, the need for steamboats...Livingston maneuvered...the monopoly through the legislature ("a veritable model of state munificence," as legal scholar Maurice G. Baxter writes—that gave him the right to seize steamboats the entered New York waters from other states. But Livingston had overreached. With so many inventors and investors interested in the steamboat, the monopoly on served to limit its adoption. The new technology was simply too important for the monopoly to remain unchallenged. (pp.39-42)

- ↑ Lee, Timothy (August 3, 2006). "Entangling the Web". The New York Times. Retrieved December 13, 2011.

- ↑ "Pulling Boeing Out of a Tailspin". Business Week. December 15, 2003. Retrieved December 13, 2011.

A national treasure, once No. 1 in commercial aviation, Boeing has become a risk-averse company stumbling to compete in the marketplace and dependent on political connections and chicanery to get government contracts. Boeing needs a strong board and a rejuvenated corporate culture based on innovation and competitiveness, not crony capitalism.

- ↑ Dreier, Peter (March 2006). "Katrina and Power in America". Occidental College. Retrieved July 22, 2012.

Three companies—the Shaw Group, Kellogg Brown & Root (KBR, a subsidiary of Haliburton, whose former CEO is Vice President Dick Cheney), and Boh Brothers Construction of New Orleans—quickly scooped up no-bid ACE contracts to perform the restoration. Bechtel and Fluor (also with close GOP ties) also reaped huge contracts. The Department of Defense has been criticized for awarding Iraq reconstruction contracts to Haliburton and Bechtel without competition (Broder 2005)

- ↑ O'Driscoll Jr, Gerald P. (September 9, 2008). "Fannie/Freddie Bailout Baloney". New York Post.

- ↑ Syrian Businessman Becomes Magnet for Anger and Dissent "Like Mr. Ezz in Egypt, he has become a symbol of how economic reforms turned crony socialism into crony capitalism, making the poor poorer and the connected rich fantastically wealthier."

- ↑ "Raymond Vernon Dies at 85". The Harvard University Gazette. President and Fellows of Harvard College. September 23, 1999. Retrieved February 9, 2013.

- ↑ Vernon (1989)

- ↑ Vernon (1989, p. 8); see also Watt steam engine and James Watt

- ↑ "Crony capitalism a big threat to countries like India, RBI chief Raghuram Rajan says". Times of India. 12 August 2014. Retrieved 6 November 2014.

- ↑ http://archive.indianexpress.com/news/no-crony-capitalism-in-india/821341/

- ↑ http://gothamist.com/2014/11/29/uber_driving_down_price_of_taxi_med.php

- ↑ "Black Faces in Limousines:" A Conversation with Noam Chomsky from Chomsky.info accessed on June 5, 2009

- ↑ Batra, Ravi (11 October 2011). "The Occupy Wall Street Movement and the Coming Demise of Crony Capitalism". Truthout. Retrieved 21 October 2011.

- ↑ Robin Hahnel. "Let's Review".

IMF officials Michel Camdessus and Stanley Fischer were quick to explain that the afflicted economies had only themselves to blame. Crony capitalism, lack of transparency, accounting procedures not up to international standards, and weak-kneed politicians too quick to spend and too afraid to tax were the problems according to IMF and US Treasury Department officials. The fact that the afflicted economies had been held up as paragons of virtue and IMF/World Bank success stories only a year before, the fact that neoliberalism’s only success story had been the Newly Industrialized Countries (NIC's) who were now in the tank, and the fact that the IMF and Treasury department story just didn’t fit the facts since the afflicted economies were no more rife with crony capitalism, lack of transparency, and weak-willed politicians than dozens of other economies untouched by the Asian financial crisis, simply did not matter.

- ↑ Nicholas D. Kristof (Oct 26, 2011). "Crony Capitalism Comes Home". The New York Times. Retrieved Nov 27, 2011.

some financiers have chosen to live in a government-backed featherbed. Their platform seems to be socialism for tycoons and capitalism for the rest of us...featherbedding by both unions and tycoons...are impediments to a well-functioning market economy.

- ↑ John Stossel (2010). "Let's Take the "Crony" Out of "Crony Capitalism"". Archived from the original on May 13, 2012. Retrieved Nov 26, 2011.

The truth is that we don't have a free market — government regulation and management are pervasive — so it's misleading to say that "capitalism" caused today's problems. The free market is innocent. But it's fair to say that crony capitalism created the economic mess.

- ↑ Ben Shapiro (2011). "There's No Such Thing as "Crony Capitalism"". Retrieved Nov 26, 2011.

This "crony capitalism," Sarah Palin said, is "not the capitalism of free men and free markets." In general, she's right. But...her terminology...is dead wrong. The fact is that there is no such thing as "crony capitalism." In reality, it is corporatism, a modern form of mercantilism. Corporatism is based on the notion that industries comprise the economy like body parts comprise the body — they must work in concert with one another, and they must take central direction.

- ↑ John Stossel (2010). "Let's Take the "Crony" Out of "Crony Capitalism"". Retrieved Nov 26, 2011.

Which are more likely to be hampered by vigorous regulatory standards: entrenched corporations with their overstaffed legal and accounting departments or small startups trying to get off the ground? Regulation can kill competition — and incumbents like it that way.

- ↑ Folsom, Burton. "Myth of the Robber Barons". Retrieved Nov 28, 2011.

The author, Burton Folsom, divides the entrepreneurs into two groups: market entrepreneurs and political entrepreneurs.

Further reading

- Wei, Shang-Jin (2001). "Domestic Crony Capitalism and International Fickle Capital: Is There a Connection?". International Finance. 4: 15–45. doi:10.1111/1468-2362.00064.

- Kang, David C. (2003). "Transaction Costs and Crony Capitalism in East Asia". Comparative Politics. 35 (4): 439–58. doi:10.2307/4150189. JSTOR 4150189.

- Ip, Po-Keung (2007). "Corporate Social Responsibility and Crony Capitalism in Taiwan". Journal of Business Ethics. 79: 167–77. doi:10.1007/s10551-007-9385-5.

- Hughes, Sallie; Lawson, Chappell H. (2004). "Propaganda and Crony Capitalism: Partisan Bias in Mexican Television News". Latin American Research Review. 39 (3): 81–105. doi:10.1353/lar.2004.0050. JSTOR 1555469.

- Shah, Ajay (7 September 2012). "Indian capitalism is not doomed". Ajay Shah's Blog.

- Singh, Ajit; Zammit, Ann (2006). "Corporate Governance, Crony Capitalism and Economic Crises: Should the US business model replace the Asian way of 'doing business'?". Corporate Governance: an International Review. 14 (4): 220–33. doi:10.1111/j.1467-8683.2006.00504.x.

- Johnson, Chalmers (1998). "Economic crisis in East Asia: The clash of capitalisms". Cambridge Journal of Economics. 22 (6): 653–61. doi:10.1093/cje/22.6.653.

- Peev, Evgeni (2002). "Ownership and Control Structures in Transition to 'Crony' Capitalism: The Case of Bulgaria". Eastern European Economics. 40 (5): 73–91. JSTOR 4380313.

- Enderwick, Peter (2005). "What's Bad About Crony Capitalism?". Asian Business & Management. 4 (2): 117–32. doi:10.1057/palgrave.abm.9200126.

- Rosas, Guillermo (2006). "Bagehot or Bailout? An Analysis of Government Responses to Banking Crises". American Journal of Political Science. 50: 175–91. doi:10.1111/j.1540-5907.2006.00177.x. JSTOR 3694264.

- Kahn, J. S.; Formosa, F. (2002). "The Problem of 'Crony Capitalism': Modernity and the Encounter with the Perverse". Thesis Eleven. 69: 47–66. doi:10.1177/0725513602069001004.

- Davis, Gerald F. (2003). "American cronyism: How executive networks inflated the corporate bubble". Contexts. 2 (3): 34–40. doi:10.1525/ctx.2003.2.3.34.

- Vaugirard, Victor (2005). "Crony Capitalism and Sovereign Default". Open Economies Review. 16: 77–99. doi:10.1007/s11079-005-5333-0.

- James, Harold (2008). "Family Values or Crony Capitalism?". Capitalism and Society. 3. doi:10.2202/1932-0213.1031.

- Khatri, Naresh; Tsang, Eric W K; Begley, Thomas M (2005). "Cronyism: A cross-cultural analysis". Journal of International Business Studies. 37: 61–75. doi:10.1057/palgrave.jibs.8400171. JSTOR 3875215.

- Khatri, Naresh (2013). Anatomy of Indian Brand of Crony Capitalism. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2335201.

- http://mpra.ub.uni-muenchen.de/19626/1/WP0802.pdf

External links

- New York Times, "The Global Cost of Crony Capitalism"

- New York Times, "Vladivostok Journal: Out of Russia's Gangland, and Into Cafe Society."

- Joseph Stiglitz, "Crony capitalism American-style".

- William Anderson, The Mises Institute, "Myths About Enron"

- Crony capitalism: The actors of change towards neoliberalism in Chile, by Patricio Imbert and Patricio Morales

- Will Africa Finally Take Off? Becker

- Crony Chronicles - The Cronyism Resource