Climate Finance

Climate finance refers to financing channeled by national, regional and international entities for climate change mitigation and adaptation projects and programs. They include climate specific support mechanisms and financial aid for mitigation and adaptation activities to spur and enable the transition towards low-carbon, climate-resilient growth and development through capacity building, R&D and economic development.[1] The term has been used in a narrow sense to refer to transfers of public resources from developed to developing countries, in light of their UN Climate Convention obligations to provide "new and additional financial resources," and in a wider sense to refer to all financial flows relating to climate change mitigation and adaptation.[2][3]

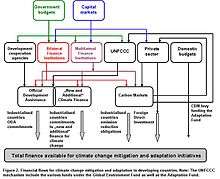

Finance is sourced from public, private and public-private sectors and can be channelled through various intermediaries, notably BFIs, MFIs, development cooperation agencies, the UNFCCC (various funds including those managed by the Global Environment Facility), non-governmental organisations and the private sector.[4] The financials flows can flow from developed to developing countries (North-South), from developing to developing countries (South-South), from developed to developed countries (North-North) and domestic climate finance flows in developed and developing countries.[5]

According to the Global Trends in Renewable Energy Investment Report 2011, investments in renewable energy in 2010 reached a record of USD 211 billion (not including large hydropower).[6] These amounts far exceed existing dedicated resources and those proposed under the developed world at the UN Framework Convention on Climate Change (UNFCCC) Cancún Agreements.

The estimations for the needed financing for climate change vary according to the geographic, sectorial and activity coverage, timescale and phasing, target and the underlying assumptions. The 2010 the World Development Report preliminary estimates of financing needs for mitigation and adaptation activities in developing countries range from USD 140-175 billion per year for mitigation over the next 20 years with associated financing needs of USD 265-565 billion and USD30 – 100 billion a year over the period 2010 - 2050 for adaptation.[7] The International Energy Agency’s 2011 World Energy Outlook (WEO) estimates that in order to meet growing demand for energy through 2035, USD 16.9 trillion in new investment for new power generation is projected, with renewable energy (RE) comprising 60% of the total.[8] The capital required to meet projected energy demand through 2030 amounts to $1.1 trillion per year on average, distributed (almost evenly) between the large emerging economies (China, India, Brazil, etc.) and including the remaining developing countries.[9]

Monitoring climate finance

A number of initiatives are underway to monitor and track flows of international climate finance. Analysts at Climate Policy Initiative have tracked public and private sector climate finance flows from a variety of sources on a yearly basis since 2011.[10] This work has fed into the United Nations Framework Convention on Climate Change Biennial Assessment and Overview of Climate Finance Flows [11] and the IPCC Fifth Assessment Report chapter on climate finance. These works, as well as research for Climate Funds Update, a joint project of the Overseas Development Institute and the Heinrich Böll Foundation, suggest the need for progress on a number of issues to make the monitoring of these flows more effective.[12] In particular, they suggest that funds can do better at synchronizing their reporting of data, being consistent in the way that they report their figures, and providing detailed information on the implementation of projects and programmes over time. The Climate & Development Knowledge Network works to ensure developing nations benefit from climate finance.

A large number of initiatives that have been implemented to assist developing countries to manage their response to climate change, both through information provision and policy-relevant analysis. Researchers at the Overseas Development Institute tracked international climate finance flows, looked at the aid effectiveness of climate finance and National delivery of climate finance, and at Knowledge sharing platforms. Their findings suggested early investment in national and regional centres of excellence for policy analysis on climate change provided national governments with the evidence to develop robust climate change policies and advance sustainable development.[13]

See also

- Climate & Development Knowledge Network

- Fossil fuel divestment

- Climate Finance Landscape - http://www.climatefinancelandscape.org/

References

- ↑ Barbara Buchner, Angela Falconer, Morgan Hervé-Mignucci, Chiara Trabacchi and Marcel Brinkman (2011) “The Landscape of Climate Finance” A CPI Report, Climate Policy Initiative, Venice (Italy), p. 1 and 2.

- ↑ Oscar Reyes (2013), "A Glossary of Climate Finance Terms", Institute for Policy Studies, Washington DC, p. 10 and 11

- ↑ http://www.eldis.org/go/topics/resource-guides/climate-change/key-issues/climate-finance/adaptation-finance/adaptation-finance

- ↑ Aaron Atteridge, Clarisse Kehler Siebert*, Richard J. T. Klein, Carmen Butler and Patricia Tella (2009) „Bilateral Finance Institutions and Climate Change: A Mapping of Climate Portfolios“, Stockholm Environment Institute for the Climate Change Working Group for Bilateral Finance Institutions Submitted to the United Nations Environment Programme (UNEP) and the Agence Française de Développement (AFD), Stockholm Environment Institute, p. 4.

- ↑ Barbara Buchner, Angela Falconer, Morgan Hervé-Mignucci, Chiara Trabacchi and Marcel Brinkman (2011) “The Landscape of Climate Finance” A CPI Report, Climate Policy Initiative, Venice (Italy), p. 1 and 2.

- ↑ Frankfurt School – UNEP Collaborating Centre for Climate and Sustainable Energy Finance and Bloomberg New Energy Finance (2011)"Global Trends in Renewable Energy Investment Report 2011", Frankfurt am Main (Germany), p.12

- ↑ World Bank Group(2010), "World Development Report 2010: Development and Climate Change, World Bank Groupe, Washington DC, ch. 6, p. 257

- ↑ International Energy Agency (2011). World Energy Outlook 2011, OECD and IEA, Paris (France), Part B, ch.2

- ↑ International Energy Agency (2011). World Energy Outlook 2011}, OECD and IEA, Paris (France), Part B, ch.2

- ↑ Buchner, B., Trabacchi, C., Mazza, F., Abramskiehn, D., and Wang, D. (2015) Global Landscape of Climate Finance 2015 http://climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2015/

- ↑ http://unfccc.int/cooperation_and_support/financial_mechanism/standing_committee/items/8034.php

- ↑ Watson, C., Nakhooda, S., Caravani, A. and Schalatek, L. (2012) The practical challenges of monitoring climate finance: Insights from Climate Funds Update. Overseas Development Institute Briefing Paper http://www.odi.org.uk/sites/odi.org.uk/files/odi-assets/publications-opinion-files/7665.pdf

- ↑ Neil Bird with contributions from Tom Beloe, Stephanie Ockenden, Jan Corfee-Morlot and Sáni Zou, Understanding climate change finance flows and effectiveness – mapping of recent initiatives: 2013 update, Overseas Development Institute, 2013, http://www.odi.org.uk/publications/8108-understanding-climate-change-finance-flows-effectiveness-mapping-recent-initiatives-2013-update