Production function

In economics, a production function relates physical output of a production process to physical inputs or factors of production. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, the defining focus of economics.The primary purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it. Production function denotes an efficient combination of inputs and outputs.

In macroeconomics, aggregate production functions are estimated to create a framework in which to distinguish how much of economic growth to attribute to changes in factor allocation (e.g. the accumulation of capital) and how much to attribute to advancing technology. Some non-mainstream economists, however, reject the very concept of an aggregate production function.[1][2]

The theory of production functions

In general, economic output is not a (mathematical) function of input, because any given set of inputs can be used to produce a range of outputs. To satisfy the mathematical definition of a function, a production function is customarily assumed to specify the maximum output obtainable from a given set of inputs. The production function, therefore, describes a boundary or frontier representing the limit of output obtainable from each feasible combination of input. (Alternatively, a production function can be defined as the specification of the minimum input requirements needed to produce designated quantities of output.) Assuming that maximum output is obtained from given inputs allows economists to abstract away from technological and managerial problems associated with realizing such a technical maximum, and to focus exclusively on the problem of allocative efficiency, associated with the economic choice of how much of a factor input to use, or the degree to which one factor may be substituted for another. In the production function itself, the relationship of output to inputs is non-monetary; that is, a production function relates physical inputs to physical outputs, and prices and costs are not reflected in the function.

In the decision frame of a firm making economic choices regarding production—how much of each factor input to use to produce how much output—and facing market prices for output and inputs, the production function represents the possibilities afforded by an exogenous technology. Under certain assumptions, the production function can be used to derive a marginal product for each factor. The profit-maximizing firm in perfect competition (taking output and input prices as given) will choose to add input right up to the point where the marginal cost of additional input matches the marginal product in additional output. This implies an ideal division of the income generated from output into an income due to each input factor of production, equal to the marginal product of each input.

The inputs to the production function are commonly termed factors of production and may represent primary factors, which are stocks. Classically, the primary factors of production were Land, Labor and Capital. Primary factors do not become part of the output product, nor are the primary factors, themselves, transformed in the production process. The production function, as a theoretical construct, may be abstracting away from the secondary factors and intermediate products consumed in a production process. The production function is not a full model of the production process: it deliberately abstracts from inherent aspects of physical production processes that some would argue are essential, including error, entropy or waste, and the consumption of energy or the co-production of pollution. Moreover, production functions do not ordinarily model the business processes, either, ignoring the role of strategic and operational business management. (For a primer on the fundamental elements of microeconomic production theory, see production theory basics).

The production function is central to the marginalist focus of neoclassical economics, its definition of efficiency as allocative efficiency, its analysis of how market prices can govern the achievement of allocative efficiency in a decentralized economy, and an analysis of the distribution of income, which attributes factor income to the marginal product of factor input.

Specifying the production function

A production function can be expressed in a functional form as the right side of

where is the quantity of output and are the quantities of factor inputs (such as capital, labour, land or raw materials).

If is not a matrix (i.e., a scalar, a vector, or even a diagonal matrix), then this form does not encompass joint production, which is a production process that has multiple co-products. On the other hand, if maps from then it is a joint production function expressing the determination of different types of output based on the joint usage of the specified quantities of the inputs.

One formulation, unlikely to be relevant in practice, is as a linear function:

where are parameters that are determined empirically. Another is as a Cobb-Douglas production function:

The Leontief production function applies to situations in which inputs must be used in fixed proportions; starting from those proportions, if usage of one input is increased without another being increased, output will not change. This production function is given by

Other forms include the constant elasticity of substitution production function (CES), which is a generalized form of the Cobb-Douglas function, and the quadratic production function. The best form of the equation to use and the values of the parameters () vary from company to company and industry to industry. In a short run production function at least one of the 's (inputs) is fixed. In the long run all factor inputs are variable at the discretion of management.

Production function as a graph

Any of these equations can be plotted on a graph. A typical (quadratic) production function is shown in the following diagram under the assumption of a single variable input (or fixed ratios of inputs so they can be treated as a single variable). All points above the production function are unobtainable with current technology, all points below are technically feasible, and all points on the function show the maximum quantity of output obtainable at the specified level of usage of the input. From point A to point C, the firm is experiencing positive but decreasing marginal returns to the variable input. As additional units of the input are employed, output increases but at a decreasing rate. Point B is the point beyond which there are diminishing average returns, as shown by the declining slope of the average physical product curve (APP) beyond point Y. Point B is just tangent to the steepest ray from the origin hence the average physical product is at a maximum. Beyond point B, mathematical necessity requires that the marginal curve must be below the average curve (See production theory basics for further explanation.).

Stages of production

To simplify the interpretation of a production function, it is common to divide its range into 3 stages. In Stage 1 (from the origin to point B) the variable input is being used with increasing output per unit, the latter reaching a maximum at point B (since the average physical product is at its maximum at that point). Because the output per unit of the variable input is improving throughout stage 1, a price-taking firm will always operate beyond this stage.

In Stage 2, output increases at a decreasing rate, and the average and marginal physical product are declining. However, the average product of fixed inputs (not shown) is still rising, because output is rising while fixed input usage is constant. In this stage, the employment of additional variable inputs increases the output per unit of fixed input but decreases the output per unit of the variable input. The optimum input/output combination for the price-taking firm will be in stage 2, although a firm facing a downward-sloped demand curve might find it most profitable to operate in Stage 1. In Stage 3, too much variable input is being used relative to the available fixed inputs: variable inputs are over-utilized in the sense that their presence on the margin obstructs the production process rather than enhancing it. The output per unit of both the fixed and the variable input declines throughout this stage. At the boundary between stage 2 and stage 3, the highest possible output is being obtained from the fixed input.

Shifting a production function

By definition, in the long run the firm can change its scale of operations by adjusting the level of inputs that are fixed in the short run, thereby shifting the production function upward as plotted against the variable input. If fixed inputs are lumpy, adjustments to the scale of operations may be more significant than what is required to merely balance production capacity with demand. For example, you may only need to increase production by million units per year to keep up with demand, but the production equipment upgrades that are available may involve increasing productive capacity by 2 million units per year.

If a firm is operating at a profit-maximizing level in stage one, it might, in the long run, choose to reduce its scale of operations (by selling capital equipment). By reducing the amount of fixed capital inputs, the production function will shift down. The beginning of stage 2 shifts from B1 to B2. The (unchanged) profit-maximizing output level will now be in stage 2.

Homogeneous and homothetic production functions

There are two special classes of production functions that are often analyzed. The production function is said to be homogeneous of degree , if given any positive constant , . If , the function exhibits increasing returns to scale, and it exhibits decreasing returns to scale if . If it is homogeneous of degree , it exhibits constant returns to scale. The presence of increasing returns means that a one percent increase in the usage levels of all inputs would result in a greater than one percent increase in output; the presence of decreasing returns means that it would result in a less than one percent increase in output. Constant returns to scale is the in-between case. In the Cobb-Douglas production function referred to above, returns to scale are increasing if , decreasing if , and constant if .

If a production function is homogeneous of degree one, it is sometimes called "linearly homogeneous". A linearly homogeneous production function with inputs capital and labour has the properties that the marginal and average physical products of both capital and labour can be expressed as functions of the capital-labour ratio alone. Moreover, in this case if each input is paid at a rate equal to its marginal product, the firm's revenues will be exactly exhausted and there will be no excess economic profit.[3]:pp.412–414

Homothetic functions are functions whose marginal technical rate of substitution (the slope of the isoquant, a curve drawn through the set of points in say labour-capital space at which the same quantity of output is produced for varying combinations of the inputs) is homogeneous of degree zero. Due to this, along rays coming from the origin, the slopes of the isoquants will be the same. Homothetic functions are of the form where is a monotonically increasing function (the derivative of is positive ()), and the function is a homogeneous function of any degree.

Aggregate production functions

In macroeconomics, aggregate production functions for whole nations are sometimes constructed. In theory they are the summation of all the production functions of individual producers; however there are methodological problems associated with aggregate production functions, and economists have debated extensively whether the concept is valid.[2]

Criticisms of the production function theory

There are two major criticisms of the standard form of the production function.[4]

On the concept of capital

During the 1950s, '60s, and '70s there was a lively debate about the theoretical soundness of production functions (see the Capital controversy). Although the criticism was directed primarily at aggregate production functions, microeconomic production functions were also put under scrutiny. The debate began in 1953 when Joan Robinson criticized the way the factor input capital was measured and how the notion of factor proportions had distracted economists. She wrote:

"The production function has been a powerful instrument of miseducation. The student of economic theory is taught to write Q = f (L, K ) where L is a quantity of labor, K a quantity of capital and Q a rate of output of commodities. He is instructed to assume all workers alike, and to measure L in man-hours of labor; he is told something about the index-number problem in choosing a unit of output; and then he is hurried on to the next question, in the hope that he will forget to ask in what units K is measured. Before he ever does ask, he has become a professor, and so sloppy habits of thought are handed on from one generation to the next".[5]

According to the argument, it is impossible to conceive of capital in such a way that its quantity is independent of the rates of interest and wages. The problem is that this independence is a precondition of constructing an isoquant. Further, the slope of the isoquant helps determine relative factor prices, but the curve cannot be constructed (and its slope measured) unless the prices are known beforehand.

On the empirical relevance

As a result of the criticism on their weak theoretical grounds, it has been claimed that empirical results firmly support the use of neoclassical well behaved aggregate production functions. Nevertheless, Anwar Shaikh has demonstrated that they also have no empirical relevance, as long as alleged good fit outcomes from an accounting identity, not from any underlying laws of production/distribution.[6]

Natural resources

Natural resources are usually absent in production functions. When Robert Solow and Joseph Stiglitz attempted to develop a more realistic production function by including natural resources, they did it in a manner economist Nicholas Georgescu-Roegen criticized as a "conjuring trick": Solow and Stiglitz had failed to take into account the laws of thermodynamics, since their variant allowed man-made capital to be a complete substitute for natural resources. Neither Solow nor Stiglitz reacted to Georgescu-Roegen's criticism, despite an invitation to do so in the September 1997 issue of the journal Ecological Economics.[1] [7]:127-136 [2] [8]

The practice of production functions

The theory of production function depicts the relation between physical outputs of a production process and physical inputs, i.e. factors of production. The practical application of production function is obtained by valuing the physical outputs and inputs by their prices. The economic value of physical outputs minus the economic value of physical inputs is the income generated by the production process. By keeping the prices fixed between two periods under review we get the income change generated by the change of production function. This is the principle how the production function is made a practical concept, i.e. measureable and understandable in practical situations.

About production

Economic well-being is created in a production process, meaning all economic activities that aim directly or indirectly to satisfy human needs. The degree to which the needs are satisfied is often accepted as a measure of economic well-being. In production there are two features which explain increasing economic well-being. They are improving quality-price-ratio of commodities and increasing incomes from growing and more efficient market production. The most important forms of production are

- market production

- public production

- household production

In order to understand the origin of the economic well-being we must understand these three production processes. All of them produce commodities which have value and contribute to well-being of individuals.

The satisfaction of needs originates from the use of the commodities which are produced. The need satisfaction increases when the quality-price-ratio of the commodities improves and more satisfaction is achieved at less cost. Improving the quality-price-ratio of commodities is to a producer an essential way to improve the competitiveness of products but this kind of gains distributed to customers cannot be measured with production data. Improving the competitiveness of products means often to the producer lower product prices and therefore losses in incomes which are to compensated with the growth of sales volume.

Economic well-being also increases due to the growth of incomes that are gained from the growing and more efficient market production. Market production is the only one production form which creates and distributes incomes to stakeholders. Public production and household production are financed by the incomes generated in market production. Thus market production has a double role in creating well-being, i.e. the role of producing developing commodities and the role to creating income. Because of this double role market production is the “primus motor” of economic well-being and therefore here under review.

Main processes of a producing company

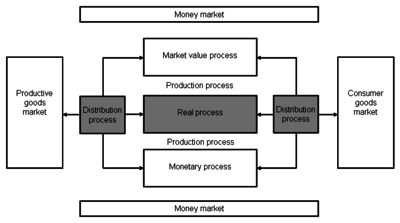

A producing company can be divided into sub-processes in different ways; yet, the following five are identified as main processes, each with a logic, objectives, theory and key figures of its own. It is important to examine each of them individually, yet, as a part of the whole, in order to be able to measure and understand them. The main processes of a company are as follows:

- real process.

- income distribution process

- production process.

- monetary process.

- market value process.

Production output is created in the real process, gains of production are distributed in the income distribution process and these two processes constitute the production process. The production process and its sub-processes, the real process and income distribution process occur simultaneously, and only the production process is identifiable and measurable by the traditional accounting practices. The real process and income distribution process can be identified and measured by extra calculation, and this is why they need to be analysed separately in order to understand the logic of production and its performance.

Real process generates the production output from input, and it can be described by means of the production function. It refers to a series of events in production in which production inputs of different quality and quantity are combined into products of different quality and quantity. Products can be physical goods, immaterial services and most often combinations of both. The characteristics created into the product by the producer imply surplus value to the consumer, and on the basis of the market price this value is shared by the consumer and the producer in the marketplace. This is the mechanism through which surplus value originates to the consumer and the producer likewise. It is worth noting that surplus values to customers cannot be measured from any production data. Instead the surplus value to a producer can be measured. It can be expressed both in terms of nominal and real values. The real surplus value to the producer is an outcome of the real process, real income, and measured proportionally it means productivity.

The concept “real process” in the meaning quantitative structure of production process was introduced in Finnish management accounting in 1960´s. Since then it has been a cornerstone in the Finnish management accounting theory. (Riistama et al. 1971)

Income distribution process of the production refers to a series of events in which the unit prices of constant-quality products and inputs alter causing a change in income distribution among those participating in the exchange. The magnitude of the change in income distribution is directly proportionate to the change in prices of the output and inputs and to their quantities. Productivity gains are distributed, for example, to customers as lower product sales prices or to staff as higher income pay.

The production process consists of the real process and the income distribution process. A result and a criterion of success of the owner is profitability. The profitability of production is the share of the real process result the owner has been able to keep to himself in the income distribution process. Factors describing the production process are the components of profitability, i.e., returns and costs. They differ from the factors of the real process in that the components of profitability are given at nominal prices whereas in the real process the factors are at periodically fixed prices.

Monetary process refers to events related to financing the business. Market value process refers to a series of events in which investors determine the market value of the company in the investment markets.

Production growth and performance

Production growth is often defined as a production increase of an output of a production process. It is usually expressed as a growth percentage depicting growth of the real production output. The real output is the real value of products produced in a production process and when we subtract the real input from the real output we get the real income. The real output and the real income are generated by the real process of production from the real inputs.

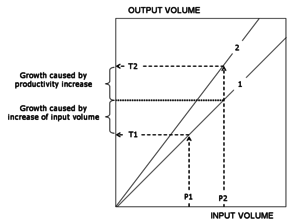

The real process can be described by means of the production function. The production function is a graphical or mathematical expression showing the relationship between the inputs used in production and the output achieved. Both graphical and mathematical expressions are presented and demonstrated. The production function is a simple description of the mechanism of income generation in production process. It consists of two components. These components are a change in production input and a change in productivity.[9][10]

The figure illustrates an income generation process(exaggerated for clarity). The Value T2 (value at time 2) represents the growth in output from Value T1 (value at time 1). Each time of measurement has its own graph of the production function for that time (the straight lines). The output measured at time 2 is greater than the output measured at time one for both of the components of growth: an increase of inputs and an increase of productivity. The portion of growth caused by the increase in inputs is shown on line 1 and does not change the relation between inputs and outputs. The portion of growth caused by an increase in productivity is shown on line 2 with a steeper slope. So increased productivity represents greater output per unit of input.

The growth of production output does not reveal anything about the performance of the production process. The performance of production measures production’s ability to generate income. Because the income from production is generated in the real process, we call it the real income. Similarly, as the production function is an expression of the real process, we could also call it “income generated by the production function”.

The real income generation follows the logic of the production function. Two components can also be distinguished in the income change: the income growth caused by an increase in production input (production volume) and the income growth caused by an increase in productivity. The income growth caused by increased production volume is determined by moving along the production function graph. The income growth corresponding to a shift of the production function is generated by the increase in productivity. The change of real income so signifies a move from the point 1 to the point 2 on the production function (above). When we want to maximize the production performance we have to maximize the income generated by the production function.

The sources of productivity growth and production volume growth are explained as follows. Productivity growth is seen as the key economic indicator of innovation. The successful introduction of new products and new or altered processes, organization structures, systems, and business models generates growth of output that exceeds the growth of inputs. This results in growth in productivity or output per unit of input. Income growth can also take place without innovation through replication of established technologies. With only replication and without innovation, output will increase in proportion to inputs. (Jorgenson et al. 2014,2) This is the case of income growth through production volume growth.

Jorgenson et al. (2014,2) give an empiric example. They show that the great preponderance of economic growth in the US since 1947 involves the replication of existing technologies through investment in equipment, structures, and software and expansion of the labor force. Further they show that innovation accounts for only about twenty percent of US economic growth.

In the case of a single production process (described above) the output is defined as an economic value of products and services produced in the process. When we want to examine an entity of many production processes we have to sum up the value-added created in the single processes. This is done in order to avoid the double accounting of intermediate inputs. Value-added is obtained by subtracting the intermediate inputs from the outputs. The most well-known and used measure of value-added is the GDP (Gross Domestic Product). It is widely used as a measure of the economic growth of nations and industries.

Absolute (total) and average income

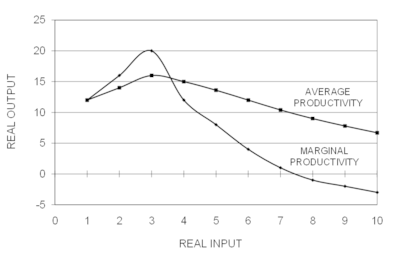

The production performance can be measured as an average or an absolute income. Expressing performance both in average (avg.) and absolute (abs.) quantities is helpful for understanding the welfare effects of production. For measurement of the average production performance, we use the known productivity ratio

- Real output / Real input.

The absolute income of performance is obtained by subtracting the real input from the real output as follows:

- Real income (abs.) = Real output – Real input

The growth of the real income is the increase of the economic value which can be distributed between the production stakeholders. With the aid of the production model we can perform the average and absolute accounting in one calculation. Maximizing production performance requires using the absolute measure, i.e. the real income and its derivatives as a criterion of production performance.

The differences between the absolute and average performance measures can be illustrated by the following graph showing marginal and average productivity. The figure is a traditional expression of average productivity and marginal productivity. The maximum for production performance is achieved at the volume where marginal productivity is zero. The maximum for production performance is the maximum of the real incomes. In this illustrative example the maximum real income is achieved, when the production volume is 7.5 units. The maximum average productivity is reached when the production volume is 3.0 units. It is worth noting that the maximum average productivity is not the same as the maximum of real income.

Figure above is a somewhat exaggerated depiction because the whole production function is shown. In practice, decisions are made in a limited range of the production functions, but the principle is still the same; the maximum real income is aimed for. An important conclusion can be drawn. When we try to maximize the welfare effects of production we have to maximize real income formation. Maximizing productivity leads to a suboptimum, i.e. to losses of incomes.

A practical example illustrates the case. When a jobless person obtains a job in market production we may assume it is a low productivity job. As a result, average productivity decreases but the real income per capita increases. Furthermore, the well-being of the society also grows. This example reveals the difficulty to interpret the total productivity change correctly. The combination of volume increase and total productivity decrease leads in this case to the improved performance because we are on the “diminishing returns” area of the production function. If we are on the part of “increasing returns” on the production function, the combination of production volume increase and total productivity increase leads to improved production performance. Unfortunately we do not know in practice on which part of the production function we are. Therefore, a correct interpretation of a performance change is obtained only by measuring the real income change.

Production models

A production model is a numerical description of the production process and is based on the prices and the quantities of inputs and outputs. There are two main approaches to operationalize the concept of production function. We can use mathematical formulae, which are typically used in macroeconomics (in growth accounting) or arithmetical models, which are typically used in microeconomics and management accounting.[11]

We use here arithmetical models because they are like the models of management accounting, illustrative and easily understood and applied in practice. Furthermore, they are integrated to management accounting, which is a practical advantage. A major advantage of the arithmetical model is its capability to depict production function as a part of production process. Consequently, production function can be understood, measured, and examined as a part of production process.

There are different production models according to different interests. Here we use a production income model and a production analysis model in order to demonstrate production function as a phenomenon and a measureable quantity. Malakooti (2013) provides an overview and problems of production models such as Aggregate planning, Push-and-Pull Systems, Inventory Planning and Control, and so on.[12]

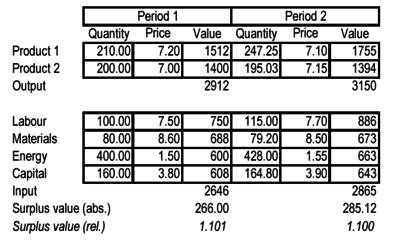

Production income model

The scale of success run by a going concern is manifold, and there are no criteria that might be universally applicable to success. Nevertheless, there is one criterion by which we can generalise the rate of success in production. This criterion is the ability to produce surplus value. As a criterion of profitability, surplus value refers to the difference between returns and costs, taking into consideration the costs of equity in addition to the costs included in the profit and loss statement as usual. Surplus value indicates that the output has more value than the sacrifice made for it, in other words, the output value is higher than the value (production costs) of the used inputs. If the surplus value is positive, the owner’s profit expectation has been surpassed.

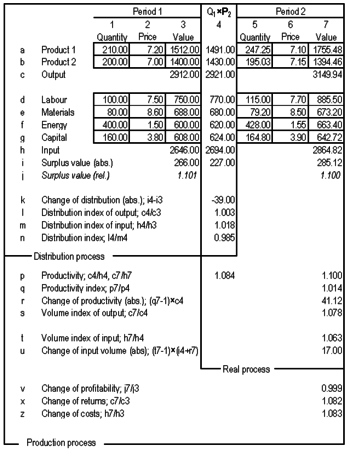

The table presents a surplus value calculation. We call this set of production data a basic example and we use the data through the article in illustrative production models. The basic example is a simplified profitability calculation used for illustration and modelling. Even as reduced, it comprises all phenomena of a real measuring situation and most importantly the change in the output-input mix between two periods. Hence, the basic example works as an illustrative “scale model” of production without any features of a real measuring situation being lost. In practice, there may be hundreds of products and inputs but the logic of measuring does not differ from that presented in the basic example.

In this context we define the quality requirements for the production data used in productivity accounting. The most important criterion of good measurement is the homogenous quality of the measurement object. If the object is not homogenous, then the measurement result may include changes in both quantity and quality but their respective shares will remain unclear. In productivity accounting this criterion requires that every item of output and input must appear in accounting as being homogenous. In other words, the inputs and the outputs are not allowed to be aggregated in measuring and accounting. If they are aggregated, they are no longer homogenous and hence the measurement results may be biased.

Both the absolute and relative surplus value have been calculated in the example. Absolute value is the difference of the output and input values and the relative value is their relation, respectively. The surplus value calculation in the example is at a nominal price, calculated at the market price of each period.

Production analysis model

A model used here is a typical production analysis model by help of which it is possible to calculate the outcome of the real process, income distribution process and production process.[13][14][15] The starting point is a profitability calculation using surplus value as a criterion of profitability. The surplus value calculation is the only valid measure for understanding the connection between profitability and productivity or understanding the connection between real process and production process. A valid analysis of production necessitates considering all production inputs, and the surplus value calculation is the only calculation to conform to the requirement. If we omit an input in productivity or income accounting, this means that the omitted input can be used unlimitedly in production without any cost impact on accounting results.

Accounting and interpreting

The process of calculating is best understood by applying the term ceteris paribus, i.e. "all other things being the same," stating that at a time only the impact of one changing factor be introduced to the phenomenon being examined. Therefore, the calculation can be presented as a process advancing step by step. First, the impacts of the income distribution process are calculated, and then, the impacts of the real process on the profitability of the production.

The first step of the calculation is to separate the impacts of the real process and the income distribution process, respectively, from the change in profitability (285.12 – 266.00 = 19.12). This takes place by simply creating one auxiliary column (4) in which a surplus value calculation is compiled using the quantities of Period 1 and the prices of Period 2. In the resulting profitability calculation, Columns 3 and 4 depict the impact of a change in income distribution process on the profitability and in Columns 4 and 7 the impact of a change in real process on the profitability.

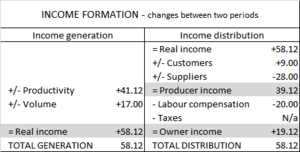

The accounting results are easily interpreted and understood. We see that the real income has increased by 58.12 units from which 41.12 units come from the increase of productivity growth and the rest 17.00 units come from the production volume growth. The total increase of real income (58.12) is distributed to the stakeholders of production, in this case 39.00 units to the customers and to the suppliers of inputs and the rest 19.12 units to the owners.

Here we can make an important conclusion. Income formation of production is always a balance between income generation and income distribution. The income change created in a real process (i.e. by production function) is always distributed to the stakeholders as economic values within the review period. Accordingly, the changes in real income and income distribution are always equal in terms of economic value.

Based on the accounted changes of productivity and production volume values we can explicitly conclude on which part of the production function the production is. The rules of interpretations are the following:

The production is on the part of “increasing returns” on the production function, when

- productivity and production volume increase or

- productivity and production volume decrease

The production is on the part of “diminishing returns” on the production function, when

- productivity decreases and volume increases or

- productivity increases and volume decreases.

In the basic example the combination of volume growth (+17.00) and productivity growth (+41.12) reports explicitly that the production is on the part of “increasing returns” on the production function (Saari 2006 a, 138–144).

Another productivity model also gives details of the income distribution.[16]:13 Because the accounting techniques of the two models are different, they give differing, although complementary, analytical information. The accounting results are, however, identical. We do not present the model here in detail but we only use its detailed data on income distribution, when the objective functions are formulated in the next section.

Objective functions

An efficient way to improve the understanding of production performance is to formulate different objective functions according to the objectives of the different interest groups. Formulating the objective function necessitates defining the variable to be maximized (or minimized). After that other variables are considered as constraints. The most familiar objective function is profit maximization which is also included in this case. Profit maximization is an objective function that stems from the owner’s interest and all other variables are constraints in relation to maximizing of profits.

The procedure for formulating objective functions

The procedure for formulating different objective functions, in terms of the production model, is introduced next. In the income formation from production the following objective functions can be identified:

- Maximizing the real income

- Maximizing the producer income

- Maximizing the owner income.

These cases are illustrated using the numbers from the basic example. The following symbols are used in the presentation: The equal sign (=) signifies the starting point of the computation or the result of computing and the plus or minus sign (+ / −) signifies a variable that is to be added or subtracted from the function. A producer means here the producer community, i.e. labour force, society and owners.

Objective function formulations can be expressed in a single calculation which concisely illustrates the logic of the income generation, the income distribution and the variables to be maximized.

The calculation resembles an income statement starting with the income generation and ending with the income distribution. The income generation and the distribution are always in balance so that their amounts are equal. In this case it is 58.12 units. The income which has been generated in the real process is distributed to the stakeholders during the same period. There are three variables which can be maximized. They are the real income, the producer income and the owner income. Producer income and owner income are practical quantities because they are addable quantities and they can be computed quite easily. Real income is normally not an addable quantity and in many cases it is difficult to calculate.

The dual approach for the formulation

Here we have to add that the change of real income can also be computed from the changes in income distribution. We have to identify the unit price changes of outputs and inputs and calculate their profit impacts (i.e. unit price change x quantity). The change of real income is the sum of these profit impacts and the change of owner income. This approach is called the dual approach because the framework is seen in terms of prices instead of quantities (ONS 3, 23).

The dual approach has been recognized in growth accounting for long but its interpretation has remained unclear. The following question has remained unanswered: “Quantity based estimates of the residual are interpreted as a shift in the production function, but what is the interpretation of the price-based growth estimates?”[17]:18 We have demonstrated above that the real income change is achieved by quantitative changes in production and the income distribution change to the stakeholders is its dual. In this case the duality means that the same accounting result is obtained by accounting the change of the total income generation (real income) and by accounting the change of the total income distribution.

See also

- Assembly line

- Computer-aided manufacturing

- Distribution (economics)

- Division of labour

- Industrial Revolution

- Mass production

- Production

- Production theory basics

- Production, costs, and pricing

- Production possibility frontier

- Productive forces

- Productive and unproductive labour

- Productivity

- Productivity improving technologies (historical)

- Productivity model

- Second Industrial Revolution

Footnotes

- 1 2 Daly, H (1997). "Forum on Georgescu-Roegen versus Solow/Stiglitz". Ecological Economics. 22 (3): 261–306. doi:10.1016/S0921-8009(97)00080-3.

- 1 2 3 Cohen, A. J.; Harcourt, G. C. (2003). "Retrospectives: Whatever Happened to the Cambridge Capital Theory Controversies?". Journal of Economic Perspectives. 17 (1): 199–214. doi:10.1257/089533003321165010.

- ↑ Chiang, Alpha C. (1984) Fundamental Methods of Mathematical Economics, third edition, McGraw-Hill.

- ↑ On the history of production functions, see Mishra, S. K. (2007). "A Brief History of Production Functions". Working Paper. SSRN 1020577

.

. - ↑ Robinson, Joan (1953). "The Production Function and the Theory of Capital". Review of Economic Studies. 21: [p. 81].

- ↑ Shaikh, A. (1974). "Laws of Production and Laws of Algebra: The Humbug Production Function". Review of Economics and Statistics. 56 (1): 115–120. doi:10.2307/1927538.

- ↑ Daly, Herman E. (1999). "How long can neoclassical economists ignore the contributions of Georgescu-Roegen?". In Daly, Herman E. (2007). Ecological Economics and Sustainable Development. Selected Essays of Herman Daly. (PDF contains full book). Cheltenham: Edward Elgar. ISBN 9781847201010.

- ↑ Ayres, Robert U.; Warr, Benjamin (2009). The Economic Growth Engine: How Useful Work Creates Material Prosperity. ISBN 978-1-84844-182-8.

- ↑ Genesca, G. E.; Grifell, T. E. (1992). "Profits and Total Factor Productivity: A Comparative Analysis". Omega. the International Journal of Management Science. 20 (5/6): 553–568. doi:10.1016/0305-0483(92)90002-O.

- ↑ Saari, S. (2006). Productivity. Theory and Measurement in Business. Espoo, Finland: European Productivity Conference.

- ↑ We do not present the former approach here but refer to the survey: Hulten, C. R. (September 2009). "Growth Accounting" (PDF). NBER Working Paper No. 15341.

- ↑ Malakooti, Behnam (2013). Operations and Production Systems with Multiple Objectives. John Wiley & Sons. ISBN 978-1-118-58537-5.

- ↑ Courbois, R.; Temple, P. (1975). La methode des "Comptes de surplus" et ses applications macroeconomiques. 160 des Collect, INSEE, Serie C (35).

- ↑ Gollop, F. M. (1979). "Accounting for Intermediate Input: The Link Between Sectoral and Aggregate Measures of Productivity Growth". Measurement and Interpretation of Productivity. National Academy of Sciences.

- ↑ Kurosawa, K. (1975). "An aggregate index for the analysis of productivity". Omega. 3 (2): 157–168. doi:10.1016/0305-0483(75)90115-2.

- ↑ Saari, S. (2011). Production and Productivity as Sources of Well-being. MIDO OY.

- ↑ Hulten, C. R. (September 2009). "Growth Accounting" (PDF). NBER Working Paper No. 15341.

References

- Jorgenson, D.W.; Ho, M.S.; Samuels, J.D. (2014). Long-term Estimates of U.S. Productivity and Growth (PDF). Tokyo: Third World KLEMS Conference.

- Riistama, K.; Jyrkkiö E. (1971). Operatiivinen laskentatoimi (Operative accounting). Weilin + Göös. p. 335.

- Saari, S. (2006). Productivity. Theory and Measurement in Business (PDF). Espoo, Finland: European Productivity Conference.

- Saari, S. (2011). Production and Productivity as Sources of Well-being. MIDO OY. p. 25.

Further reading

- Brems, Hans (1968). "The Production Function". Quantitative Economic Theory. New York: Wiley. pp. 62–74.

- Craig, C.; Harris, R. (1973). "Total Productivity Measurement at the Firm Level". Sloan Management Review (Spring 1973): 13–28.

- Guerrien B. and O. Gun (2015) "Putting an end to the aggregate function ofproduction... forever?", Real World Economic Review N°73

- Hulten, C. R. (January 2000). "Total Factor Productivity: A Short Biography" (PDF). NBER Working Paper No. 7471.

- Heathfield, D. F. (1971). Production Functions. Macmillan Studies in Economics. New York: Macmillan Press.

- Intriligator, Michael D. (1971). Mathematical Optimalization and Economic Theory. Englewood Cliffs: Prentice-Hall. pp. 178–189. ISBN 0-13-561753-7.

- Laidler, David (1981). Introduction to Microeconomics (Second ed.). Oxford: Philip Allan. pp. 124–137. ISBN 0-86003-131-4.

- Maurice, S. Charles; Phillips, Owen R.; Ferguson, C. E. (1982). Economic Analysis: Theory and Application (Fourth ed.). Homewood: Irwin. pp. 169–222. ISBN 0-256-02614-9.

- Moroney, J. R. (1967). "Cobb-Douglass production functions and returns to scale in US manufacturing industry". Western Economic Journal. 6 (1): 39–51. doi:10.1111/j.1465-7295.1967.tb01174.x.

- Pearl, D.; Enos, J. (1975). "Engineering Production Functions and Technological Progress". Journal of Industrial Economics. 24: 55–72. doi:10.2307/2098099.

- Shephard, R. (1970). Theory of Cost and Production Functions. Princeton, NJ: Princeton University Press.

- Thompson, A. (1981). Economics of the Firm: Theory and Practice (3rd ed.). Englewood Cliffs: Prentice Hall. ISBN 0-13-231423-1.

External links

- A further description of production functions

- Anatomy of Cobb-Douglas Type Production Functions in 3D

- Anatomy of CES Type Production Functions in 3D