Affordability of housing in the United Kingdom

Affordability of housing in the UK reflects how easy or difficult it is to rent or buy property. Housing tenure in the UK can be broadly divided into three categories: Owner-occupied; Private Rented Sector (PRS); and Social Rented Sector (SRS).[1] The affordability of housing in the UK varies widely on a regional basis – house prices and rents will differ as a result of market factors such as the state of the local economy, transport links and the supply of housing. For owner-occupied property key determinants of affordability are: house prices; income; interest rates; and purchase costs. For rented property, PRS rents will largely be a reflection of house prices, while SRS rents are set by Local Authorities, Housing Associations or similar on the basis of what lower income groups can afford.

House prices

Growth of house prices

Land Registry figures for England and Wales show that house prices tripled in the 20 years between 1995 and 2015. Growth was almost continuous during the period, save for a two-year period of decline around 2008 as a result of the banking crisis.[2]

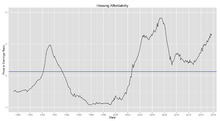

Deteriorating affordability

The gap between income and house prices has changed in the last 20 years such that even in the most affordable regions of England and Wales buyers have to spend six times their income, while in London the median house now costs 12 times the median London income. In comparison, in 1995 where a homebuyer earning the median salary for their region would have had to spend between 3.2 times and 4.4 times their salary on a house, depending on where they lived.

In London in 1995, the median income was £19,000 and the median house price was £83,000, meaning that people were spending 4.4 times their income on buying a property. By 2012-13, the median income in London had increased to £24,600 and the median London house price had increased to £300,000, thus people were forced to spend 12.2 times their income on a house.[3]

However, in 1995 the Bank Base Rate was 6%, but was cut to 0.5% in March 2009, where it has remained to date (November 2015).[4] The resultant cheap mortgages have significantly ameliorated the affordability issues as can be seen by the mortgage payment as a percentage of take home pay chart in the right pane.

In 2015, parliament published research regarding housing supply and affordability which included the following findings: "Successive Governments have failed to ensure housing supply matches demand. After a long period under the radar, the shortage of housing supply has been thrown into the spotlight thanks to the combination of a recent price boom and stagnant real wages. Though it may only recently have captured widespread political attention, it has been clear for some time that housing supply is not keeping up with the additional demand generated by rising life expectancy, immigration and the growing number of one-person households. The resultant house price inflation in areas of high demand has led commentators to suggest that by 2020 home ownership will be an ‘impossible dream’ for those not already on the ladder. Declining affordability would suggest that, for many, that dream is already impossible." [5]

Impact of planning restrictions on house prices

Some economists and pressure groups such as Shelter argue that planning restrictions are a major factor behind the rise in prices as 70% of the cost of building new houses is the purchase of the land (up from 25% in the late 1950s).[6] An analysis by the LSE and the CPB Netherlands Bureau for Economic Policy Analysis found that house prices in England would have been 35% cheaper without regulatory constraints.[7] A report by the Adam Smith Institute found that by using 4% of London's green belt, one million homes could be built within 10 minutes walk of a railway station.[8]

The Economist has criticised green belt policy, saying that unless more houses are built through reforming planning laws and releasing green belt land, then housing space will need to be rationed out. It noted that if general inflation had risen as fast as housing prices had since 1971, a chicken would cost £51; and that Britain is "building less homes today than at any point since the 1920s".[9] According to the independent Institute of Economic Affairs, there is "overwhelming empirical evidence that planning restrictions have a substantial impact on housing costs" and are the main reason why housing was two and a half times more expensive in 2011 than it was in 1975.[10]

The Campaign to Protect Rural England argued that "Green Belt land is important for our wider environment, providing us with the trees and the undeveloped land which reduce the effect of the heat generated by big cities. Instead of reducing this green space, we should be using it to its best effect. We know from our research that three quarters (79%) of the population would like to see more trees planted and more food grown in the areas around towns and cities."[11]

Valuation of land and impact on house prices

Property companies state that land values follow house prices and that a developer assesses what new build house price is achievable in any particular location with reference to prices and sales rates in the second hand market and on nearby comparable new build sites. At a basic level (assuming no affordable housing, S106 or CIL), they then multiply that new build house price by the number of homes to be built on the land and to arrive at the gross development value (GDV) of the site. The underlying value of the land is then the GDV less the cost of development and less an allowance for profit.[12]

Purchase costs

The principal costs are Stamp Duty Land Tax, estate agent fees, legal fees (conveyancing), mortgage arrangement fees (where applicable), surveys and removals. Some have argued that the costs of moving depress house sales.[13]

Stamp Duty Land Tax

Stamp Duty Land Tax is payable by the buyer of a property as a percentage of the purchase price.

From December 2014, Stamp Duty was changed to a graduated system which eliminates the big jumps in stamp duty at the threshold values. For instance a property of £600,000 under the old system would pay 4% tax of the whole asking price i.e. £24,000. Under the new system no tax is paid on the first £125,000, the next £125-250,000 is charged at 2% i.e. £2500 plus the portion (£350,000) in the £250,000-£925,000 tax band at 5% i.e. £17,500. This gives a total tax of £20,000. This change was said to be beneficial to 98% of property purchases[14] but caused a collapse in sales at the upper end of the market.[15][16][17][18]

| Purchase price of property | Rate of SDLT on portion of purchase price |

|---|---|

| £0 - £125,000 | 0% |

| £125,001 to £250,000 | 2% |

| £250,001 to £925,000 | 5% |

| £925,001 to £1,500,000 | 10% |

| over £1,500,000 | 12% |

Estate Agent fees

In 2011, Which? magazine found the national average estate agents fees to be 1.8%,[19] although fees vary widely.

Survey

There are four main types of survey: a valuation survey, a condition report, a homebuyer report and a full structural survey. Costs are likely to range from around £100 to £1000.[20] Expensive or very large properties may cost even more.

Legal fees

Legal (conveyancing) fees vary greatly in the UK according to the value of the property and the service provided[21] with one report finding that they range from £250 to £1300.[22] Costs are also increased if someone is both buying and selling.

Mortgage arrangement fees

In April 2013, The Daily Telegraph reported that research by Moneyfacts showed the average mortgage arrangement fee to be £1522.[23]

Removal costs

These will vary considerably subject to quantity of furniture/possessions and distance to travel. They are likely to range from around £500 for a short distance move for a two-bed house, to several thousand pounds for a long distance move for a large house.[24]

As well as removal, there may be an additional service which may need to be considered. This will involve any storage. Storage costs can vary from company to company but can be a valid solution if goods need to be stored for a certain amount of time. Along with removal costs, potential storage costs may also need to be facilitated for.

Possible solutions

Replacing council tax

The Joseph Rowntree foundation has suggested replacing the current Council tax system based on bands of house prices with a system which would mean the tax was more closely related to property prices. This would increase taxes on the highest priced properties and decrease them for the lowest. They claim it would also have the effect of reducing house price volatility.[25]

Rented homes

The English Housing Survey Bulletin 13[26] states that in 2013/14 there were 4.4 million households in the private rented sector and 3.9 million households in the social rented sector, of whom 2.3 million households (10%) were renting from a housing association and 1.6 million (7%) were renting from a local authority. Private renters had the highest weekly housing costs, paying on average £176 per week in rent. Mortgagors paid an average of £153 per week in mortgage payments while mean weekly rents in the social housing sector were £98 for housing association tenants and £89 for local authority tenants. When considering the gross weekly income, including benefits, of all household members, the proportion of income spent on housing costs was 18% for mortgagors, 29% for social renters, and 34% for private renters.

See also

- Gazumping

- Green belt (United Kingdom)

- Housing in the United Kingdom

- Great Recession

- Help to Buy

- List of entities involved in 2007–2008 financial crises

- Real estate economics

- Subprime mortgage crisis

References

- ↑ https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/467800/Bulletin_12Aug2015_FINAL.pdf

- ↑ "Land Registry - search the house price index". Landregistry.data.gov.uk. Retrieved 2016-01-06.

- ↑ "The widening gulf between salaries and house prices". Theguardian.com. Retrieved 2016-01-06.

- ↑ "Bank of England Statistical Interactive Database | Interest & Exchange Rates | Official Bank Rate History". Bankofengland.co.uk. Retrieved 2016-01-06.

- ↑ "Housing supply in 2015-2020: Key issues for the 2015 Parliament". parliament.uk.

- ↑ It's Land, stupid, Inside Housing, retrieved 2016-01-06

- ↑ "Why UK house prices have grown faster than anywhere else". Telegraph.co.uk. Retrieved 2016-01-06.

- ↑ "Green belt a "green noose", claims Adam Smith Institute". Environmentsite.com. Retrieved 2016-01-06.

- ↑ "Build on the green belt or introduce space rationing: your choice", Economist.com, retrieved 2016-01-06

- ↑ Kristian Niemietz (April 2012). "Abundance of land, shortage of housing : IEA Discussion Paper No. 38" (PDF). Iea.org.uk. Retrieved 2016-01-06.

- ↑ "Green Belts: breathing spaces for people and nature - Campaign to Protect Rural England". Cpre.org.uk. Retrieved 2016-01-06.

- ↑ "Savills UK | The value of land". Savills.co.uk. Retrieved 2016-01-06.

- ↑ Simon Lambert (2012-01-27). "Cost of moving home rockets by 70% to almost £9,000 as estate agency fees and stamp duty rises put strain on families | Mail Online". Dailymail.co.uk. Retrieved 2012-09-23.

- ↑ "Stamp Duty Land Tax". GOV.UK. 2015-12-11. Retrieved 2015-12-29.

- ↑ Watkins, Simon. "Tax haul falls as stamp duty rise hits sales of top homes". Dailymail.co.uk. Retrieved 2016-01-06.

- ↑ Hawkes, Alex (2015-11-21). "Hopes rise that top rate of stamp duty may be cut as sales of upmarket homes collapse". This is Money. Retrieved 2016-01-06.

- ↑ "Stamp duty: has London finally lost its status as the luxury property hotspot of the world?". Telegraph. 2015-11-30. Retrieved 2016-01-06.

- ↑ Jonathan Prynn; Joanna Bourke (2015-07-24). "Stamp duty rise hits London home prices with fastest fall since the crash". Standard.co.uk. Retrieved 2016-01-06.

- ↑ "Estate agents' fees exposed - March - 2011 - Which? News". Which.co.uk. 2011-03-31. Retrieved 2012-09-23.

- ↑ "What sort of property survey should you go for?". MoneySupermarket.com. 2011-07-18. Retrieved 2015-12-29.

- ↑ Choosing a conveyancer in 2013 by Graham Norwood in The Guardian, 15 February 2013. Retrieved 18 September 2013.

- ↑ A complete guide to conveyancing reallymoving.com, 2012. Retrieved 18 September 2013. Archived here.

- ↑ Mortgage fees climb to new high Jessica Winch, The Telegraph, 9 April 2013. Retrieved 12 October 2013. Archived here.

- ↑ "Choose a removal company". Rightmove.co.uk. Retrieved 2015-12-29.

- ↑ "After the Council Tax: impacts of property tax reform on people, places and house prices".

- ↑